- I. Core Summary and Future Positioning: Key Takeaways from 2026 Bio International Convention

- II. The First Major Strategic Transformation at 2026 Bio International Convention: From "In Vitro Diagnostics (IVD)" to "Actionable Intelligence"

- III. The Second Major Strategic Transformation Highlighted at 2026 Bio International Convention: Platformization and Democratization of Precision Medicine

- IV. Third Strategic Transformation Unveiled at 2026 Bio International Convention: Global Reshaping and Regional Focus of Industrial Chains

- V. Practical Action Checklist for 2026 Bio International Convention Attendees and Industry Observers

- VI. Conclusion and Long-Term Outlook: Charting the Course Post-2026 Bio International Convention

I. Core Summary and Future Positioning: Key Takeaways from 2026 Bio International Convention

1.1 A Captivating Opening: Medlab 2026 Witnesses a Disruptive Turning Point in Middle Eastern Laboratory Medicine

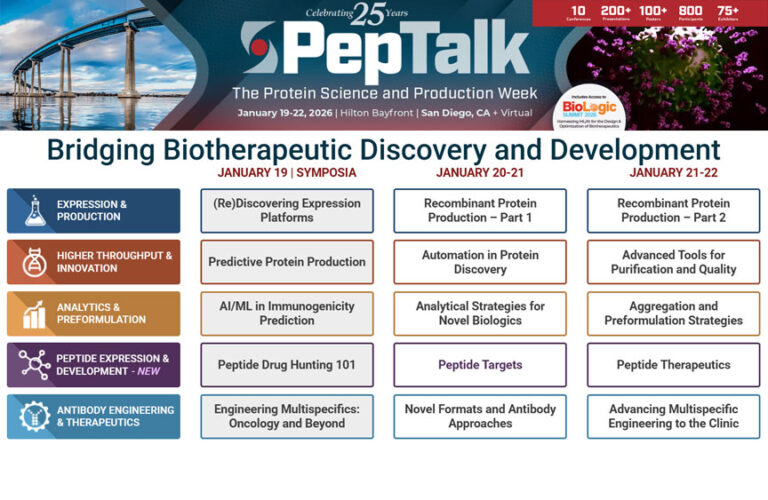

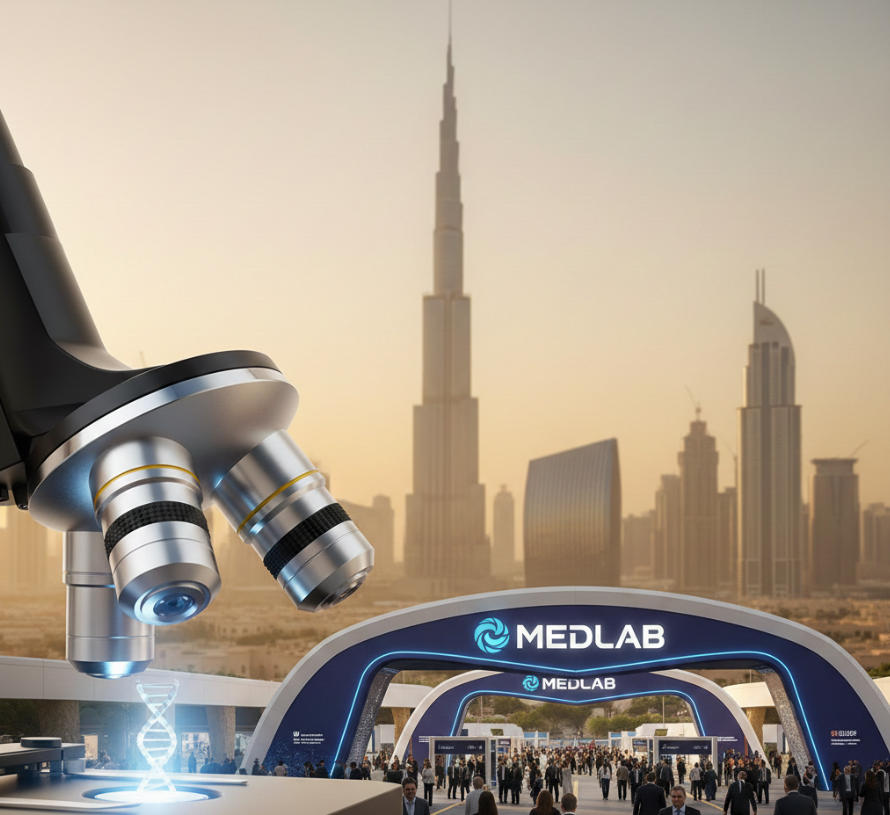

In the 2026 global healthcare landscape, Medlab Middle East—synergizing with the 2026 Bio International Convention—transcends its origins as a regional trade exhibition, evolving into a strategic global hub for laboratory medicine. With attendance surpassing 30,000+ in 2024, Medlab 2026, alongside the 2026 Bio International Convention, will mark the Middle East’s structural shift from a “consumer of high-end medical equipment” to a “pioneer in life sciences innovation”. For global IVD and precision medicine decision-makers, these two landmark events represent a pivotal moment to redefine growth trajectories for the next five years.

For years, the global market’s perception of the Middle East’s healthcare sector has been limited to its robust end-consumer spending power and capital-intensive private healthcare services, often assuming a lack of indigenous industrial chain support. But if you attended the 2024 Medlab exhibition, that impression would have been completely shattered.Last year, I specifically flew to Dubai to explore the event. Upon entering the exhibition hall, I was immediately struck: among the 30,000 attendees, alongside massive booths from global healthcare giants like Siemens and Roche, numerous Middle Eastern companies showcased their independently developed IVD devices and gene sequencing kits.From hospital procurement teams in Nigeria to European tech startups and Chinese nucleic acid drug companies, people of diverse backgrounds and accents crowded around booths exchanging ideas. This trend of “global resources converging on the Middle East” is undeniable, with its industrial magnetism experiencing explosive growth.

Previously, the Middle Eastern healthcare market functioned more like an “end-consumer market”—spending money on advanced equipment and top-tier doctors to address local high-end medical needs.But now, as evident from the evolution of the Medlab exhibition, the Middle East is proactively building an “industrial chain ecosystem”: at the governmental level, promoting CGT manufacturing centers and clinical trial bases; at the corporate level, shifting from “pure equipment sales” to “providing integrated diagnostic-therapeutic solutions”; and even hospital laboratories are transforming into “AI-driven smart centers.”

Take a straightforward example: In 2022, Medlab’s core keywords centered on “equipment upgrades,” with most booths showcasing more precise analyzers and faster sequencers. By 2024, however, the keywords had shifted to “collaboration,” “ecosystem,” and “Intelligence”—major announcements like Roche’s CDx joint lab partnership with a Middle Eastern pharmaceutical company, Dubai’s launch of the “Middle East Genomic Sequencing Big Data Center,” and the groundbreaking ceremony for a Chinese-Abu Dhabi IVD production base all debuted at this year’s event.By 2026, this transformation will deepen: Laboratories will evolve beyond “test-focused facilities” into medical hubs delivering actionable intelligence; precision medicine will transition from an exclusive “luxury” to accessible “value-based care” for emerging markets; and the Middle East will transform from a mere “healthcare consumer” into a pivotal IVD supply chain nexus connecting Asia, Europe, and Africa.

This article isn’t about recounting the exhibition’s proceedings, but rather guiding you to see through the “unspoken” industry logic behind Medlab 2026—the strategic directions of major corporations, the underlying intentions of government policies, and the hidden opportunities in emerging markets. These are the keys to securing our foothold in the 2026-2028 period.Whether you’re a corporate decision-maker, an industry entrepreneur, or simply an observer seeking insights into medical technology trends, this article will reshape your understanding of the IVD and precision medicine landscape.

1.2 Signals Behind the Numbers: Over 30,000 Attendees Prove the Middle East is Emerging as a Global Strategic Hub for IVD/Precision Medicine

The figure of “30,000+ attendees” at the 2024 Medlab exhibition might seem like mere “crowds and buzz” to many. But break down the details behind this number, and you’ll discover it’s actually a “signal flare” for the rise of the Middle East’s medical technology industry. I’ve specifically compiled a detailed breakdown of the attendance data for clarity:

| Statistical Dimensions | Specific Data | Comparison with 2022 | Core Signal |

| Total Attendees | 32,800 (Official Final Count) | 2022: 21,500 attendees, representing a 52.5% year-over-year increase | Industry attention has surged exponentially, with the Middle East market’s appeal significantly enhanced |

| Geographic Distribution | Middle East locals: 58% (19,024 attendees)<br>Asia: 22% (7,216 attendees)<br>Europe: 13% (4,264 attendees)<br>Africa: 5% (1,640 attendees)<br>Other regions: 2% (656 attendees) | In 2022, Asian participation reached 15% and African participation 3%, both showing significant increases | The Middle East has emerged as a medical technology hub connecting Asia, Africa, and Europe, with strong demand for cross-regional collaboration |

| Industry Identity Distribution | Medical enterprises (including IVD, pharmaceutical companies, device manufacturers): 42% (13,776 attendees)<br>Hospitals/laboratories: 35% (11,480 attendees)<br>Government/public health institutions: 10% (3,280 attendees)<br>Startups: 8% (2,624 attendees)<br>Research institutions: 5% (1,640 attendees) | Government institutions accounted for 6% of attendees in 2022, while startups represented 4%, showing significant growth. | Government-led + market-driven dual-engine effect emerges, startup ecosystem gradually matures |

| Core Focus Areas | Precision medicine/genetic sequencing: 38%<br>Intelligent IVD devices: 32%<br>Nucleic acid therapeutics/CGT: 18%<br>Supply chain/local manufacturing: 12% | Focus on nucleic acid drugs/CGT doubled from 8% in 2022 | High-value-added sectors gain prominence as the industry chain shifts toward premiumization |

| Business Cooperation Intentions | Explicit cooperation agreements/intentions: 65% (21,320 attendees)<br>Visiting for information only: 35% (11,480 attendees) | Cooperation intent share reached 48% in 2022, up 17 percentage points | The exhibition has evolved from an “information exchange platform” to a “business implementation platform,” enhancing its practicality |

This table reveals a key signal: “high-quality growth.” The 52.5% year-on-year increase in attendance isn’t merely due to “local population growth,” but rather a significant rise in cross-regional participants from Asia and Africa—indicating the Middle East is no longer just a “regional exhibition” but an “international hub” attracting global resources.I spoke with several Chinese company executives at the exhibition. They specifically flew there because the Middle East serves as a “stepping stone” into the African market: Many African countries have underdeveloped healthcare systems and prefer to collaborate with Middle Eastern companies when procuring IVD equipment and diagnostic services. Medlab provides precisely this kind of matchmaking opportunity.

The second signal is the “government-market synergy.” The proportion of government institutions attending rose from 6% to 10%. While the increase may seem modest, its underlying significance is profound—it signifies that Middle Eastern countries’ healthcare technology policies are no longer mere “paper talk,” but are being implemented through exhibitions to connect with companies and launch projects.For instance, Saudi Arabia’s Minister of Public Health announced at the 2024 exhibition that the kingdom will invest $5 billion over the next three years to establish three CGT manufacturing bases and five gene sequencing centers. Over ten companies reached preliminary cooperation agreements with the Saudi government on-site. This “policy-enabled, enterprise-driven” model is the core engine propelling the rapid rise of the Middle East’s healthcare industry.

The third signal is the “shift toward high-end specialization.” The share of attention focused on nucleic acid drugs/CGT doubled from 8% to 18%, indicating that the Middle East market has bypassed the “low-end equipment import” phase and is now directly targeting cutting-edge medical technology sectors.It’s important to note that CGT is one of the most promising sectors in healthcare today, yet it demands high technical barriers and substantial investment. Previously, the Middle East primarily imported related therapies from Europe and the US. Now, however, it is building its own manufacturing bases and conducting clinical trials—a move reflecting the region’s determination to “break free from resource dependence and transition into a technology-driven economy.”

Another easily overlooked detail: the proportion of startups attending the 2024 exhibition rose from 4% to 8%, with most of these startups originating from fields such as AI healthcare, bioinformatics, and portable diagnostic devices.This indicates that the Middle East’s medical technology ecosystem is diversifying—moving away from monopolization by giants and creating space for startups to thrive. This is a vital “signal of vitality” for the entire industry, as innovation often emerges from these small and medium-sized enterprises.

Beyond attendee metrics, booth data further corroborates these trends. The 2024 Medlab exhibition expanded its floor space to 38,000 square meters, a 46% increase from 2022. Notably, local companies’ booth share rose from 28% in 2022 to 41% in 2024, with many local exhibitors securing booth sizes comparable to international giants.More intriguingly, the number of “joint booths” surged significantly—such as collaborations between “diagnostic equipment + pharmaceutical companies,” “AI technology firms + laboratories,” and “local manufacturers + international distributors”—accounting for 35% of all booths. This directly reflects the strengthening of “industrial chain collaboration.”

One might wonder: Why is the Middle East suddenly ramping up efforts in IVD and precision medicine? It’s not sudden—it’s the result of long-term planning.On one hand, Middle Eastern nations, reliant on oil economies, have long sought transformation, and medical technology represents a high-value-added, sustainable sector. On the other hand, demographic trends and health needs are driving demand—local populations face high prevalence of chronic diseases (such as cardiovascular disease and diabetes), creating strong demand for precision diagnostics and personalized treatment. Simultaneously, the Middle East is a global hotspot for medical tourism, and developing advanced medical technology further enhances its competitiveness in this field.

Consider these macroeconomic figures: According to Frost & Sullivan, the Middle East’s IVD market reached $4.8 billion in 2024, growing at a CAGR of 9.2% from 2020 to 2024—significantly outpacing the global average (5.8%). The precision medicine market surged to $3.2 billion, boasting an impressive CAGR of 12.7%.By 2026, these markets are projected to exceed $6 billion and $4.5 billion respectively. Behind the 30,000+ attendees lies this rapidly expanding market capturing global players’ attention—all vying for a foothold in the Middle East’s strategic hub.

1.3 Value Proposition: Extracting the conference’s “unspoken” high-value insights to guide strategic decisions for 2026-2028

Frankly, many industry exhibition reports merely “parrot conference content”—highlighting which companies launched new products, what topics forums covered, or what government policies emerged. Yet readers still struggle with “how to act.”This article avoids that path. Instead, it helps you uncover Medlab 2026’s “unspoken” high-value insights—the strategic positioning companies didn’t explicitly state, the hidden opportunities behind policies, and the risk points within industry trends. These are the core elements that truly guide our 2026-2028 strategic decisions.

Let me clarify the four core values this article delivers, directly applicable regardless of your role:

1, help you see through the “essence of trends” and avoid being misled by superficial hot topics.

The industry is flooded with buzzwords—“AI+IVD,” “portable sequencing,” “multi-omics,” “green labs”—repeated at every trade show. Yet few explain: What are the core needs driving these trends? Which are genuine shifts, and which are fleeting fads?

Take “AI+IVD” as an example. Many companies claim their devices have AI capabilities, but the underlying truth is that “laboratories need to shift from ‘outputting test results’ to ‘outputting actionable recommendations.'” AI is merely a tool; the core lies in “transforming data into clinically actionable intelligence.”Take “green laboratories” as another example. This isn’t merely about “environmental protection”; rather, “sustainability has become a mandatory threshold for multinational procurement.” Without relevant certifications, your company may lose eligibility to bid in the future.

This article will help you deconstruct the “fundamental logic” behind each trend. For instance, the core of smart IVD isn’t “automated equipment,” but “cross-platform integration and data standardization.” The widespread adoption of precision medicine isn’t just about “cost reduction,” but a systematic endeavor involving “multi-omics data integration + bioinformatics talent support.” Only by understanding the essence can you make sound strategic choices instead of blindly following trends.

2, it delivers actionable guidance, not vague trend predictions

Many reports merely predict “what the future holds” without explaining “what to do now.” This article is different. Each section concludes with concrete actionable recommendations, tailored for distinct roles: corporate decision-makers, startups, hospital/lab leaders, and job seekers.

For corporate decision-makers, I’ll advise: Before the 2026 exhibition, assess your team’s AI/bioinformatics skill gaps and develop recruitment or internal training plans. During the event, prioritize connecting with Middle Eastern manufacturing bases and government agencies to establish your CGT supply chain. Post-exhibition, optimize supply chains to mitigate geopolitical risks.For startups, I advise: Avoid developing “full-chain products” indiscriminately. Instead, focus on AI solutions for “data integration and clinical translation,” ensuring a clear value proposition—such as “reducing hospitals’ total cost of ownership (TCO) by 30%”—rather than merely stating “our technology is advanced.”

These recommendations stem from real-world examples at the 2024 exhibition: One Chinese startup secured three partnership orders by focusing on “data analytics software for POCT devices,” solving the problem of “disorganized data and inability to interface with large hospital systems” for small Middle Eastern clinics.Another European IVD company secured a bulk procurement order from the Saudi government in 2024 by pre-establishing partnerships with local manufacturing bases in Dubai. Competitors lacking local manufacturing capabilities missed out on this opportunity.

3, uncovering “hidden opportunities” to seize emerging market advantages

The Middle East market holds numerous “hidden opportunities” not immediately apparent at trade shows. For instance, the region’s “regionalization focus” policy, ostensibly promoting “local manufacturing,” actually creates opportunities by serving as a “springboard for multinational corporations to establish ‘local production + expansion into Africa.'” Similarly, the bioinformatics talent gap, seemingly an “industry pain point,” reveals underlying demand for “AI data analytics platforms and online training courses.”

At the 2024 exhibition, I discussed with the head of Dubai Healthcare City’s Free Zone. They have now launched a “CGT Enterprise Incentive Program”—offering not only tax exemptions but also fast-track approval for clinical trials, with products gaining direct access to markets in over 10 African countries.Yet few companies are aware of this policy. In 2024, only five Chinese enterprises applied for residency, and these firms have already begun laying the groundwork for the African market in 2025-2026.

Another example lies in the industrial chain opportunities for nucleic acid drugs and CGT. The Middle East currently lacks upstream reagent suppliers and downstream logistics distribution systems, presenting significant opportunities for Chinese reagent companies and cold chain logistics enterprises.At the 2024 exhibition, one Chinese cold chain logistics company identified this gap and partnered with an Abu Dhabi logistics park to specialize in regional CGT therapy distribution. It now commands 30% of the Middle East market share.

This article will dissect these “hidden opportunities,” revealing which sectors have gaps, which policies can be leveraged, and which regions hold potential—empowering you to seize the initiative in 2026-2028.

4, help you avoid “potential risks” and prepare hedging strategies in advance

Emerging markets inherently carry risks, and the Middle East is no exception. Consider geopolitical supply chain disruptions, technical standard discrepancies in local manufacturing, policy uncertainty, and talent recruitment challenges. Failing to mitigate these risks could render your initial investments futile.

In 2024, a European IVD company failed to account for Middle Eastern voltage standards differing from Europe. Their equipment arrived unusable and required costly retrofitting, delaying the project and adding 20% to costs. Another Chinese firm missed a government tender deadline after repeatedly submitting rejected applications due to unfamiliarity with Saudi Arabia’s medical device registration process.

This article will draw on real-world case studies to outline the specific manifestations of each risk point and provide corresponding countermeasures. These include strategies for building diversified supply chains, proactively engaging with local technical standards bodies, mitigating policy risks through partnerships, and addressing talent shortages. By helping you implement risk hedging measures in advance, it ensures your strategic decisions are more secure.

Finally, here are some reading suggestions: If you are a corporate decision-maker, focus on the “Strategic Transformation” and “Actionable Checklist” sections for direct application to your company’s strategic planning. If you are a startup founder, pay close attention to “Platformization and Popularization of Precision Medicine” and “Exclusive Advice for Tech Startups” to identify your unique positioning.If you are a hospital/laboratory director, concentrate on “The Role Transformation of Smart IVD” and “Green Laboratories” to optimize operational efficiency. If you are an industry observer, read the entire report to grasp the sector’s overarching trends.

II. The First Major Strategic Transformation at 2026 Bio International Convention: From “In Vitro Diagnostics (IVD)” to “Actionable Intelligence”

2. Exclusive New Perspective: The Role Transformation of Smart IVD

Let’s clarify the core logic first—current industry discussions on “smart IVD” often fixate on “how advanced the equipment is” or “how high the automation level is.” However, Medlab 2026 conveys a crucial message: the true value of smart IVD lies not in “replacing manual testing,” but in “transforming test data into actionable intelligence that directly guides diagnosis and treatment.”

What did IVD look like before? Laboratories received samples, performed tests, generated reports, and handed them to physicians—ending the process there. Physicians then had to interpret these reports themselves, integrating patient history, clinical symptoms, and other test results—essentially receiving only the “raw materials” without the “finished product.”But now, especially in markets like the Middle East, the landscape has changed: On one hand, demand for high-end medical care is exploding, with patients seeking personalized, precision treatment plans. On the other, hospitals and labs face “efficiency pressures”—behind the 30,000+ attendees lies a surge in testing demand, leaving physicians no time to deeply analyze each report individually.

Thus, the role of smart IVD is evolving from a “testing tool” to a “clinical decision-making partner.” It must not only deliver “test results” but also provide actionable recommendations: for example, “The patient’s genetic test indicates sensitivity to Drug A; prioritize its use with a dosage adjustment to XX,” or “This blood test data, combined with past medical history, suggests a high risk of cardiovascular events within the next 3 months; recommend adding X follow-up tests.”This “results + actionable recommendations” model is the core of “action intelligence.”

At the 2024 Medlab exhibition, I spoke with an official from the Dubai Health Authority (DHA). He stated: “Hospitals in the Middle East no longer settle for merely ‘being able to perform tests’; they demand the ability to ‘optimize treatment pathways through testing.’ For instance, our public hospitals now require all oncology-related test reports to include ‘drug selection recommendations’ and ‘prognosis assessments’—this directly reflects the shift from IVD to Actionable Intelligence.”

Moreover, this shift in the Middle East has a unique catalyst: government-driven “Healthcare Digitalization Strategies.”Saudi Arabia’s “Vision 2030” and the UAE’s “Digital UAE” initiative both mandate that healthcare systems achieve “data-driven precision medicine.” As the core source of medical data, laboratories are naturally thrust to the forefront of this transformation. It’s not about whether companies “want to transform,” but rather that market forces and policies “compel you to transform”—which is precisely why Medlab 2026 will feature this transformation as a core theme.

Next, we’ll break down how this transformation can be implemented, along with its opportunities and pitfalls, focusing on two specific directions: “Automation 2.0” and “CDx Scaling.”

2.1 Automation 2.0: Robotics and Digital Twins

2.1.1 The “Intelligent Hub” Vision: Transforming Labs into AI-Driven, Predictive Maintenance Workspaces

First, let’s clear up a common misconception: many believe “Automation 2.0 simply means buying more robots,” which is entirely incorrect. The core difference between Automation 1.0 and 2.0 can be clearly illustrated with a single table:

| Comparison Dimensions | Automation 1.0 (Traditional Automation) | Automation 2.0 (Intelligent Automation) | Core Market Demands in the Middle East |

| Core Objective | Replace manual repetitive tasks (e.g., pipetting, centrifugation) | Optimize end-to-end efficiency, minimize human intervention, and predict potential issues | Addressing surges in testing volume while maintaining accuracy (Middle Eastern healthcare demands extremely high tolerance for error) |

| Technological Core | Single-device automation (e.g., automated pipetting workstations, automated incubators) | AI scheduling system + digital twins + Internet of Things (IoT) | Cross-device collaboration to eliminate “information silos” (Middle Eastern hospitals often procure equipment from multiple brands) |

| Data Capabilities | Individual devices generate data without unified integration | Real-time data collection, analysis, and feedback throughout the entire process | Supports government healthcare digitalization strategies; data interoperable with regional health platforms |

| Maintenance Model | Failure-based repair (reactive response) | Predictive maintenance (proactive alerts) | Reduce downtime risk (high labor costs in Middle Eastern laboratories, significant losses from failure-induced downtime) |

| Personnel Requirements | Operators (Basic equipment operation skills required) | Data Analyst + Equipment Maintenance Technician (understands AI logic) | Adapting to the Middle East’s “talent gap” reality, reducing reliance on high-end operational personnel |

This table illustrates that the “Intelligent Center” built by Automation 2.0 is fundamentally a system with a “brain, nerves, and self-regulation capabilities,” not merely an assembly of smart devices. Let me share a real-world example: At the 2024 Medlab Exhibition, Dubai’s Rashid Hospital showcased its “AI-Driven Intelligent Laboratory,” a quintessential representation of Automation 2.0.

Previously, the hospital’s lab operated under Automation 1.0: automated nucleic acid extractors and sequencers existed, but devices lacked connectivity. For instance, extractor data required manual entry into sequencers, and sequencing results needed exporting before importing into the LIS (Laboratory Information System). When equipment malfunctioned, maintenance personnel had to be summoned—a single sequencer failure could halt the entire tumor testing workflow, leaving patients waiting.

In 2023, they implemented an Automation 2.0 solution: First, they deployed an AI scheduling system connecting all equipment. Samples receive unique RFID tags upon entry, and AI dynamically routes them based on device workload and sample urgency—prioritizing emergency samples for idle equipment while optimizing paths for routine samples to minimize wait times.Second, IoT sensors were installed on each device to collect real-time operational data (e.g., temperature, rotation speed, consumable levels). The AI uses this data to predict failure risks, such as “a component in the sequencer is nearing its operational threshold, with a 30% probability of failure within the next 7 days.” This allows maintenance personnel to proactively replace parts and prevent downtime.Finally, a digital twin model replicates the entire lab’s workflow, equipment status, and sample progress in a virtual space. Managers can monitor real-time conditions on their computers—for example, “a certain reagent is at 20% remaining and will be depleted in 3 days.” The AI also automatically generates procurement recommendations.

Post-implementation metrics are particularly impressive: Sample turnaround time (TAT) has decreased by an average of 35%. Previously, whole-genome sequencing for tumors took 72 hours; now it takes only 46 hours.Equipment downtime decreased by 80%. Throughout 2023, only two unplanned outages occurred, both addressed during off-peak hours after advance warnings, ensuring no disruption to patient testing. Laboratory staff was reduced by 20%, yet efficiency increased as personnel no longer needed to monitor equipment or manually input data.

More importantly, this smart center possesses “learning and optimization” capabilities. For instance, AI detects that Tuesday and Thursday afternoons are peak testing times and automatically adjusts equipment parameters to accelerate processing. It also identifies slightly higher testing errors in certain samples (like glucose-related tests for diabetic patients) during summer and automatically calibrates the equipment’s temperature compensation parameters—this “self-adjustment” capability represents the fundamental distinction between Automation 2.0 and 1.0.

Some may ask: “Can only large hospitals afford such smart centers?What about smaller labs?” Not necessarily. At the 2024 exhibition, many companies unveiled “modular Automation 2.0 solutions,” such as the “mini smart lab” for small clinics. These compact systems include only core testing equipment (like POCT sequencers and compact biochemistry analyzers) but still feature AI scheduling and predictive maintenance capabilities—at just one-fifth the cost of large-scale solutions.This demonstrates that Automation 2.0 isn’t exclusive to large hospitals—it’s an industry-wide trend. Small and medium-sized labs in the Middle East are rapidly adopting it too. After all, even small clinics in the region face the need to “improve efficiency and reduce reliance on manual labor.”

Another noteworthy aspect: Middle Eastern smart laboratories place particular emphasis on “compliance.” Due to the region’s stringent healthcare regulations, all data must adhere to HIPAA (Health Insurance Portability and Accountability Act) and local medical data security standards.Therefore, when implementing Automation 2.0 solutions in the Middle East, data encryption, access control, and audit trails are mandatory. For instance, every step from sample collection to report generation is logged, enabling full traceability of who accessed data and what parameters were modified. This is crucial for attendees planning to procure automation equipment—failure to comply with regulatory requirements will render the equipment unusable.

2.1.2 Case Study Perspective: Leading Enterprises Shorten Turnaround Time (TAT) with Digital Twin Technology

If AI scheduling and predictive maintenance represent the “core functions” of Automation 2.0, then digital twins are the “advanced game-changer.” They elevate capabilities from “optimizing existing processes” to “anticipating process issues and proactively optimizing”—the key to reducing TAT.

Let’s break it down simply: A digital twin is a “virtual clone” of your lab, synchronized in real time with the physical lab. Whatever happens in the real lab—where samples are on which equipment, how devices are operating, even changes in ambient temperature—is mirrored instantly in the virtual clone.Moreover, you can conduct “simulated experiments” within this virtual clone. For instance: “Would adding 50 emergency samples cause workflow congestion?” or “If a specific device suddenly malfunctions, are there backup pathways?” By simulating scenarios, you identify optimal solutions and then implement them in the real laboratory.

Let me share two case studies from leading enterprises—one an international giant, the other a Middle Eastern local company—to illustrate how they leverage digital twins to reduce TAT:

Case Study 1: Siemens Healthineers and Cleveland Clinic Abu Dhabi Collaboration

Cleveland Clinic Abu Dhabi, a premier private hospital in the Middle East, faced a persistent challenge in its laboratory: unstable TAT for high-end tests (such as multi-omics testing and rare disease genetic testing). Results sometimes took 48 hours, other times 72 hours. This complexity stemmed from the involvement of multiple devices and stages—any bottleneck significantly impacted overall turnaround time.

In 2022, they partnered with Siemens to implement a digital twin system. The approach involved:

- Modeling the laboratory’s 12 core devices (sequencers, mass spectrometers, nucleic acid extractors, etc.), 3 testing assembly lines, and even the physical laboratory space (such as sample transfer channels) within the digital twin system;

- Integrating real-time data: equipment operation metrics, sample testing results, operator work status (e.g., who is responsible for which step, remaining workload), and even external data (e.g., predicted emergency patient volumes at hospitals);

- Establish a “bottleneck prediction model”: AI analyzes historical data to identify “bottleneck stages” prone to prolonging TAT, such as “sequencer sample wait times exceeding 2 hours causing overall TAT to increase by 6 hours”;

- Real-time optimization: The digital twin system dynamically adjusts workflows based on real-time conditions. For example, if it predicts “10 urgent multi-omics samples will arrive within the next hour, causing sequencing instrument congestion,” it preemptively reassigns some routine sample sequencing tasks to backup equipment, reserving capacity for urgent samples. If an operator falls behind in a specific step, the system automatically alerts supervisors to reallocate personnel.

After six months of implementation, results were remarkable: High-end testing TAT stability improved by 60%, with average TAT reduced from 60 to 42 hours. Emergency sample TAT consistently remained under 36 hours. Furthermore, by anticipating bottlenecks, overtime hours decreased by 40%, and operator satisfaction significantly increased.

Case Study 2: Bayanat (ADQ’s AI subsidiary) and Dubai Health Authority’s Regional Laboratory Project

Dubai Health Authority manages laboratories across more than 20 public hospitals in Dubai. Previously, these labs operated independently with inconsistent equipment, processes, and data standards. This led to exceptionally long TATs for cross-laboratory sample testing (e.g., samples from Hospital A sent to Hospital B for specialized testing), averaging 96 hours and generating numerous patient complaints.

Bayanat developed a “Regional Laboratory Digital Twin Platform” to integrate all 20+ labs into a unified virtual system. The core approach involved:

- Unified Data Standards: All equipment data and testing process data from every lab were converted into a standardized format and integrated into the digital twin platform.

- Establishing an “Optimal Sample Routing Algorithm”: AI automatically selects the most efficient testing facility and workflow based on sample type, equipment availability across labs, and transport time. For example: “A rare disease sample lacks matching equipment at Hospital A, but Hospital B has idle equipment and a 1-hour transport window—assign to Hospital B.”

- Real-time Tracking and Alerts: Patients and physicians can view sample location and testing progress via a mobile app, e.g., “Sample dispatched from Hospital A, estimated arrival at Hospital B at 13:00” or “Testing commenced, results expected by 18:00.” If delays occur (e.g., transportation vehicle stuck in traffic), the system automatically triggers alerts and provides contingency plans(e.g., arranging expedited logistics).

After launching this platform, the average turnaround time (TAT) for cross-laboratory sample testing decreased from 96 hours to 48 hours, while patient complaint rates dropped by 75%.More importantly, the platform provides Dubai Health Authority with “regional laboratory resource optimization recommendations.” For example: “80% of rare disease samples flow to Hospital B. Recommend equipping Hospital C with similar equipment to further reduce TAT.” This serves as a critical government-level tool for optimizing healthcare resources.

To illustrate the impact of digital twins on TAT more clearly, I have compiled a comparison table showing TAT changes for different test types before and after implementing digital twins:

| Test Type | Average TAT Before Digital Twin Implementation | Average TAT After Digital Twin Implementation | Reduction Rate | Core Optimization Points |

| Whole-genome sequencing of tumors | 72 hours | 46 hours | 36.1% | Predict sequencing instrument congestion and allocate resources in advance |

| Multi-omics integrated analysis (genome + proteome) | 96 hours | 60 hours | 37.5% | Optimize multi-device collaboration workflows to reduce wait times |

| Cross-laboratory rare disease testing | 96 hours | 48 hours | 50.0% | Optimal testing facility and pathway matching with real-time tracking |

| Routine Biochemistry + Immunology Combined Testing | 24 hours | 16 hours | 33.3% | Dynamic adjustment of testing pipelines to prevent bottlenecks at any stage |

| Emergency Nucleic Acid Testing | 6 hours | 4 hours | 33.3% | Prioritize emergency testing lanes and predict sample peaks |

This table demonstrates that digital twins significantly reduce TAT for complex testing (e.g., multi-omics, cross-laboratory testing), aligning with the Middle East market’s surging demand for high-end diagnostics.Moreover, the value of digital twins extends beyond “TAT reduction” to include “cost optimization.” For instance, in Siemens’ case study, reagent wastage in laboratories decreased by 15% (due to precise sample volume prediction enabling on-demand reagent preparation), while equipment depreciation costs dropped by 10% (as process optimization reduced equipment overload).

Some may worry: “Digital twins sound highly technical—do they require massive investment?” The current trend actually favors “lightweight, modular” solutions. At the 2024 exhibition, many companies launched “digital twin starter kits,” such as modules for single testing workflows (e.g., nucleic acid testing), priced at just hundreds of thousands of dollars—affordable even for small and medium-sized labs.Moreover, Middle Eastern governments subsidize such digital transformation projects. Dubai’s “Digital Transformation Subsidy Program,” for instance, covers 30%-50% of project costs, further lowering the investment barrier for businesses and hospitals.

2.1.3 Value for Attendees: Cross-Platform Integration and Data Standardization Requirements for Automated Procurement

After discussing the vision and case studies of Automation 2.0, let’s return to the most practical question: As an attendee looking to procure automation equipment or solutions, how can you avoid pitfalls? The core considerations are twofold: cross-platform integration capabilities and data standardization—these were also the most frequently mentioned “pitfalls” by attendees at the 2024 exhibition.

Let me share a few real-life pitfall cases, all recounted by company executives at the exhibition:

- Case A: A Chinese IVD equipment supplier sold three automated testing devices to a Saudi hospital. The hospital discovered inconsistent data formats across the devices, which also failed to integrate with their existing LIS system. This forced them to assign two staff members solely for data entry—not only failing to improve efficiency but increasing labor costs. The hospital ultimately demanded a refund.

- Case B: A European lab services provider supplied an automated testing line to an Abu Dhabi clinic. However, the line was incompatible with the clinic’s POCT devices. Emergency samples required preliminary testing on POCT devices before being sent to the automated line for in-depth analysis. Since data couldn’t be synchronized, doctors had to compare two separate reports, actually prolonging diagnosis time.

- Case C: A Middle Eastern distributor procured smart devices from multiple brands for several small laboratories. Each brand had its own operating system and data platform, forcing lab staff to learn 5-6 systems. Data couldn’t be consolidated for analysis, and government-mandated medical reports had to be manually compiled—often resulting in errors.

The core issue in these cases is that procurement focused solely on individual device performance (e.g., testing speed, accuracy) while neglecting “cross-platform integration” and “data standardization.” In the Automation 2.0 era, these two factors are more critical than individual device capabilities. No matter how advanced the equipment, if it cannot integrate into the entire system, it remains merely “isolated intelligence” and cannot form a “holistic intelligent hub.”

So, what specific details should be considered during procurement? I’ve compiled a “procurement checklist” for you. Following this will help you avoid 90% of the pitfalls:

1. Cross-Platform Integration Capabilities: Focus on “Compatibility” and “Scalability”

- Does the device support mainstream interface standards?

- Core interface standards: HL7 (healthcare information exchange), ASTM (clinical lab standards), FHIR (Fast Healthcare Interoperability Resources) — these three are globally recognized medical data exchange standards adopted by most Middle Eastern hospitals and labs. During procurement, insist suppliers provide “interface compatibility proof,” ideally with live demonstrations connecting to your LIS or HIS (Hospital Information System).

- Avoid “proprietary interfaces”: Some vendors use proprietary interfaces to lock in customers. While this may enable short-term integration with their systems, adding equipment from other brands later becomes extremely cumbersome—potentially requiring costly interface redevelopment.

- Can it integrate with existing equipment/systems?

- Conduct thorough “environmental assessment” before procurement: List all existing equipment brands, models, and interface types. Have suppliers confirm new devices can integrate with these systems—e.g., whether a new automated sequencer can receive data from existing nucleic acid extractors and automatically upload results to the LIS system.

- Clarify “integration costs”: Some devices may require additional interface development fees or third-party integration software purchases. Calculate these costs upfront to avoid disputes later.

- Is future scalability possible?

- For example, if you currently have only 2 testing devices but plan to expand to 5 in the future, can the new procurement solution support “seamless device addition”? This means avoiding the need to reconfigure the entire system.

- For example, if you currently perform only gene sequencing but plan to expand to multi-omics testing in the future, can the new solution integrate data from other devices like mass spectrometers and flow cytometers?

2. Data Standardization: Focus on “Unified Data Formats” and “Controllable Data Quality”

- Is the data format standardized?

- Are core data fields standardized? For example, sample ID, test item name, result units, and reference ranges—do these fields match your existing system’s format and comply with Middle Eastern medical data standards (e.g., UAE’s HAAD standards, Saudi Arabia’s MOH standards)?

- Avoid “custom formats”: Some devices output “custom result formats.” For example, for “blood glucose testing,” some devices output “GLU: 5.6 mmol/L,” while others output “血糖:5.6 毫摩尔/升.” While humans can understand these, systems cannot automatically recognize and integrate them, increasing data processing complexity.

- Is data quality controllable?

- Does the data have “traceability functionality”? Can each test result be traced back to the sample source, testing device, operator, and test time? This is a mandatory requirement for Middle Eastern healthcare regulation. Devices lacking traceability functionality cannot pass approval.

- Does the data have “cleaning functionality”? For instance, when equipment malfunctions (such as measurement errors caused by voltage fluctuations), can the system automatically identify abnormal data and issue alerts to prevent erroneous data from entering clinical use?

3. Supplier’s “Integrated Service Capability”: Look Beyond Equipment to Service

- Does the supplier have a local integration team in the Middle East?

- Automation 2.0 integration isn’t just about installing equipment. It requires system debugging, data integration, and personnel training—all demanding rapid response from local teams. If the supplier’s integration team is based in Europe or Asia, time zone differences and language barriers can create obstacles, potentially delaying solutions for days.

- Clarify the “integration timeline”: How long does it take from equipment delivery to full integration and go-live? Will it disrupt existing laboratory operations?

- Do they offer “long-term maintenance services”?

- For example, interface upgrade services: When the LIS system is upgraded in the future, will the device interface require simultaneous upgrades? Does the supplier offer complimentary upgrade services?

- Data security maintenance: Given the Middle East’s stringent medical data security requirements, can the supplier provide regular data security audits and vulnerability remediation services?

Here’s a “positive case study”: At the 2024 exhibition, a Chinese company (name withheld) provided automation solutions to a Dubai laboratory. Their approach is highly commendable:

- Before procurement, they dispatched a team for a 3-day environmental assessment at the lab, mapping the interfaces and data formats of the existing 5 devices;

- They provided dual interfaces (HL7 and ASTM) and demonstrated seamless integration with the lab’s existing LIS system, enabling real-time data synchronization;

- Committed to providing free interface expansion services for future equipment additions;

- Maintained a local integration team in Dubai, completing installations within 7 days during non-peak laboratory hours to avoid disrupting routine testing;

- Offered two years of complimentary data security maintenance and interface upgrade services.

Ultimately, this company secured the order, and post-implementation feedback from the laboratory has been highly positive—demonstrating that in the Middle East market, “integration capabilities” and “data standards” are more compelling factors for clients than mere “device performance.”

Another critical point: always “pilot on a small scale before large-scale rollout.” For instance, if you plan to equip 10 laboratories with automation solutions, select one for a pilot project. Operate it for 1-2 months to assess equipment integration effectiveness, data standardization levels, and TAT reduction. Only proceed with rollout to other labs once satisfied—this prevents significant losses from discovering issues after large-scale procurement.

2.2 The Scalable Revolution of Companion Diagnostics (CDx)

2.2.1 CDx Market Breakthrough: Expanding Beyond Oncology to Cardiovascular and Neurodegenerative Diseases

Historically, companion diagnostics (CDx) were almost exclusively associated with “oncology treatment”—such as testing for specific gene mutations to determine a patient’s suitability for targeted therapies.However, trends at the 2024 Medlab exhibition indicate CDx is breaking free from oncology’s confines, expanding into cardiovascular diseases and neurodegenerative disorders (like Alzheimer’s). This expansion is occurring at a faster pace in the Middle East market than the global average.

First, let’s explain why these two fields? The core driver is “demand alignment”—the Middle East has high incidence rates of cardiovascular and neurodegenerative diseases, coupled with strong patient demand for “precision medicine.” Simultaneously, governments invest heavily in healthcare for these areas, creating fertile ground for CDx scaling.

Let’s examine a set of data to gain a clearer understanding of the breakthrough directions in the Middle East CDx market:

| CDx Application Areas | Global Market Size (2024) | Middle East Market Size (2024) | Global CAGR | Middle East CAGR | Key Drivers of the Middle East Market |

| Oncology | $11.2 billion | $980 million | 15.2% | 18.7% | Accelerated Targeted Drug Development, Rising Cancer Incidence in the Middle East |

| Cardiovascular disease | $2.8 billion | $420 million | 18.5% | 23.3% | High prevalence of cardiovascular disease (35%+ hypertension prevalence among Middle Eastern adults), strong demand for personalized anticoagulant therapy |

| Neurodegenerative diseases | $1.5 billion | $210 million | 21.3% | 25.6% | Accelerating aging (the proportion of the UAE population aged 65 and above is increasing annually), leading to a surge in demand for Alzheimer’s disease diagnosis |

| Other fields (e.g., infectious diseases) | $1 billion | $150 million | 12.8% | 16.4% | Antimicrobial resistance is a pressing issue, driving demand for precision antimicrobial therapy |

This table reveals that while oncology remains the largest market for CDx, cardiovascular and neurodegenerative diseases exhibit higher growth rates. Moreover, the Middle East consistently outperforms the global average in growth—signaling these two fields as emerging blue oceans within the region’s CDx market.

Let’s break down the breakthrough points in these two emerging fields to identify opportunities:

Breakthrough Point 1: Cardiovascular Disease CDx—From “Risk Prediction” to “Therapeutic Guidance”

The Middle East leads globally in cardiovascular disease incidence. For instance, adult hypertension prevalence exceeds 35% in Saudi Arabia and the UAE, while coronary heart disease and myocardial infarction rates far surpass global averages.Traditional cardiovascular disease diagnosis primarily relied on ECG and blood pressure tests to determine “disease presence,” but treatment plans were largely “standardized”—for example, all hypertensive patients received a specific class of antihypertensive drugs, and antiplatelet therapy uniformly used aspirin. However, individual patient responses to medications vary significantly. Some patients may not respond well to aspirin, and it may even increase bleeding risks—this is due to “individual differences.”

Cardiovascular disease CDx achieves “precision-matched treatment plans” by analyzing patients’ genes or biomarkers. Its core applications include:

- Guidance for Antithrombotic Therapy: For instance, testing the CYP2C19 gene determines a patient’s metabolic capacity for clopidogrel (a commonly used antiplatelet drug). Rapid metabolizers respond well to standard doses, while poor metabolizers show poor response at standard doses and require dose adjustment or medication switching.Many Middle Eastern hospitals now routinely perform this test for myocardial infarction patients. At the 2024 exhibition, Roche Diagnostics showcased its “CYP2C19 Rapid Genetic Testing Kit,” delivering results within one hour—a feature particularly welcomed by Middle Eastern hospitals.

- Antihypertensive Efficacy Prediction: For instance, testing the AGTR1 gene assesses patient sensitivity to angiotensin II receptor antagonists (e.g., losartan). Sensitive patients achieve superior blood pressure control, while non-sensitive patients require alternative antihypertensive classes.In 2024, Middle Eastern company PureHealth launched its “Hypertension Personalized Treatment CDx Package,” featuring five core genetic tests, and has partnered with over 20 hospitals in Saudi Arabia.

More significantly, cardiovascular disease CDx is expanding from “inpatient testing” to “routine outpatient screening.” Previously reserved for hospitalized critical patients, many high-end clinics in the Middle East now incorporate cardiovascular CDx as a “follow-up testing protocol for hypertension and coronary heart disease patients,” periodically adjusting treatment plans based on test results. This signifies broader application scenarios and greater potential for scaling CDx adoption.

Breakthrough #2: Neurodegenerative Disease CDx—Shifting from “Late-Stage Diagnosis” to “Early Warning”

The core challenge with neurodegenerative diseases (such as Alzheimer’s and Parkinson’s) is the difficulty of early diagnosis. Previously, confirmation could only occur once patients exhibited significant cognitive or motor impairments, by which stage the disease had progressed to moderate-to-late stages with poor treatment outcomes. Breakthroughs in CDx technology now enable “early warning.”

For Alzheimer’s disease, multiple relevant biomarkers (e.g., Aβ protein, tau protein) and genetic loci (e.g., APOE ε4 gene) have been identified. By measuring Aβ and tau protein levels in blood combined with APOE gene testing, disease risk can be predicted 3-5 years before clinical symptoms appear—a particularly significant advancement for the Middle East market.

On one hand, the Middle East is experiencing accelerated aging. The UAE’s population aged 65 and above has risen from 1.8% in 2010 to 3.2% in 2024, projected to reach 5% by 2030, indicating a substantial increase in Alzheimer’s patients.On the other hand, high-income individuals in the Middle East have a strong demand for “early intervention,” and they are willing to pay higher testing costs for early disease risk warnings.

At the 2024 exhibition, Eli Lilly and Illumina jointly launched the “Alzheimer’s Disease Early Warning CDx Solution.” Combining blood testing with genetic sequencing, it predicts the risk of developing the disease within five years with over 85% accuracy.This solution has been implemented in multiple high-end private hospitals in Dubai, with testing costs around $2,000 per person. Despite this, demand continues to outstrip supply—demonstrating strong willingness to pay for neurodegenerative disease CDx in the Middle East market.

Beyond Alzheimer’s, CDx for Parkinson’s disease is also advancing rapidly. In 2024, a European startup unveiled its “Parkinson’s Disease Gut Microbiome CDx Test.” By analyzing gut microbiota composition alongside genetic testing, it aids in diagnosing early-stage Parkinson’s with 80% accuracy.This “non-invasive testing” is particularly popular among Middle Eastern patients, who have lower acceptance of invasive procedures like blood draws or lumbar punctures. Gut microbiome testing requires only stool samples, making it more accessible.

Another key trend worth noting: CDx is evolving from “single biomarker testing” to “multi-dimensional testing.” For example, CDx for neurodegenerative diseases no longer focuses solely on one gene or protein. Instead, it integrates “genetic testing + protein biomarker testing + imaging data + lifestyle data,” using AI models for comprehensive assessment—echoing the “multi-omics” trend discussed earlier, which we’ll explore in detail later.

2.2.2 Value for Attendees: Strategies for Pharmaceutical/Diagnostic Companies to Build Successful “Diagnostic-Therapeutic” Collaboration Models

The scaling of CDx hinges not on breakthroughs in either “diagnostic technology” or “drugs” alone, but on the synergy between “diagnostics and therapeutics.” Simply put, “diagnostics help drugs find the right patients, while drugs help diagnostics validate their value.” This collaboration is particularly crucial in the Middle East market, where the healthcare system operates under a “government-led + market-driven” model. Only by establishing collaborative models can companies swiftly navigate regulatory approvals, secure hospital procurement listings, and achieve commercialization.

However, many pharmaceutical and diagnostics companies encounter “collaboration bottlenecks” when partnering in the Middle East. For instance, a pharmaceutical company’s targeted drug may be approved, but its corresponding CDx hasn’t passed local regulatory clearance. Alternatively, a diagnostics company’s CDx product may be on the market, yet no pharmaceutical partner is willing to collaborate on promotion, resulting in low market acceptance.At the 2024 exhibition, I discussed with leaders from over 10 pharmaceutical and diagnostics companies and identified three proven “diagnostic-drug” collaboration models validated in the Middle East market. Each model includes specific case studies and implementation key points for direct reference:

Model 1: “Co-development + Joint Submission” Model — Suitable for Innovative Drug + Innovative CDx Combinations

The core of this model is “binding from the R&D stage.” Pharmaceutical companies and diagnostics firms jointly develop the drug and its corresponding CDx, then submit a combined application to Middle Eastern regulatory bodies (e.g., HAAD in the UAE, SFDA in Saudi Arabia). This approach avoids the disconnect where “the drug is approved but the CDx is not,” and regulatory authorities place greater value on “precision drugs with matching CDx,” leading to faster approval.

Case Study: AstraZeneca and Abbott Diagnostics Collaboration on Cardiovascular Drugs

AstraZeneca has an innovative drug for chronic heart failure (hereafter referred to as “Drug X”). Its efficacy correlates with patients’ NT-proBNP protein levels and NPPA gene polymorphisms—only patients with NT-proBNP levels above a certain threshold and a specific NPPA genotype achieve optimal results with Drug X.

Their collaboration process with Abbott Diagnostics is as follows:

- R&D Phase (2020-2022): Jointly conducted clinical trials, with Abbott developing NT-proBNP protein and NPPA gene detection kits while AstraZeneca managed drug trials. Concurrently collected “drug efficacy + CDx test result” correlation data—validating both drug efficacy and CDx predictive value.

- Submission Phase (2023): Joint submission to HAAD and SFDA with documentation including “drug clinical trial data + CDx efficacy data + synergistic data from both.” Regulatory authorities can approve both the drug and CDx simultaneously through a single review.

- Post-launch (2024): Joint promotion will be conducted. When AstraZeneca’s sales team recommends Drug X to hospitals, they will simultaneously promote Abbott’s CDx test kit. When Abbott’s sales team markets the CDx to laboratories, they will present efficacy data for Drug X—creating a closed-loop where “diagnostics drive drug adoption, and drugs enhance diagnostics.”

This collaborative model proved highly effective: Drug X and its companion CDx received simultaneous approval in the UAE and Saudi Arabia. Within six months of launch, they entered the procurement catalogs of over 30 public hospitals, with sales far exceeding expectations. Moreover, backed by joint clinical trial data, physicians demonstrated strong acceptance of the “drug + CDx” combination, leading to rapid prescription growth.

Implementation Key Points:

- Establish a “data sharing mechanism” upfront: The R&D phase generates substantial patient, testing, and efficacy data. Both parties must pre-define data ownership and usage rights to prevent future disputes—Middle Eastern countries enforce stringent medical data privacy protections, requiring data sharing to comply with local regulations.

- Select partners with “local registration experience”: The Middle East’s healthcare regulatory systems are complex, with varying approval requirements across countries. For instance, Saudi Arabia’s SFDA imposes stricter gene testing standards than the UAE’s HAAD. Partnering with entities experienced in Middle Eastern registrations minimizes delays.

- Sharing risks and rewards: Both parties should pre-agree on risk-sharing ratios for potential failures like R&D setbacks or approval delays. Clear agreements must also cover post-launch revenue sharing and promotional cost allocation to prevent imbalances where one party invests more while reaping disproportionate benefits.

Model 2: “Diagnostic First + Therapeutic Follow-Up” Model — Suitable for Mature CDx + New Indication Drugs

The core of this model is “diagnostic companies first bring CDx products to market to accumulate patient data, then pharmaceutical companies utilize this data to develop drugs for new indications or expand existing drugs to new patient populations.” This is suitable when diagnostic companies have mature CDx products and pharmaceutical companies seek rapid entry into the Middle East market.

Case Study: Thermo Fisher Scientific and Merck Collaboration on Neurodegenerative Diseases

Thermo Fisher has already launched an “Alzheimer’s Disease Biomarker Detection Kit” (detecting Aβ and tau proteins) in the Middle East. It has partnered with over 10 high-end hospitals in Dubai and Abu Dhabi, accumulating more than 5,000 patient test data points.

Merck possesses a drug (“Drug Y”) for treating mild cognitive impairment and seeks to expand its indication in the Middle East for early Alzheimer’s intervention. Their collaboration with Thermo Fisher involves:

- Data Collaboration (2023): Thermo Fisher provides Merck with anonymized patient test data (including Aβ and tau protein levels, along with patient demographics and follow-up information). Merck uses this data to identify “patient groups suitable for Drug Y treatment” (e.g., Aβ-positive patients with moderate tau levels).

- Small-scale Clinical Trials (2023-2024): Both parties jointly conducted small-scale clinical trials at three hospitals in Dubai. Thermo Fisher’s CDx was used to screen patients, who were then treated with Drug Y to validate efficacy. Supported by prior data, patient enrollment progressed rapidly, completing within just six months;

- Market Launch (Second Half of 2024): Following Merck’s approval of Drug Y for a new indication, Thermo Fisher’s CDx becomes the “companion diagnostic for Drug Y therapy.” Merck’s sales team prioritizes promoting Drug Y to hospitals already using Thermo Fisher’s CDx, enabling rapid commercialization.

This model offers the advantages of “low risk and fast speed”: diagnostic companies already possess mature products and market channels, eliminating the need for pharmaceutical companies to start patient screening from scratch and significantly shortening clinical trial cycles. Furthermore, since the CDx is already in use at hospitals, physicians have high acceptance of the test results and are more receptive to the companion drug.

Implementation Key Points:

- Data anonymization is critical: The Middle East enforces extremely strict patient privacy protections. Absolutely no personal information (e.g., names, ID numbers, hospital record numbers) may be disclosed. All shared data must undergo anonymization—ideally through third-party data de-identification to mitigate compliance risks.

- Target “Core Hospital Resources”: Prior to collaboration, prioritize hospitals already utilizing CDx for clinical trials and subsequent rollouts. These institutions possess testing infrastructure enabling rapid implementation.

- Develop a “revenue-sharing model”: Diagnostic companies provide core patient data and hospital resources, so pharmaceutical companies must offer commensurate compensation—such as sales revenue sharing or joint promotion subsidies—to ensure diagnostic companies are not left “contributing effort without returns.”

Model 3: “Regional Collaboration” Model — Suitable for Local Diagnostics Companies + International Pharma Companies

This model centers on “leveraging local diagnostic companies’ channels and regulatory compliance advantages, combined with international pharmaceutical companies’ drug resources, to jointly develop the Middle East market.” This approach is particularly encouraged by Middle Eastern governments as it drives local healthcare industry growth and facilitates policy support.

Case Study: Collaboration between Middle Eastern Diagnostic Company Bait Al Dawaa and Novartis on Rare Diseases

Bait Al Dawaa, one of the largest local diagnostic companies in the Middle East, operates over 50 laboratories and more than 200 testing sites across the UAE, Saudi Arabia, Qatar, and other countries. It possesses deep familiarity with local regulatory frameworks and hospital procurement processes, granting it significant local channel advantages.Novartis developed a gene therapy for rare diseases like spinal muscular atrophy but faced challenges in the Middle East market, including insufficient distribution channels and difficulties in patient screening.

Their collaborative process is as follows:

- Establishing a “Rare Disease CDx Testing Network” (2023): Novartis provides CDx technical support for rare diseases (e.g., testing methods, reagent standards), while Bait Al Dawaa builds a specialized rare disease CDx testing network across the Middle East. “Rare Disease Testing Centers” are established in laboratories across 10 core cities to conduct patient screening and testing.

- Patient Registration and Treatment Coordination (2023-2024): Bait Al Dawaa leverages its channels to conduct rare disease screening campaigns. Patients meeting treatment criteria through CDx testing are registered in Novartis’ “Patient Treatment Database.” Novartis provides drug therapy for these patients and collaborates with Middle Eastern governments to include medications in national health insurance reimbursement lists;

- Long-term follow-up and data feedback (ongoing): Bait Al Dawaa conducts post-treatment follow-up testing and shares results with Novartis to optimize drug efficacy. Both parties jointly submit “Rare Disease Treatment Effectiveness Reports” to Middle Eastern governments to secure additional policy support (e.g., increased reimbursement rates, testing cost subsidies).

The model’s strength lies in its “grounded, actionable” approach: Local diagnostic companies understand regional markets, swiftly addressing “patient location, screening methods, and testing implementation.” International pharmaceutical firms provide high-quality drug resources to meet patient needs. Moreover, this “local + international” collaboration facilitates government policy support (e.g., insurance coverage, expedited approvals).

Implementation Key Points:

- Define “Responsibility Division”: Local diagnostics firms focus on channel development, patient screening, testing implementation, and regulatory compliance; international pharmaceutical companies concentrate on drug supply, technical support, and insurance negotiations—avoiding collaboration chaos caused by unclear responsibilities.

- Prioritize “Patient Education”: Many rare disease patients in the Middle East lack awareness about their conditions and treatments. Joint patient education initiatives (e.g., free clinics, educational seminars) are essential to boost screening willingness and treatment adherence.

- Establish Long-Term Partnerships: This model requires a longer implementation cycle (typically 1-2 years). Both parties must commit to sustained collaboration rather than pursuing short-term gains—for instance, agreeing to a minimum 5-year cooperation period and jointly investing resources in market cultivation.

Finally, a critical reminder: When pursuing “diagnostic-drug” collaborations in the Middle East market, it is essential to “closely follow government policies.”For instance, Saudi Arabia’s “Vision 2030” initiative emphasizes “enhancing access to precision medicine,” offering expedited approval channels for “diagnostic-drug” combination products. The UAE’s “Healthcare Industry Development Plan” provides financial subsidies for collaborative projects between local and international enterprises. Aligning collaborative projects with government policies not only accelerates approvals but also secures policy support and reduces operational costs.

Take the earlier example of Bait Al Dawaa and Novartis’ collaboration: they applied for Saudi Arabia’s “Precision Medicine Innovation Grant,” securing $2 million in funding to establish a rare disease testing network—accelerating their project timeline while reducing costs.

In summary, the scaling revolution of CDx fundamentally reflects the expansion of precision medicine beyond oncology into broader disease areas, with “diagnostic-drug” collaborations serving as the core pathway to achieve this scale.For pharmaceutical and diagnostics companies attending the conference, selecting the right collaboration model tailored to their needs, combined with the market demands and policy advantages of the Middle East, will enable them to seize the initiative in this revolution. After all, the Middle East’s CDx market is still growing rapidly, and entering now still offers significant market potential.

III. The Second Major Strategic Transformation Highlighted at 2026 Bio International Convention: Platformization and Democratization of Precision Medicine

3. Exclusive Perspective: Precision Medicine as the Key to Achieving “Value-Based Healthcare” in Emerging Markets

Historically, precision medicine carried an “exclusive and high-end” image—either as prohibitively expensive gene therapies for rare diseases or as genetic sequencing accessible only to top-tier hospitals, seemingly out of reach for ordinary individuals.However, Medlab 2026 conveyed a fundamentally different message: Precision medicine is shedding its “niche luxury” label, shifting toward “platforming” and “democratization.” This transformation is particularly evident in emerging markets like the Middle East.

Why emerging markets? Because regions like the Middle East face a core contradiction: on one hand, healthcare demand is exploding—an aging population, high prevalence of chronic diseases, and growing demand for high-end medical tourism, with people becoming increasingly discerning about “precise, effective” treatment plans; on the other hand, healthcare resources are limited—high-quality doctors and large hospitals are mostly concentrated in core cities like Dubai and Abu Dhabi, while remote areas lag in medical standards, and overall healthcare costs are rising.

This is where precision medicine emerges as the solution: by combining “precise diagnosis with personalized treatment,” it maximizes therapeutic outcomes while avoiding wasteful spending on ineffective care—the very essence of “value-based healthcare.” Consider cancer treatment: previously, patients might endure multiple costly and painful chemotherapy regimens with uncertain results. Now, genetic testing identifies targetable mutations, enabling direct use of targeted therapies that deliver superior efficacy while reducing unnecessary expenses.

Middle Eastern governments have long recognized this, making precision medicine a cornerstone of national strategies like “Vision 2030” and “Digital UAE.”Their goal isn’t “precision medicine accessible only to the few,” but rather precision medicine that “reaches more people, extends to grassroots levels, and lowers overall healthcare costs”—this is the core demand for “universalization.” Achieving universalization requires more than individual companies or technologies; it demands building a “platform-based” ecosystem: unified genetic databases, shared testing platforms, and collaborative industrial chains that enable SMEs and grassroots hospitals to participate.

At the 2024 Medlab exhibition, I spoke with an official from Saudi Arabia’s Ministry of Health who stated: “We don’t want precision medicine confined to top hospitals in Riyadh. Our vision is for every province in Saudi Arabia to offer genetic testing and personalized treatment. Achieving this requires transforming precision medicine into an ‘open platform’ where equipment manufacturers, testing institutions, pharmaceutical companies, and research institutes can collaborate.”

This encapsulates the “platformization + democratization” transformation Medlab 2026 will focus on: precision medicine shifting from “isolated breakthroughs” to “ecosystem synergy”; evolving from “elite exclusivity” to “universal accessibility.” Next, we’ll break down how this transformation materializes and identify tangible opportunities for attendees through three key directions: NGS technological breakthroughs, multi-omics integration, and the nucleic acid therapeutics/CGT industrial chain.

3.1 Breakthroughs in “Speed and Cost” of Next-Generation Sequencing (NGS)

NGS serves as the “core engine” of precision medicine—essential for genetic testing, disease screening, and drug development alike. The key to achieving widespread adoption in the Middle East lies in two factors: speed and cost. Previously, NGS sequencing was slow and expensive, limiting its use to research or select severe cases. Now, with increasing speed and decreasing costs, it has laid the foundation for integration into routine diagnostics and broader population coverage.

3.1.1 Cost Reduction Drives Whole Genome Sequencing (WGS) into Routine Diagnostics

First, consider these striking figures: the cost trajectory of whole-genome sequencing (WGS). By comparing global average costs from 2000 to 2024 with actual Middle Eastern market rates, the rationale for WGS’s diagnostic adoption becomes clear:

| Time Point | Global Average WGS Cost | Average WGS Fee in Middle East Market | Key Technology Breakthrough | Middle East Market Application Scenarios |

| 2000 | $100 million per person | – (No commercial services available) | First-generation sequencing technology, extremely low efficiency | Used exclusively for research; fewer than 10 cases globally |

| 2010 | $100,000 per person | $150,000 per person | Second-generation sequencing technology (Illumina platform) matured | Used exclusively for rare disease diagnosis, with annual testing volume under 100 cases |

| 2018 | $1,000 per person | $3,000 per person | Sequencer throughput increased, reagent costs decreased | Precision cancer therapy, rare disease screening, annual testing volume approximately 5,000 cases |

| 2024 | $200–300 per person | $800–1200 per person | Third-generation sequencing technologies (PacBio, Oxford Nanopore) become widespread; domestic companies introduce low-cost solutions | Routine diagnostics (e.g., cancer, cardiovascular diseases), newborn screening, and health checkups, with annual testing volume exceeding 50,000 cases |

| 2026 (Projected) | $100 per person | $500 per person | Portable sequencers achieve mass adoption; automated sample processing technologies mature | Routine testing at primary care hospitals and large-scale population screening, with annual testing volume projected to exceed 150,000 cases |

This table demonstrates that WGS costs have decreased by 500,000-fold over two decades—an unprecedented pace in any industry!While Middle Eastern market pricing remains above the global average (primarily due to local service and compliance costs), the downward trend aligns perfectly—reaching $800–1,200 per person by 2024. This price point is now within reach for the region’s middle-income population and aligns with government healthcare reimbursement capabilities.

This cost reduction has directly propelled WGS into routine diagnostics. Let me share two real-world examples from the Middle East market illustrating how WGS transitioned from a “niche test” to a “routine procedure”:

Case 1: Rashid Hospital in Dubai incorporates WGS into routine oncology diagnostics

Rashid Hospital, one of Dubai’s largest public hospitals, previously performed only “hotspot gene panel testing” (e.g., targeting common mutations like EGFR and ALK) for cancer patients at a cost of approximately $500. However, this approach had a critical limitation: it covered only a limited number of targets, often missing rare mutations and preventing some patients from identifying suitable targeted therapies.

In 2023, they incorporated WGS into routine cancer diagnostics—all confirmed advanced-stage cancer patients can now receive WGS free of charge (covered by Dubai government healthcare).Why was this possible? The key factor was cost reduction: In 2021, their WGS cost was $2,000 per person. By 2023, through bulk purchasing sequencing services from local companies, the cost dropped to $800 per person—fully affordable under government healthcare.

The impact has been significant: Previously, only 30% of advanced cancer patients could find matching targeted therapies; now that rate has risen to 55%. Moreover, by identifying rare targets, many patients have gained access to “orphan drugs,” extending their average survival by 12 months.More importantly, WGS predicts patient tolerance to chemotherapy drugs, avoiding wasted costs and side effects from ineffective treatments. Hospital statistics show that after implementing WGS, the average treatment cost for cancer patients decreased by 18%—a clear demonstration of value-based healthcare.

Case Study 2: Saudi Arabia’s Newborn WGS Screening Program

Saudi Arabia has a high incidence of rare diseases (due to a high rate of consanguineous marriages). Previously, newborn screening could only detect over 50 common genetic disorders, meaning many rare diseases were only diagnosed after symptoms appeared, missing the optimal treatment window.

In 2024, the Saudi government launched the “Newborn WGS Screening Pilot Program.” Maternity hospitals in five cities, including Riyadh and Jeddah, now offer free WGS screening for newborns—parents voluntarily enroll, with the government covering all costs (approximately $1,000 per person). The pilot aims to screen over 100,000 newborns for more than 1,000 rare diseases.

The project’s implementation hinges on breakthroughs in cost and speed: Previously, testing for 1,000 rare disease-related genes required multiple panel tests costing over $3,000 with results taking two weeks. Now, WGS completes the process in a single test, reducing costs to under $1,000 and delivering results within 72 hours.As of October 2024, the pilot program has screened 30,000 newborns, identifying 87 rare disease cases. All affected infants received timely treatment, preventing disease progression.

Some may wonder: “With such a significant cost reduction, does the accuracy of testing suffer?” In fact, there is no cause for concern.Modern NGS technology, particularly third-generation sequencing, not only offers lower costs but also achieves higher accuracy than previous methods. For instance, PacBio’s HiFi sequencing boasts an accuracy rate of 99.9%, surpassing second-generation sequencing. Moreover, it can detect structural variations (such as gene segment insertions or deletions) that were previously undetectable—variations often closely linked to rare diseases and tumors.

At the 2024 exhibition, Illumina showcased its latest NovaSeq X Plus sequencer. This instrument can complete WGS testing for 200 individuals within 24 hours, achieving an accuracy rate of 99.8% at an average cost of less than $200 per person.Meanwhile, Middle Eastern company PureHealth introduced its self-developed low-cost WGS solution. By partnering with local reagent suppliers, they reduced testing costs to $800 per person while offering database interpretation tailored specifically for Arab populations. This approach better aligns with local needs than international solutions, as genetic frequencies vary across populations, necessitating localized interpretation databases.