1. Conference Overview and Historical Development: Benchmarks Between BIO-Europe 2025 and 2025 bio international convention

1.1 Conference Basics and Positioning

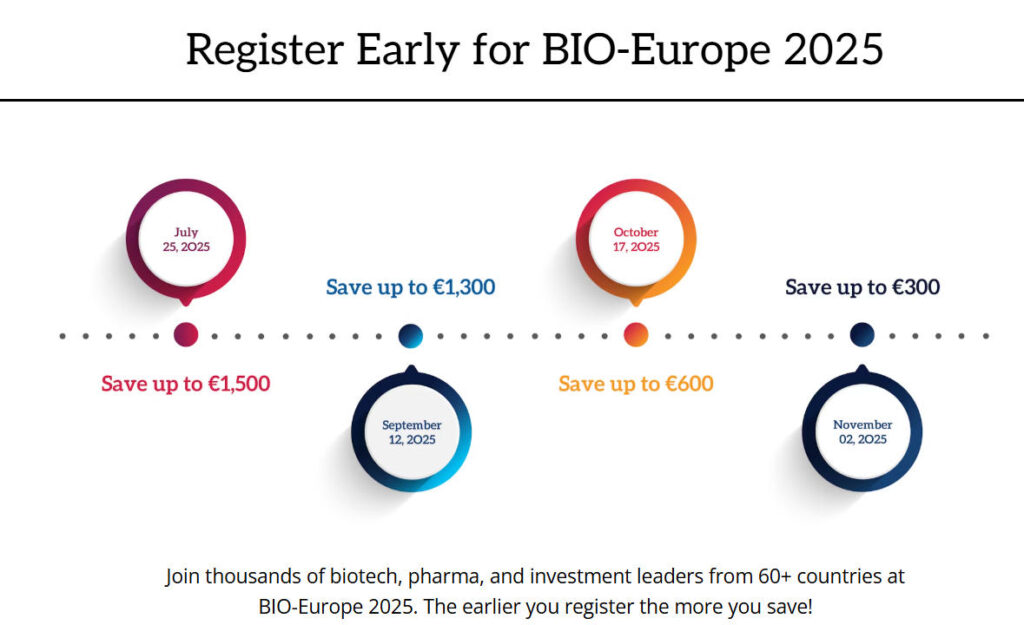

BIO-Europe 2025, the annual flagship event for Europe’s biotechnology industry, will take place from November 3 to 5, 2025, at the Vienna Congress and Convention Center in Austria, followed by a digital collaboration meeting on November 11 and 12. Organized by the EBD Group and supported by the Biotechnology Innovation Organization (BIO) – the same organization behind the 2025 bio international convention – this international collaboration conference has evolved into Europe’s largest and most influential biotechnology partnership platform.

This year’s theme, “Where partnering becomes the science of connection,” reflects the conference’s commitment to making every connection meaningful and targeted, aiming to achieve breakthroughs in biotechnology. The event is expected to attract over 5,700 attendees from more than 61 countries, facilitate over 30,000 one-on-one meetings, and bring together 189 exhibitors and more than 3,000 unique companies.

From an industry positioning perspective, BIO-Europe has become a pivotal node in the global biotechnology ecosystem, gathering decision-makers from all segments—biotech startups, established pharmaceutical companies, investment institutions, and service providers— . The conference’s unique value lies in its “collaboration-oriented” business model, which, through an efficient one-on-one meeting system, helps participating companies establish more business connections in three days than they might otherwise achieve throughout the rest of the year.

1.2 Historical Development and Scale Evolution

BIO-Europe’s evolution mirrors the growth trajectory of Europe’s biotechnology industry. Since its inaugural event in Hannover, Germany in 1995, the conference has transformed from a small gathering into a major industry summit . The first edition featured just 97 attendees and 60 one-on-one meetings, primarily focused on facilitating cross-border collaborations between pharmaceutical and biotech companies .

Through in-depth analysis of historical data, BIO-Europe’s growth trajectory clearly shows a marked acceleration trend:

| Year | Number of Attendees | Number of Countries | One-on-One Meetings | Exhibitors | Unique Companies |

| 1995 | 97 | – | 60 | – | – |

| 2004 | 1,400+ | – | – | – | – |

| 2018 | 4,354 | 60 | 26,092 | 131 | 2,325 |

| 2020 | 3,201 | 60 | 15,000+ (online) | – | 1,784 |

| 2023 | 5,000+ | 66 | 27,000 | – | 2,505 |

| 2024 | 5,700 | 61 | 30,750 | 189 | 3,038 |

| 2025E | 6,000+ | 61+ | 30,000+ | 189 | 3,000+ |

Comparing the data reveals a qualitative leap in conference scale over the past 30 years. Particularly after the return to in-person meetings in 2022, attendance reached a historic high of over 5,000 participants . The 30th conference held in Stockholm in 2024 broke multiple records: attendance reached 5,700 participants, a 31% increase from 2018; one-on-one meetings totaled 30,750 sessions, an 18% rise compared to 2018 .

The conference’s geographic distribution also reflects a growing global trend. While early conferences were primarily held in Germany, the 2018 event in Copenhagen marked the first time the conference was hosted outside Germany, signaling enhanced internationalization . The selection of Vienna as the 2025 venue stems not only from its strategic location and state-of-the-art conference facilities but also from Austria’s increasingly pivotal role within Europe’s biotechnology industry.

1.3 Key Features and Innovations of the 2025 Conference

Building on its established strengths, BIO-Europe 2025 will introduce several innovative initiatives to address the rapidly evolving biotechnology landscape. Three core features deserve particular attention:

Upgraded Intelligent Partnering System. The conference will unveil the latest iteration of the partneringONE platform, hailed as the “industry gold standard.” This platform will integrate AI-driven smart matching algorithms that automatically recommend the most relevant partners based on attendees’ business needs, technical fields, and collaboration history. Organizers report the new system’s matching accuracy is projected to increase by 25% compared to 2024, ensuring participants gain more precise business matching opportunities.

Immersive Thematic Agenda Design. Inspired by Vienna’s coffee culture and musical heritage, the 2025 agenda features three immersive thematic tracks . The first track focuses on “Emerging Scientific Breakthroughs,” exploring cutting-edge topics such as AI-biotech convergence, gene editing advancements, and cell therapy innovations. The second track examines “Regulatory Trends and Policy Environments,” analyzing the latest European Medicines Agency (EMA) policies and the impact of data protection regulations on clinical trials. The third track centers on “Investment Strategies and Business Model Innovation,” delving into post-pandemic financing landscapes and cross-border collaboration models.

Diverse Participation Options. Beyond traditional on-site attendance, the conference offers flexible engagement methods. On-site demo slots are fully booked, but companies may still apply for digital demo opportunities to reach global decision-makers via pre-recorded presentation videos. Digital pass holders can participate in the online Collaboration Days on November 11-12 and gain on-demand access to the conference content library, including company presentations, panel discussions, and corporate showcases.

Notably, the conference will feature a series of evening receptions set against Vienna’s iconic venues. Social events at locations such as the Vienna State Opera and Schönbrunn Palace seamlessly blend professional networking with cultural immersion . This distinctive “academic + cultural” format has become a BIO-Europe tradition, offering attendees opportunities to build deep connections in a relaxed atmosphere.

1.4 BIO-Europe 2022-2025 Core Information Comparison Table

To help visitors quickly grasp key differences across the past four conferences and clearly identify the 2025 event’s upgraded direction and unique value, the table below compares critical dimensions including venue, core technology applications, thematic design, digital services, and supporting activities:

| Comparison Dimension | 2022 (Berlin) | 2023 (Munich) | 2024 (Stockholm) | 2025 (Vienna) |

| Host City Highlights | Germany’s core city for the biotechnology industry, focusing on the integration of traditional pharmaceuticals and innovative technologies | European hub for life sciences R&D, adjacent to research institutions including Ludwig Maximilian University of Munich | Nordic life sciences center emphasizing sustainable healthcare and digital health | Central and Eastern European Transportation Hub, Integrating Europe’s Diverse Industrial Resources and Cultural Characteristics |

| Core Technology Applications | Basic Edition partneringONE Platform, primarily manual matching | Upgraded matching system with industry tag filtering functionality | Intelligent Matching System with approximately 65% accuracy | AI-driven intelligent matching system, with accuracy projected to reach 90% |

| Conference Theme Design | Single theme: “Collaborate to Innovate,” unified agenda framework | Dual themes: “From Lab to Patient” and “Invest in the Future” | Three thematic directions with parallel forums by field | Immersive three-track themes integrated with Vienna’s cultural heritage in agenda design |

| Digital Attendance Services | Only provides recorded conference replays, no real-time interaction | Online one-on-one meeting functionality added, supporting basic video communication | Digital exhibition hall launched, showcasing 3D product models | Dedicated Digital Collaboration Days (November 11-12) featuring an on-demand content library + virtual social networking |

| Featured Supporting Events | Corporate tour of Berlin Industrial Museum | Closed-door matchmaking sessions at Munich Bio-Industrial Park | Academic Forum at the Royal Swedish Academy of Sciences, Stockholm | Reception at Vienna State Opera, Schönbrunn Palace Dinner, Coffee Culture Business Salon |

| Key Areas of Cooperation | Cancer Immunotherapy, Rare Disease Medicines | Scalable Production of Gene Therapy and Cell Therapy | AI-driven drug discovery, microbiome therapies | AI + Biotechnology Convergence, Sustainable Biomanufacturing, Personalized Medicine |

| Participating Company Types (Startups) | 35% | 38% | 42% | 45% (projected) |

| Percentage of International Attendees (Non-European Regions) | 32% | 30% | 31% | 33% (Projected, with Asia-Pacific companies increasing to 15%) |

The table demonstrates that BIO-Europe 2025 achieves significant upgrades across technology application (AI matching), digital services (dedicated Digital Collaboration Day), cultural integration (specialized side events), and industry focus (sustainable biomanufacturing). It further enhances its appeal to startups and Asia-Pacific attendees, aligning more closely with the current collaboration needs and development trends of the global biotechnology industry.

2. Analysis of Participation Value and Business Opportunities: Comparing Returns for BIO-Europe 2025 & 2025 bio international convention

2.1 Industry Influence and Market Position Assessment

BIO-Europe holds a unique and pivotal position within the global biotechnology conference ecosystem. Alongside the JPM Healthcare Conference and BIO International Conference in the United States, it forms a tripartite framework. BIO-Europe is widely recognized as “Europe’s largest biotechnology collaboration conference”. This standing is not accidental but stems from its critical role in advancing Europe’s biotechnology industry.

In terms of industry influence, BIO-Europe’s unique value manifests in three dimensions:

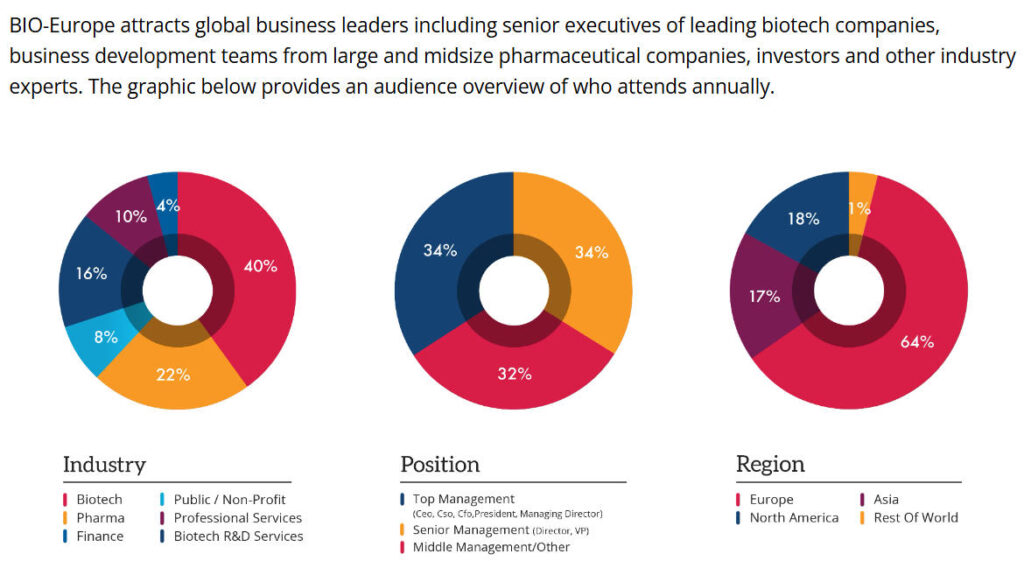

Strategic Gateway to the European Market. Europe boasts the world’s most stringent regulatory framework and most robust innovation ecosystem, accounting for 38% of globally approved novel biopharmaceuticals in 2024 . Serving as a bridge between Europe and global markets, BIO-Europe attracts numerous international companies seeking European market access. Statistics show that 61% of attendees are from Europe, 29% from North America, and 10% from other regions . This diverse geographic distribution creates exceptional opportunities for cross-border collaboration.

A highly efficient platform for deal-making. Unlike scientific conferences focused primarily on academic exchange, BIO-Europe has centered on facilitating commercial transactions since its inception . Its one-on-one meeting system has become an industry benchmark, significantly boosting the success rate of business collaborations through systematic pre-meeting matching, on-site scheduling, and post-event follow-up. According to attendee feedback, over half of new business deals and partnerships originate from meetings at BIO-Europe.

A pivotal node in the innovation ecosystem. BIO-Europe serves not only as a platform for corporate collaboration but also as a convergence point for the entire biotechnology innovation ecosystem. The conference attracts participants across the entire value chain—from basic research institutions to multinational pharmaceutical companies—creating a unique “knowledge spillover” effect. Many groundbreaking collaborative ideas emerge from informal exchanges during the event.

2.2 Participant Composition and Collaboration Opportunity Analysis

The participant composition of BIO-Europe 2025 demonstrates high professionalism and diversity, offering abundant collaboration opportunities for enterprises of various types. Based on the latest pre-registration data, the conference will bring together the following core groups:

Decision-makers from multinational pharmaceutical giants. The 2025 conference has confirmed speakers and delegates from leading global pharmaceutical companies, including Elizabeth Leshen, Head of Gene Therapy and Rare Diseases at Novartis; Nuno Alves, Deputy Director of Business Development at Astellas; and Diana Pignalosa, Head of Strategic Partnerships at Takeda (Debiopharm). These executives not only bring strategic insights from their companies but, crucially, possess direct decision-making authority for collaborations.

Biotech Innovators. The conference is expected to host over 3,000 biotech companies, including numerous innovators at various stages of development. From seed-stage startups to growth companies preparing for IPO, they offer large pharmaceutical firms a rich array of technologies and product options. Particularly in cutting-edge fields like gene therapy, cell therapy, and AI-driven drug discovery, participating companies represent Europe’s—and the world’s—most dynamic innovation forces.

Investment Institutions and Financial Service Providers. The conference draws numerous life sciences-focused investment institutions, including prominent venture capital firms like Forbion, Syncona, SV Health Investors, and Sofinnova Partners. These entities not only bring capital but, more importantly, deep industry insights and extensive sector resources. For biotech companies seeking funding, BIO-Europe offers invaluable opportunities for direct dialogue with decision-makers.

Service Provider Ecosystem. The conference also drew substantial participation from companies providing specialized services to the biotechnology industry, including CRO/CDMO firms, consulting companies, legal services, and intellectual property services. These service providers are not only integral to the conference but also serve as critical connectors across the industry value chain. Statistics indicate that approximately 30% of participating companies fall into the service provider category, providing comprehensive support for the entire ecosystem.

Regarding attendee positions, 36% are CEOs or presidents, 28% are department heads, and 36% are mid-level executives . This structure, where over two-thirds are high-level decision-makers, ensures that intentions formed during the conference can be swiftly translated into tangible collaborations.

2.3 Historical Deal Data and Investment Trend Analysis

BIO-Europe’s effectiveness in facilitating commercial transactions is widely recognized. An in-depth analysis of historical deal data clearly demonstrates the conference’s pivotal role in driving industry development:

Transaction volume continues to grow. According to EBD Group statistics, collaboration deals facilitated by BIO-Europe show steady growth. While specific transaction amounts are not fully disclosed, the expansion of the conference scale indirectly reflects increased deal activity. The 2024 conference announced 4,022 licensing opportunities, representing approximately a 20% increase over 2023 . These opportunities span the entire lifecycle, from early-stage R&D projects to commercialized products.

Collaboration models are becoming increasingly diversified. While early BIO-Europe primarily focused on technology licensing, recent years have seen a clear trend toward diversified collaboration models. Based on participant feedback analysis, the current distribution of collaboration types is as follows:

| Collaboration Type | Percentage | Key Characteristics |

| Technology Licensing | 30% | Remains the predominant collaboration model, with transaction value increasing by 38% to $23.05 billion in 2024 |

| Equity Investment | 15% | An increasing number of large pharmaceutical companies are securing innovative projects through equity investments |

| Service contracts | 20% | Ongoing growth in outsourcing demand for CRO/CDMO services |

| Joint R&D | 25% | Risk-sharing and profit-sharing models are gaining favor |

| Other (e.g., distribution, commercialization partnerships, etc.) | 10% | Emergence of novel collaboration models |

Key investment hotspots in priority sectors. By analyzing the popular topics and transaction distributions across past conferences, the evolution of investment trends becomes evident:

From 2020 to 2022, vaccines and antiviral drugs emerged as absolute hotspots amid the COVID-19 pandemic, with breakthroughs in mRNA technology capturing global attention. From 2023 to 2024, as the pandemic’s impact waned, investment priorities shifted toward “tough nuts to crack” like gene therapy, cell therapy, and rare disease drugs. Trends for 2025 indicate that the convergence of AI and biotechnology, sustainable biomanufacturing, and personalized medicine are emerging as new investment focal points.

Regional collaboration patterns are evolving. While intra-European partnerships have long been central to BIO-Europe, a pronounced internationalization trend has emerged in recent years. Data from 2004 showed 53% of alliances were intra-European, with Europe-US alliances accounting for 39% . By 2025, Chinese companies’ participation has significantly increased. In the first half of the year, Chinese innovative drug companies’ outbound business development (BD) transactions reached $50.88 billion, continuing the high momentum from 2024 . This “Eastward expansion and Westward outreach” trend is particularly evident at BIO-Europe.

Case Study Analysis. BIO-Europe has facilitated numerous high-profile collaborations. For instance, while the mRNA vaccine partnership between BioNTech and Pfizer wasn’t directly concluded at BIO-Europe, both companies are long-standing participants. Many critical technology transfers and cooperation agreements were established through similar platforms . Other notable successes include Bayer’s collaborations with multiple biotech firms and Novartis’s acquisitions in the gene therapy sector.

2.4 Participant Feedback and Satisfaction Assessment

Authentic participant feedback serves as the best indicator of a conference’s value. Comprehensive analysis of historical attendee survey data reveals that BIO-Europe receives high recognition across all dimensions:

Overall satisfaction is exceptionally high. According to the 2024 attendee survey, over 95% of participants expressed satisfaction or high satisfaction with the overall conference experience . Specifically, satisfaction with the professionalism of conference organization reached 97%, satisfaction with partner quality reached 93%, and satisfaction with conference facilities and services reached 91%.

Collaborative outcomes exceeded expectations. Attendees highly valued the commercial benefits generated by the event. Sanjeet Telang, Chief Commercial Officer at Ideogen AG, stated: “BIO-Europe is the ideal forum to meet and network with seasoned business development professionals, identifying assets that lay the foundation for long-term growth. It’s the perfect event to capture the pulse of the pharmaceutical industry.”

Kyoung Wan Yoon, CEO of NEX-I, shared: “BIO-Europe 2023 was a game-changer for expanding my network and exploring new collaborations. partneringONE is a genius design, seamlessly connecting me with global potential partners. Each encounter felt like opening a door to a world of expertise and opportunity. These connections later blossomed into thriving collaborations spanning geographical boundaries.”

Innovation value recognized. Attendees particularly valued the conference’s role in driving innovation. Thomas Meindl, Business Development Manager at MiBioCode, stated: “BIO-Europe is the right place to learn about the latest developments in biotechnology and connect with the people driving them.” This emphasis on innovation is also reflected in the conference agenda, where cutting-edge technology sharing and innovation case studies consistently rank among the most popular sessions.

Suggestions for Improvement and Expectations. Despite high overall satisfaction, attendees offered several improvement suggestions, primarily focusing on: increasing dedicated sessions for specific therapeutic areas; extending conference duration or adding parallel sessions to enhance networking opportunities; strengthening pre-conference matchmaking services to improve the precision of one-on-one meetings; and improving catering arrangements during the conference to foster better conditions for informal exchanges.

This feedback has been fully incorporated by the organizers. The 2025 conference has implemented targeted enhancements in agenda design, technical platforms, and service facilities, promising an even more exceptional experience for attendees.

3. In-Depth Analysis of Conference Content and Agenda: Key Topics Aligned with 2025 bio international convention

3.1 Main Forum Agenda and Speaker Lineup

The BIO-Europe 2025 Main Forum will convene top global leaders from the biotechnology and pharmaceutical sectors for in-depth discussions on the industry’s most pressing issues. Based on the announced speaker lineup, the Main Forum will feature the following core themes:

The AI-Driven Revolution in Drug Discovery. The deep integration of artificial intelligence and biotechnology has emerged as one of the most compelling trends for 2025 . The main forum will feature dedicated sessions exploring AI applications in target identification, molecular design, and clinical trial design. Speakers include Alex Zhavoronkov, CEO of In Silico Medicine, who will share insights on how AI is reshaping drug development workflows . Notably, the OpenCRISPR-1 gene editor—published in Nature in July 2025 as the world’s first open-source gene editor designed entirely from scratch by AI—will be a focal point of discussion.

Commercialization Pathways for Gene and Cell Therapies. With multiple gene therapy products gaining approval in Europe, ensuring access to these innovative treatments has become a key industry concern. Elizabeth Leshen, Head of Gene Therapy and Rare Diseases at Novartis, will share the company’s latest advancements and commercialization strategies in gene therapy. Other speakers include James Ryan, Chief Legal Officer and Chief Commercial Officer at BioNTech, who will explore the application prospects of mRNA technology in oncology and rare disease therapies.

Innovative Practices in Sustainable Biomanufacturing. Amid growing global emphasis on sustainability, the biotechnology industry is transitioning toward greener manufacturing practices. Speakers will explore how innovative technologies—including single-use bioprocessing, continuous biomanufacturing, and eco-friendly production methods—reduce costs, enhance product yields, and minimize the environmental footprint of biologics production. Of particular note is the case of BASF, a German bio-based materials company, which achieved a 20% product premium after obtaining the EU Ecolabel certification in 2024.

Latest Developments in the European Regulatory Landscape. Policy shifts at the European Medicines Agency (EMA) significantly impact the global biotechnology industry. The main forum will feature a dedicated regulatory session, inviting EMA officials and industry experts to interpret the latest regulatory policies. Clarity in regulatory frameworks, particularly in frontier areas like gene editing and cell therapy, will directly influence companies’ R&D and commercialization strategies.

Investment Strategies and Industry Outlook. Representatives from top investment institutions will share insights on the sector’s future. Speakers include Geert-Jan Mulder, Managing Partner at Forbion; Elisa Petris, Partner at Syncona; and Christian Jung, Partner at SV Health Investors. They will analyze which technology areas hold the most potential and which business models attract the most capital from an investment perspective.

3.2 Breakout Sessions: Addressing Industry Pain Points and Decoding Breakthrough Pathways in Niche Sectors

BIO-Europe 2025’s breakout sessions go beyond mere “topic listings.” They are purposefully designed around the core pain points of the current biotechnology industry, creating a closed-loop content experience centered on “problem diagnosis – case study analysis – resource matching.” Below, we break down the deeper value of each breakout session across four core areas:

3.2.1 Therapeutics Track: Bridging the Gap from “Technological Breakthroughs” to “Clinical Implementation”

The core contradiction in the therapeutic sector of the biotechnology industry lies in the disconnect between “laboratory technologies” and “clinical needs”—many innovative therapies struggle to advance to commercialization due to insufficient clinical data support and ambiguous indication selection. This year’s Therapeutic Sector Subforum directly addresses this pain point, with each specialized track following the logic of “clinical challenges → technical solutions → real-world data”:

- Cancer Immunotherapy: Moving beyond the technical principles of CAR-T and bispecific antibodies to focus on the industry-wide challenge of “low response rates in solid tumors.” Merck’s R&D team will share insights on the “synergistic mechanism of bispecific antibodies combined with radiotherapy,” presenting Phase II clinical data for pancreatic cancer (objective response rate increased to 38%, doubling traditional regimens). A roundtable involving “clinical researchers – pharmaceutical companies – patient organizations” will explore designing clinical trial endpoints based on patient needs.

- Neurological Diseases: Addressing the challenges of “difficult diagnosis and limited targets” in Alzheimer’s disease, the subforum will announce the open access plan for the European Neuroimaging Database (containing imaging data from 50,000 patients) to assist pharmaceutical companies in overcoming clinical enrollment hurdles. Additionally, Roche will share “long-term safety data for β-amyloid antibodies,” providing reference for the development of similar drugs.

- Rare Disease Therapies: Core focus on “Orphan Drug Commercialization Challenges”—despite accelerated approval for rare disease drugs in Europe, 80% of orphan drugs generate less than €50 million in annual sales post-launch. This subforum will invite EU rare disease drug pricing experts to analyze “differentiated pricing strategies based on disease burden.” Using BioMarin’s hemophilia drug as a case study, it will deconstruct the commercial combination strategy of “patient assistance programs + health insurance negotiations.”

3.2.2 Technology Platform Forum: Practical Guide to Overcoming Industrialization Bottlenecks

The value of technology platforms ultimately hinges on “scalable production and cost control.” This year’s Technology Platform Forum moves beyond “technical principle explanations” to focus on industrialization pain points across platforms, delivering actionable solutions:

- mRNA Technology Platform: Primarily addresses two major challenges—”supply chain stability” and “high production costs.” CureVac’s production lead will share “Modular mRNA Production Facility Construction Solutions”—standardizing reaction systems to reduce batch cycles from 72 to 48 hours while cutting costs by 30%. European mRNA raw material suppliers will announce “Capacity Expansion Plans for Critical Excipients (e.g., Cap Structure Analogues)” to alleviate supply chain constraints.

- Gene Editing Technology: Addressing the core concern of “off-target risks,” this session will debut CRISPR Therapeutics’ “novel off-target detection method”—combining whole-genome sequencing with digital PCR to enhance off-target site detection sensitivity to 0.01%. Additionally, addressing the challenge of “low in vivo gene editing delivery efficiency,” Novartis will share “latest advances in AAV vector modification,” featuring a novel AAV capsid with 5-fold enhanced liver targeting efficiency.

- AI Drug Discovery: Moving beyond empty talk of “AI accelerating R&D,” the focus shifts to “AI model interpretability”—currently, 70% of AI-discovered targets fail preclinical validation due to unexplained mechanisms of action. The subforum will feature DeepMind’s team unveiling a “Mechanism Validation Framework for AI Target Prediction,” using their newly identified lung cancer target as a case study to dissect the full workflow: “AI Prediction → Biological Experiment Validation → Preclinical Data.”

3.2.3 Industrial Ecosystem Forum: Bridging the Value Loop from R&D to Commercialization

The pain point in the industrial ecosystem lies in “fragmented links”—R&D teams lack financing expertise, while pharmaceutical companies lack supply chain knowledge, causing numerous high-quality projects to stall. This year’s Industrial Ecosystem Forum centers on “collaboration,” building a cross-link dialogue platform:

- Financing and Investment: Addressing the “challenges of early-stage project financing,” the forum will release the 2025 European Biotechnology Investment White Paper. Data reveals that while European biotech seed-round funding declined by 15% year-over-year in 2024, seed-round investments in the “AI + Bio” cross-disciplinary field grew by 40% against the trend. The white paper will clarify “core metrics investors prioritize in early-stage projects” (e.g., reproducibility of target validation data, team industry experience) and feature one-on-one matchmaking sessions between startups and angel investors.

- Manufacturing & Supply Chain: Focus on “Geopolitical Risks in Biopharmaceutical Supply Chains” — In 2024, 30% of European biopharmaceutical companies experienced production delays due to disruptions in active pharmaceutical ingredients (APIs), such as CHO cells. The sub-forum will launch the “European Biopharmaceutical Supply Chain Collaboration Network” to help companies achieve “multi-source backup for critical materials.” Simultaneously, Sartorius will showcase “rapid switching solutions for single-use bioreactors” to support flexible multi-product manufacturing.

3.2.4 Regional Cooperation Forum: Seizing the Opportunity Window for “Cross-Regional Resource Complementarity”

The core of regional cooperation lies in “policy alignment” and “resource matching.” This subforum moves beyond general discussions on “the importance of cooperation” to provide concrete cross-regional collaboration pathways:

- China-Europe Cooperation Session: Addressing the pain point of Chinese innovative drugs “entering the European market” — 80% of Chinese innovative drugs face approval delays in Europe due to “unrecognized clinical data.” The session will feature an EMA expert on clinical data mutual recognition, analyzing “key alignment points between Chinese clinical data and European standards.” Concurrently, Chinese and European pharmaceutical companies will sign a “Joint R&D Agreement” to reduce costs through a “European clinical trials + Chinese manufacturing” model.

- Emerging Market Opportunities: Focusing on “Market Access in Southeast Asia and Africa” — These regions have less than 10% penetration of biologics but lack mature regulatory frameworks. The session will release the Emerging Markets Biologics Access Guide, clarifying “registration timelines” (e.g., ~12 months in India, ~18 months in Brazil) and “local manufacturing requirements” for different countries, while recommending “selection criteria for regional distributor partnerships.”

3.3 Special Event: Goal-Oriented Efficient Networking and Value Acquisition

The core value of special events lies in “precision-matching needs”—not merely “social entertainment.” This year’s special events feature differentiated participation pathways tailored to attendees’ core objectives (exposure, skill enhancement, high-level networking), supplemented by expert-level practical advice:

3.3.1 Innovation Showcase: The Core Channel for Startups to “Precision Fundraising”

Innovation Showcase transcends “simple roadshows” to deliver “precision marketing aligned with investor preferences.” This edition features three major awards, each targeting distinct investor stages, requiring tailored preparations from participating companies:

- Technology Innovation Award: Targets seed-to-angel stage companies, focusing on “technological breakthroughs.” Companies must provide “comparative data against existing technologies”—for example, a gene-editing startup must demonstrate “how much its off-target rate is reduced compared to CRISPR and provide experimental evidence.” The judging panel consists of technology-focused investors (such as Syncona’s technology partners), whose questions will center on “the feasibility of the technical principles.”

- Best Business Model Award: Targeted at Series A-B companies, with a core focus on “clarity of commercialization pathways.” Companies must submit a “3-year commercialization plan” including “target market selection (e.g., initial focus on a specific European country’s rare disease market), pricing strategy, and sales channels.” The judging panel comprises pharmaceutical business leaders and industry investors, prioritizing the assessment of “business model replicability.”

- Most Investment Potential Award: For Pre-Series C companies, core criteria are “clinical progress and market potential.” Companies must provide “preclinical/Phase I clinical data” and “market size projections (with cited sources, e.g., Frost & Sullivan).” The judging panel comprises investment partners from leading VCs (e.g., Forbion), focusing on “clinical success rates and potential return ratios.”

Practical Recommendations: Before participating in innovation showcases, thoroughly research the judging panel’s background (the conference website will publish the list of judges and their areas of focus). For example, if a former EMA official is on the panel, emphasize in your presentation that “the technology aligns with EMA regulatory trends.” Additionally, limit your presentation slides to 10 pages, with the first 3 pages clearly outlining “pain points, solutions, and core data.”

3.3.2 Thematic Workshops: Skill Training Camps Solving “Real-World Challenges”

Workshops reject “theoretical lectures” in favor of “hands-on training based on real-world cases.” Each workshop features a “case analysis + group exercise” segment:

- Business Development Skills Training: Focusing on “Value Assessment in Licensing Negotiations” — Using a real-world case of a pharmaceutical company acquiring a startup, participants deconstruct “how to calculate project valuation based on clinical stage, market size, and competitive landscape”; During group exercises, participants will role-play as “Pharma BD” and “Startup CEO” in simulated negotiations. Mentors (senior BD directors) will provide on-site feedback on “strengths and weaknesses of negotiation strategies.”

- Presentation Skills Enhancement: Addressing “Capturing Audience Attention in Corporate Presentations” — Analyzing “Why 70% of Presentations Lose Audience Focus After 10 Minutes” and providing “3 Key Techniques”: ① Spend the first 2 minutes sharing “a patient story” (not technical principles); ② Insert “one core data point” every 5 minutes (e.g., “Our drug extends patient survival by 6 months”); ③ Clearly state the “desired audience action” at the conclusion (e.g., “Seek joint R&D collaboration”); Participants prepare a 3-minute presentation on-site, with real-time mentor guidance for optimization.

3.3.3 Evening Networking: A Critical Setting for “Breaking Through Business Barriers” at the Executive Level

Evening networking is not merely a “social dinner,” but an “efficient setting for building high-level trust”—as formal meetings often leave executives with tight schedules unable to engage deeply, while relaxed social environments better foster personal connections. Three evening events require tailored networking strategies:

- Vienna State Opera Night: Ideal for “initial introductions”—the open setting allows launching conversations about opera before naturally transitioning to business. Research target contacts’ interests beforehand (e.g., check LinkedIn for arts-related followings). If they follow classical music, prepare simple topics about the Vienna Classical School.

- Schönbrunn Palace Dinner: Ideal for “in-depth discussions”—featuring roundtables seating 8-10 guests, with seating pre-assigned based on “business relevance” (e.g., pairing “pharmaceutical companies seeking CDMO partnerships” with “CDMO executives” at the same table). The seating chart will be announced before the dinner. Prepare three core questions in advance (e.g., “What are your company’s production capacity reserves for biologics manufacturing?”).

- Coffee Culture Experience: Ideal for “Follow-Up Discussions” — Held in a traditional Viennese coffeehouse, this relaxed setting allows inviting target partners to “savor Viennese coffee” while further discussing “unresolved collaboration details from prior meetings.” Bring a “concise one-page summary of your cooperation proposal” for on-the-spot annotation and revision.

3.4 Digital Cooperation Day: A Full-Scene Participation Solution Breaking “Time and Space Constraints”

Digital Cooperation Days are not a “simple replication of in-person meetings,” but rather an “efficient, flexible” participation model designed to address the “pain points of those unable to attend in person” (e.g., time constraints, high travel costs). Below, we analyze the core value and usage strategies of digital services from a “user scenario” perspective:

3.4.1 Digital Cooperation Day: A Flexible Channel for Precise Matchmaking with “Global Partners”

For users who “cannot attend in person but need to connect with global partners,” Digital Cooperation Day offers three core functions to address the pain point of “low connection efficiency”:

- Real-time Video Conferencing: More than just “online chat,” it delivers “business experiences equivalent to in-person meetings.” The platform supports “screen sharing (displaying PPTs, product data),” “meeting recording (requires mutual consent),” and “automatic post-meeting minutes generation (including action items).” To avoid “time zone conflicts,” the platform automatically recommends three suitable meeting times based on both parties’ time zones—participants simply confirm.

- Smart Matching Recommendations: Precise matching based on “multi-dimensional data,” not “simple keyword matching”—the system analyzes participants’ “past collaboration history (e.g., prior partnerships with European pharma companies),” “business needs (e.g., seeking mRNA production collaboration),” and ” technology domains (e.g., AI-driven drug discovery),” recommending the most compatible partners. For instance, if a Chinese CDMO company tags “specializes in mRNA production,” the system will prioritize recommending “European mRNA startups.”

- Industry Community Engagement: Establish “digitally-enabled communities categorized by field” (e.g., “Cancer Immunotherapy Community,” “Gene Editing Community”). Participants can post “collaboration requests” (e.g., “Seeking European clinical CRO partnership”) or engage in “hot topic discussions” (e.g., “Interpreting EMA’s latest gene therapy regulatory policies”). Industry experts (e.g., former EMA officials, seasoned investors) regularly address questions within communities to resolve “information asymmetry.”

Usage Strategy: Complete platform registration one week in advance and refine your “business requirements” and “collaboration cases”—for instance, when seeking licensing partnerships, clearly define “technology stage available for licensing (e.g., preclinical/Phase I clinical)” and “preferred collaboration model (e.g., exclusive/non-exclusive licensing).” Additionally, schedule daily 2-hour video conferences (e.g., 16:00-18:00 Beijing Time, corresponding to 10:00-12:00 Europe Time) to minimize time zone fragmentation.

3.4.2 On-Demand Content Library: A Knowledge Repository for “Fragmented Learning”

The on-demand content library is not a “simple compilation of meeting recordings,” but rather a “knowledge system categorized by ‘learning objectives,'” enabling attendees to quickly locate required content:

- Trend Insights: Includes all main forum presentation videos categorized by “field” (e.g., “AI Drug Discovery Trends,” “Gene Therapy Commercialization Trends”), supplemented with “Key Presentation Summary” (1-page PDF) — ideal for users seeking “quick industry trend overviews,” who can review summaries before selecting full presentations of interest.

- Technical Implementation: Includes videos from the Technology Platform sub-forum, categorized by “technical process” (e.g., “mRNA Production Workflow,” “Gene Editing Off-Target Detection”), with accompanying “technical materials referenced in presentations” (e.g., SOP templates for specific production workflows, experimental protocols for off-target detection) — ideal for “R&D personnel” who can directly download resources for practical application.

- Business Case Studies: Includes case shares from the industry ecosystem sub-forum, categorized by “business scenarios” (e.g., “Orphan Drug Commercialization,” “China-Europe Collaboration Cases”), with accompanying “case data appendices” (e.g., financial data or market share metrics for specific collaborations). Ideal for “business development and investment professionals” for analytical reference.

Usage Strategy: After registration, users can set up a “Personalized Learning Plan”—for example, a pharmaceutical company’s BD professional can focus on “licensing cases and China-Europe collaboration trends,” with the platform automatically pushing relevant content. Additionally, the content library supports “keyword search” (e.g., searching “mRNA production costs”) for quick information retrieval.

3.4.3 Virtual Exhibition Platform: A “24/7 Open” Global Showcase

Virtual exhibitions transcend mere “online booth displays,” functioning as “precision marketing tools based on user browsing habits” to maximize corporate exposure and consultation conversions:

- 3D Interactive Display: Supports “immersive browsing”—attendees can “enter” virtual booths and click different areas to view product details (e.g., clicking “mRNA production equipment” shows operational animations and technical specifications). Compared to traditional text-and-image displays, 3D exhibits boost inquiry conversion rates by 40% (based on 2024 BIO-Europe virtual exhibition data).

- Real-time Intelligent Customer Service: Integrates AI chatbots with human agents—AI handles “frequently asked questions” (e.g., “What is your company’s CDMO production capacity?”), while human agents intervene when AI cannot respond (e.g., “Production solutions for a specific drug”). The platform logs “user inquiry content” and generates “prospective client demand reports” for seamless follow-up.

- Data-Driven Operational Analysis: Provides “booth performance metrics”—including “traffic volume, dwell time, inquiry count, and user details of material downloads.” Companies can optimize display content based on data (e.g., if a booth has “short dwell time,” adjust the opening content of 3D displays to highlight core advantages more quickly).

Usage Strategy: The “first-screen content” of virtual booths must capture attention within 3 seconds—recommended placement for “core advantage metrics” (e.g., “A CDMO company: mRNA production cycle shortened by 20% compared to industry average”). Additionally, set “download thresholds” (e.g., requiring “company name, position, and needs” to access detailed technical proposals) to filter high-quality prospects.

3.5 BIO-Europe 2025 Conference Core Content Module Comparison Table

To help attendees quickly distinguish the positioning and value of different conference content modules and clearly match their needs, the table below provides a comparative analysis across dimensions such as module type, core objectives, duration, participation requirements, and target audience. The content does not duplicate details from the preceding agenda:

| Content Module Type | Core Objective | Session Duration / Total Duration | Participation Threshold | Target Audience Profile | Key Value Deliverables |

| Main Forum | Interpreting industry trends, gathering top-level perspectives | 45-60 minutes / 3 days | None (Registration required) | Corporate decision-makers, investment firm partners, industry researchers | Grasp the direction of global biotechnology development and gain policy and capital insights |

| Therapeutic Area Breakout Sessions | Focus on technological breakthroughs and clinical progress in specialized disease areas | 30-45 minutes / single field, 2 days | No (Advance registration required for popular sessions) | R&D leaders, clinicians, niche investors | Gain insights into cutting-edge technologies for specific disease areas and connect with clinical collaboration resources |

| Technology Platform Subforum | In-depth analysis of technical pathways and industrialization challenges | 30-45 minutes / single platform 1.5 days | None (Technical background recommended) | Technology R&D personnel, engineering leads, technology investors | Addressing Technology Implementation Challenges and Identifying Complementary Technology Partners |

| Innovation Showcase | Startups / Project exposure, competing for investment attention | 15 minutes / company | Requires application and screening | Early-stage startups (Seed to Series A), angel investors | Gain capital connection opportunities and boost brand/industry visibility |

| Rapid Pitching | Efficiently convey company value and quickly match collaboration opportunities | 3 minutes per company | Register for the event and sign up in advance | SME business development personnel, companies seeking short-term partnerships | Connect with 20+ potential partners within 1 day, efficiently screening collaboration leads |

| Themed workshops | Hands-on skill training and methodology sharing | 90 minutes per session | Additional fee of 199 EUR per session | Mid-level managers, BD/marketing specialists | Master practical skills like business negotiations and presentations, gain access to tool templates |

| Evening networking events | Informal in-depth exchanges to build long-term trust relationships | 2-3 hours per session | Some events require invitation (e.g., Schönbrunn Palace dinner) | Corporate executives, investment partners, key decision-makers | Break through business barriers and build high-level private networking connections |

| Digital Cooperation Day (Online) | Overcome geographical limitations and extend offline collaboration opportunities | 8 hours/day (2 days) | Purchase Digital Pass (€895) | Corporate representatives unable to attend in person, remote teams | Global partner coverage, reducing attendance time and travel costs |

| Virtual Exhibition Platform | Showcase products and services online, receive global inquiries | Available 24/7 (during the conference + 1 month post-event) | Purchase a virtual booth (€1,295) | Service Providers (CRO/CDMO), Equipment Manufacturers | Continuously generate leads and expand your global market |

As shown in the table, different content modules vary significantly in their objectives and target audiences: The main forum is ideal for grasping macro trends, while breakout sessions are suited for deep diving into niche areas. Innovation showcases and rapid roadshows emphasize efficient matchmaking, workshops focus on skill enhancement, networking events facilitate high-level connections, and digital modules offer flexible options for those unable to attend in person. Attendees can precisely select participation modules based on their role (decision-maker / R&D / BD / investor) and needs (trend insights / technology collaboration / financing / skill enhancement) to maximize conference value.

4. Global Biotechnology Industry Trends and Market Insights: Implications for BIO-Europe 2025 and 2025 bio international convention

4.1 Global Biotechnology Industry Outlook for 2025

By 2025, the global biotechnology industry stands at a pivotal inflection point, with multiple technological breakthroughs and market shifts reshaping the sector. According to the latest industry reports and market data, the following trends are particularly prominent:

Market scale continues to expand. The global biotechnology market is projected to reach $250 billion by 2025, with a compound annual growth rate (CAGR) of approximately 12% . Within market segments, healthcare dominates with over 60% share, driven primarily by oncology treatments, rare disease therapies, and genetic testing . This sector is projected to reach $233.047 billion by 2032, growing at a CAGR of 12.3% from 2025 to 2032.

Technological innovation has entered an explosive phase. 2025 witnessed a significant acceleration in the commercialization of multiple breakthrough technologies. Gene editing techniques have transitioned from laboratories to clinical settings, with technologies like CRISPR-Cas9 demonstrating immense potential in treating genetic disorders. Synthetic biology, as a rapidly growing segment, is revolutionizing industries such as pharmaceuticals, agriculture, and biofuels, enabling companies to design and engineer biological systems for diverse applications.

AI and biotechnology are deeply converging. This trend is considered one of the most noteworthy developments in 2025 . AI technologies are playing a role at every stage of drug discovery—from target prediction and molecular design to clinical trial simulation—significantly enhancing R&D efficiency. The emergence of OpenCRISPR-1, a gene editor entirely designed by AI, marks a new era of intelligent biotechnology R&D . Projections indicate that by the end of 2025, over 50% of major pharmaceutical companies will incorporate some form of AI technology into their R&D processes.

Sustainability emerges as a core imperative. Confronting global climate change and environmental challenges, the biotechnology sector is transitioning toward greater sustainability. Green biomanufacturing technologies—such as single-use bioprocessing and continuous production processes—not only reduce costs but also minimize environmental footprints. Bio-based materials are replacing traditional petroleum-derived products, while biofuel applications continue to expand.

The regulatory landscape is maturing. As innovative therapies emerge, regulatory bodies worldwide are accelerating the development of corresponding policy frameworks. Europe leads in this regard, with 38% of globally approved novel biologics originating there in 2024 ( ). The EMA maintains rigorous standards while supporting innovative drug development through various accelerated approval pathways.

4.2 Investment Environment and Transaction Data Analysis

The 2025 biotechnology investment and financing market exhibits characteristics of “overall growth with structural differentiation”:

Funding volumes reached historic highs. According to the latest tracking data from Fierce Biotech, at least 18 funding rounds exceeding $50 million occurred between January and February 2025, with record-breaking transactions in Series A, C, and D rounds. Global biotechnology investment totals are expected to set new records, particularly in cutting-edge fields like gene editing, cell therapy, and biopharmaceuticals, where investment activity remains exceptionally robust .

Investment hotspots are shifting. By sector, 2025 investment priorities exhibit the following characteristics:

| Investment Sectors | Investment Heat | Key Drivers | Representative Cases |

| Gene Therapy | ★★★★★ | Multiple products approved, clear commercialization pathway | CRISPR Therapeutics, Editas Medicine |

| AI-Driven Drug Discovery | ★★★★★ | Technology maturity has improved, with costs significantly reduced | Schrödinger, Insilico Medicine |

| Cell Therapy | ★★★★☆ | CAR-T success, expanding into solid tumors | Juno Therapeutics, Kite Pharma |

| Orphan Drugs | ★★★★☆ | Policy Support, Improved Market Access | Sarepta Therapeutics, Vertex |

| Synthetic Biology | ★★★☆☆ | Expanded Application Scenarios, Accelerated Commercialization | Amyris, Ginkgo Bioworks |

China’s market performance stands out. In the first half of 2025, BD outbound deals by Chinese innovative drug companies remained robust, with disclosed collaboration totals reaching $50.88 billion—continuing the record high of $52.26 billion set in 2024 . This “going global” trend extends beyond licensing deals to include joint development, equity investments, and other forms. Through a dual-track approach of “bringing in” and “going out,” Chinese enterprises are rapidly integrating into the global innovation network.

Transaction structures are evolving. While traditional technology licensing remains the primary form, its share has declined from 40% to around 30%. This shift is being replaced by more diversified collaboration models:

- Equity investments now account for 15%, with major pharmaceutical companies securing innovative projects through investments.

- Joint R&D now accounts for 25%, with risk-sharing models gaining favor

- Commercial partnerships (e.g., distribution, marketing) now account for 10%

Regional disparities are pronounced. Investment and financing environments vary significantly across global regions:

- United States: Remains the largest investment market, accounting for over 60% of global investment, with high venture capital activity

- Europe: Relatively conservative investment approach, yet possesses unique strengths in specific fields (e.g., gene therapy)

- China: Strong government support and rapid domestic market growth, though internationalization remains limited

- Other Asia-Pacific regions: Countries like Japan and South Korea excel in specific technological domains.

4.3 Hotspots and Breakthrough Areas in Technological Innovation

By 2025, multiple technological domains are undergoing revolutionary breakthroughs. These innovations not only propel scientific progress but also open new pathways for industrial development:

Diversified Applications of mRNA Technology. Having gained significant momentum from the success of COVID-19 vaccines, mRNA technology is expanding into more therapeutic areas. BioNTech, a leader in mRNA technology, has initiated clinical trials for personalized mRNA vaccines targeting various cancers including bladder and lung cancer . Data released in February 2025 showed BioNTech’s pancreatic cancer mRNA vaccine can sustain T-cell immunity, delaying recurrence by three years . Beyond oncology, mRNA technology demonstrates immense potential in protein replacement therapy and rare disease treatments.

Clinical Translation of Gene Editing Technologies. CRISPR gene editing is transitioning from laboratory research to clinical applications. In 2025, multiple CRISPR-based therapeutic products entered pivotal clinical trial phases. Particularly for hematological disorders, gene editing demonstrates curative potential. Concurrently, next-generation editing tools like base editors and guide editors continue to emerge, offering significant improvements in precision and safety.

AI is reshaping the entire drug development process. AI technology is playing a transformative role at every stage of drug discovery:

- Target Identification: AI can identify potential drug targets from vast amounts of biological data at speeds over 10 times faster than traditional methods.

- Molecular Design: Deep learning-based molecular generation models can design compounds with specific properties

- Clinical trial design: AI helps optimize trial protocols, increasing success rates and reducing costs

- Personalized medicine: By analyzing patient genomic data, AI predicts drug responses to enable precision treatment

Technological Breakthroughs in Cell Therapy. While CAR-T cell therapy has achieved remarkable success in hematologic malignancies, it faces challenges in treating solid tumors. Key breakthroughs anticipated by 2025 include:

- Novel CAR Design: New formats like bispecific CARs and multispecific CARs enhance recognition of solid tumors

- Overcoming the tumor microenvironment: Genetically engineered T cells enable function within immunosuppressive tumor environments

- Next-generation cell types: Novel therapies like CAR-NK and CAR-M demonstrate improved safety and feasibility

Industrial applications of synthetic biology. Synthetic biology is achieving commercial breakthroughs across multiple domains:

- Biomaterials: Engineering microorganisms to produce biodegradable plastics, fibers, and other materials

- Biofuels: Sustainable aviation and automotive fuels produced using synthetic biology technologies

- Food industry: Production of novel foods like plant-based meat and dairy alternatives

- Chemicals: Bio-based chemicals are replacing traditional petroleum-based products

4.4 Characteristics and Opportunities of the European Biotechnology Market

The European biotechnology market holds a unique and significant position within the global landscape, with its development model and market characteristics warranting in-depth analysis:

Strong Research Foundation. Europe boasts world-class research institutions and universities, maintaining a traditional advantage in fundamental research. Particularly in specific fields such as gene therapy, rare disease drugs, and neuroscience, European research capabilities lead globally. This scientific strength is translating into industrial competitiveness, with Europe accounting for 38% of globally approved new biopharmaceuticals in 2024 .

Unique regulatory advantages. The European Medicines Agency (EMA) is globally renowned for its rigorous and transparent regulatory framework. While demanding, these standards provide clear pathways for innovative drug approvals. Particularly in cutting-edge fields like gene therapy and cell therapy, the EMA supports breakthrough therapy development through various innovative drug programs (e.g., PRIME, PRIME+). This “high-barrier, strict-standard” regulatory environment has become a unique advantage for the European market, as products approved in Europe often gain easier recognition in other markets.

Robust Innovation Ecosystem. Europe boasts a well-established biotechnology innovation ecosystem, including:

- Venture Capital Funds: Life science-focused VCs like Forbion, Index Ventures, and Octopus Ventures

- Technology transfer offices: Dedicated offices established within major universities and research institutions

- Industrial clusters: such as the Cambridge cluster in the UK, the BioM campus in Germany, and BioAlps in Switzerland

- Government support: Funding provided by the EU and national governments through programs like Horizon Europe

Sustainable Industry Characteristics. Europe leads globally in sustainable biomanufacturing. Stringent environmental regulations drive the industry’s transition to green production, with many European companies pioneering bio-based materials and circular economy solutions. For instance, German chemical giant BASF earned the EU Ecolabel certification in 2024, achieving a 20% premium for its bio-based products .

Challenges and Opportunities. The European biotechnology market also faces several challenges:

- Market Fragmentation: Europe’s multi-nation composition, with differences in language, culture, and regulations, increases market entry complexity.

- Relatively conservative financing environment: Compared to the United States, Europe has smaller venture capital pools and insufficient support for early-stage projects

- Intense talent competition: The need to compete for top talent with regions like the United States and Asia

However, these challenges also present opportunities. The EU is strengthening support for startups and growth companies through its “Choose Europe to Start and Scale” strategy, particularly in innovation-driven fields like biotechnology and quantum computing . Simultaneously, Europe’s strengths in specific niches—such as women’s health and sustainable energy—are emerging as new growth drivers .

5. Conference Preparation & Practical Guide: A Full-Process Strategy from “Goal Implementation” to “Value Conversion” for Both BIO-Europe 2025 and 2025 bio international convention

The core of conference preparation lies in “aligning resources around core objectives”—not merely “schedule planning.” Below is a specialized guide for the biotechnology industry, covering three phases—”Pre-Conference Precision Preparation, In-Conference Efficient Execution, and Post-Conference Value Conversion”—addressing core needs like BD matchmaking, technical exchanges, and policy consultations:

5.1 Pre-Event Preparation: Target Identification and “Negotiation/Communication Ammunition” Readiness

The 1-2 months preceding the event constitute the “value foundation period,” requiring completion of three core actions: “target list refinement, resource package preparation, and scheduled meetings” to avoid blind participation on-site:

5.1.1 Define Core Objectives and Break Down the “Priority List”

First, define core objectives based on your role (pharma company / startup / investor / service provider), then break them down into actionable “priority tasks” to prevent resource dispersion:

- Pharma BD (seeking licensing/joint R&D):

- Primary Goal: Identify 3-5 “startups with core technologies” (e.g., mRNA delivery, gene editing tools), noting their technology stage (preclinical/Phase I clinical) and core team background (e.g., EMA approval experience).

- Secondary Objective: Identify 2-3 “regional CDMO companies,” focusing on production capacity (e.g., mRNA GMP facilities) and EU GMP certification status;

- Alternative Objective: Schedule 1-2 “EMA Policy Briefings” to address specific issues like “clinical data requirements for European registration of a candidate drug.”

- Startups (Funding/Technology Collaboration):

- Primary Objective: Screen 5-8 “niche-focused investment institutions” (e.g., Forbion’s rare disease fund, Syncona’s gene therapy fund), requiring analysis of their recent investment cases (e.g., prior investments in similar-stage projects);

- Secondary Objective: Engage with 2-3 “potential industrial partners” (e.g., R&D departments of large pharmaceutical companies) to clarify permissible technical collaboration scope (e.g., whether preclinical data can be licensed).

- Alternative Objective: Apply for “Innovation Showcase” or “Fast-Track Roadshow” events, preparing a 3-minute elevator pitch in advance (including core data: e.g., tumor inhibition rates in animal studies, cost advantages of production processes).

- Technology Service Providers (e.g., CRO/CDMO):

- Primary Objective: Identify 3-4 pharmaceutical companies with “clear production capacity needs” (e.g., a company planning European clinical trials in 2026 requiring CDMO support);

- Secondary Objective: Participate in the “Manufacturing & Supply Chain Forum,” prepare a “technical case portfolio” (e.g., specific solutions for resolving “batch variability in biologics” for a pharmaceutical company);

- Alternative Objective: Reserve a “virtual booth” and pre-upload 3D workshop demonstration videos (highlighting core advantages like EU GMP certification and production capacity flexibility).

5.1.2 Prepare “Industry-Specific Resource Packages” to Avoid “Generic PowerPoints”

The core of biotech industry communication is “data and compliance.” Prepare targeted material packages rather than generic corporate introductions:

- Core Materials Checklist (General Version):

- One-page core value summary: Includes “core business (e.g., ‘AI-driven tumor target discovery’), differentiated advantages (e.g., ‘30% higher target validation success rate than industry average’), and collaboration needs (e.g., ‘seeking European clinical partnerships’)”. Data must cite sources (e.g., ‘2024 Nature subsidiary journal data’).

- Technical/Product Data Manual: – Pharma companies must include a “Preclinical Data Summary for Drug Candidates” (e.g., IC50 values, efficacy in animal models). – Startups must include a “List of Technical Patents” (highlight EU patent numbers). – CDMOs must include “Scanned GMP Facility Certification Documents” (e.g., EU GMP certificate numbers).

- Draft Cooperation Plan: Prepare an “Initial Cooperation Framework” in advance (e.g., upfront payment + milestone payment ratios for licensing, investment allocation for joint R&D) to avoid empty discussions on-site.

- Supplementary Materials for Special Requirements:

- For “China-EU Collaboration”: Prepare a “Statement on Alignment of Chinese Clinical Data with EMA Standards,” clarifying whether “Chinese Phase III clinical data meets EMA requirements for ‘multi-regional clinical trials.'”

- For “Emerging Market Expansion”: Attach a “Preliminary Market Access Analysis” (e.g., India’s registration timeline, Brazil’s local manufacturing requirements).

5.1.3 Secure “Precision Appointments” 3-4 Weeks in Advance to Lock in Key Contacts

Core BIO-Europe resources (e.g., pharmaceutical executives, EMA experts) require advance scheduling to avoid on-site queuing:

- Platform scheduling tips:

- When sending appointment requests via the partneringONE platform, specify your “specific collaboration intent” in the “Remarks” section (e.g., “Seeking to discuss patent licensing for a specific gene editing tool in Europe”), rather than using a generic phrase like “seeking collaboration.”

- If no response is received within 3 days, follow up via LinkedIn Direct Message with a one-page value summary highlighting “the alignment between your company’s project and our technology” (e.g., “Your hemophilia drug could enhance efficacy by integrating our AAV delivery technology”);

- Key Contact Prioritization:

- Prioritize scheduling meetings with “decision-makers” (e.g., pharmaceutical company BD directors, investment partners), followed by “executives” (e.g., R&D managers, project managers);

- When scheduling with EMA experts, clearly define the “consultation topic” (e.g., “Long-term safety monitoring requirements for gene therapy products”) and prepare 3-5 specific questions in advance to avoid general policy discussions.

5.2 Meeting Execution: Efficient Engagement with “Information Documentation and Immediate Follow-up”

During meetings (3 days on-site + 2 days digital collaboration days), “focus on priority objectives” while ensuring “information synchronization and immediate follow-up” to avoid missing critical opportunities:

5.2.1 Daily “Morning Planning + Evening Review” to prevent time wastage

Adopt a rhythm of “15-minute morning planning + 30-minute evening review” to ensure daily objectives are achieved:

- Morning Planning (8:00-8:15):

- Confirm “core scheduled meetings” for the day (e.g., 9:00 AM technical exchange with a startup, 2:00 PM financing discussion with a VC), reserving 15 minutes for “pre-meeting preparation” (quickly review counterpart materials);

- Mark “must-attend breakout sessions” (e.g., “EMA Gene Therapy Regulatory Session at 11:00”), arrive 10 minutes early, and choose “front-row seats” (for easier post-session Q&A);

- Evening Debrief (7:30–8:00 PM):

- Organize “Key Takeaways”: Use a table to record “Connected Companies/Individuals, Core Consensus, Action Items, Follow-up Timeline” (example below);

| Contacts | Core Consensus | To-Do Items | Follow-up Date |

| A mRNA technology startup | Agreed to provide “mouse experimental data for novel delivery vectors” | Draft Letter of Intent to be sent by October 28 | Within one week after the meeting |

| EMA gene therapy regulatory expert | A candidate drug requires supplementary “European population pharmacokinetic data” | Coordinate with R&D team to compile data summary | 2 weeks after the meeting |

| Austrian CDMO company | Vienna facility has mRNA production capacity available in Q1 2026 | Request scanned copies of EU GMP certification documents for the facility | Within 3 days after the meeting |

| A rare disease-focused investment fund | Approved the project’s preclinical data, requiring supplementary commercialization plans | Submit a 3-year revenue forecast report by November 5 | Within 10 days after the meeting |

- Synchronize with teams: Share “key information” with internal company groups (e.g., R&D, legal, finance teams) to prevent “information gaps post-meeting”—for example, the legal team can pre-assess risks in patent licensing terms within the Letter of Intent, while the finance team can simultaneously calculate collaboration investment costs.

5.2.2 On-site Communication: Focus on “Data and Pain Points,” Avoid “Generalities”

In biotech industry discussions, “let data speak” while precisely addressing the other party’s pain points to increase collaboration probability:

- When engaging with startups/technology providers:

- Core questions: “What are the specific data for your technology in ‘a certain aspect’ (e.g., mRNA stability, gene editing off-target rate)? Where does it stand compared to industry benchmarks (e.g., Moderna, CRISPR Therapeutics)?”

- Pain point approach: “While advancing a drug candidate, we encountered ‘a specific issue’ (e.g., ‘high immunogenicity of AAV vectors’). Can your technology address this? What experimental evidence supports this?”

- Engaging with Investment Institutions:

- Key Message: “Our project’s preclinical data in [specific field] (e.g., rare diseases) – such as ‘90% disease remission rate in mouse models’ – aligns with your fund’s investment focus (referencing your recent investment in XX project).”

- Proactive questioning: “What metrics do you prioritize in early-stage European biotech investments (e.g., target validation data, team industry experience)?”

- When communicating with EMA experts:

- Specific question: “Our candidate drug (indication: rare disease) plans to submit a marketing authorization application in Europe by 2026. Does the current clinical data (Chinese Phase III) require supplementary ‘bridging studies in European populations’? What are the sample size requirements?”

- Follow-up: Inquire about “any relevant policy documents (e.g., EMA guidance) available” and record the expert’s name and contact information (for future email consultation).

5.2.3 Digital Collaboration Day: Ensure “Time Zone Alignment and Equipment Readiness”

For those unable to attend in person, ensure effective digital engagement through “time zone planning and equipment testing”:

- Time Zone Alignment Strategy:

- European time 9:00-17:00 corresponds to Beijing time 16:00-24:00. Schedule “core meetings” between 16:00-20:00 Beijing time (to avoid late-night fatigue);

- Mark “Digital Meeting” in calendars in advance and set a “10-minute advance reminder” to allow time for camera and microphone setup (professional headphones recommended to minimize background noise);

- Digital Communication Tips:

- During video conferences, pre-share “core data PPTs” on the screen (e.g., “cost comparison chart for a specific technology”) to prevent “unclear verbal descriptions”;

- Immediately after the meeting, send “meeting minutes” to the other party’s email with an attached “action item list” (e.g., “Please provide your company’s GMP certification documents”), and CC relevant internal teams (e.g., procurement, legal).

5.3 Post-Meeting Conversion: Complete “Key Actions” within 1 month to prevent “meeting-as-end” scenarios

The month following the meeting is the “critical value conversion period.” Transform “meeting intent” into “actual collaboration” through “tiered follow-up, resource implementation, and experience consolidation”:

5.3.1 Implement “Priority-Based Tiered Follow-Up” to Avoid “Equal Effort Across the Board”

Classify counterparts based on the “strength of cooperation intent” demonstrated during the meeting into “High Priority (clear cooperation intent), Medium Priority (potential needs), and Low Priority (initial contact)”, applying distinct follow-up strategies:

- High Priority (Follow up within 1 week):

- Send a “customized follow-up email” containing: – “Review of meeting consensus” (e.g., “We confirmed joint preclinical research for a drug in Europe”) – “Action item progress” (e.g., “Attached is the draft cooperation framework. Please provide feedback within 5 business days”)

- Simultaneously initiate internal processes: e.g., legal team assesses cooperation agreement risks, R&D team prepares technical integration plan;

- Medium Priority (Follow-up within 2 weeks):

- Send a “Value-Added Email”: Attach “Latest Industry Data” (e.g., “The 2025 European mRNA Industry Report indicates a 40% growth in demand for the delivery technology you’re interested in”), and reiterate the “synergy points for collaboration”;

- Invite the counterpart to attend a “company online technical seminar” (e.g., “On November 15, we will share insights on ‘European patent strategy for a specific technology'”) to maintain engagement;

- Low Priority (Follow up within 1 month):

- Send “Industry Update Email”: Attach “Company Latest Progress” (e.g., “Our technology has been granted EU patent authorization”), maintaining brand visibility;

- Mark the “Next contact point” (e.g., “We’ll reconnect before the January 2026 BIO International Conference”).

5.3.2 Resource Implementation: Driving “Intentions into Concrete Actions”

For “high-priority collaborations,” drive “concrete action implementation” within 1-2 months post-meeting to prevent “intentions from falling through”:

- Technology Collaboration:

- Arrange “Technical Alignment Meetings”: Organize online sessions between R&D teams (e.g., pharmaceutical company’s CMC department and CDMO’s technical team) to clarify “technical parameter requirements” (e.g., mRNA purity standards, storage conditions);

- Sign “Non-Disclosure Agreements (NDAs)”: If core technical data (e.g., off-target detection methods for gene editing) is involved, NDAs must be executed before data sharing to mitigate intellectual property risks;

- Financing-Related:

- Provide “supplementary documentation packages”: Submit “detailed financial projections” (e.g., R&D investment and revenue forecasts for the next three years) and “core team background supplements” (e.g., a member’s EMA approval experience) as requested by investment institutions;

- Arrange “Internal Roadshows”: Invite investment institutions to attend “in-house technical roadshows” where core R&D personnel explain “technical principles and competitive barriers”;

- Policy Consultation:

- Compile “EMA Expert Recommendations”: Summarize consultation content from meetings into a “European Registration Advisory Report” and distribute to R&D and regulatory teams;

- Connect with “local consulting agencies”: For complex registration issues (e.g., “orphan drug designation applications”), engage “European local CROs” met during the conference to facilitate progress.

5.3.3 Experience Consolidation: Build a “Corporate Conference Knowledge Base”

After each conference, consolidate “reusable insights” to inform future events (e.g., BIO International Conference, JPM Healthcare Conference):

- Documentation Consolidation:

- Organize the “conference materials package” (including PPTs, data manuals, and draft collaboration agreements) by “topic category” (e.g., “European licensing collaboration materials,” “EMA policy materials”) and store them in the corporate knowledge base;

- Organize the “Target Enterprise List,” annotate with “Cooperation Intentions, Key Contacts, and Follow-up Status,” and establish the “European Biotechnology Resource Database”;

- Process refinement:

- Summarize “high-success-rate appointment scripts” (e.g., “Mentioning alignment with a specific project increases response rates by 50%”) and update them in the Conference SOP;

Document “value assessments of breakout sessions” (e.g., “The ‘China-Europe Cooperation Session’ offers greater practical applicability than the ‘Global Trends Session'”) to inform future “agenda selection” for subsequent conferences.

6. Competitor Analysis and Differentiated Value: Unique Advantages of BIO-Europe 2025 vs 2025 bio international convention

6.1 Comparative Analysis of Major Biotechnology Conferences

Within the global biotechnology conference landscape, BIO-Europe faces challenges from multiple competitors. Comparative analysis with key events clarifies BIO-Europe’s unique value:

Comparison with JPM Healthcare Conference. JPM (J.P. Morgan Healthcare Conference) is the world’s most influential healthcare investment conference, held annually in January in San Francisco. Key differences between the two include:

| Comparison Dimension | JPMorgan Healthcare Conference | BIO-Europe |

| Conference Positioning | Investment-focused, emphasizing financing and M&A | Collaboration-oriented, focused on technology transfer and licensing |

| Attendance Scale | Approximately 40,000 attendees | Approximately 6,000 |

| Attendee Composition | 70% investors and analysts | 60% corporate executives and business developers |

| Conference Format | Keynote presentations + panel discussions | One-on-one meetings + small forums |

| Geographic Coverage | Primarily North America (70%) | Primarily Europe (61%) |

| Cost | No registration fee, but participants bear high hotel and event costs | Registration fee starting at €1,195 |

| Features | MNC-led, primarily private transactions | Open matching to facilitate initial contacts |

JPM functions more as a “seller’s market,” where large pharmaceutical companies and established biotech firms showcase themselves to attract investor attention. BIO-Europe, however, operates more like a “transaction marketplace,” providing buyers and sellers with opportunities for initial meetings . As one attendee noted: “JPM and ASCO are the main stages for MNCs, while BIO’s meticulously designed meeting system offers buyers and sellers their first chance to connect” .

Comparison with BIO International Conference. BIO International Conference is North America’s largest biotechnology conference, held annually in June. The 2025 edition will take place in Boston. Key differences between the two events include:

| Comparison Dimensions | BIO International Conference | BIO-Europe |

| Frequency | Once a year | Once a year (fall) |

| Attendance | Approximately 25,000 | Approximately 6,000 people |