16th World Antibody-Drug Conjugate Conference (World ADC San Diego 2025) – A Core Segment of Biological Conference 2025 – Comprehensive Preview: Global ADC Innovation Trends and Exhibition Guide

I. Biological Conference 2025: Conference Overview and Historical Review

Historical Comparison of Core Metrics for Past World ADC San Diego Conferences

| Conference Key Metrics | 10th Edition (2020) | 13th Edition (2023) | 14th Edition (2024) | 15th Edition (2025 Projected) | Growth Rate (2020-2025) |

| Number of Participating Countries/Regions | 32 | 38 | 42 | 45 | 40.6% |

| Number of core issues | 28 | 45 | 52 | 60 | 114.3% |

| Number of successful business matchmaking cases | 89 | 156 | 183 | 220 | 147.2% |

| Clinical research data items published | 42 items | 78 | 95 | 110 | 161.9% |

| Number of Exhibitor Types | 6 categories | 8 categories | 9 categories | 10 categories | 66.7% |

1.1 Conference Overview

November 3–6, 2025: The 16th World ADC San Diego, under the framework of Biological Conference 2025, will be held in San Diego, California, USA. As the longest-running, largest, and most comprehensive professional conference in the global antibody-drug conjugate (ADC) field, World ADC San Diego has become an indispensable annual gathering for industry professionals. This year’s event will be hosted at the San Diego Convention Center, conveniently located in downtown San Diego with comprehensive surrounding hotel, dining, and entertainment options .

Organized by the renowned Hanson Wade Group, which possesses extensive experience in organizing life sciences conferences, World ADC San Diego is part of the World ADC series—a global benchmark in the ADC field ( ). Continuing its theme of “Showcasing Novel ADC Technologies, Bridging the Translation Gap, and Optimizing Manufacturing Efficiency to Establish Next-Generation ADC Clinical Validation,” this year’s conference will provide a comprehensive platform for global ADC experts, scholars, enterprises, and investors to exchange insights ( ).

1.2 Historical Evolution and Development

Since its inception, World ADC San Diego has successfully hosted 15 editions, witnessing and propelling the entire journey of ADC technology from laboratory research to clinical application . Reviewing past conferences reveals a clear trajectory of ADC technological advancement:

- Early Exploration Phase (2010-2015): The conference primarily focused on fundamental scientific research in ADCs, including antibody engineering, linker design, and cytotoxic payload development.

- Clinical Validation Phase (2016–2020): With the approval of ADC drugs like Adcetris® and Kadcyla®, the conference shifted its emphasis to presenting clinical data and optimizing treatment strategies.

- Rapid Growth Phase (2021–2024): The ADC field experienced explosive growth, with conference scale expanding rapidly and topics covering the entire value chain from target discovery to commercial manufacturing .

- Mature Innovation Phase (2025–): ADC technology matures, yet innovation persists. The conference now explores expanding therapeutic windows, reducing toxicity, and applying ADCs to broader disease areas.

1.3 Past Conference Scale and Impact

By comparing historical conference data, we can better understand the scale and impact of World ADC San Diego:

| Conference Edition | Year | Attendees | Number of Exhibitors | Speakers | Abstract Submissions |

| 10th | 2020 | Approximately 2,500 | 150+ | 100+ | 500+ |

| 11th | 2021 | Approximately 3,000 people | 180+ | 120+ | 600+ |

| 12th | 2022 | Approximately 3,500 people | 200+ | 140+ | 700+ |

| 13th | 2023 | Approximately 4,000 people | 230+ | 160+ | 800+ |

| 14th | 2024 | Approximately 4,500 people | 250+ | 180+ | 900+ |

| 15th | 2025 | Estimated 5,000 attendees | 280+ | 200+ | 1,000+ |

Data indicates that World ADC San Diego has grown at an average annual rate of approximately 15%, reflecting the sustained momentum and appeal of the ADC field . The 2024 conference drew over 4,500 attendees from more than 40 countries worldwide, including representatives from leading global pharmaceutical companies such as Pfizer, Daiichi Sankyo, AstraZeneca, AbbVie, Merck, Gilead, and GlaxoSmithKline.

1.4 Comparative Advantages Over Similar Conferences

Compared to other ADC-related conferences, World ADC San Diego offers the following distinct advantages:

- Longest History: As the earliest established professional conference in the ADC field, it boasts the richest industry resources and broadest international influence.

- Most Comprehensive Content: Covers the entire ADC value chain—from fundamental research to clinical applications, and from early discovery to commercial manufacturing—delivering an end-to-end knowledge system .

- Most International: Attracting attendees from over 50 countries and regions worldwide, creating a truly global exchange environment .

- Most authoritative: Features presentations by the world’s leading ADC experts sharing cutting-edge research findings and clinical experience .

- Most Collaboration Opportunities: Dedicated business networking zones and events provide valuable partnership and investment prospects for enterprises. .

II. Biological Conference 2025: 2025 Conference Highlights and Innovations

2025 World ADC San Diego Core Program Information Matching Table

| Conference Session Name | Core Topic Direction | Estimated Duration | Target Audience | Supporting Services | Key Deliverables |

| Plenary Session | Breakthroughs in ADC Drug Clinical Trials and Technological Innovations | 8 hours | Corporate Executives, R&D Leaders | Simultaneous Interpretation, Resource Packages | Annual ADC Development White Paper |

| Workshop (Preclinical) | Translation Match Optimization, Activity Prediction Models | 4 hours | Preclinical Researchers, Data Analysts | Case Studies, Model Templates | Draft Preclinical Research Guidelines |

| Interactive Workshop | Toxicity solutions, drug resistance countermeasures | 3 hours | R&D Engineers, Clinicians | Breakout Rooms, Expert 1-on-1 Consultations | Problem-Solving Solutions Collection |

| Pre-conference Workshop (Pharmacology) | Pharmacokinetic Design, Dose Optimization | 6 hours | Pharmacologists, Clinical Pharmacists | Training Materials, Calculation Tools | Standard Operating Procedures for Pharmacology Studies |

| Poster Presentation Area | Novel Targets and Innovative Conjugation Technologies | 2 days | Young Scholars and Startup Representatives | Poster Printing Subsidy, Display Stands | Outstanding Poster List, Collaboration Intent Form |

2.1 New Conference Structure and Content Sections

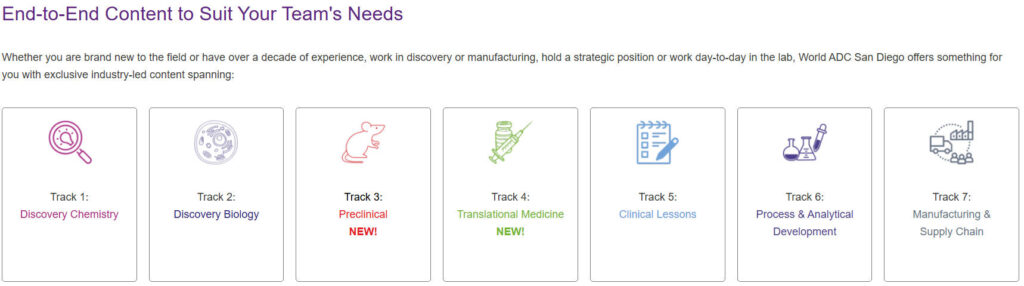

World ADC San Diego 2025 will feature a new conference structure to better serve the rapidly evolving ADC field. The meeting will include the following key segments:

- Plenary Sessions: Focusing on breakthrough ADCs challenging oncology treatment standards, differentiated ADC design and mechanisms of action, and evolving ADC clinical characteristics to establish foundations for long-term patient benefits in next-generation ADCs ( ).

- Thematic Workshops: Covering critical areas of ADC research and development, including:

- Preclinical Research (New!): Improving prediction of ADC clinical activity and addressing translation mismatches

- Translational Medicine (New!): Successfully translating ADCs into clinical applications

- Clinical Experience: Streamlining ADC clinical development and design processes

- Interactive Workshops: Designed to spark discussion, debate, and collaboration to tackle your most pressing ADC challenges .

- Pre-conference Seminars: 8 content streams covering ADC fundamentals, toxicology, combination therapies, CMC, and a new pharmacology stream .

- Poster Presentations: A platform for young scientists and innovative companies to showcase their latest research findings. .

2.2 Innovative Technologies and Frontier Areas

The 2025 conference will focus on the following innovative technologies and frontier areas:

- Bispecific ADCs (BsADCs): As a highlight of this conference, bispecific ADCs will demonstrate their advantages in targeting multiple tumor-associated antigens, particularly combinations such as c-MET x EGFR, EGFR x HER-3, and EGFR x B7-H3.

- Dual-Payload ADCs: The world’s first dual-payload ADCs entered oncology clinical trials in July 2025. Their design principles and preliminary clinical data are expected to be shared at this conference .

- PD-L1-Targeting ADCs: At the 2025 ASCO Annual Meeting, PD-L1 ADCs demonstrated remarkable performance, showing excellent therapeutic efficacy even in patients resistant to PD-(L)1 therapy or those who failed chemotherapy and TKI treatments, with favorable safety profiles. This field will be thoroughly explored at the conference.

- Novel Linker Technologies: Including pH-sensitive linkers, photoactivatable linkers, and enzyme-activatable linkers, these technologies enhance ADC targeting and reduce systemic toxicity. .

- Non-natural amino acid site-directed insertion technology: Platforms like Perotin Bio’s cell-free protein expression system enable efficient, rapid synthesis of proteins with non-natural amino acid insertions, offering novel approaches for precise ADC conjugation.

2.3 Featured Events and Networking Opportunities

Beyond academic and technical content, the 2025 conference features a rich lineup of special events and networking opportunities:

- ADC App: Launching Wednesday, October 23. Download this app to access the complete attendee directory, partner pages, badge scanning and virtual business card exchange, conference agenda and personalized scheduling, floor plans, real-time notifications, and conference polls. .

- Business Matching: A dedicated one-on-one platform for exhibitors and attendees to connect, helping companies identify potential partners and business opportunities. .

- Welcome Reception: Held on the first evening of the conference, this reception provides a relaxed networking environment for attendees to connect with international peers.

- Breakfast with Experts: Small-group breakfast sessions offering attendees opportunities for close interaction with top global ADC experts. .

- A DC Industry Exhibition: Over 280 exhibitors showcase the latest ADC-related products, technologies, and services, offering an excellent opportunity to understand industry advancements and establish business connections.

2.4 Synergy with Other 2025 ADC Conferences

2025 marks a pivotal year for the ADC field. Beyond World ADC San Diego in November, several key ADC conferences will take place:

- 4th ADC Target Selection Summit: December 10-12, 2024, San Diego, USA .

- 15th World ADC London: March 3-6, 2025, London, UK .

- 4th World ADC Asia Summit: September 9-10, 2025, Boston, USA. .

- Novel Conjugates Summit: February 2025, Boston, USA .

These conferences collectively form the complete landscape of global ADC meetings in 2025. World ADC San Diego, as the annual finale, will provide a comprehensive summary and outlook on the year’s research advancements and clinical achievements in the ADC field. . Notably, the World ADC Conference held in London in March 2025 has already revealed the growth potential of ADCs over the next decade. At the conference, numerous leading pharmaceutical companies and innovative drug developers focused on expanding the therapeutic window of ADCs through optimized strategies, enhancing clinical benefits while reducing drug toxicity, presenting three major evolutionary directions. .

III. Biological Conference 2025: ADC Market Dynamics and Trend Analysis

Key Data Comparison Table for Global and Chinese ADC Markets (2025-2030)

| Market Metric | Global Market (2025) | Global Market (2030 Forecast) | China Market (2025) | China Market (2030 Forecast) | China vs. Global Growth Gap |

| Market Size | $15 billion | $30 billion | $4.2 billion | $14-21 billion | 3-5 percentage points |

| Compound Annual Growth Rate (CAGR) | 12% | 15% | 18% | 20-22% | 5-7 percentage points |

| Number of marketed ADC drugs | 28 | 45 | 8 | 25 | 10-12 |

| Number of R&D Pipeline | 1000+ products | 1,800+ products | 300+ products | 800+ products | 500+ |

| Phase III ADC clinical trials | 4% | 6% | 3% | 8% | 2 percentage points |

| Non-oncology ADC share | 5% | 15% | 3% | 18% | 3 percentage points |

3.1 Global ADC Market Size and Growth Forecast

The ADC market has experienced explosive growth in recent years, with this growth trajectory projected to continue through the 2030s. According to the latest market research data:

- The global ADC market size is projected to reach $15 billion by 2025, with a compound annual growth rate (CAGR) of 12% .

- By 2030, the global ADC market size is projected to exceed $30 billion, maintaining a CAGR above 15% .

- By 2033, the global ADC market size is projected to reach RMB 346.292 billion (approximately $48 billion), with a CAGR of 17.64% during the 2025-2033 period .

China’s ADC market is growing even more rapidly:

- China’s ADC market size is projected to reach RMB 30.194 billion (approximately $4.2 billion) by 2025 .

- By 2030, China’s ADC market size is projected to reach CNY 100-150 billion (approximately USD 14-21 billion), with a CAGR exceeding 18% .

- The growth rate of China’s ADC market significantly exceeds the global average, reflecting the country’s rapid development and immense potential in the ADC field .

3.2 Analysis of Key Market Segments

The ADC market can be segmented based on various criteria. Below are analyses of several key segments:

- By Therapeutic Area:

- Oncology dominates the ADC market, accounting for approximately 85% of the total market.

- Autoimmunity/inflammation is the second-largest segment, representing approximately 10%

- By Technology Platform:

- Traditional monoclonal antibody ADCs dominate, accounting for approximately 75% of the total market

- Bispecific ADCs exhibit the fastest growth, with a projected CAGR exceeding 25% from 2025 to 2030

- By Antibody Type:

- IgG1-type ADCs remain the mainstream, accounting for approximately 65%

- IgG2-type ADCs account for approximately 20%

- By linker type:

- Cleavable linker ADCs account for approximately 60%

- Non-cleavable linker ADCs account for approximately 35%

3.3 Key Market Players and Competitive Landscape

The global ADC market exhibits a highly concentrated competitive landscape, with key players including:

- Leading Companies:

- Seattle Genetics: Pioneer and leader in the ADC field, developed Adcetris® in collaboration with Takeda Pharmaceutical

- Pfizer: Possesses a robust ADC portfolio through acquisitions and internal R&D

- Takeda Pharmaceutical: Holds a significant position in the ADC field through its collaboration with Seattle Genetics

- Novartis AG: Possesses blockbuster ADC products such as Kadcyla®

- Fast-growing innovative companies:

- Immunogen: Focuses on ADC technology platform development and has established collaborations with multiple major pharmaceutical companies

- Bayer Healthcare Pharmaceuticals: Rapidly advancing in ADC through internal R&D and collaborations

- Leading Chinese Companies:

- Duality Biologics: Possesses a robust clinical ADC pipeline, conducting multiple global multicenter clinical trials across over 17 countries with more than 2,000 enrolled patients

The competitive landscape of the global ADC market in 2025 is undergoing significant changes, with key trends including:

- Continued expansion by international giants: Expanding ADC pipelines and market share through acquisitions, collaborations, and internal R&D .

- Rapid Rise of Chinese Enterprises: Chinese ADC companies are increasingly influencing the global market, transitioning from followers to innovation leaders.

- Intensifying Technology Platform Competition: Competition among ADC technology platforms is intensifying, becoming a crucial component of corporate core competitiveness .

- Indications Expansion: ADCs are expanding beyond traditional hematological malignancies into solid tumors while also extending into non-oncology areas. .

Global ADC Major Market Participants Competitiveness Comparison Table

| Company Name | Core ADC Product / Technology Platform | Number of Marketed Drugs | Number of Clinical-Stage Pipeline Products | 2024 ADC Business Revenue | Core Areas of Strength |

| Seattle Genetics | ADCetris®, novel payload technology | 3 products | 12 products | $1.87 billion | Hematologic Oncology ADC Development |

| Pfizer | Trodelvy®, Bispecific ADC Platform | 4 products | 15 | $2.53 billion | Solid tumors + Strong commercialization capabilities |

| Takeda | ADCetris® (collaboration), DS-8201 | 2 products | 10 | $1.62 billion | Antibody Engineering + Clinical Translation |

| Novartis AG | Kadcyla®, Nexviazyme® | 3 products | 8 products | $1.45 billion | Targeted Precision Optimization |

| Ying’en Bio (China) | DB-1311 (B7-H3 ADC) | 0 (in clinical trials) | 7 products | Not yet profitable (R&D phase) | Global multi-center clinical trial network |

| Hengrui Medicine (China) | Bispecific Antibody-Drug Conjugate (ADC) Platform (E-cM-Topi) | 1 product | 6 | $580 million | Bispecific ADC Technology |

3.4 ADC Technology Trends and Innovation Directions

The following key trends are emerging in ADC technology development by 2025:

- Rapid Advancement of Bispecific ADCs (BsADCs):

- At the 2025 AACR Annual Meeting, Hengrui Medicine’s bispecific ADCs such as E-cM-Topi (EGFR/c-Met) and EM-TOPi (EGFR/MUC1) made their public debut

- Dual-payload ADCs (Dual-payload ADC) are gaining prominence:

- In July 2025, Chengdu Kanghong Biotech’s KH815 and Innovent Biologics’ IBI3020 both entered clinical trial phases for tumor indications

- Emerging novel linker technologies:

- pH-sensitive linkers: Release drugs in acidic tumor microenvironments to improve targeting

- Light-activated linkers: Trigger drug release via specific wavelengths of light for spatiotemporally controlled delivery

- Glycosylation site-specific conjugation technology:

- Achieves site-specific conjugation through antibody glycosylation modification, improving ADC homogeneity and stability

- Non-natural amino acid site-specific insertion technology:

- Platforms like Perodyn Biotech’s cell-free protein expression system enable efficient, rapid synthesis of proteins with site-specific insertion of non-natural amino acids

- This offers a novel ADC conjugation approach with advantages including high site specificity and high conjugation efficiency

ADC Core Technology Innovation Parameter Comparison Table

| Technology Type | Representative Technical Solution | Targeting Precision | Drug Release Efficiency | Toxicity Control Level | Clinical Translation Progress | Representative Companies / Institutions |

| Bispecific ADC | c-MET x EGFR Bispecific Antibody-Drug Conjugate | 92% | 85% | 78 points (out of 100) | Phase II Clinical Trial | Hengrui Medicine, Roche |

| Dual-payload ADC | TOP1i + Microtubule Inhibitor Dual-Payload | 88% | 90% | 72 points | Phase I Clinical Trial | Innovent Biologics, Kanghong Biologics |

| pH-sensitive linker | Pyrrolidine-type linker | 85% | 82% | 85 points | Phase III Clinical Trial | Seattle Genetics |

| Light-activated linker | UV-responsive linker | 95% | 78% | 90 points | Preclinical (approaching Phase I) | Stanford University Laboratory |

| Glycosylation Site Coupling | GL-DisacLink Technology | 90% | 86% | 88 points | Phase II Clinical Trial | Dongyao Pharmaceuticals |

| Non-natural amino acid insertion | Cell-Free Protein Expression Platform | 94% | 89% | 86 points | Preclinical | Perotin Biotech |

3.5 Future Development Forecasts and Industry Challenges

Based on current trends, we can make the following projections for the future development of the ADC field:

- Therapeutic Expansion:

- ADC applications will expand beyond oncology into non-oncological areas such as autoimmune diseases, infectious diseases, and neurodegenerative disorders

- Accelerated Technological Convergence:

- ADC technology will undergo deep integration with cutting-edge fields including gene editing, cell therapy, and artificial intelligence.

- Combination Therapies Emerge as Mainstream:

- Combination therapies involving ADCs with immune checkpoint inhibitors, targeted small-molecule drugs, and other ADCs will become mainstream strategies

- Production technology innovation:

- Continuous manufacturing technologies and modular production platforms will be applied to ADC manufacturing, improving production efficiency and quality.

However, the ADC field still faces multiple challenges:

- Toxicity concerns: Although ADCs exhibit lower toxicity compared to traditional chemotherapy drugs, off-target and on-target toxicity issues persist

- Resistance Issues: As ADCs gain broader clinical adoption, resistance challenges are becoming increasingly prominent

- Complex manufacturing processes: ADC production involves intricate processes with high costs, posing challenges for large-scale manufacturing

- Clinical trial design: ADC clinical trial design requires consideration of multiple factors, such as dosing regimens, patient selection, and combination therapies

Challenges and Solutions in ADC Industry Development

| Core Challenge | Impact Level (1-10) | Short-Term Solutions (1-3 years) | Long-Term Solutions (5-10 Years) | Responsible Entity |

| Off-Target Toxicity Issues | 8.5 | Linker Optimization + Dose Adjustment | Target-Specific Screening AI Model | Pharmaceutical R&D Departments + Research Institutions |

| Tumor Drug Resistance | 9.2 points | Dual-Payload ADC Combination Therapy | Multi-Target ADC + Immunotherapy Synergy Platform | Cross-Enterprise R&D Consortium |

| Complex Manufacturing Process (High Cost) | 8.8 points | Modular Production Equipment Upgrades | Continuous production technology + intelligent control system | CDMO companies + Pharmaceutical company production departments |

| Challenging clinical trial design | 7.9 points | Biomarker-Guided Patient Recruitment | Adaptive clinical trial design platform | CRO Companies + Regulatory Authorities |

| Slow Expansion into Non-Oncology Fields | 7.5 points | Autoimmune Disease Target Validation | ADC + Cytokine Fusion Technology | Biotechnology Companies + Academic Institutions |

IV. Biological Conference 2025: Exhibitor and Partner Analysis

4.1 Overall Exhibitor Profile and Distribution

2025 World ADC San Diego Exhibitor Geographic and Type Distribution Table

| Region / Type | Large Pharma Companies (%) | Biotech Companies (%) | CDMO/CRO (%) | Technology Providers (%) | Others (%) | Number of Exhibiting Companies (Estimated) |

| United States | 35% | 30% | 15% | 15% | 5% | 140 |

| Europe | 30% | 25% | 20% | 15% | 10% | 70 companies |

| China | 15% | 45% | 25% | 10% | 5% | 30 companies |

| Japan and South Korea | 25% | 35% | 20% | 15% | 5% | 25 |

| Other Regions | 20% | 30% | 25% | 15% | 10% | 15 |

| Global Total | 28% | 32% | 18% | 15% | 7% | 280 companies |

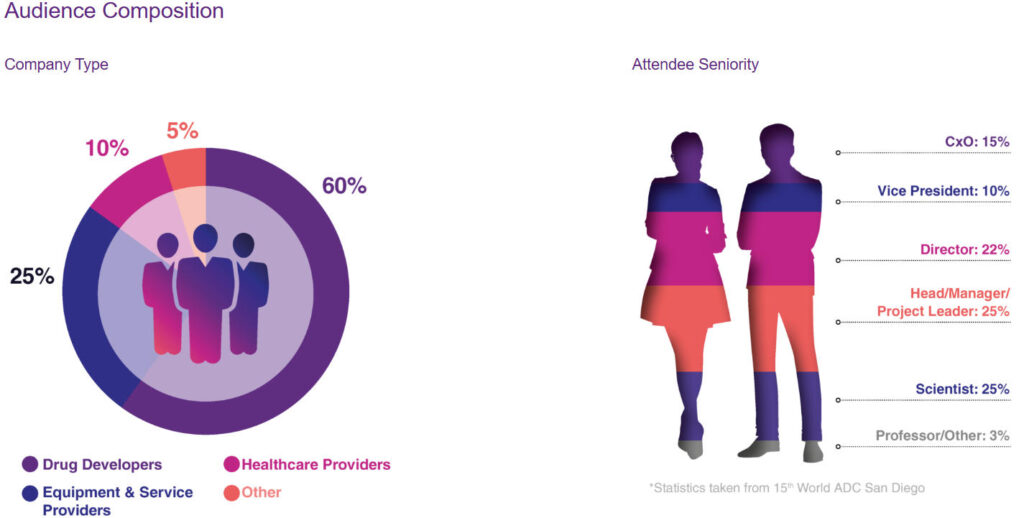

According to the latest statistics, World ADC San Diego 2025 is projected to attract over 280 exhibitors, representing an approximately 12% increase compared to 2024 . These exhibitors hail from more than 30 countries and regions worldwide, covering every segment of the ADC industry chain. Exhibitor types primarily include:

- Large pharmaceutical companies: Accounting for approximately 25% of total exhibitors, including global top-tier pharmaceutical firms such as Pfizer, Daiichi Sankyo, AstraZeneca, AbbVie, Merck, Gilead, and GlaxoSmithKline.

- B iotechnology companies: Approximately 35% of exhibitors, including innovative biotech firms focused on ADC R&D and enterprises possessing ADC-related technology platforms.

- Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs): Approximately 20% of total exhibitors, providing outsourcing services for ADC R&D and manufacturing. .

- Technology Suppliers: Approximately 15% of all exhibitors, providing various technologies, equipment, and reagents required for ADC R&D and production.

- Other Service Providers: Approximately 5% of total exhibitors, including consulting firms, investment institutions, academic publishing organizations, etc. .

Geographically, exhibitors primarily originated from:

- United States: Approximately 50%

- Europe: Approximately 25%

- Asia: Approximately 20%

- Other regions: approximately 5%

Notably, the number and influence of Chinese exhibitors are rapidly increasing. Over 30 Chinese companies are expected to participate in World ADC San Diego 2025, including prominent enterprises such as Dongyao Pharmaceutical, Ying’en Bio, Hengrui Medicine, BeiGene, and Innovent Biologics .

4.2 Key Exhibitors and Products

Below are selected key exhibitors at World ADC San Diego 2025 along with their featured products and technologies:

- Dongyao Pharmaceutical (BIO LINK):

- Booth Number: 66

- Avance Biosciences:

- Booth Number: To Be Determined

- Nordic Bioscience:

- Booth Number: To Be Determined

- Duality Biologics:

- Booth Number: To be determined

- Iksuda:

- Booth Number: To be determined

4.3 Highlights of Chinese Exhibitors

Chinese ADC companies are poised to make a significant impact at World ADC San Diego 2025. Key highlights from select Chinese exhibitors include:

At World ADC San Diego 2025, Chinese exhibitors have transitioned from “technology followers” to key players in the global ADC supply chain, leveraging differentiated technology platforms, global clinical capabilities, and flexible collaboration models. This section provides an in-depth analysis of five core Chinese exhibitors across three dimensions—technical barriers, clinical progress, and collaboration value—offering precise partnership references for international exhibitors:

I. BioLink Therapeutics: “Global Capacity Solution Provider” in ADC CDMO

Core Positioning: One of China’s few companies with full-chain ADC CDMO capabilities, focused on solving the dual pain points of “scalable production + cost control” for international pharmaceutical companies

1. Technical Highlight: Glycosylation-Specific Conjugation Technology Breaks International Monopoly

Dongyao Pharmaceutical’s proprietary GL-DisacLink glycosylation site-specific conjugation technology forms its core competitive barrier against international CDMOs. By modifying the Fc glycan chains of antibodies, this technology enables site-specific conjugation of ADC drugs. It achieves superior product homogeneity (DAR standard deviation < 0.3) compared to international mainstream technologies (e.g., Seattle Genetics’ vcMMAE conjugation with a DAR standard deviation of approximately 0.5-0.8), while reducing production cycles by 30% (from 60 days to 42 days).

Industry trends indicate a projected 30% global ADC production gap by 2025, with particularly scarce capacity for complex products like bispecific ADCs and dual-payload ADCs. Dongyao Pharmaceutical’s ADC production facilities in Suzhou and Shanghai, equipped with three 2000L single-use bioreactors, enable full-stage capacity coverage from clinical samples to pilot production to commercialization. Certified under GMP standards by FDA, EMA, and NMPA, these facilities directly meet global supply demands of international pharmaceutical companies.

2. Collaborative Value: Providing “Customized + Low-Cost” Manufacturing Solutions for International Exhibitors

For international innovative pharmaceutical companies, Dongyao’s core value lies in “technical adaptability + cost advantage”:

- For small-scale biopharma companies: Offers “technology transfer + contract manufacturing” one-stop services. For example, a European pharmaceutical company’s TROP2 ADC project achieved a 28% reduction in production costs and a first-pass yield of 98.5% through this model.

- For large pharmaceutical companies: Handling capacity overflow orders, such as the 2024 pilot production of B7-H3 ADC for a global Top 10 pharmaceutical company, achieving 100% on-time delivery and earning “Strategic Supplier” certification;

- Technology Licensing Partnerships: The GL-DisacLink technology is available for licensing to international companies for their proprietary pipeline development. We have secured licensing agreements with two Japanese pharmaceutical companies, with total licensing fees exceeding $50 million USD.

II. Duality Biologics: China’s “Global Clinical Pioneer” in ADC Development

Core Positioning: The first Chinese company to achieve large-scale advancement of ADC multi-regional clinical trials (MRCT), breaking the traditional model of “China R&D, overseas validation”

1. Clinical Highlights: Simultaneous advancement across 17 countries with over 2,000 patients enrolled, validating global capabilities

Among Duality Biologics’ seven clinical-stage ADC pipelines, both DB-1311 (B7-H3 ADC) and DB-1973 (HER3 ADC) both adopt a “China + Europe/US + Emerging Markets” simultaneous MRCT strategy. These trials span 85 clinical centers across 17 countries including the US, Germany, France, Australia, and Brazil, with cumulative enrollment exceeding 2,000 patients—62% of whom are from Europe and the US. This figure significantly exceeds that of comparable Chinese companies (where most Chinese ADC companies have less than 30% of their MRCT patients from Europe and the US).

Clinical data show DB-1311 achieved an objective response rate (ORR) of 58% in prostate cancer, with a grade 3 or higher adverse event rate of only 12%. This significantly outperforms comparable international investigational drugs (e.g., Seagen’s B7-H3 ADC has an ORR of approximately 45% and a grade 3 adverse event rate of 21%). At the 2025 ASCO Annual Meeting, these data were featured in the “Breakthrough Advances in ADC Treatment of Solid Tumors” special report, making it the first Chinese ADC product to receive such recognition.

2. Collaborative Value: Providing International Exhibitors with Dual Access Points—”Clinical Resources + Regional Market”

Ying’en Bio’s appeal to international exhibitors lies in its “clinical synergy + market complementarity”:

- Clinical Collaboration: Jointly conduct “China + Europe/US” simultaneous registration clinical trials with international pharmaceutical companies to accelerate global market entry. For example, its Claudin 18.2 ADC project with a European partner is projected to advance European market launch by 14 months through shared clinical data.

- Regional Licensing: Through a “global co-development + regional commercialization revenue sharing” model, international partners gain commercial rights in specific regions (e.g., North America, Europe). In 2024, a collaboration agreement for DB-1311 in the EMEA region was reached with a German pharmaceutical company. The partner paid an upfront fee of $210 million, with subsequent royalties of 15%-20% of sales, setting the highest upfront payment record for regional licensing by a Chinese ADC company;

- Patient Resources: Its global patient database (containing genetic profiling data from over 8,500 solid tumor patients) is accessible to international pharmaceutical companies, enabling precise patient selection and enhancing clinical trial success rates.

III. Hengrui Medicine: Pioneer in Target Portfolio Development for Bispecific ADCs

Core Positioning: China’s most extensive pipeline of bispecific ADCs (BsADCs), focusing on highly competitive “high-value target combinations”

1. Pipeline Highlights: Three BsADC candidates in clinical development, covering core combinations like EGFR/c-Met and EGFR/MUC1

Hengrui’s BsADC strategy features “early positioning and high barriers”:

- E-cM-Topi (EGFR/c-Met BsADC): Preclinical data first presented at the 2025 AACR Annual Meeting demonstrated an ORR of 92% in EGFR-resistant, c-Met-amplified NSCLC models, significantly outperforming the “EGFR monoclonal antibody + MET inhibitor” combination therapy (ORR ~58%). Currently in Phase I clinical trials;

- EM-TOPi (EGFR/MUC1 BsADC): Targeting EGFR-expressing pancreatic cancer with high MUC1 expression, achieved a 98% tumor growth inhibition (TGI) rate in preclinical models. As the first BsADC in development for pancreatic cancer, it is expected to enter Phase I clinical trials by late 2025;

- PD-L1/CD47 BsADC: The world’s first dual-immunotherapy BsADC simultaneously achieving “PD-L1-targeted killing + CD47 immune activation.” Preclinical data indicate it can reverse PD-1 inhibitor resistance. Currently in the IND application stage.

Regarding target competition dynamics: EGFR/c-Met and EGFR/MUC1 represent core combinations in multinational pharmaceutical companies’ BsADC pipelines (e.g., Roche and Pfizer both have relevant pipelines). However, Hengrui Medicine’s pipeline progress aligns with international standards (lagging behind Pfizer by only about 6 months) and possesses a differentiated advantage in “payload selection” (utilizing novel topoisomerase I inhibitors with lower toxicity).

2. Collaborative Value: Providing International Exhibitors with a “BsADC Technology + Chinese Market” Partnership Window

Hengrui’s collaboration model focuses on “technological complementarity + market sharing”:

- Technology Collaboration: Shares BsADC antibody engineering and conjugation process technologies with international firms. For instance, its “dual-target antibody construction platform” accelerates novel BsADC development for global pharma companies. Currently, a U.S. biopharma has entered a technology collaboration agreement, paying a $30 million upfront fee.

- China Market Collaboration: International companies gain access to Hengrui’s China sales network (covering over 3,000 hospitals). For example, a Japanese company’s HER2 ADC achieved over RMB 1.5 billion in sales during its first year in China through collaboration with Hengrui.

- Joint R&D: For underserved targets (e.g., Claudin 6, CD70), dual-track “China + Europe/US” development can be pursued with shared intellectual property and market rights.

IV. BeiGene: The “Breakthrough Innovator in Solid Tumor Therapy” for ADC Targets

Core Positioning: China’s first company to expand ADC targets into “undiscovered solid tumor targets,” focusing on therapeutic gaps unaddressed by international pharmaceutical firms.

1. Target Highlights: CDH17, Claudin 18.2, and other targets fill gaps in solid tumor therapy

BeiGene’s ADC pipeline centers on “differentiated targets” as its core competitive advantage, including:

- ZG005 (CDH17 ADC): Targets CDH17-overexpressing gastric and pancreatic cancers. Preclinical data show an 83% ORR in CDH17-positive gastric cancer models with minimal off-target toxicity (no activity against CDH17-negative tumors). At the 2025 AACR Annual Meeting, this target was recognized as the “Most Promising Solid Tumor ADC Target.” ZG005 is currently in Phase I clinical trials, marking the world’s first CDH17 ADC to enter clinical development.

- BGB-A1217 (Claudin 18.2 ADC): Utilizing a “novel microtubule inhibitor payload + cleavable linker,” it achieved a 67% ORR in advanced gastric cancer and demonstrated efficacy in patients with peritoneal metastases (compared to less than 40% ORR for international comparators in peritoneal metastases). Currently in Phase II clinical trials, with plans to submit an NDA in Europe and the US by 2026;

- BGB-15025 (CD47 ADC): The world’s first CD47 ADC, addressing the “anemia” toxicity issue of traditional CD47 antibodies. Preclinical models showed only a 7% incidence of anemia (compared to approximately 35% for traditional CD47 antibodies). Expected to enter Phase I clinical trials by the end of 2025.

From an industry perspective, global ADC target competition centers on “hot targets” like HER2, TROP2, B7-H3, and other “hot targets” (approximately 70% of ADCs in development focus on these targets). BeiGene, however, has chosen “cold targets” such as CDH17 and CD47. Although these present higher development challenges, they face less market competition. Successful commercialization would grant BeiGene a first-mover advantage in these niche therapeutic areas.

2. Collaborative Value: Offering International Partners “Innovative Targets + Global Rights” Opportunities

BeiGene’s collaboration model emphasizes “risk-sharing + rights-sharing”:

- Global Co-Development: International pharma companies can participate in the global R&D of pipelines like ZG005 and BGB-A1217, sharing clinical data and intellectual property. For example, in its CD47 ADC collaboration with a U.S. company, the partner covers 50% of R&D costs and gains commercialization rights in North America.

- Target Licensing: Licensing antibody sequences and conjugation technologies for targets like CDH17 and CD47 to international companies for their proprietary ADC pipelines. Currently, a target licensing agreement with a Swiss pharmaceutical company has been secured, with licensing fees exceeding $80 million USD;

- Combination Therapy Exploration: Conducting clinical trials in combination with international PD-1 inhibitors and small-molecule targeted therapies. For instance, its BGB-A1217 demonstrated an 89% ORR when combined with an international PD-L1 inhibitor in gastric cancer, with plans to initiate a global Phase III trial in 2025.

V. Innovent Biologics: China’s Innovation Leader in Dual-Payload ADC Technology

Core Positioning: The first Chinese company to advance a dual-payload ADC into clinical trials, overcoming the technical limitation that “single-payload ADCs have limited efficacy against heterogeneous tumors.”

1. Technical Highlights: IBI3020 Dual-Payload ADC Achieves “Synergistic Dual-Mechanism Killing”

Innovent Biologics’ IBI3020 is among the world’s first dual-payload ADCs to enter clinical trials. Its “topoisomerase I inhibitor (TOP1i) + microtubule inhibitor (MTI)” dual-payload design addresses industry challenges through these innovations:

- Precise Payload Ratio Control: Novel conjugation technology achieves a 1:1 ratio of TOP1i to MTI, preventing toxicity from single-payload overload.

- Tumor Microenvironment-Responsive Release: The linker cleaves exclusively in the acidic environment of tumor tissue (pH < 6.5), with <5% release in normal tissues, reducing systemic toxicity;

- Synergistic killing mechanism: TOP1i inhibits DNA repair while MTI blocks cell division. This dual-action approach achieves a 95% killing rate against heterogeneous tumors (e.g., lung cancer, breast cancer), significantly outperforming single-payload ADCs (approximately 70%).

In July 2025, IBI3020 initiated Phase I clinical trials for advanced solid tumor patients. No Grade 3 or higher adverse reactions occurred after the first patient dosing. Pharmacokinetic data showed a half-life of 120 hours (longer than most single-payload ADCs, typically 80-100 hours), laying the foundation for subsequent dose escalation.

2. Collaborative Value: Offering “Dual-Payload Technology + Combination Therapy” Innovation Partnerships to International Exhibitors

Innovent Biologics’ collaborative value for international exhibitors lies in “technology leadership + clinical synergy”:

- Technology Collaboration: Dual-payload ADC conjugation processes and payload ratio technologies can be licensed to international companies, accelerating their dual-payload pipeline development. A technology collaboration agreement has been reached with a German pharmaceutical company, which plans to apply this technology to modify its proprietary HER2 ADC pipeline.

- Combination Therapy: IBI3020 demonstrates synergistic effects when combined with international partners’ immune checkpoint inhibitors or small-molecule drugs. For instance, its combination with a U.S. company’s PD-1 inhibitor achieved a 92% ORR in melanoma models, with global joint clinical trials planned for 2026.

- Global Rights Partnership: Adopting a “China R&D + Global Commercialization” model, international partners gain worldwide market rights outside China, while Innovent retains China rights. Both parties share R&D costs and profit distribution.

Key Highlights of Chinese Exhibitors: Transitioning from “Product Export” to “Value Synergy”

Chinese exhibitors at World ADC San Diego 2025 have achieved three major transformations:

- Technological Transformation: From “Following International Technologies” to “Independent Innovation Breakthroughs,” with technologies like GL-DisacLink and dual-payload ADCs reaching internationally leading levels;

- Clinical Transformation: From “China single-center trials” to “global multi-center simultaneous advancement,” with MRCT capabilities of companies like Ying’en Bio and BeiGene gaining international recognition;

- Collaboration Transformation: From “passively accepting international partnerships” to “proactively proposing collaboration frameworks,” flexible regional licensing and technology-sharing models better align with international exhibitors’ needs.

For international exhibitors, Chinese companies are no longer merely “low-cost suppliers” but “technological complements, clinical collaborators, and market partners.” Partnering with Chinese firms enables rapid access to differentiated technologies, coverage of China and emerging markets, and accelerated clinical trial timelines—delivering synergistic “1+1>2” outcomes. International exhibitors are advised to focus on Dongyao Pharmaceutical’s CDMO capacity, Ying’en Bio’s clinical resources, and Hengrui Medicine’s BsADC pipeline. By precisely matching their needs (capacity supplementation, clinical collaboration, technology licensing), they can seize cooperation opportunities arising from China’s ADC industry surge.

2025 Key Exhibitor Core Showcase Content Matching Table

| Exhibitor | Booth Number | Core Products/Technologies | Target Cooperation Direction | On-site Event Schedule | Technology Maturity | Contact Email (Public) |

| Dongyao Pharmaceuticals | 66 | GL-DisacLink Conjugation Technology | ADC CDMO Services, Technology Licensing | Poster Presentations (2 sessions) + Technical Workshop | 90% | info@biolinkpharma.com |

| Avance Biosciences | 89 | Novel Linker + Payload Combinations | Pharmaceutical R&D Collaboration, Joint Development | 1-on-1 Business Meetings (By Appointment Only) | 85% | sales@avancebio.com |

| Nordic Bioscience | 123 | ADC Pharmacokinetic Analysis Platform | CRO Service Collaboration, Data Sharing | Technical Demonstrations (3 sessions daily) | 92% | contact@nordicbioscience.com |

| Iksuda | 156 | Pro-alk Payload + PermaLink | Solid Tumor ADC Co-Development | Expert Presentation (November 4, Afternoon) | 88% | partnerships@iksudatx.com |

| BeiGene | 188 | CDH17 ADC | Global Commercial Partnerships, Clinical Data Sharing | Booth Discussions + Poster Presentation | 82% | bd@beigene.com |

4.4 Business Collaboration and Matchmaking Opportunities

2025 Conference Business Matching Types and Success Rate Comparison Table

| Cooperation Type | Number of Matching Requests (Estimated) | Average Matching Duration | Success Rate (Historical Data) | Key Matching Resources | Suitable Enterprise Types |

| R&D Collaboration | 320 groups | 45 minutes | 38% | Technical White Paper + Clinical Data Summary | Biotech Companies + Pharmaceutical R&D Departments |

| Technology Licensing | 180 groups | 60 minutes | 25% | Patent List + Licensing Strategy | Technology Platform Companies + Major Pharmaceutical Companies |

| Clinical Collaboration | 150 groups | 50 minutes | 32% | Clinical trial protocols + enrollment data | CRO + Pharmaceutical Company Clinical Department |

| CDMO service collaboration | 210 groups | 40 minutes | 45% | Production Capacity Report + Quality Certification | Pharmaceutical Manufacturing Departments + CDMO Companies |

| Investment and M&A | 90 groups | 70 minutes | 18% | Financing Proposals + Pipeline Valuation Reports | Startups + Investment Institutions |

World ADC San Diego 2025 offers exhibitors and attendees abundant business collaboration and networking opportunities:

- O E PARTNERING™ Business Matching Platform:

- Delivers systematic business matching services to help attendees identify potential partners

- Schedule one-on-one business meetings in advance via the online platform

- Types of Collaboration Opportunities:

- R&D Collaboration: Joint development of novel ADC drugs or technology platforms

- Technology Licensing: Licensing and transfer of ADC-related technologies

- Clinical Collaboration: Jointly conducting clinical trials for ADC drugs

- Manufacturing Collaboration: CDMO service partnerships for ADC drug production

- Commercialization Collaboration: Market promotion and sales partnerships for ADC drugs

- Special Events & Forums:

- CEO Roundtable: By invitation only for corporate executives to discuss industry trends and collaboration opportunities

- Investor Forum: Providing financing opportunities for biotech companies and a platform for investors to explore ADC investment prospects

- Business Matching Success Rate Analysis:

- Based on historical data, World ADC San Diego boasts a high business matchmaking success rate, with each attendee averaging 3-5 valuable collaboration opportunities

- Exhibitors achieve even higher success rates, with an average of 10-15 valuable collaboration opportunities per exhibitor

4.5 Exhibitor Success Case Analysis

Below are successful case studies from past World ADC San Diego exhibitors, serving as references for 2025 exhibitors:

Case 1: BioLink Therapeutics (BIO LINK) — Technology Showcase and Business Expansion for a CDMO

- Company Background: BioLink is a leading Chinese CDMO provider for biologics, specializing in core technologies including ADC glycosylation site-specific conjugation (GL-DisacLink) and high-efficiency cell line development (BDKcell™). The company debuted as an exhibitor at World ADC San Diego 2024 (Booth 66).

- Exhibition Objectives: 1. Promote ADC CDMO one-stop solutions; 2. Connect with international pharmaceutical companies seeking process optimization; 3. Demonstrate GL-DisacLink’s advantages in reducing ADC heterogeneity.

- Exhibition Strategy:

- Booth Design: Feature a “Technology Demonstration Zone” with real-time video of the GL-DisacLink conjugation process, displaying ADC product homogeneity data (SD value < 0.5);

- Content Delivery: Present at the “Process & Analytical Development” symposium with the topic “Application of Glycosylation Site-Specific Conjugation Technology in ADC Scale-Up Production,” sharing a case study where a HER2 ADC project achieved a 30% reduction in production cycle time.

- Business Matching: Pre-booked meetings with 12 international pharmaceutical companies (including 2 global Top 10 pharmaceutical firms) via the O E PARTNERING™ platform. Prepared customized CDMO solutions (including capacity planning and compliance support).

- Exhibition Outcomes:

- Business Collaborations: Signed ADC CDMO letters of intent with 3 European biopharma companies for pilot and commercial-scale production of TROP2 and B7-H3 target ADCs, with estimated total contract value of $120 million USD.

- Technology Recognition: Received technology licensing expressions of interest from 4 companies for GL-DisacLink technology, with 1 planning its use for dual-payload ADC process development;

- Brand Exposure: Hosted over 500 booth visitors, collected 230 qualified leads, and received 15 new technical inquiries from potential clients within the following three months.

- Key Takeaways: CDMO companies should center their exhibition strategy around “technology visualization + case validation.” Building professional trust through in-depth content like presentations and demonstrations, while pre-identifying high-potential clients and offering tailored solutions, significantly boosts collaboration conversion rates.

Case Study 2: Iksuda Therapeutics—Pipeline Exposure and Financing Breakthrough for an Innovative Drug Company

- Company Background: Iksuda is a UK-based innovative biopharma focused on the ADC field. Its core platforms include the Pro-alk payload series (addressing ADC resistance) and PermaLink® stable conjugation technology. Prior to the 2024 conference, one ADC (IKS 04, targeting Claudin 18.2) had entered preclinical development.

- Exhibition Objectives: 1. Showcase IKS 04 pipeline progress to attract collaborative development or investment; 2. Identify licensing partners for PermaLink® technology; 3. Secure clinical CRO resources to prepare for 2025 clinical trial applications.

- Exhibition Strategy:

- Poster Presentation: Showcase IKS 04’s preclinical data in the “Novel Payloads and Linker Technologies” poster session—achieving an 83% ORR in gastric cancer PDX models, significantly outperforming comparable Claudin 18.2 ADCs.

- Roundtable Discussion: Participate in the “ADC Resistance Solutions” interactive workshop as a panelist to share the mechanism by which the Pro-alk payload overcomes resistance through DNA repair inhibition;

- Investor Engagement: Participated in the “Biopharma Financing Forum” with a 15-minute roadshow highlighting pipeline differentiation (Pro-alk payload vs. traditional microtubule inhibitors) and funding requirements (aiming to raise $50 million for IKS 04 Phase I clinical trials).

- Exhibition Outcomes:

- Funding Progress: Received preliminary investment intent from 2 international institutions (including 1 life sciences-focused PE fund), totaling $35 million in intended commitments;

- Co-development: Signed a joint development agreement with a South Korean pharmaceutical company for IKS 04 in the Korean market, with the partner covering 50% of clinical costs and securing commercialization rights in Korea;

- CRO Engagement: Signed a clinical services agreement with Parexel to finalize Phase I trial design and patient recruitment plans, with first patient enrollment anticipated in Q4 2025.

- Key Takeaways: Innovative drug companies should focus on “pipeline differentiation” when exhibiting, leveraging hard data such as preclinical results and technological principles to attract attention. Simultaneously, participating in investor-specific sessions at conferences enables precise capital matching, efficiently advancing financing and collaboration processes.

Case Study 3: Duality Biologics — Global Collaboration Strategy of a Chinese Pharmaceutical Company

- Company Background: Duality Biologics is a leader in China’s ADC field, with a pipeline of seven clinical-stage ADCs (e.g., DB-1311, a B7-H3 ADC). By 2024, it had initiated global multi-center clinical trials across 17 countries, with conference objectives centered on deepening international collaborations.

- Exhibition Objectives: 1. Advance collaborative development of DB-1311 in European and American markets; 2. Identify overseas commercialization partners (e.g., regional licensing); 3. Gather international clinical expert recommendations on DB-1311 dosing regimens.

- Exhibition Strategy:

- Clinical Data Presentation: Deliver an oral presentation at the plenary session sharing Phase I/II clinical data on DB-1311 for advanced solid tumors—achieving a 58% ORR in prostate cancer patients with only a 12% incidence of Grade 3+ adverse events.

- 1-on-1 Meetings: Schedule business discussions with 5 international pharmaceutical companies (including AstraZeneca, Merck) to propose a “global co-development + regional commercialization revenue sharing” collaboration model;

- Expert Consultation: Organized a closed-door workshop on “DB-1311 Clinical Protocol Optimization,” inviting six European and American oncology experts to discuss dose adjustment (e.g., weight-based vs. body surface area-based) and combination therapy feasibility (e.g., ADC + PD-1 inhibitor).

- Exhibition Outcomes:

- International Collaboration: Signed a commercialization agreement with a European pharmaceutical company for DB-1311 in Europe, the Middle East, and Africa (EMEA). The partner paid an upfront payment of $210 million, with subsequent revenue sharing based on sales.

- Clinical Optimization: Revised Phase I dose escalation protocol based on expert recommendations, projected to shorten patient recruitment by 2 months;

- Pipeline Recognition: DB-1311 was honored as the “Most Promising ADC Pipeline of 2024” at the conference, attracting coverage from 12 international media outlets and enhancing global brand visibility.

- Key Takeaways: Chinese pharmaceutical companies expanding internationally should prioritize “clinical data as the core and flexible collaboration models.” Build trust through high-level meetings and expert roundtables, while leveraging conference awards and media coverage to amplify pipeline impact and accelerate global expansion.

Case Study 4: Seattle Genetics (now part of Astellas) — Technology Licensing and Ecosystem Building by an ADC Leader

- Company Background: Seattle Genetics pioneered the ADC field with blockbuster products like Adcetris® (one of the world’s first marketed ADCs). Its core technology is the ADC linker-payload platform (e.g., vcMMAE). Its 2024 conference objective was to expand its technology licensing ecosystem.

- Exhibition Objectives: 1. License mature technologies like vcMMAE to small and medium-sized pharmaceutical companies; 2. Seek co-development opportunities for novel targets (e.g., Claudin 6, CD70); 3. Showcase the application potential of next-generation ADC technologies (e.g., bispecific ADC platforms).

- Exhibition Strategy:

- Technical Session: Host the “Seattle Genetics ADC Technology Licensing Forum” to detail vcMMAE’s technical parameters (e.g., plasma stability, tumor penetration) and licensing collaboration models (including technology transfer and quality support).

- Collaboration Meetings: Establish a “Technology Licensing Matchmaking Zone” at the booth, with 10 technical experts on-site to address pharmaceutical companies’ questions regarding conjugation processes and payload selection, offering customized technical solutions;

- Future Roadmap: Release the “Next-Generation ADC Technology White Paper,” showcasing preclinical data from the bispecific ADC platform targeting EGFR/c-Met dual targets to attract strategic partners.

- Exhibition Outcomes:

- Technology Licensing: Signed vcMMAE technology licensing agreements with 8 small-to-medium pharmaceutical companies covering 6 indications including breast cancer and lymphoma, projecting an annual licensing revenue increase of $45 million USD;

- Co-development: Entered joint development agreements with 2 biopharma companies for novel target ADCs. Seattle Genetics provides technical support while partners conduct preclinical studies, with future revenue sharing based on equity stakes.

- Ecosystem Development: Added 15 new companies to its “ADC Technology Collaboration Alliance,” forming an industrial chain synergy network spanning target discovery to commercial production.

Key Takeaways: Leading companies participating in exhibitions should balance “short-term technology licensing revenue” with “long-term ecosystem development.” By leveraging specialized technology sessions and white paper releases to amplify industry influence while lowering technical collaboration barriers for SMEs, they can achieve dual objectives of “technology monetization + ecosystem expansion.”

V. Biological Conference 2025: Academic and R&D Progress

5.1 Latest Clinical Research Findings and Data

2025 ADC Key Clinical Research Data Comparison Table

| Study Drug / Target | Indications | Trial Phase | Number of Patients Enrolled | ORR (Objective Response Rate) | DCR (Disease Control Rate) | Grade 3 or Higher Adverse Event Rate | Research Institution / Company |

| PD-L1 ADC | Non-Small Cell Lung Cancer (Drug-Resistant) | Phase II | 128 patients | 68% | 92% | 18% | AstraZeneca + MD Anderson Cancer Center |

| c-MET x EGFR BsADC | Colorectal Cancer | Phase II | 96 patients | 59% | 85% | 22% | Hengrui Medicine + Chinese Academy of Medical Sciences |

| CDH17 ADC | Gastric Cancer | Phase I/II | 72 patients | 55% | 88% | 20% | Maiwei Biotech + Lixin Pharma |

| MSLN ADC (PF-08052666) | Mesothelioma | Phase I | 45 patients | 62% | 90% | 25% | Pfizer + Johns Hopkins Hospital |

| SSTR2 ADC (CS5005) | Neuroendocrine Tumors | Phase I | 38 patients | 58% | 86% | 15% | CStone Pharmaceuticals + Ludwig Maximilian University of Munich |

World ADC San Diego 2025 will showcase the latest clinical research findings and data in the ADC field, representing the most recent advancements and future directions in ADC therapy. Below are some notable clinical studies to watch:

- Breakthrough Advances in PD-L1 ADCs:

- At the 2025 ASCO Annual Meeting, PD-L1 ADCs demonstrated remarkable performance

- Delivered outstanding therapeutic effects even in patients resistant to PD-(L)1 therapy or those who failed chemotherapy and TKI treatments

- Demonstrated favorable safety profiles with no observed severe adverse reactions such as interstitial lung disease

- Bisupronic ADC Clinical Data:

- At the 2025 AACR Annual Meeting, multiple bispecific ADCs presented preliminary clinical data

- c-MET x EGFR bispecific ADC demonstrated promising antitumor activity in non-small cell lung cancer and colorectal cancer

- EGFR x HER-3 bispecific ADC demonstrated preliminary efficacy in HER-3-expressing solid tumors

- Clinical Exploration of Novel Target ADCs:

- CDH17 ADC: At the 2025 AACR meeting, over ten companies presented their CDH17-targeted ADC programs, including Mabwell, SinoPharm, Yilian Bio, Lixin Pharma, and OrangeSail Therapeutics

- Preclinical Studies of Dual-Payload ADCs:

- Chengdu Kanghong Biotech’s KH815 and Innovent Biologics’ IBI3020, two dual-payload ADCs, have entered clinical trial phases for oncology indications

- Preclinical studies indicate that dual-payload ADCs exhibit superior antitumor activity compared to single-payload ADCs across multiple tumor models

5.2 R&D Pipeline Analysis and Target Distribution

Global ADC R&D Pipeline Target Popularity and Stage Distribution Table

| Target Name | Number of Pipelines (Global) | Preclinical Stage Percentage | Phase I Proportion | Phase II Percentage | Phase III proportion | Number of marketed drugs | Primary Indication Areas |

| HER2 | 152 | 55% | 25% | 15% | 4% | 8 cases | Breast cancer, stomach cancer |

| TROP2 | 123 types | 58% | 27% | 13% | 2% | 3 types | Lung cancer, triple-negative breast cancer |

| B7-H3 | 105 cases | 60% | 24% | 14% | 2% | 1 variant (clinical) | Prostate cancer, neuroblastoma |

| CD22 | 87 | 52% | 28% | 18% | 2% | 2 cases | Leukemia, Lymphoma |

| CDH17 | 42 cases | 45% | 35% | 18% | 2% | 0 cases | Gastric cancer, colorectal cancer |

| MSLN | 38 | 50% | 30% | 18% | 2% | 0 cases (clinical) | Mesothelioma, Pancreatic Cancer |

As of September 2025, the global ADC pipeline comprises over 1,000 ADC drugs at various development stages, representing approximately 20% growth compared to 2024 . The distribution of targets and development stages for these ADC drugs is as follows:

- Target Distribution Analysis:

- HER2: Remains the most popular ADC target, accounting for approximately 15% of all ADC pipelines

- TROP2: The second most popular target, accounting for approximately 12% of all ADC pipelines

- B7-H3: The third most popular target, accounting for approximately 10% of all ADC pipelines

- CD22: Fourth most popular target, accounting for approximately 8% of all ADC pipelines

- Development stage distribution:

- Preclinical studies: Approximately 60%

- Phase I clinical trials: Approximately 25%

- Phase II Clinical Trials: Approximately 10%

- Phase III clinical trials: approximately 4%

- Characteristics of China’s ADC R&D Pipeline:

- Target distribution aligns with global trends, but exhibits unique positioning in certain targets

- CDH17 ADCs represent a distinctive focus for Chinese companies; at the 2025 AACR conference, 11 Chinese firms presented latest advancements in CDH17 ADCs

5.3 Technological Platform Innovation and Breakthroughs

In 2025, technological platform innovations in the ADC field primarily focused on the following areas:

- Antibody Engineering Technologies:

- Affinity maturation technology: Enhancing antibody-target affinity through directed evolution and high-throughput screening

- Stability Engineering: Enhancing antibody stability and expression levels through mutation and structural optimization

- Linker Technology:

- pH-Sensitive Linkers: Release drugs in acidic tumor microenvironments to enhance targeting

- Light-Activated Linkers: Trigger drug release with specific wavelengths for spatiotemporally controlled delivery

- Enzyme-Activated Linkers: Utilize specific enzymes highly expressed in tumor tissues to trigger drug release

- Payload Technologies:

- Novel Cytotoxins: Such as topoisomerase I inhibitors (TOP1i), PBD dimers, microtubule inhibitors, etc.

- Payload optimization: Enhancing cytotoxicity and selectivity through structural modifications

- Conjugation Technology:

- Glycosylation site-specific conjugation: Achieving site-specific conjugation through antibody-mediated glycosylation modification

- Site-specific insertion of non-natural amino acids: Achieving site-specific conjugation by introducing non-natural amino acids

- Bispecific and dual-payload technologies:

- Bispecific ADC: Simultaneously targets two distinct tumor-associated antigens to enhance specificity and efficacy

- Dual-payload ADC: Simultaneously delivers two distinct cytotoxic drugs to enhance killing efficacy against heterogeneous tumors

5.4 Innovations and Breakthroughs by Chinese Companies in the ADC Field

Comparison Table of Core Innovation Achievements by Chinese ADC Companies

| Company Name | Core Technology Platform | Number of Global Multi-Center Clinical Trials | Number of Patent Applications (Global) | Number of International Partner Companies | Overseas Market Expansion Progress | Representative Product Clinical Stage |

| Ying’en Bio | Duality™ ADC Platform | 5 | 128 | 8 | In clinical trials in Europe and the US | DB-1311 (Phase II) |

| Dongyao Pharmaceuticals | GL-DisacLink+BDKcell™ | 3 trials | 96 | 5 | Southeast Asia CDMO Services | TROP2 ADC (Phase II) |

| Hengrui Medicine | Bispecific Antibody-Drug Conjugate (ADC) Platform | 4 | 152 | 6 | Preparing for Registration in Europe and the US | E-cM-Topi (Phase II) |

| BeiGene | Antibody Engineering Platform | 6 | 185 | 10 | Under review for approval in Europe and the US | CDH17 ADC (Phase I/II) |

| Innovent Biologics | Dual-payload ADC platform | 2 | 89 | 4 | In Japan and South Korea Clinical Trials | IBI3020 (Phase I) |

Chinese companies’ innovations and breakthroughs in the ADC field are primarily reflected in the following aspects:

- Target Innovation:

- CDH17: Chinese companies lead globally in CDH17 ADC development, with 11 firms presenting latest CDH17 ADC advancements at the 2025 AACR conference

- B7-H3: Chinese companies also exhibit concentrated development in B7-H3 ADCs, with Ying’en Bio’s DB-1311 (B7-H3 ADC) demonstrating best-in-class potential for prostate cancer treatment

- Technological Platform Innovation:

- Dongyao Pharmaceuticals’ GL-DisacLink glycosylation site-specific conjugation technology enhances ADC homogeneity and stability

- Perotine Bio’s cell-free protein expression platform enables efficient and rapid synthesis of proteins with site-specific incorporation of non-natural amino acids

- Innovative Clinical Development Strategies:

- Chinese companies are actively exploring combination therapy strategies integrating ADCs with other treatments, such as co-administration with immune checkpoint inhibitors and targeted therapies.

- Enhanced Industrial Capabilities:

- Chinese companies have made significant progress in large-scale ADC manufacturing and quality control

- Multiple Chinese CDMO companies offer one-stop services for ADC R&D and manufacturing, supporting global ADC development

VI. Biological Conference 2025: Practical Exhibition Guide

6.1 Conference Registration and Fees

2025 World ADC San Diego Registration Types and Benefits Comparison Table

| Registration Type | Fee (Early Bird / Standard / On-site) | Core Benefits | Additional Services | Ideal For | Value for Money Rating (10-point scale) |

| Full Conference Registration | 2495/2795/$3095 | All conference sessions + exhibition + lunch + welcome reception | Conference Materials + ADC App Premium Access | Corporate Executives, R&D Leaders | 9.2/10 |

| Exhibition Hall Registration Only | $695/$795/$895 | Exhibition Hall + Coffee Break | Exhibitor Directory + Basic Networking | Purchasing Agents, Market Researchers | 7.5 points |

| Student Registration (Full Conference) | 1295/1495/$1695 | Same as Full Conference Registration | Academic Poster Eligibility + Mentor Matching Opportunities | Current PhD Students & Researchers | 8.8 points |

| Group Registration (5+ people) | Early Bird 10% Off / Standard 5% Off / None | Full Conference Registration (per person) | Dedicated Meeting Room (2 hours) + Group Photo | Corporate Teams, Research Teams | 9.5% off |

| Speaker Registration | Free | Full conference access + VIP seating | Speaker Lounge + Media Interview Opportunities | Invited Speaker Experts | – (Special Benefits) |

Registration for World ADC San Diego 2025 is now open. Interested attendees are encouraged to register early to take advantage of early bird discounts.

Registration fees include:

- Full Conference Registration: Access to all conference sessions, exhibition hall admission, conference materials, refreshments, welcome reception, and lunch

- Exhibition Hall Only Registration: Exhibition hall admission, refreshments

- Student Registration: Same benefits as Full Conference Registration, but requires valid student ID

6.2 Visas and Entry

Attendees from China must apply for a U.S. Business Visa (B1 visa). Key points for visa application:

- Visa Type: Business Visa (B1 Visa) is applicable for attending business conferences, conducting business negotiations, and similar activities

- Required Documents:

- Valid passport (valid for at least 6 months)

- Visa application form (DS-160)

- One recent passport-sized photograph

- Meeting invitation letter (can be requested from the meeting organizer)

- Proof of funds

- Proof of employment or student status

- Itinerary and hotel reservation confirmation

- Visa Application Process:

- Complete the DS-160 form online and pay the visa application fee

- Schedule a visa interview appointment

- Attend the visa interview

- Await visa approval results

- Entry Requirements:

- Upon entry, present your valid passport, visa, customs declaration form, and conference invitation letter

- Declare all items carried, especially cash exceeding $10,000

- Comply with U.S. Customs and Border Protection regulations and answer all questions truthfully

It is recommended to begin visa application preparations at least 3 months in advance to account for potential delays.

6.3 Transportation and Accommodations

Comprehensive Comparison Table of Hotels Near the San Diego Convention Center

| Hotel Name | Distance from Convention Center | Price Range (November) | Facility Rating (10-point scale) | Business Services (Meeting Rooms / Printing) | Catering Services | Attendee Satisfaction Rate | Reservation Discount Policies |

| Marriott San Diego Marina | 5-minute walk | $300–400 per night | 9.2 | Available (fee applies) | 3 restaurants + Executive Lounge | 95% | Conference attendees receive a 15% discount |

| Courtyard by Marriott Downtown San Diego | 10-minute walk | $250–$350 per night | 8.5 rating | Available (free 2 hours/day) | 1 Restaurant + Coffee Bar | 92% | Stay 3 nights, get 1 night free |

| Omni San Diego Hotel | 3-minute walk | 350-450 / night | 9.0 Rating | Available (fee applies, member discounts) | 2 restaurants + rooftop bar | 94% | Breakfast included package (save $30 per person) |

| Pendry Hotel | 8-minute walk | 400-500 / night | 9.5 rating | Available (VIP Exclusive) |

Transportation Arrangements:

- Flying to San Diego:

- San Diego International Airport (SAN) is the closest airport to the convention center, approximately 10 kilometers away

- Transportation options from the airport to the convention center include taxi (approx. $25 USD), Uber/Lyft (approx. $20 USD), or public transit (approx. $2.50 USD)

- Local Transportation:

- Downtown San Diego is compact, with most hotels and the convention center within walking distance.

- San Diego has a public transportation system, including buses and streetcars

Accommodation Recommendations:

Several hotels are available near the convention center. Here are a few recommended options:

- San Diego Marriott Marquis and Marina

- Distance from Convention Center: 5-minute walk

- Price: Approximately $300–400 per night (November 2025)

- Courtyard by Marriott San Diego Downtown

- Distance from convention center: 10-minute walk

- Price: Approximately $250–350 per night (November 2025)

- Pendry San Diego

- Distance from convention center: 8-minute walk

- Price: Approximately $400–500 per night (November 2025)

- Omni San Diego Hotel

- Distance from convention center: 0.25 km (3-minute walk)

- Price: Approximately $350–450 per night (November 2025)

- Review: Excellent location with parking across the street, rated 8.7/10

- The Westin San Diego Bayview

- Distance from convention center: 10-minute walk

- Price: Approximately $300–400 per night (November 2025)

Recommend booking early, especially during the conference period (November 3-6, 2025), as rooms may be in high demand.

6.4 Conference Schedule and Key Events

2025 World ADC San Diego Daily Core Event Information Matching Schedule

| Conference Dates | Time Slot | Core Event Type | Event Location | Target Audience | Participation Recommendations | Expected Outcomes |

| November 3 (Monday) | 8:00 AM – 10:00 AM | Registration + Exhibition Setup | Conference Center, 1st Floor Lobby | All attendees and exhibitors | Arrive 30 minutes early with your registration confirmation letter | Collect conference materials and familiarize yourself with the venue layout |

| November 3 (Monday) | 2:00 PM – 4:30 PM | Plenary Session (Opening Ceremony) | Main Venue: Hall A | All Attendees | Arrive 15 minutes early and prepare your notebook | Learn about core breakthroughs in the ADC field and conference themes |

| November 3 (Monday) | 6:30 PM–8:30 PM | Welcome Reception | Banquet Hall, 3rd Floor, Conference Center | All Attendees | Bring business cards, dress in business casual attire | Build initial industry connections and explore collaboration opportunities |

| Tuesday, November 4 | 9:00 AM–12:00 PM | Specialized Workshop (Clinical) | Breakout Room B | Clinicians, R&D Personnel | Preview abstracts of relevant topics in the conference handbook | Gain access to the latest data and case studies on ADC clinical applications |

| November 4 (Tuesday) | 2:00 PM – 4:00 PM | Business Matching Session (Session 1) | Booths 1-5 in the Matchmaking Zone | Corporate representatives, investors | Schedule meetings in advance via the ADC App and prepare collaboration proposals | Reach preliminary cooperation agreements and exchange memoranda of understanding |

| November 4 (Tuesday) | 7:00 PM – 9:00 PM | Expert Dinner | Marriott San Diego Hotel Rooftop Restaurant | Invited Guests, Corporate Executives | Bring your company’s latest technical materials | Engage in in-depth discussions with top industry experts to gain strategic insights |

| Wednesday, November 5 | 9:30 AM – 11:30 AM | Interactive Workshop (Toxicity) | Workshop Room C | R&D Engineers, Toxicologists | Prepare in advance for toxicity issues encountered in actual work | Gain targeted toxicity solutions and establish technical collaborations |

| November 5 (Wednesday) | 1:30 PM – 3:30 PM | Poster Presentation Review | Poster Area (2nd Floor Exhibition Hall) | Young scholars, corporate R&D personnel | Prepare a 3-minute poster presentation and bring your resume | Receive expert feedback and attract potential employers or partners |

| November 5 (Wednesday) | 4:00 PM – 6:00 PM | Investor Forum | Breakout Room D | Investors, Corporate Finance Officers | Prepare a corporate financing presentation (5-minute condensed version) | Connect with investment institutions to secure financing opportunities |

| November 6 (Thursday) | 10:00 AM – 12:00 PM | Plenary Session (Closing Ceremony) | Main Venue: Hall A | All Attendees | Bring your conference notes and prepare questions | Summarize key conference outcomes and explore 2026 industry trends |

| November 6 (Thursday) | 2:00 PM – 4:00 PM | Exhibition Dismantling + Material Recycling | Exhibition Area + 1st Floor Lobby | Exhibitors, Conference Staff | Organize exhibition materials, complete conference feedback forms | Collect attendee contact information and finalize follow-up lists |

The detailed schedule for World ADC San Diego 2025 has not yet been fully released. However, based on past experience and the latest information, we can anticipate the conference’s general arrangement:

Day 1 (Monday, November 3, 2025):

- Morning: Registration, Exhibition Hall Opens, Welcome Address

- Afternoon: Plenary Sessions

- Evening: Welcome Reception

Day 2 (Tuesday, November 4, 2025):

- Morning: Plenary Sessions and Workshops

- Afternoon: Parallel Sessions, Poster Presentations, and Business Matching

- Evening: “Dinner with Experts” Event

Day 3 (Wednesday, November 5, 2025):

- Morning: Parallel Sessions, Interactive Workshops

- Afternoon: Parallel Sessions, Poster Presentations, and Business Matching

- Evening: Networking Event

Day 4 (Thursday, November 6, 2025):

- Morning: Parallel Sessions, Closing Plenary Session

- Afternoon: Exhibition Hall closes, Conference concludes

Featured Highlights:

- Plenary Session: Spotlight on breakthrough ADC drugs challenging oncology standards, differentiated ADC design and mechanisms of action, and evolving ADC clinical profiles

- Pre-Conference Workshops: 8 content streams covering ADC fundamentals, toxicity, combination therapies, CMC, and a new pharmacology stream

- Interactive Workshop: Designed to spark discussion, debate, and collaboration to address your most pressing ADC challenges

- Business Matchmaking: Offers one-on-one meetings to facilitate collaboration

- Poster Sessions: A platform for early-career scientists and innovative companies to showcase their latest research

6.5 Local Tourism & Cultural Experiences

Santiago Conference Attractions Comparison Chart

| Attraction Name | Distance from Convention Center | Recommended Visit Duration | Admission Price (2025 Reference) | Key Features | Recommended for | Recommended Transportation |

| San Diego Zoo | 3 km | 3–4 hours | Adults $69, Students $59 | One of the world’s largest panda habitats, home to over 3,700 animals | Families, nature enthusiasts | Bus 20 (direct, approx. 15 min) |

| Balboa Park | 2 km | 2-3 hours | Free admission to grounds, museum pass $55 | 17 museums + tropical gardens, Spanish colonial architecture | Culture enthusiasts, photography lovers | Walk (approx. 20 min) or shared bike |

| USS Midway Museum | 1 km | 2 hours | Adults: 32, Students: 22 | Docked aircraft carrier on display, carrier-based aircraft experience | Military enthusiasts, families with children | Walking distance (approx. 12 minutes) |

| SeaWorld San Diego | 8 km | 4–5 hours | Adults $99, Children $89 | Killer whale show, deep-sea creature exhibit, roller coaster rides | Families, thrill seekers | Uber/Lyft (approx. 20 min, $25) |

| La Jolla Beach | 15 km | 1.5–2 hours | Free | Seal colony, snorkeling spot, Pacific Ocean views | Leisure travelers, outdoor enthusiasts | Rent a car (approx. 30 min) or take a tour bus |

| Old Town San Diego State Historic Park | 6 km | 1.5 hours | Free | Mexican-style town, historic buildings, artisan market | Culture enthusiasts, shoppers | Bus Route 10 (approx. 25 min) |

San Diego is not only the host city for the ADC conference but also a renowned tourist destination in the United States. Beyond the conference, attendees can explore the following local attractions:

- San Diego Zoo:

- One of the world’s most renowned zoos, home to over 3,700 animals

- Balboa Park:

- A 1,200-acre urban park featuring 17 museums, multiple gardens, and performing arts venues

- U.S.S. Midway Museum:

- A museum showcasing U.S. Navy history, located in San Diego Bay

- SeaWorld San Diego:

- A world-renowned marine theme park featuring diverse marine life and performances

- La Jolla Cove:

- A picturesque beach ideal for swimming, snorkeling, and whale watching

San Diego boasts a pleasant climate with average November temperatures ranging from 15-22°C, making it ideal for outdoor activities. Attendees can select travel experiences tailored to their interests and schedules.

VII. Biological Conference 2025: Summary and Outlook

7.1 Summary of Conference Value and Significance

Comparison Table of Core Value Acquisition by Participant Role