1. Bio Conference San Diego 2025 (Biopharma Focus) Preview: Seizing Global Collaboration Opportunities at the Crossroads of Industry Transformation

On October 4, 2025, Bio Conference San Diego 2025 (the 23rd San Diego Biopharma Conference) will convene at the heart of America’s “Biotech Coast.” The global pharmaceutical industry stands at a pivotal turning point: patents worth over $300 billion will expire between 2026 and 2030, AI-driven drug discovery achieves breakthroughs, and regulatory frameworks continue to evolve. Hosted by the San Diego Asia-Pacific Biopharma Association (SABPA), this conference transcends routine networking—it will serve as a strategic compass for global industry professionals.

Home to over 2,000 life science companies contributing $56 billion to the local economy, San Diego is adding 3.2 million square feet (approx. 297,000 square meters) of research space by year-end. Building on this industrial foundation, this conference will catalyze profound dialogues reshaping the industry’s future trajectory. This article provides a comprehensive guide for international exhibitors and attendees to fully leverage this pivotal event in the biopharmaceutical sector.

2. Conference Context and Strategic Value: Why Bio Conference San Diego 2025 Matters

San Diego’s biopharmaceutical ecosystem has become a global benchmark, with talent density and innovation vitality rivaling any life sciences cluster worldwide. The region boasts 78,860 science and technology professionals (with a significant proportion in biotechnology), earning an average annual salary of $140,939, highlighting the high value of its life sciences workforce.

2.1 This talent pool underpins a diverse industrial ecosystem

From industry giants like Illumina (a leader in gene sequencing) and Thermo Fisher Scientific (a life science tools provider) to dynamic startups, the region fosters a unique environment where “mature expertise and entrepreneurial energy coexist.” The 23rd conference will leverage this ecosystem to provide a platform for over 1,500 attendees—including corporate executives, research directors, investors, and regulatory experts—to explore innovative directions and collaborative models defining the next phase of biopharmaceutical development.

2.2 For international attendees, the timing of this conference holds particular strategic significance

Deloitte’s 2025 industry analysis indicates that amid rising R&D costs, biopharmaceutical companies are increasingly adopting “fail-fast” R&D strategies and real-time data analytics to optimize portfolio decisions. Data reveals that nearly half of the top 20 biopharmaceutical companies’ R&D activities focus on oncology, while clinical trial costs continue to rise due to complex protocols and patient recruitment challenges. Against this backdrop, the need for global collaboration has never been more urgent. The San Diego conference serves as a pivotal “hub” to address these challenges, bringing together solutions from the Pacific Rim and worldwide.

Host SABPA holds a distinguished reputation for fostering “East-West collaboration” in biopharmaceuticals, particularly valuable for international attendees seeking cross-market access. While the 2025 conference agenda details remain incomplete, past editions typically featured three core components: keynote speeches by industry leaders, specialized forums on cutting-edge technologies, and structured networking events designed to facilitate substantive collaborations. The 2025 edition will uphold this tradition while focusing on the industry’s most pressing issues—such as AI integration and supply chain resilience—making it an essential event for companies seeking to maintain competitiveness in the rapidly evolving global marketplace.

3. Key Trend Forecasts from Bio Conference San Diego 2025: Shaping the Post-2025 Biopharmaceutical Landscape

3.1 Portfolio Optimization in the Era of Patent Cliffs

The 2026-2030 period will witness a “patent cliff”—with over $300 billion in drug sales facing patent expirations—compelling biopharmaceutical companies to redefine their R&D pipeline strategies. This critical issue will undoubtedly be central to this year’s conference, with sessions likely exploring how companies balance investments in core therapeutic areas with exploring emerging opportunities. Deloitte research indicates that 56% of biopharmaceutical executives plan to redefine their R&D strategies by 2025, underscoring the practical urgency of this topic.

Attendees can expect in-depth discussions on therapeutic area (TA) prioritization, particularly focusing on the currently “crowded” oncology field (which consumes nearly half of large biopharma companies’ R&D resources). Concurrently, sessions may analyze “high-potential alternative areas” like rare diseases, neuroscience, and antimicrobial therapies—domains where substantial unmet medical needs persist. The U.S. Food and Drug Administration’s (FDA) final guidance on “Antimicrobial Therapies for Unmet Medical Needs,” released June 26, 2025, may serve as the regulatory framework for antimicrobial R&D strategy discussions, offering practical insights for pipeline diversification.

Portfolio optimization discussions will also address rising clinical trial costs (driven by complex protocols, patient recruitment challenges, and inflationary pressures). Panel sessions may showcase innovative trial design approaches—such as adaptive trial methodologies and real-world evidence integration—to help companies maintain R&D efficiency amid these challenges. For international exhibitors, these sessions will offer comparative benchmarks for regional clinical trial strategies, facilitating the identification of complementary partners.

3.2 Revolutionary Advances in AI and Multi-Target Drug Development

Artificial intelligence has transitioned from “theoretical application” to “practical implementation,” a transformation that will be a highlight of the 2025 conference. A breakthrough achievement from Nagoya University in Japan—an AI system capable of simultaneously designing compounds targeting multiple therapeutic proteins—exemplifies such innovation. The research team successfully designed compounds targeting two bronchial asthma pathways, with three out of ten synthesized compounds demonstrating high specificity, fully showcasing AI’s potential to accelerate multi-target drug development.

Conference sessions may focus on four core applications of AI in drug discovery:

- Target Identification and Validation: AI analyzes vast biological datasets to discover novel therapeutic targets, shortening traditional validation cycles;

- De novo molecular design: Machine learning algorithms generate optimized molecular structures with targeted properties (e.g., research achievements from Nagoya University);

- Predictive toxicology: AI models anticipate potential adverse reactions to reduce late-stage development failure rates;

- Clinical trial optimization: Algorithms enhance patient recruitment efficiency, refine trial designs, and enable real-time data analysis.

The FDA’s January 2025 draft guidance, “Considerations for AI-Supported Regulatory Decision-Making,” will provide critical regulatory context for these discussions. International attendees should focus on U.S. regulatory requirements for AI validation and documentation—these guidelines may influence global standards. For Asian and European exhibitors, relevant sessions offer both an opportunity to showcase regional AI innovations and a window into U.S. regulatory expectations for “AI-driven therapies.”

3.3 Supply Chain Resilience and New CDMO Collaboration Models

Global supply chain disruptions have exposed the vulnerabilities of traditional biopharmaceutical production models, making “supply chain resilience” a key focus of the 2025 conference. The Contract Development and Manufacturing Organization (CDMO) sector is actively responding by increasing investments in areas like peptide synthesis and Antibody-Drug Conjugate (ADC) production to enhance specialized capabilities. These fields have seen surging demand driven by the explosive growth of GLP-1 receptor agonists (weight loss and diabetes medications) and targeted cancer therapies.

Conference discussions may center on two key risk mitigation strategies: “dual-source supply” and “global manufacturing footprint.” Against the backdrop of ongoing geopolitical tensions impacting supply chains, sessions will also explore optimal approaches to “regional production network design,” weighing the pros and cons of “nearshoring” versus “global diversification.” Santiago, as a “hub for production innovation” (home to multiple companies leading in continuous manufacturing and digital process control), provides an ideal setting for such discussions.

For exhibitors from Asia and Europe, sessions comparing regional supply chain regulations and quality standards will be particularly valuable. The conference may share “successful case studies of cross-border production collaboration,” distilling best practices in technology transfer and regulatory coordination. With both the FDA and the European Medicines Agency (EMA) updating guidance on production changes (such as the FDA’s final guidance on CMC pre-submission communications issued in June 2025), these discussions will provide directly actionable recommendations for companies operating across jurisdictions.

3.4 Global Harmonization and Regional Differences in Regulatory Frameworks

2025 marks significant shifts in biopharmaceutical regulation: New guidance from both the FDA and EMA will profoundly impact global product development strategies. These regulatory updates will be central conference themes, helping international attendees navigate increasingly complex approval pathways.

In the first half of 2025, the FDA issued several key guidance documents:

- July 18: Final Guidance on Formal Meetings for Biosimilar Products

- July 18: Draft Guidance on the Inclusion of Pregnant and Lactating Women in Clinical Trials

- June 20: Final Guidance on Post-Warning Letter Meetings for Generic Drugs

Concurrently, the EMA implemented revised “Regulations on Changes” effective January 1, 2025, adjusting the approval process for post-marketing variations. This transformation presents both challenges and opportunities for pharmaceutical companies in the EU market, with new provisions including “Work Sharing Procedures” and “Handling of Changes During Public Health Emergencies.”

Conference sessions will compare regulatory dynamics across major markets, helping international exhibitors understand the “convergence points” and “differences” in global regulation. Panel discussions featuring current and former regulatory officials may reveal enforcement priorities and future policy directions. For Asian companies seeking entry into European and American markets, or European and American companies planning to expand into Asia, these sessions will serve as key references for developing strategies that “balance regional compliance with global R&D efficiency.”

4. Supporting Bio Conference San Diego 2025: San Diego Biopharmaceutical Ecosystem: In-Depth Analysis of a Global Innovation Engine

4.1 Cluster Advantages and Key Players

San Diego’s biopharmaceutical cluster has evolved into one of the world’s most dynamic innovation ecosystems, providing an ideal backdrop for the conference. Nearly 2,000 life science companies in the region span the entire drug development lifecycle, forming a “high-density network of specialized capabilities.” This density accelerates knowledge exchange and talent mobility, fostering innovation and unique collaboration opportunities. Attendees can leverage these resources through targeted networking and site visits.

The local industrial ecosystem comprises three core participant categories:

- Industry Giants: Companies like Illumina (genetic sequencing), Thermo Fisher Scientific (life science tools), and Vertex Pharmaceuticals (specialty drugs) maintain significant operations here, shaping an industrial culture of “scalability and commercialization capabilities.”

- Mid-sized innovators: Companies like ResMed (respiratory health) and DexCom (diabetes monitoring) bring specialized expertise in therapeutic areas and technological directions;

- Emerging Startups: San Diego’s vibrant venture capital ecosystem supports startups commercializing cutting-edge research, many originating from renowned local research institutions.

Additionally, the region offers $215 million in tax credits to support technology and biotechnology industries, creating a “business-friendly environment” that attracts international investment. Attendees should fully leverage the conference’s organized tours and networking sessions to connect with these ecosystem participants—many of whom will be exhibiting or speaking at the event.

4.2 Seamless Integration of Academic Research and Industrial Translation

The success of San Diego’s biopharmaceutical industry hinges on the “seamless integration of academic research and industrial application”—a model that will be comprehensively showcased during the conference. The region hosts top-tier research institutions like The Scripps Research Institute, the University of California, San Diego (UCSD), and the Salk Institute for Biological Studies, which consistently rank among the world’s leading biomedical research centers.

This formidable academic strength is translated into tangible innovation through “technology transfer mechanisms” and “collaborative research programs.” The addition of 3.2 million square feet of new research space by the end of 2025 will further enhance this capability, providing expanded facilities for translational research and startup incubation. The conference may include tours of these new facilities, offering international attendees firsthand insight into San Diego’s research infrastructure.

Particularly noteworthy is the region’s leadership in “interdisciplinary research”—integrating biotechnology with artificial intelligence, engineering, and digital health. This convergence is revolutionizing drug discovery. This cross-disciplinary approach has driven breakthroughs in personalized medicine, digital therapeutics, and AI-driven drug design, with multiple achievements featured in conference presentations. For international academic institutions and research-based enterprises, these sessions will offer reference models for successful industry-academia-research collaboration, providing insights applicable to building ecosystems in their own regions.

4.3 Talent Pool and Workforce Development

The core competitiveness of San Diego’s biopharmaceutical ecosystem ultimately stems from its highly skilled workforce. The region boasts 78,860 technology professionals across fields including artificial intelligence, biotechnology, and software development. This talent pool is underpinned by two pillars: continuous cultivation of life sciences graduates by local universities, and the region’s ability to attract top global talent through its dual advantages of career opportunities and quality of life.

Despite a modest 2.5% reduction in biotech sector employment in recent years, experts project robust recovery by late 2025—a trend aligning closely with the conference timing and signaling fresh momentum for industry growth. The average annual salary in San Diego’s technology sector (including biotechnology) reaches $140,939, reflecting both the high valuation of specialized skills and the region’s ability to compete globally for top talent.

For international exhibitors, understanding San Diego’s talent landscape is crucial for “collaborative decision-making”: whether considering R&D partnerships, establishing U.S. branches, or identifying acquisition targets, talent remains a critical factor. Conference sessions on workforce trends may explore “emerging skill demands” in biotechnology (particularly related to AI and digital technologies), offering insights for future talent development strategies. Furthermore, the region’s emphasis on “continuous learning and career development”—such as coding bootcamps and specialized training programs—ensures its workforce remains at the forefront of biopharmaceutical innovation.

5. Practical Attendee Guide: Maximizing Your Experience at Bio Conference San Diego 2025

5.1 Registration Strategy and Key Deadlines

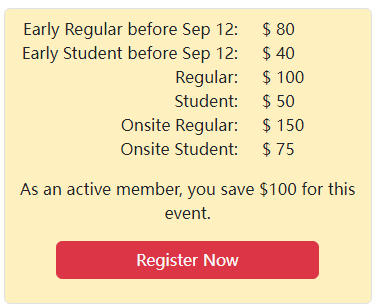

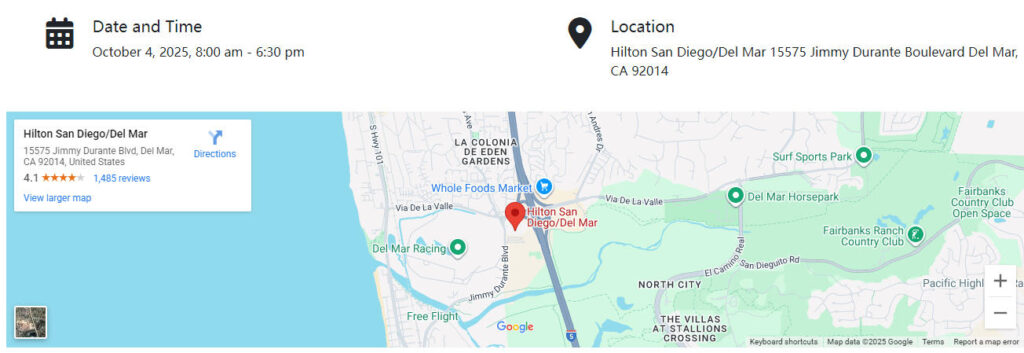

To fully capitalize on the opportunities at the 23rd San Diego Biopharma Conference, a strategic approach to registration is essential. While 2025 registration details will be announced on the official SABPA event page (https://sabpa.org/member/event.php?id=100144), past experience suggests the following key phases:

- Early Bird Registration: Typically closes 8-10 weeks before the event (expected in August 2025), offering the deepest discounts—usually 20%-30% below standard rates;

- Standard Registration: Open until 4-6 weeks before the conference (expected in September 2025);

- Late Registration: Available until the day of the conference, but at a premium rate.

International attendees should prioritize “Early Bird Registration” to save costs and allow ample time for visa applications. Organizers typically provide official invitation letters for visa purposes, but these applications should be submitted 6-8 weeks before travel to account for potential processing delays. Groups of 5 or more registrants from the same organization often qualify for “Group Discounts,” presenting a significant cost-saving opportunity for exhibitors sending multiple attendees.

Registration packages may include varying access levels: from “Full Conference Passes” (covering all sessions, exhibitions, and networking events) to “Single-Day Passes” or “Exhibition-Only Passes.” For first-time attendees, the “Full Conference Pass” offers the best value, enabling comprehensive participation in the agenda and networking activities. The conference app typically becomes available for download 2-3 weeks prior to the event. It supports customizing schedules, bookmarking sessions, and connecting with other attendees in advance—pre-event planning is key to maximizing on-site efficiency.

5.2 Optimal Transportation & Accommodation Solutions

San Diego offers diverse transportation options for international attendees:

5.3 Air Travel

San Diego International Airport (SAN) is just 3 miles (4.8 km) from downtown. Direct flights are available from major U.S. cities, while international travelers typically connect through hubs like Los Angeles (LAX) or San Francisco (SFO). Ground transportation options include ride-hailing services (Uber, Lyft), taxis, and public buses.

5.4 Local Transportation

The San Diego public transit system (MTS) covers major areas, but ride-hailing services offer greater flexibility for trips between hotels, venues, and evening events. If your accommodation is near the convention center, renting a car is generally unnecessary.

5.5 Accommodation Recommendations

The core principle for accommodation selection is “proximity to the conference venue” (typically located in Downtown San Diego or the Mission Bay area), minimizing commute time and maximizing networking opportunities. Three recommended areas:

- Downtown San Diego: Offers the widest hotel selection within walking distance of conference facilities, ranging from luxury brands like Manchester Grand Hyatt to budget-friendly options.

- Gaslamp Quarter: Adjacent to downtown, featuring boutique hotels in renovated historic buildings and abundant dining options, ideal for evening business meetings;

- Mission Bay: Approximately a 15-minute drive from downtown, offering resort-style accommodations with more spacious rooms, ideal for extended stays.

International attendees should finalize accommodations by early August 2025. San Diego hosts numerous conferences year-round, and late bookings may encounter limited availability or higher rates. Booking through the conference website typically secures “conference-exclusive rates,” 10%-15% lower than standard prices. For cost-effective options, consider distinctive accommodations in areas like North Park or Hillcrest, with quick access to downtown via public transit or ride-hailing services.

5.6 Effective Networking and Business Development Strategies

The San Diego Biopharma Conference offers “unparalleled networking opportunities,” and targeted preparation significantly enhances the value of these interactions. International exhibitors may consider the following strategies:

- Pre-conference research: Identify 20-30 “priority contacts” (including potential partners, clients, and industry thought leaders) from the attendee list (typically released 4-6 weeks prior). Research their company backgrounds and recent achievements to prepare for in-depth discussions.

- Booth Strategy: If exhibiting, staff booths with multilingual teams and prepare high-quality translated promotional materials. Schedule 30-minute “demonstration sessions” for core technologies or services to facilitate in-depth exchanges.

- Session Selection: Prioritize sessions aligned with your “business development goals” over pursuing “comprehensive coverage.” Q&A segments offer prime opportunities to engage speakers and showcase your company’s expertise.

- Official Social Events: Structured gatherings like opening receptions, thematic roundtables, and closing dinners often yield the most valuable connections. Prepare a 30-second elevator pitch to clearly convey your company’s core value proposition.

- Regional Extension: Extend your stay by 2-3 days to arrange one-on-one meetings with local biotech companies, research institutions, and contract service providers. Conference organizers may offer “ecosystem tours” providing systematic access to key institutions.

For Asian exhibitors, SABPA’s focus on “Pacific Rim Collaboration” naturally creates “two-way matchmaking” opportunities: connecting with U.S. companies seeking Asian partners while also building ties with institutions across other Asian regions. European attendees should prioritize sessions on “Transatlantic Regulatory Harmonization” to connect with companies facing similar market access challenges. Additionally, follow-ups with new contacts must be completed within 48 hours post-meeting—when dialogue memories are fresh and “initial connections” are most easily converted into “substantive opportunities.”

5.7 Visa and Logistical Preparation Essentials

U.S. visa processing times vary significantly by country and season; international attendees must allow ample preparation time:

5.7.1 Visa Requirements

Most business attendees require a B-1 visa, necessitating the following documents: an official invitation letter from SABPA, conference registration confirmation, and evidence of professional status and intent to return home after the event (e.g., employment verification, financial proof).

5.7.2 Application Timeline

Initiate the visa application at least 90 days prior to the planned departure date. Schedule the consular interview as early as possible—appointment slots may be limited during peak seasons (e.g., around holidays).

5.7.3 Interview Preparation

Clearly state the purpose of attendance, your organization’s role within the biopharmaceutical industry, and specific sessions or meetings you plan to attend.

5.7.4 Logistics Checklist

- Health Insurance: Purchase comprehensive travel insurance covering medical expenses — U.S. healthcare costs far exceed expectations in most countries.

- Power Adapters: The U.S. uses Type A and Type B outlets with 120V voltage; prepare compatible adapters in advance.

- Payment Methods: While credit cards are widely accepted, carry a small amount of USD cash for minor expenses; notify your bank of your travel plans beforehand to prevent credit cards from being frozen due to suspected fraudulent activity;

- Clothing Preparation: San Diego’s October climate is mild (average temperature 18-24°C), but conference venues are typically air-conditioned to cooler temperatures. Pack layers.

Language: The conference primarily uses English, but non-native speakers should prepare key technical terms in advance. Given SABPA’s international scope, translation services may be available for main sessions. Finally, familiarize yourself with U.S. entry procedures (e.g., prohibited items, customs declaration requirements) to ensure smooth arrival.

6. Sustaining Engagement Post-Bio Conference San Diego 2025: Extending the Value of Connections Made at Bio Conference San Diego 2025

Connections and insights gained at the San Diego Biopharma Conference can be transformed into long-term value through a “structured follow-up strategy.” International exhibitors should implement the following measures within weeks of the conference:

- Tiered Follow-Up System: Categorize new contacts into three groups (A: Immediate Collaboration Opportunities; B: Potential Partners; C: Knowledge Sharing Candidates) and tailor follow-up content accordingly. Follow-up emails should reference specific discussions held during the conference to enhance personalization.

- Content Sharing: Within one week post-conference, share relevant resources mentioned during discussions (e.g., white papers, case studies, technical specifications). Proactively introduce internal experts in relevant fields based on specific needs.

- Opportunity Documentation: Maintain detailed records of collaboration discussions, including next steps, timelines, and decision-makers. Conduct internal meetings to prioritize follow-up efforts.

- Ecosystem Integration: Maintain engagement through SABPA and San Diego biopharma organization digital channels; consider joining relevant membership organizations to sustain access to regional industry resources;

- Effect Tracking: Establish “Meeting ROI” metrics (e.g., qualified leads, initiated collaboration discussions, applied regulatory insights) and conduct reviews at 30, 60, and 90 days.

For many international companies, the conference serves as the starting point for “deep integration into the San Diego ecosystem”—whether for R&D collaborations, contract service partnerships, or ultimately entering the U.S. market. By nurturing connections formed during the event and deepening acquired insights, attendees can transform a “one-time conference experience” into “sustained business value.”

The biopharmaceutical industry currently stands at a pivotal inflection point marked by technological transformation, regulatory evolution, and shifting market dynamics. The 23rd San Diego Biopharmaceutical Conference converges specialized insights, innovative achievements, and collaborative opportunities. For international exhibitors and attendees, it serves not only as a networking platform but also as a strategic fulcrum for “addressing industry challenges, tapping into San Diego’s dynamic ecosystem, and building global partnership networks.” By leveraging the insights and strategies presented in this article, attendees will maximize conference value and position their enterprises for competitive advantage in the dynamic market landscape beyond 2025.