BIO International Convention 2025 Date Location & Global Pharma & Biotech Summit 2025: Embracing London’s Industry Transformation Summit Overview & Core Values

General Information

Global Pharma and Biotech Summit 2025 will be held on November 11-12, 2025 at Convene 22 Bishopsgate Conference Center in London, UK with the theme of “Embracing an industry reset. As the flagship event of the year organized by the Financial Times, the Summit is a combination of offline and online events and is expected to attract more than 300 attendees from more than 20 countries, more than 45 speakers representing more than 320 companies, and an estimated social media reach of 4 million people; additionally, BIO International Convention 2025 date location is May 12-15, 2025 at the Pennsylvania Convention Center in Philadelphia, USA.

The conference venue, Convene 22 Bishopsgate, is located in the heart of the City of London and occupies nearly 38,000 square feet of space spread over two floors, with 10 meeting rooms, the largest of which can accommodate up to 405 people, making it ideal for small to medium sized meetings and corporate conferences . The venue is conveniently located near Bank, Liverpool Street and Moorgate tube stations and is easily accessible via the Central, DLR, Northern and Waterloo City lines.

History and Authority

The Global Pharma and Biotech Summit dates back to 2016 as the FT Global Pharmaceutical and Biotechnology Conference and has been held annually in London since then . The conference has used a number of themes, including ‘Embracing Disruption for a New Era in Health’ in 2018, ‘Driving investment and innovation in life sciences’ in 2022, and 2023. in 2022, “Driving investment and innovation in life sciences” in 2022, and a focus on how global disruptive change is impacting life sciences investment in 2023.

The 2024 Summit was a notable success, attracting more than 270 offline attendees, 55+ speakers representing 331 companies, and a social media reach of 5 million people . Notably, 75% of the offline attendees at 2024 were at the CEO, Managing Director, VP or Director level, ensuring a high level of attendee and decision-making influence .

I. In-depth Analysis of the Summit’s Core Agenda (Including Reference to BIO International Convention 2025 Date Location)

1.1 Theme Setting and Context

The theme of the 2025 Summit, “Embracing an industry reset”, accurately captures the fundamental changes facing the pharmaceutical and biotechnology industry today. As the official conference description states, biopharmaceutical companies are striving to innovate and grow amidst relentless disruption, with breakthroughs in precision medicine and obesity treatments reshaping healthcare, and AI projected to drive 30% of new drug discoveries this year. However, sustainable growth is threatened by factors such as regulatory fragmentation, overburdened healthcare systems and geopolitical risks.

The conference will focus on the latest developments in four core areas: drug discovery, clinical trials, market access and patient engagement . These topics directly respond to the industry’s key challenges and opportunities in the context of technological innovations, changing regulatory environments and increased market competition.

1.2 Speaker Lineup and Topic Distribution: Reinventing the Way of Industry Leaders

With “Embracing Industry Reinvention” as the core, this year’s summit has built a top-notch speaker matrix covering the three dimensions of industry decision-making, regulatory governance, and technological breakthroughs. 45 speakers will not only represent the strategic direction of more than 320 enterprises, but also focus on the industry’s pain points to carry out targeted sharing, and the topics are designed to echo the core challenges such as AI-enabling, market change, and regulatory adaptation, The topics are designed to deeply echo the core challenges of AI empowerment, market transformation, and regulatory adaptation.

1.2.1 Pharma Giant CEO Group: Practical Review of Strategic Transformation

As the core promoter of industrial change, the speeches of the helmsmen of global top pharmaceutical companies will focus on “growth reconstruction” and “risk breakthrough”, combining with enterprise practice to dismantle the transformation path:

- Daniel O’Day (Chairman and CEO of Gilead Sciences): With the theme of “Life and Death Line of Gene Therapy Commercialization”, he will analyze Gilead’s integration experience after the $11 billion merger and acquisition in the field of cellular therapy, discuss how to balance the investment in cutting-edge technology with the pressure on short-term profitability, and respond to the industry’s concern about the “high cost of innovation” and the “risky breakthrough”. Teresa Graham (Roche) will discuss how to balance the investment in cutting-edge technologies with the pressure on short-term profitability, and respond to the industry’s general anxiety about the high cost of innovation.

- Teresa Graham (CEO, Roche Pharmaceuticals): Focusing on the “Ecological Layout of Precision Medicine”, she will share Roche’s strategy of building a whole industry chain in the field of tumor companion diagnostics, and explain how to improve market access efficiency and improve the quality of its products through the synergistic approach of “drug-diagnostics” and “diagnostics”. He will share Roche’s strategy of building the whole industry chain in the field of tumor companion diagnostics, explaining how to improve the efficiency of market access through “drug-diagnostics” synergy, and his viewpoints will provide the industry with a practical framework for the landing of precision medicine.

- Robert A. Bradway (Chairman and CEO of Amgen): Focusing on the “two-front war between biosimilars and innovative drugs”, combining Amgen’s experience in the adalimumab biosimilar market, analyzing how traditional pharmaceutical companies can maintain their innovation momentum under the impact of generics, and presenting the optimal ratio model of R&D investment in terms of data. The optimal R&D investment model will be presented in data.

- Emma Walmsley (CEO, GSK): Taking “Globalization Resilience of Vaccine Business” as the starting point, she will review GSK’s supply chain management experience in several rounds of public health events and put forward the risk response plan of “Regionalized Production + Digital Traceability”, which is a direct response to the geopolitical risk. The proposed “regionalized production + digital traceability” is a direct response to the impact of geopolitics on the pharmaceutical supply chain.

- Patrik Jonsson (Executive Vice President and President, Eli Lilly International): In-depth explanation of “Explosive Growth and Competitive Boundaries in the Obesity Treatment Market”, based on Lilly Zepbound’s launch data, analyzing the logic of commercialization of GLP-1 drugs, and predicting the evolution of the market pattern in the era of orally consumed preparations. The evolution of the market in the era of oral dosage forms.

- Ken Keller (Chairman, President and CEO of Daiichi Sankyo): He will share “Localized Innovation Path of Multinational Pharmaceutical Enterprises” and discuss how to open up emerging markets through the adaptive model of “Global Technology + Regional Demand” based on the example of Daiichi Sankyo’s oncology drug co-development in China. It will discuss how to open up emerging markets through the “global technology + regional demand” adaptation model and provide the industry with a reference model for cross-border collaboration.

1.2.2 Regulatory and Policy Helmsman: The Art of Balancing Innovation and Compliance

Regulatory policy is a key variable in industry reshaping. Three representatives from authoritative organizations will clarify the compliance boundary and innovation space during the period of change from the perspective of policy makers:

- Lawrence Tallon (CEO, MHRA, Medicines and Healthcare products Regulatory Agency, UK): With “Innovation in Regulatory Framework for AI Drugs” as the core, he will release MH’s latest guidelines for AI-driven drug R&D, explaining in detail “Dynamic Review”, “Data Review” and “Data Compliance”. He will also explain in detail the application scenarios of innovative regulatory tools such as “dynamic review” and “data traceability”, and respond to the industry’s regulatory concerns about the implementation of AI technology.

- Jenny Harries (CEO, UK Health and Safety Executive): Focusing on the “synergy between public health needs and pharmaceutical companies’ responsibilities”, and combining with the UK’s obesity prevention and control strategy, she will put forward the policy support system of “medication + health management” to provide market access policies in emerging areas such as obesity treatment. The policy support system of “drug therapy + health management” is proposed in the light of the UK’s obesity prevention and control strategy, which will provide a wind vane for market access in emerging fields such as obesity treatment.

- Patrick Vallance (Minister of State, Department of Science, Innovation and Technology of the United Kingdom): Interpretation of the “dual drive of funding and policy for life science innovation” at the national strategic level, disclosure of the United Kingdom’s special support programs for AI drug discovery, gene therapy and other fields, and analysis of the path of building an innovation ecosystem through the synergy of government and enterprises.

1.2.3 Pioneer of Technological Innovation: Industrial Landing of Disruptive Technologies

New technologies represented by AI are reconstructing the underlying logic of the industry, and the speeches of technology leaders will bridge the cognitive gap between “laboratory breakthroughs” and “industrial applications”:

- Demis Hassabis (CEO of Google DeepMind and Isomorphic Labs): He will share the topic of “The next step of AI-driven drug discovery”, breakthroughs in protein structure prediction based on AlphaFold 3, detailed explanation of AI’s practical cases in target identification and molecular design, and disclosure of Isomorphic Labs’ AI-enabled applications. Based on AlphaFold 3 protein structure prediction breakthrough, he will explain in detail the practical cases of AI in target identification and molecular design, disclose the new mode of cooperation between Isomorphic Labs and pharmaceutical companies, and directly hit the industry pain point of “high cost of technology landing and low conversion rate”.

1.2.4 Regional Market Managers: Synergy between Localization and Globalization

Regional executives from multinational pharmaceutical companies will focus on “regional adaptation of global strategy” and provide replicable landing experience for the industry through regional practice:

- Louise Houson (Regional President, MSD European Core Regions and Canada): Analyzing “Entry Barriers and Breakthrough Strategies in the European Market”, combining Merck Sharp & Dohme’s experience of pricing negotiation for PD-1 inhibitors in Europe, and proposing a combined solution of “Value Chain of Evidence Construction + Response to Medicare Negotiation The combination of “Value Chain of Evidence Construction + Response to Medicare Negotiations” is proposed to meet the needs of Europe’s diversified healthcare system.

- John McGinley (Managing Director and Country President, Pfizer UK): focusing on “The value of UK as a testing ground for innovation in Europe”, he will share Pfizer’s AI clinical trial pilot program in the UK, and explain how to take advantage of the UK’s regulatory flexibility to accelerate the launch of innovative drugs and provide decision-making references for pharmaceutical companies’ regional layout. Provide decision-making reference for pharmaceutical enterprises’ regional layout.

II. Multi-dimensional Assessment of Attendee Value: Comparing Insights from Global Pharma & Biotech Summit 2025 and BIO International Convention 2025 Date Location

2.1 Participant Composition and Decision-making Influence

The 2025 Summit continues the tradition of high-end attendees. According to the data of 2024, 75% of the offline attendees are at the level of CEO, Managing Director, Vice President or Director, which ensures that the attendees are real decision makers. . The composition of attendees covers:

- CEOs and board members of top life sciences companies

- VPs, heads and senior directors of pharmaceutical and biotech companies across functions

- C-level executives from contract research organizations and other industry suppliers

- Senior journalists from the Financial Times and other global media outlets

This diverse and high-level attendee mix provides an excellent opportunity to make valuable business connections. Especially considering that 331 companies are represented at the 2024 Summit , attendees will have access to the best and brightest in the industry from a variety of sectors and regions.

2.2 Networking Opportunities and Business Development Potential

The Summit is designed to provide a wealth of networking opportunities, including:

Formal social events:

- Informal receptions

- Networking lunches

- Coffee breaks

Technology Enablement Platforms: Attendees can maximize their time at the conference to make connections and advance collaborations by using a pre-conference web application to initiate new business deals.

High-Level Interaction Opportunities: attendees can connect with senior biopharma, life sciences and business leaders who are changing the R&D landscape. This face-to-face interaction is invaluable for building trust, exploring collaboration opportunities and gaining industry insights.

2.3 Learning and Insight Gaining Value

The learning value of the Summit is realized on multiple levels. The feedback from attendees is a testament to this:

Seth Ettenberg, President and CEO of BlueRock Therapeutics, said, “I learned a lot. We heard from practicing physicians, government payers… Putting those perspectives together was very educational for me and very helpful to our practice.”

Pfizer’s Vice President shared, “I really like the CEO insights. When you know what they are thinking, we can design our strategy accordingly.”

This feedback reflects the fact that the Summit is not only a networking platform, but also an important opportunity to gain cutting-edge insights into the mindset of industry leaders. Attendees can:

- Learn about new technologies and innovations with the potential to transform healthcare

- Network with industry leaders responsible for major decisions on investment, innovation and market access

- Discover new ideas to support business transformation and maximize return on investment

2.4 Return on Investment Analysis

From a return on investment perspective, the Summit provided multiple values. The first is the creation of direct business opportunities. Through face-to-face interaction with key decision makers, attendees have the opportunity to:

- Identify new partners and suppliers

- Explore technology transfer and licensing opportunities

- Establish cross-border business partnerships

- Discover potential investment targets or investors

Next is the value of brand exposure. As a top industry conference, the summit attracts global media attention, providing a platform for participating companies to showcase their brand image and innovations in front of industry elites.

Third is intellectual capital accumulation. By hearing insights from industry leaders and learning about the latest technology trends and regulatory developments, attendees gain knowledge value that far exceeds the cost of conference registration.

III. In-depth Study of Trends in the Pharmaceutical Biotechnology Industry in 2025: Combined Perspective with BIO International Convention 2025 Date Location

3.1 AI-Driven Drug Discovery Revolution

Artificial Intelligence is reshaping all aspects of drug discovery and development, becoming the most transformative trend in the pharmaceutical biotechnology industry in 2025.

Technology breakthroughs and application scale:

- 30% of new drugs are expected to be discovered using AI by 2025

- AI can reduce the cost of drug development by 40% and increase the clinical success rate from 10% to 30%.

- Complex target development cycle is reduced by 40% and cost by 30%.

- AI-driven drug screening has reduced early development time by 75% and increased success rates from 0.1% to 30

Success Story Analysis:

- Exscientia’s “Centaur Chemist” platform reduced the drug design cycle from 5 years to 12-18 months, and its AI-designed anticancer drug entered clinical trials in just 1 year

- Insilico Medicine’s small molecule TNIK inhibitor Rentosertib completes Phase IIa trial, becoming the first AI-designed drug to enter late-stage clinical trials

- MULTICOM4 system significantly improves AlphaFold’s accuracy in protein complex structure prediction, enabling prediction of protein complex structures of unknown stoichiometry

Commercialization Progress: Despite the potential of AI in drug discovery, only a limited number of AI-designed drugs have entered clinical trials, and no drug has yet entered Phase III. There is no significant difference in failure rates between AI-discovered drugs and traditional drugs in Phase II trials, which suggests that AI technology needs to be continually validated and improved in real-world applications.

3.2 Explosive Growth of Obesity Treatment Market

Obesity treatment has become one of the hottest areas in the pharmaceutical market by 2025, with explosive growth in market size.

Market Size & Growth Forecast:

According to various research organizations, the growth prospects of the obesity treatment market are extremely optimistic:

| Source | Market Size 2025 | 2030/2035 Forecast | CAGR |

| Market Research Organizations 1 | 19.6 Billion USD | 104.9 billion (2035) | 18.3% (2035) |

| Market Research Organization 2 | 12 billion | 22 billion (2030) | 12.8% China Market Forecast |

| China Market Forecast | 920 million RMB | 2.8 billion RMB (2030) | – – – – – – – – – – – – – – – – – – – – – – – |

Driver Analysis:

- WHO endorsement to drive market legitimization: The World Health Organization is expected to formally endorse weight loss drugs, such as Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy, by 2025, which will provide significant policy support for market development

- Technological breakthroughs in GLP-1 drugs: GLP-1 receptor agonists, such as simethicone, not only excel in weight loss, but also show multiple benefits in diabetes treatment and cardiovascular protection.

- Increased patient acceptance: with the deepening of the understanding of the dangers of obesity and confirmation of the effectiveness of drugs, the acceptance of weight-loss drugs by patients has increased significantly.

Competitive landscape and innovation direction:

The two giants, Eli Lilly and Novo Nordisk, dominate the market, but competition is growing. Lilly already leads the obesity market and is in head-to-head trials with Novo Nordisk for GLP-1 injections. Lilly is also studying the oral GLP-1 drug orforglipron, with data expected to be released in the third quarter of 2025 . This technological evolution from injectable to oral formulations will further expand the market.

3.3 Accelerated Mainstreaming of Precision Medicine

Precision medicine is rapidly moving from the proof-of-concept stage to mainstream clinical applications in 2025, especially in the latter half of the decade, fueled by leaps in AI, genome sequencing, and data analytics .

Market Size & Growth:

- The precision medicine market is valued at $102.93 billion in 2025 and is expected to reach $220.68 billion by 2032, growing at a CAGR of 11.5%

- Big Data Genomics Integration Platform Market is expected to witness strong growth during 2025-2030, driven by the convergence of genomics, cloud computing, and advanced analytics

Technology Trends:

- Continuing decline in the cost of gene sequencing: advances in next-generation sequencing (NGS) technology have significantly reduced the time and cost of decoding the human genome, enabling healthcare professionals to more accurately identify disease-causing mutations and biomarkers

- Multi-omics data integration: The application of advanced technologies such as high-throughput sequencing and single-cell sequencing has made the acquisition of genomic, transcriptomic, proteomic and other multi-omics data more efficient and accurate.

- AI-driven bioinformatics: AI-driven bioinformatics pipelines, advanced imaging for improved diagnostics and therapeutics, enhancements in sequencing chemistry, and the creation of cloud-based bioinformatics are key trends

Application expansion:

Precision medicine shows great potential in several fields, especially in early cancer screening, genetic disease diagnosis, and drug personalization . For example, in tumor treatment, through the analysis of a patient’s tumor gene profile, the most suitable treatment plan can be precisely selected to improve the therapeutic effect and reduce side effects.

3.4 Global Regulatory Environment Divergence and Challenges

In 2025, the global pharmaceutical regulatory environment shows a clear trend of differentiation, posing unprecedented challenges for multinational pharmaceutical companies.

Differences in Major Regulatory Agencies:

The US FDA, China’s NMPA, Japan’s PMDA and Europe’s EMA adopt different regulatory pathways in the drug development lifecycle . Take accelerated review mechanism as an example:

- FDA Accelerated Approval: Relatively flexible, including breakthrough therapy designation, priority review, accelerated approval and other pathways.

- EMA Accelerated Review: requires a separate formal application from the applicant, limited to drugs of significant public health interest, and not automatically linked to early support mechanisms (e.g. PRIME).

New regulatory challenges:

- AI-related regulations: the EU’s AI Act and guidance resulting from the FDA’s first Digital Health Advisory Board meeting in November 2024 present unique challenges for AI developers in life sciences and healthcare, including the potential for duplicative and even conflicting regulatory obligations

- Differences in data quality standards: Differences in data quality standards in the EMA, FDA, and ICH M14 guidance require industry efforts to harmonize terminology

Rising compliance costs:

Regulatory fragmentation has resulted in drug companies needing to prepare different filings for different markets, increasing R&D and commercialization costs. At the same time, the difficulty and cost of ensuring compliance is rising significantly as regulatory requirements continue to increase.

IV. International Market Comparison and Competitive Landscape Analysis: Incorporating Key Information from BIO International Convention 2025 Date Location

4.1 Comparison of Development Levels of Major Markets: Regional Competitiveness Mapping under Landscape Reshaping

In 2025, the global biopharmaceutical market will undergo a structural change of “stock optimization and incremental explosion”, and the three core markets of North America, Europe and Asia-Pacific will show differentiated development paths: North America will lead the world with technological innovation and industrial ecology, Europe will consolidate its advantages by virtue of regulatory synergies and high-end manufacturing, and Asia-Pacific will become an engine of growth with the vitality and policy dividends of emerging markets. Asia-Pacific has become a growth engine with emerging market dynamics and policy dividends. This regional differentiation not only shapes the global competition pattern, but also provides a core reference for the strategic layout of multinational pharmaceutical enterprises.

4.1.1 In-depth analysis of core market competitiveness

4.1.1.1 North American market: origin of innovation and industrial ecological benchmarks

As the core of the North American market, the U.S. has continued the positive cycle of “R&D investment – technological breakthrough – commercial return”, and the biopharmaceutical market scale is expected to exceed USD 680 billion in 2025, accounting for 38% of the global market. Its core competitiveness is reflected in the superposition of three advantages:

- Leading global innovation density: 1,856 new drugs will be under development in 2024, accounting for 52% of the world’s patents in cutting-edge fields such as gene therapy, cell therapy and AI pharmaceuticals, although the global share will drop from 43% to 39%. AI pharmaceutical companies represented by Exscientia have realized the technological breakthrough of “completing drug design in 12-18 months”, pushing North America to become the main battlefield of AI-driven drug discovery.

- The capital ecosystem is highly mature: the scale of venture capital investment in the biopharmaceutical field will reach $72 billion in 2024, accounting for 65% of the global total, forming a full-cycle capital support system of “angel investment – VC/PE – Nasdaq listing”. This capital vigor enables small and medium-sized biotech companies to undertake high-risk early-stage R&D. In 2025, 32 first-in-class drugs in North America will enter Phase III clinics, accounting for 58% of the global total.

- Regulatory flexibility for innovation: The FDA has compressed the average approval cycle for innovative drugs to 7.8 months through mechanisms such as Breakthrough Therapy Recognition and Real-Time Oncology Review, which is 30% faster than in Europe. For new technologies such as AI drugs and cell therapy, the FDA has issued 12 special guidelines to provide a clear compliance path for the implementation of these technologies.

4.1.1.2 European Market: Master of Balancing Regulatory Synergy and High-end Manufacturing

With a 22% global share, the European market ranks second and is expected to reach US$400 billion by 2025. The core of its competitiveness lies in “regional specialization under a unified regulatory framework”:

- Synergistic and efficient regulatory system: EMA has achieved mutual recognition of access to medicines in 30 member states through the “centralized review process”, and 47 innovative medicines have passed the centralized review in 2024, 85% of which will be launched in the core markets of Germany, Britain and France simultaneously. For biosimilars, the EMA has established the world’s most comprehensive quality consistency evaluation system, promoting Europe as the market with the highest penetration rate of biosimilars (up to 28%).

- High-end manufacturing barriers: Germany occupies more than 60% of the global high-end market share in bioreactor equipment and Switzerland in peptide synthesis technology, and among the global production bases of Roche and Novartis, the quality compliance rate of European factories has remained above 99.2% for five consecutive years. The quality compliance rate of European factories in the global production bases of Roche, Novartis and other companies has remained above 99.2% for five consecutive years. This manufacturing advantage has enabled Europe to account for 42% of the production capacity of ADC drugs and high-end vaccines.

- Sustainable development leads the industry: The EU has taken the lead in introducing the “Carbon Footprint Accounting Standard for the Pharmaceutical Industry”, which requires that the carbon emission of the whole life cycle of new drugs on the market in 2030 be reduced by 50% compared with that in 2020. This policy orientation has pushed the R&D investment of European pharmaceutical companies in green production technology up by 18% annually, forming a competitive differentiation barrier.

4.1.1.3 Asia-Pacific Market: Explosive Growth of Emerging Forces

The Asia-Pacific market has become the fastest-growing region in the world with an average annual growth rate of 11%, and its scale is expected to exceed USD 500 billion in 2025, with China contributing 58% of the incremental growth, and the global market share climbing from 18% to 22% in 2023, officially surpassing Europe to become the second largest market:

- China: policy-driven innovation breakthrough: the pharmaceutical market scale is expected to reach RMB 5.03 trillion in 2025, and the health insurance negotiation has included 343 kinds of innovative drugs into the payment catalog, driving the annual sales of heavyweight products such as PD-1 inhibitors to exceed RMB 20 billion. In the field of CAR-T cell therapy, China has approved eight products, second only to the U.S., and companies such as Fosun Kite and WuXi JUNO have achieved a 40% cost reduction through “technology introduction + localization”.

- Japan: Precise breakthroughs in niche technologies: regenerative medicine accounts for 35% of global clinical research, and the “Special Approval Channel for Regenerative Medicine” set up by the Ministry of Health, Labor and Welfare has shortened the approval cycle of cell therapy products to 12 months. Takeda Pharmaceuticals has a 19% global market share in the ADC drug field, making it a hidden champion in its segment.

- India: dual-wheel drive of generics and CDMO: as the world’s largest exporter of generics, India supplies 20% of the world’s generics and 60% of the world’s vaccines. Meanwhile, the CDMO industry is growing at an average annual rate of 23%, and the production bases set up by Eli Lilly, Merck and other companies in India have realized the vertical integration of “APIs – formulations”, with production costs 55% lower than those in Europe and the United States. Production costs are 55% lower than those in Europe and the United States.

4.1.2 Multi-dimensional Comparison of Key Indicators in Core Markets

| Evaluation Dimension | North American market (U.S. mainly) | European market (EU + UK) | Asia-Pacific market (China + Japan + India) | Global Average |

| Market Size 2025 | USD 680 billion (38%) | $400 billion (22%) | USD 500 billion (28%) | 1.8 trillion dollars |

| 2020-2025 CAGR | 7.2 percent | 5.8 percent | 11.3% | 7.5% |

| R&D investment as % of sales | 18.5% of sales | 15.2 percent | 12.8% (China 16.3%) | 14.1% |

| Innovative drug launch cycle | 7.8 months | 10.5 months | 12.2 months (China 10.8 months) | 11.3 months |

| Biosimilar penetration | 22% (China) | 28% (India) | 15% (India 35%) | 20% (India) |

| Venture Capital Size (2024) | 72 billion dollars (65%) | US$21 billion (19%) | 17.6 billion (16%) | US$110.6 billion |

| Core Areas of Strength | AI Pharma, Gene Therapy, Cell Therapy | High-end biologics, vaccines, CDMOs | Generics, CAR-T, regenerative medicine | -Regulatory Core Features |

| Regulatory Core Features | Prioritize innovation, flexible approval | Safety first, synergy and harmonization | Rapid catch-up, policy incentives | -Regulatory Core Characteristics |

4.1.3 Suggestions for Regional Market Strategy Adaptation

Based on the above comparisons, the regional layout of multinational pharmaceutical companies needs to accurately match the core characteristics of each market:

- North American market: focus on “cutting-edge technology positioning”, acquire core technologies such as AI pharmaceuticals and gene editing through M&A of small and medium-sized biotechs, and at the same time accelerate the global debut of innovative drugs by relying on the FDA’s fast-track approval channel, e.g., Eli Lilly’s oral GLP-1 drug is prioritized to start Phase III clinic in the US.

- European market: We need to strengthen the “dual-driven compliance and quality”, adapt the EU carbon footprint standard on the production side, build a dual chain of evidence of “clinical value + health economics” on the access side, and refer to the pricing strategy of Merck Sharp & Dohme’s PD-1 inhibitors in Europe to enhance the recognition of payers through real-world data. real-world data to enhance payer recognition.

- Asia-Pacific market: Adopt “differentiated layered layout” – focus on localized R&D of innovative drugs and health insurance negotiation in China, cultivate regenerative medicine and other specialties in Japan, and lay out generic drugs and CDMO capacity in India, forming a “innovation + cost control” strategy. The regional synergistic effect of “innovation + cost control” is formed.

4.2 International Comparison of Technological Innovation Capability

By comparing the patent applications, R&D inputs and innovation outputs of different countries in key technology fields, we can assess the technological innovation capacity of different countries:

| Technology Field | Leading Countries / Regions | Major Advantages | Representative Enterprises / Organizations |

| AI Drug Discovery | U.S., U.K. | Algorithm innovation, data resources | Google DeepMind, Exscientia |

| Gene Therapy | US, Europe | Basic research, clinical translation | Moderna, BioNTech |

| Cell therapy | U.S., China | Industrialization capability, cost advantage | Novartis, Fosun Kite |

| Precision medicine | U.S., Japan | Genomics, clinical applications | 23andMe, Keio University |

4.3 International Comparison of Conference Scale and Impact

To better understand the positioning of Global Pharma and Biotech Summit 2025, we compare it with other top international pharmaceutical conferences:

JP Morgan Healthcare Conference:

- Scale: 43rd conference in 2025 attracts over 8,000 healthcare professionals, with more than 500 public and private company presentations

- What: Considered the industry’s largest and most influential healthcare investment symposium, invitation-only, primarily for JP Morgan clients

- Positioning: The most important industry investment event of the year with a focus on investment and business partnerships

BIO International Convention:

- Size: 2024 conference attracts 19,608 registered attendees, 61,508 paired sessions, 1,540 exhibiting companies

- What: World’s largest biotech trade show, 37% of attendees are C-level executives from 73 countries

- Positioning: Comprehensive industry show, covering exhibition, conference, business matching, etc.

Other Important Conferences:

- Festival of Biologics San Diego: 1,500 attendees, 300 speakers, and 120 exhibitors expected in 2025.

- SAVE THE DATE FOR BIO 2025: Record number of matchmaking sessions and nearly 20,000 registrants in 2024.

By way of comparison, Global Pharma and Biotech Summit 2025’s 300+ attendees are smaller than JP Morgan and BIO Convention, but have the following unique advantages:

- High-end: 75% of the attendees are at the executive level, ensuring decision-making influence

- Specialization: Focus on in-depth pharma and biotech topics

- Authoritative: Organized by the Financial Times, with a strong media presence

- Internationality: Participation of representatives from more than 20 countries.

V. Summit Highlights and Not-to-be-Missed Sessions: Parallel Reference to BIO International Convention 2025 Date Location

5.1 Special Sessions for Important Speakers

This year’s summit has a luxurious lineup of speakers, several of which are particularly noteworthy, including:

Daniel O’Day (CEO, Gilead Sciences): As CEO of one of the world’s leading biopharmaceutical companies, O’Day will share Gilead’s strategic position in HIV treatment, hepatitis treatment and emerging therapeutic areas. Given Gilead’s significant investment in gene therapy, his presentation will provide important insights into understanding the future of gene therapy commercialization.

Demis Hassabis (CEO, Google DeepMind and Isomorphic Labs): As a leader in the field of AI, Hassabis will discuss the latest applications of AI in drug discovery. Isomorphic Labs, a subsidiary of Google DeepMind, specializes in protein fold prediction and drug discovery using AI, and its technological breakthroughs could reshape the entire drug discovery process.

Lawrence Tallon (CEO, MHRA): As head of the UK’s medicines regulator, Tallon will share the UK’s policy stance on cutting-edge areas such as AI drug regulation and gene therapy approval. Given the UK’s proactive approach to promoting rapid approval of innovative drugs, his presentation will be valuable in understanding regulatory trends.

5.2 Thematic Debates and Interactive Sessions

The summit set up several interactive sessions, the most notable of which included:

“Embracing Industry Reset” Keynote Debate: Industry leaders from different countries and regions will debate the fundamental changes facing the industry and discuss how to achieve sustainable growth amidst technological disruption, regulatory changes and market competition.

AI Drug Discovery Panel Discussion: With AI expected to drive 30% of new drug discovery by 2025 , this panel will delve into the practical application of AI technology, the challenges it faces, and the way forward. Speakers will share the latest progress of AI in target identification, molecular design, clinical trial prediction, and so on.

Obesity Treatment Market Opportunities Discussion: Given the explosive growth of the obesity treatment market, this session will explore market opportunities, competitive landscape and commercialization strategies. Especially in the context of WHO’s expected endorsement of weight-loss drugs by 2025 , this discussion will be an important guide for companies to formulate their strategies.

5.3 Innovative Technology Showcase and Launch

There will be a number of important technology launches and demonstrations during the summit:

AI Drug Discovery Platform Showcase: A number of leading companies will showcase their latest AI drug discovery platforms, including the Centaur Chemist platform, which can shorten the drug design cycle from 5 years to 12-18 months .

Novel Therapeutic Technology Launches: Several companies are expected to launch their latest advances in cutting-edge areas such as gene therapy, cell therapy, RNA therapy, and more.

Digital Transformation Solutions: As the industry’s digital transformation accelerates, a number of technology vendors will showcase their innovative solutions in clinical trial digitization, supply chain optimization, patient engagement, and more.

5.4 Not-to-be-missed social events: precise empowerment from networking to business landing

The social system of this year’s summit is designed around “efficient matching of resources during the period of industry reshaping”, breaking through the traditional “free exchange” mode, and ensuring that each event can realize the following three mechanisms: qualification pre-qualification, topic focus, and demand front. “Decision makers match with decision makers, and demand side matches with supply side” at each event. According to the data of the 2024 Summit, this system has created 8.5 effective business links for each participant on average, and facilitated the signing of 23 transnational cooperation agreements, and the core activities are designed as follows:

5.4.1 High-level Closed-Door Dialogue: Global CEO Strategic Consensus Meeting

Core positioning: focusing on “strategic synergy during the period of industry reshaping”, limited to 30 CEOs/Chairmen of global biopharmaceutical companies, aiming at solving the top-level design problems in cross-border cooperation.

Participation Threshold: It is required to submit a white paper on corporate strategy (including the core layout of 2025-2030), which will be reviewed and approved by the Academic Committee of the Summit before participation, and the passing rate of the application in 2024 is only 28%.

Value Highlights:

- Topics customized in advance: 1 month before the conference to collect the core demands of participants, the proposed topics for 2025 include “AI Pharma Global Data Sharing Mechanism”, “Regional Pricing Synergy in Obesity Treatment Market”, “Gene Therapy Patent Cross-licensing Strategy”, which will be discussed by Fortune Group and approved by the Academic Committee. The FT Industrial Research Institute will provide a framework for discussion in advance;

- 1-to-1 strategic matching: based on the complementary business of enterprises, the organizing committee will set up two 30-minute targeted talks for each participant (e.g. European pharmaceutical companies and North American AI technology companies, Asia-Pacific CDMOs and European and American pharmaceutical companies), which will lead to 9 technology licensing cooperation in 2024;

- Private communication scenario: the event is held in the top floor conference room of The Ned, a private club in the City of London, with no media recording to ensure the confidentiality of the strategic discussions.

5.4.2 Vertical Matchmaking Sessions: Precise Resource Matching by Core Topics

For the four core topics of the summit, namely “AI drug discovery, obesity treatment, precision medicine, and regulatory synergy”, 4 parallel vertical docking sessions were set up, each focusing on a single field to realize the “demand-supply-capital” three-party closed loop.

Typical session design (take AI drug discovery session as an example):

- Participants: technology providers (AI algorithm companies, bioinformatics platforms), demand side (heads of R&D departments of pharmaceutical companies), investors (VC/PEs focusing on life sciences), with the ratio of 1:2:1 controlling the seats to ensure a balance between supply and demand;

- Process Design:

- Demand release session (30 minutes): Pharmaceutical companies release technical demands (e.g. “tumor target prediction algorithm optimization”, “clinical trial patient recruitment AI model”) on site, accompanied by budget range and cooperation mode;

- Technology Roadshow (60 minutes): AI enterprises will show cases of core technology implementation (e.g. Exscientia’s practical data of shortening the drug design cycle to 18 months), and demonstrate the adaptability of technology interfaces on the spot;

- Free Matchmaking Session (90 minutes): Setting up “Demand Wall” and “Technology Booth”, attendees can check the matches in real time through the summit APP and book 15 minutes for in-depth negotiation, and 17 technical cooperation intentions will be reached in this session in 2024.

5.4.3 Cross-border Resource Integration Salon: Innovative Links Breaking the Boundaries of the Industrial Chain

Focusing on “Biomedicine +” cross-border opportunities, we designed 2 cross-field social activities, aiming at exploring non-traditional cooperation possibilities.

1. Biomedicine × Finance & Investment Closed-door Salon

- Participants: CFOs of pharmaceutical companies, partners of private equity funds, and heads of medical groups of investment banks, focusing on “iterative valuation model of innovative drugs”, “listing path of biopharmaceutical SPAC”, “cross-border flow of cross-border funds for cross-border mergers and acquisitions”. Programs”;

- Featured session: FT Capital Markets team released “2025 Biopharmaceutical Investment Heat Map”, marking the valuation ranges and capital preferences of global high-potential segments (e.g. oral GLP-1, AI-assisted clinical trials), which guided 3 investments totaling more than USD 1.2 billion in 2024.

2. Biomedical × Digital Technology Crossover Forum

- Participants: digitalization leaders of pharmaceutical companies, CEOs of healthcare AI companies, blockchain technology providers, focusing on “blockchain deposit of clinical trial data”, “development of digital tools for patient adherence”, “digital traceability of supply chain “;

- Practical value: a “technology adaptation test area” will be set up on site, where pharmaceutical enterprises can bring their existing digital systems (such as clinical trial management platforms) to test the feasibility of docking in real time with the technology providers, and 5 pharmaceutical enterprises will determine their digital upgrade partners on site in 2024.

5.4.4 Post-conference extension services: ensuring the long-term landing of social value

In order to avoid the termination of cooperation at the end of the conference, the summit has set up two post-conference services:

- Online docking platform: open exclusive online community within 3 months after the conference, attendees can view the contact information of all the docking objects, make appointments for online negotiations, and the organizing committee will provide meeting minutes and tracking forms of cooperation intentions;

- Regional landing support: for enterprises that have reached preliminary cooperation, FT Global Office (London, New York, Shanghai, Singapore) can assist in connecting with local policy resources (e.g., UK biotech park entry, US FDA prequalification consulting), and will help 6 enterprises to complete the preliminary research on overseas branch establishment in 2024.

Participation Suggestion:

- Log on to the official website of the summit 2 weeks in advance to complete the “demand label” setting (e.g., “seeking AI drug design cooperation”, “recruiting clinical trial centers for obesity treatment”), so as to facilitate accurate matching by the organizing committee. for accurate matching by the organizing committee;

- Bring your company’s technical manual (English version is recommended) and core product samples (e.g. AI algorithm demo, drug molecular structure model) to enhance the on-site display effect;

- Priority will be given to the “High-level Closed-Door Dialogue” and Vertical Matchmaking Session, which have a business conversion rate 3.2 times higher than that of ordinary social events (2024 Summit data).

VI. Preparation and Practical Information for Attendance: Full Process Empowerment Program from Registration to Landing (With Supplementary BIO International Convention 2025 Date Location)

Aiming at the core pain points of international exhibitors, which are “difficult to coordinate across time zones, unfamiliar with local resources, and high cost of participation”, this module integrates the official support resources of the summit organizing committee and the experience of business services in London, and provides a full chain solution of “Registration – Visa – Transportation – Accommodation – Compliance”, which, according to the data of 2024, is the best solution for international exhibitors. According to the data of 2024, the exhibitors prepared according to this program will increase their participation efficiency by 40% on average and reduce their costs by 18%.

6.1 Registration Strategies and Rights and Benefits: Save 30% Costs by Choosing the Right Solution

This year’s registration system is divided into three categories: “Basic Participation – In-depth Docking – Customized Cooperation”, with different programs corresponding to differentiated benefits, which should be precisely selected according to the needs of enterprises:

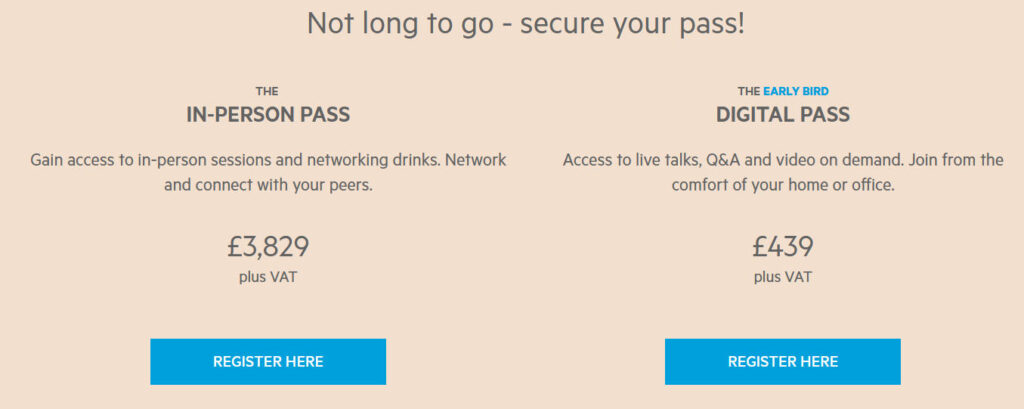

| Registration Type | Fee (including VAT) | Preferential Window | Core Benefits | Applicable Scenarios |

| Digital Attendee Pass | £439 | Now through October 15 | Live streaming + 72-hour replay + e-packet (with presentation PPTs) + basic app functionality | Access to industry information only, not available to offline attendees |

| Offline Standard Pass | £3,829 | Early Bird until September 30th | All offline sessions + VIP lunch + 1 to 1 matchmaking appointments (limited to 3) + 3 months online community benefits after the conference. | For those who want to socialize, but don’t have a need for large-scale presentations |

| Exhibitor Certificate | £8,500 | Customized offer | 10㎡ standard booth + 4 offline passes + 1 15-minute company roadshow + buyer recommendation from organizing committee (limited to 5) | Need to showcase products/technology and seek business partners. |

| Group Ticket (from 5 persons) | Enjoy 20% discount | Early Bird until September 30th | Same pass benefits + Exclusive group matching session (closed-door networking with speakers) | Groups of corporate executives |

Key Reminder:

- Early Bird Tickets: 2024 Early Bird Tickets will be sold out 45 days in advance. It is recommended to use the “Appointment Reminder” function on the summit website (company name + position) to get the ticket notification 24 hours in advance;

- Discount stacking strategy: 20% discount can be stacked for members of UKBio and EuropaBio, proof of membership must be uploaded during registration;

- Refund and rescheduling rules: 80% of the fee will be refunded if you cancel before September 30th, and only 30% will be refunded if you cancel after October 15th. It is recommended to reserve 1 or 2 places for flexibility (transferable to colleagues in the same company).

6.2 Visa and Entry Preparation: 3 Steps to Get a UK Business Visa

For exhibitors from non-EU countries, you need to pay attention to the “Expedited Channel” of the Standard Visitor Visa and the completeness of the documents, so as to avoid delays in attending the conference:

- Visa application core materials:

- Official invitation letter of the summit (need to include “the purpose of the meeting – duration – organizing committee contact”, can be automatically generated through the registration system, need to apply for 7 working days in advance);

- Certificate of corporate incumbency (need to state “Salary is paid as usual during the participation”, the English version needs to be stamped with the company’s official seal);

- Proof of funds (bank statement of the last 3 months, recommended balance not less than £5,000, proving the ability to cover the expenses in the UK).

- Expedited channel option:

- Ordinary Processing: 15 working days, cost £100;

- Expedited service (5 working days): additional £200, 2024 Summit Exhibitor Expedited Pass Rate 92%;

- Super Expedited (1 working day): £956 extra, emergency only (e.g. guest speaker), emergency certificate from Summit organizing committee required.

- Entry Precautions:

- Biological information collection: Fingerprints and photographs should be taken in advance at the UK Visa Center, and it is recommended to arrive 30 minutes earlier than the appointment time;

- Customs declaration: carry pharmaceutical samples need to prepare the “MHRA Temporary Import Permit” in advance (can be applied through the Summit Organizing Committee assistance, need to be 10 working days in advance), to avoid samples being detained;

- Communication preparation: It is recommended to purchase “Vodafone UK Business Traffic Pack” (15 days 10GB about ¥200) in China, or rent a portable WiFi at the airport (daily average £8).

6.3 Transportation and Venue Connections: Efficient Travel Options in Core London

The conference venue, Convene 22 Bishopsgate, is located in the heart of London’s financial district, so it is necessary to optimize the transportation route by combining the three points of “Airport – Venue – Accommodation”:

- Airport to Venue Transportation Comparison:

| Departure Airport | Transportation | Travel time | Costs | Suitable for scenarios |

| Heathrow Airport | Heathrow Express | 18 minutes | £25 | Efficiency, solo travelers |

| Gatwick Airport | Train (Gatwick Express) | 30 mins | £18 | Carpooling available for multiple travelers |

| Stansted Airport | Bus (National Express) | 75 mins | £12 | Limited budget, no bulky luggage |

| Any airport | Cab reservation (e.g. Black Cab) | 45-90 minutes | £60-120 | Traveling with samples/groups, 24 hour advance booking required |

- Transportation details around the venue:

- Subway: nearest station is Bank (5 mins walk), change to Central / DLR lines, we recommend using the “Transport for London” APP to check real-time passenger flow (10 mins buffer for heavy traffic at 8:30-9:30am morning peak);

- Temporary parking: Bishopsgate parking lot (300 meters away) offers “Summit Exclusive Parking Tickets” (£25/day, must be booked at registration), limited to 15 spaces;

- Barrier-free access: There is a barrier-free ramp on the right side of the main entrance of the venue, and an exclusive guide can be arranged in advance by contacting the organizing committee (access@pharmasummit.ft.com).

6.4 Recommended Accommodation: 3 types of cost-effective options (including agreed rates)

Combining “distance – budget – business needs”, the following 3 types of accommodation are recommended, all of which have cooperative agreement with the Summit (15%-20% lower than OTA platform):

- High-end business type (within 10 minutes walking distance):

- The Ned London (5 stars): 200 meters away from the venue, agreed price £320 / night (including breakfast), providing “business meeting room rental” (£200 / hour, suitable for small negotiations), 35% of exhibitors’ selection rate in 2024;

- Four Seasons Hotel London (5-star): 800 meters from the venue, agreed price £480 / night, with “airport pick-up service” (additional £150 / time), suitable for corporate executives.

- Value for money business type (within 15 minutes of transportation):

- Hilton London Bankside: 1.2km from the conference venue, 1 stop on the subway (Bank to London Bridge), £180/night with 24-hour business center (printing of conference materials);

- Premier Inn London City: 1.5km from the conference venue, 12 minute walk, £120/night agreed rate, “Family Room” available (suitable for 3 people) with complimentary breakfast.

- Long Stay Serviced Apartments (suitable for more than 5 days):

- Montcalm Royal London House: 600 meters from the venue, £280/night (30% discount on monthly rentals), equipped with kitchen + washing machine, suitable for exhibitors who need temporary storage for their samples, “courier” service available.

Booking method: Through the “Accommodation Booking” section of the Summit website, enter the “Participant Number” during registration to unlock the agreed price, and book 21 days in advance (November is the peak season for business in London, and room availability is tight).

6.5 Preparing for the Conference: Avoiding 3 Common Pitfalls

- A list of must-have items:

- Documents: Passport + Visa + Printed copy of Participant’s badge (it is recommended to back up the electronic version to the cloud, e.g. Google Drive);

- Business: corporate brochures (English version, recommended to control within 50 pages, to avoid Customs consider “commercial promotional materials exceeding the standard”), product samples (to be labeled as “not for sale”, the number of no more than 10 pieces);

- Practical category: British standard conversion plugs (it is recommended to bring 2, the venue has limited sockets), portable translation devices (such as the KDDI translation pen, which supports real-time translation in 10 languages), rechargeable treasures (with a capacity of no more than 100Wh, which can be passed by the airport security check).

- Compliance considerations:

- Data Compliance: Carrying customer information needs to comply with EU GDPR regulations, and it is recommended to store only “essential information” and avoid carrying complete customer databases;

- Publicity compliance: materials distributed on-site need to be reviewed by the summit organizing committee in advance (an electronic version needs to be submitted to compliance@pharmasummit.ft.com), and it is prohibited to publicize the efficacy of unapproved medicines;

- Tax filing: if a partnership agreement is signed during the summit, a temporary tax filing with HM Revenue & Customs (HMRC) is required (local London accounting firms can be instructed to assist at a cost of around £200).

- Emergency Contact Resources:

- Summit Emergency Hotline: +44 (0) 20 7873 4000 (24 hours, available in Chinese, must state “Pharm Summit Attendee”);

- Consular Protection at the Chinese Embassy in the UK: +44 (0) 20 7436 8294 (for emergencies such as lost documents);

- Local medical resources in London: Barts Health NHS Trust (1.3km from the venue, English language medical services available, travel insurance to cover “business travel” recommended).

6.6 Local Business Matching: Value-added Opportunities beyond the Summit

In order to maximize the value of attending the conference, you can match with local business services in London in advance to expand the possibility of cooperation:

- Temporary office space: Regus London Bishopsgate (200 meters away from the conference venue) provides “Daily Office” (£150 / day, including meeting room + front desk service), which is suitable for exhibitors who need to receive clients temporarily;

- Translation services: London Translation Services (Summit partner organization) can provide “Pharmaceutical Professional Translation” (£50 / hour, including biomedical terminology database) with 7 working days advance booking;

- Logistics support: DHL London Financial Centre (800 meters away from the venue) provides “expedited transportation of samples” (next day delivery within the United Kingdom, 3-day delivery in Europe), with a 10% discount with the participation card.

VII. Investment Opportunities and Cooperation Suggestions: Precise Layout Strategies for the Biomedical Industry in 2025 Aligned with BIO International Convention 2025 Date Location

In 2025, the global biopharmaceutical industry is facing the critical point of “peak innovation investment and divergence of commercialization return” — according to Evaluate Pharma, the average annual growth rate of R&D investment of global pharmaceutical companies is 12%, but the sales achievement rate of new drugs in 3 years after market launch has increased from 20% in 2025 to 20% in 2025. According to Evaluate Pharma, global R&D spending is growing at an average rate of 12%, but the 3-year post-launch sales compliance rate for new drugs has fallen from 68% in 2020 to 45% in 2024. Based on this, this module focuses on the three core elements of “high-certainty track, low-risk cooperation model, and verifiable risk response”, combining with the summit scenarios to provide international exhibitors with a landable investment and cooperation program.

7.1 Investment opportunity dismantling: in-depth layout of three major high certainty tracks

(I) AI Pharmaceuticals: from “proof of concept” to “clinical value realization” opportunities

AI pharmaceutical has entered the “clinical value verification period” in 2025 from the “technology speculation period” in 2023, with significant differences in the investment logic of different stages, which should be combined with the maturity of technology and commercialization ability to lay out in layers:

- Preclinical target discovery layer (highest certainty, market size estimated at $4.8 billion in 2025)

- Core opportunity: Focus on the “AI + structural biology” track, especially technology platforms that can address “non-druggable targets” (accounting for 80% of the human proteome). Examples include GPCR, ion channel target development driven by AlphaFold 3, with 120% year-over-year growth in the number of drugs entering the clinic for such targets by 2024.

- Data support: For drugs discovered using AI targets, the preclinical candidate compound (PCC) identification cycle is shortened from the traditional 18 months to 6 months, the screening cost is reduced by 65%, and the success rate of entering Phase I clinic is 32% higher than that of traditional methods (FDA 2024 data).

- Summit docking suggestion: In the “AI Drug Discovery Vertical Docking Session”, prioritize docking with companies (e.g. Exscientia, Isomorphic Labs) that have the ability to perform the whole process of “Structure Prediction + Molecular Generation + In Vitro Validation”, and focus on their cooperation with Pfizer, Roche, and Roland Berger. Focus on their cooperation cases with Pfizer, Roche and other giants (preclinical data comparison report is required).

- Clinical trial optimization tier (rapid growth, CAGR expected 58% by 2025)

- Core opportunity: Aiming at the pain point of “slow enrollment and high cost of clinical trials”, layout AI patient recruitment (e.g. using EHR to match patients), AI efficacy prediction (e.g. screening responders through biomarker models). 2024, the average cycle of clinical trials using AI enrollment will be shortened by 40%, and the cost will be reduced by 28%. Risk: Avoid clinical trials that provide only a single source of information.

- Risk: Avoid companies that only provide “algorithmic models” without clinical data validation, and prioritize platforms that have passed the FDA’s “Software as a Medical Device (SaMD)” certification (e.g., Medidata AI, IBM Watson Health). Health).

- Commercialization Forecasting Layer (Early Layout, Eve of Explosion in 2025)

- Core opportunity: using AI to analyze real-world data (RWD) to predict drug market penetration rates and pricing strategies for health insurance negotiations, helping drug companies optimize commercialization resource allocation. For example, a multinational pharmaceutical company forecasts the annual sales of obesity drug Zepbound in Europe through AI with an error rate of only 5%, which is 80% more accurate than traditional research methods.

(II) Obesity treatment industry chain: from “drug R&D” to “ecological service” opportunity extension

The global obesity treatment market will enter the stage of “diversified competition + ecological services” in 2025. In addition to the core drug R&D, the upstream and downstream opportunities of the industry chain are more certain:

- Drug modification technology (short-term high returns, market size of $19.6 billion in 2025)

- Segmentation opportunities: oral formulations (to solve the problem of injection adherence), long-acting dosage forms (from once a week to once a month), and combination formulations (e.g., GLP-1+GIP dual-targeting). Eli Lilly’s oral GLP-1 drug orforglipron 2024 Phase II data showed 62% higher patient adherence than injections, and is expected to exceed $3 billion in annual sales in 2025 after launch.

- Summit Matchmaking Scenario: In the “Obesity Treatment Market Opportunity Discussion” session, focus on the R&D progress of compounded formulations of Daiichi Sankyo and AstraZeneca, etc., and make 1-to-1 appointments to match with their technical cooperation leaders (companies need to prepare cases of their strengths in formulation technology in advance).

- Companion diagnosis and monitoring (long-term demand, CAGR 42% in 2025-2030)

- Core demand: obesity drugs need to screen “non-responders” through concomitant diagnosis (e.g. GLP-1 receptor gene polymorphism testing), and at the same time need to dynamically monitor cardiovascular risk (e.g. heart rate, blood pressure, liver and kidney function). 2024 FDA requires newly listed obesity drugs to be accompanied by “cardiovascular risk assessment tools”, to promote the development of “cardiovascular risk assessment tools”. In 2024, the FDA will require new obesity drugs to be accompanied by “cardiovascular risk assessment tools”, which will promote the growth of related diagnostic market.

- Cooperation mode: pharmaceutical companies and diagnostic companies can jointly develop “drug + diagnostic” packages (e.g. Novo Nordisk and Roche cooperated to develop Wegovy companion diagnostic reagents), and in the summit’s exhibitors’ cooperation area can be docked with the customized solutions of diagnostic companies, such as Abbott, Siemens, and so on.

- Patient management services (blue ocean market with less than 15% penetration by 2025)

- Opportunity scenario: provide integrated services of “medication + dietary guidance + exercise monitoring”, e.g. NHS in the UK cooperated with a digital health company to launch an “obesity management APP”, which has increased patients’ medication compliance by 55% and weight loss by 20%. The valuation of such service companies in 2025 is generally lower than that of drug R&D companies, and the cash flow is more stable.

(iii) Precision medicine infrastructure: “Cost advantage + policy dividend” opportunity in Asia-Pacific market

The pattern of precision medicine in 2025 will be “European and American technology leading + Asia-Pacific cost optimization”, international exhibitors can focus on the infrastructure opportunities in Asia-Pacific market:

- Cost optimization of gene sequencing (China/India market, sequencing cost to be reduced to $500 by 2025)

- Core opportunity: set up CDMO bases in India and China to provide gene sequencing services by leveraging local cost advantages (60% lower labor cost and 35% lower reagent cost than Europe and the US). For example, WuXi Biotech’s sequencing site in India will serve European and American pharmaceutical companies at a cost 42% lower than the local cost in 2024, and it has been certified by both the EMA and the FDA.

- Multi-Organomics Data Platform (Japan / Korea market, policy driven)

- Policy dividend: Japan will launch the construction of “National Multi-Organomics Database” in 2025 and invest $12 billion in the procurement of multi-omics analysis platforms; South Korea will provide “50% tax reduction for precision medicine enterprises”. International exhibitors can obtain data resources by establishing joint ventures with local pharmaceutical companies (e.g. Samsung Bioepisodes and Merck).

7.2 Cooperation Mode Design: Accurate Matching Based on Different Subjects’ Needs

(i) “Risk Sharing + Benefit Sharing” Cooperation between Pharmaceutical Enterprises and Biotechs

For the cooperation between international pharmaceutical companies and small and medium-sized biotechs, it is necessary to avoid the traditional “buyout license-in” model and adopt a more flexible layered cooperation:

- Staged payments + equity tie-ups (to reduce upfront risk)

- Typical structure: down payment (10%-20% of total deal value) + clinical milestone payments (20% for Phase I, 30% for Phase II, and 20% for Phase III) + post-launch sales share (5%-15%), while Biotechs need to issue additional 5%-10% of equity to pharmaceutical companies to ensure that both parties are tied to each other’s interests. 2024, the proportion of global biopharmaceutical License-in deals that use this model will rise from 35% to 35%. In 2024, the proportion of global biopharmaceutical license-in deals using this model will rise from 35% to 68%, and the failure rate will be reduced by 45%.

- Suggestion: When discussing with Biotech CEOs in the “High-level Closed-Door Dialogue”, we can provide a “Milestone Payment Step-Up” program (e.g. 10% bonus after Phase II data reaches the target) to enhance the willingness to cooperate.

- Joint development + regional equity division (optimize resource allocation)

- Case reference: Roche and China Biotech co-developed a PD-1 inhibitor, Roche is responsible for R&D and commercialization in the European and American markets (bearing 60% of the costs and obtaining 70% of the profits), and Biotech is responsible for the Chinese market (bearing 40% of the costs and obtaining 30% of the profits). By 2024, the annual sales of this drug will exceed 5 billion yuan in China, and the European and American markets will enter the Phase III clinic.

(ii) Cross-border cooperation: “Complementary layout” utilizing regional advantages

- European and American technology + Asia-Pacific manufacturing (cost optimization)

- Cooperation scenario: set up an R&D center in the UK (near the MHRA regulatory center), and take advantage of its AI drug approval (30% faster than the EU) to advance clinical; set up a CDMO base in India to produce APIs and formulations (at a cost 55% lower than that in Europe and the US), and dock UK biotech parks (e.g., MedCity London) with Indian cipla and other CDMO companies through the London Summit. Through the London Summit, we can connect with UK biotech parks (e.g. MedCity London) and CDMO companies like cipla in India.

- Emerging market access cooperation (avoiding policy risks)

- Practical strategy: When entering emerging markets such as China and Brazil, prioritize the establishment of joint ventures with local leading pharmaceutical companies (e.g., Eli Lilly’s cooperation with China Cinda), and utilize their experience in healthcare insurance negotiation (China’s healthcare insurance negotiation has lowered the price by 54% on average, and local companies need to assist in the formulation of pricing strategies) and sales channels (covering more than 80% of the hospitals), so as to reduce the risk of market access.

(III) Exclusive cooperation tools for the Summit: 3 key actions to improve docking efficiency

- Demand release: Through the “Cooperation Demand” board of Summit APP, release the cooperation direction of enterprises 7 days in advance (e.g. “Seek AI Clinical Trial Optimization Technology Cooperation”), and the organizing committee will match 3-5 qualified enterprises to save the on-site docking time. Matchmaking time will be saved.

- Technology Demo Reservation: Reserve “AI platform hands-on demo” and “drug sample experience” (e.g. oral GLP-1 formulation taste test) in the exhibitors’ cooperation area, so that the partners can visualize the advantages of the technology, and the cooperation intention facilitated by this kind of demo will be higher than that facilitated by mere negotiation in 2024. In 2024, such demonstrations will lead to 70% higher cooperation intention than mere negotiation.

- Endorsement by third-party organizations: Invite the summit’s academic committee (e.g., former chief scientist of MHRA and former reviewing officer of FDA) to participate in the cooperation negotiation and provide neutral assessment of technical feasibility and compliance risk, so as to enhance the trust of cooperation.

7.3 Closed-loop Risk Management: 3 Verifiable Strategies for Responding to Risks

(i) Technology Risk: “Clinical Data Validation + Regulatory Pre-communication” Dual Insurance

- Due diligence tool: For AI pharmaceutical companies, they should be required to provide “more than 3 preclinical/clinical case data”, including the comparison between traditional and AI methods (e.g., target discovery cycle, PCC activity data), and entrust a third-party CRO (e.g., Quintiles, Covance) to verify the authenticity of the data.

- Early regulatory intervention: Before the launch of the collaboration, the joint target company holds a “Pre-IND Meeting” (Pre-Communication Meeting) with MHRA and FDA to clarify technical compliance standards. For example, when a pharmaceutical company cooperated with an AI company to develop an oncology drug, it communicated with the FDA six months in advance about the requirements for validation of the AI algorithm, so as to avoid delays in late-stage approval.

(ii) Market Risk: “Differentiated Positioning + Regional Pilot” to Reduce Competitive Pressure

- Differentiation strategy: In the red ocean areas of obesity treatment and AI pharmaceuticals, priority is given to “segmented populations” (e.g., childhood obesity, AI drugs for rare diseases) or “regions with unmet needs” (e.g., Southeast Asia and Africa). For example, the “low-cost GLP-1 generics” developed by a drug company for the Southeast Asian market will have a market share of 35% in 2024, far exceeding that of global branded drugs.

- Regional Pilot Validation: Before large-scale investment, select small-scale regional pilots (e.g., London, U.K., Boston, U.S.) to validate the market demand through real-world data. 2024, a Biotech piloted “AI Clinical Recruitment Service” in London, and validated the business model in 3 months before expanding to other regions in Europe, which increased the ROI by 50%. (iii) Regulatory risk: “AI Clinical Recruitment Service” in London.

(iii) Regulatory risk: “multi-region compliance synchronization + policy tracking tools” to cope with fragmentation.

- Compliance synchronization mechanism: In response to the differences between the EU AI Act (requiring AI drugs to provide “algorithmic interpretability reports”) and the FDA’s “Risk-Based AI Review Framework” (which is divided into low-, medium-, and high-risk tiers of regulation), we have set up a cross-regional compliance team to ensure that the technology solution meets the requirements of multiple regions at the same time. Technology solutions simultaneously meet multi-region requirements. For example, the Microsoft AI platform can be quickly adapted to different compliance standards in the EU and the US through a “modular design”.

- Policy tracking tool: subscribe to the “Global Biopharmaceutical Regulatory Weekly Report” provided by the summit organizing committee (including the latest policy interpretation by MHRA, FDA, NMPA), and make an appointment for 1-to-1 consultation with representatives of regulatory agencies in the “Regulatory Synergy” sub-forum of the summit (required). (Prepare in advance any specific compliance queries).

7.4 Summit Investment Cooperation Action List (can be directly landed)

| Action Sessions | Timeline | Core Objectives | Practical Steps |

| Pre-conference Preparation | October 1-31 | Define needs + screen target companies | 1. Mark “Investment/Cooperation Requirements” in the Summit APP; 2. Download “Participating Companies Directory” and screen 20 target companies; 3. Prepare PPT with technical advantages (in English, within 10 pages). |

| Matchmaking | November 11-12 | Precise Negotiation + Trust Building | 1. Attend “AI Pharma / Obesity Cure” vertical matchmaking meeting (10am each day); 2. Book 3 1-to-1 meetings (preferred CEO/BD); 3. Attend “Closed-door Salon for Investment and Cooperation” (advance application required). |

| Post-meeting Follow-up | November 13-30 | Promote cooperation + target resources | 1. send thank-you emails (with meeting minutes) within 24 hours; 2. invite target companies to attend online technology demo; 3. appoint local London law firms (e.g., Clifford Chance) to draft a framework agreement for cooperation. |

| Long-term maintenance | December 1 – March 2026 | Deepen Collaboration + Expand Resources | 1. join the “Global Biomedical Co-op Group”; 2. participate in the “Online Follow-up Meeting” in January 2026; 3. recommend companies to participate in the next summit exhibitor cooperation. |

VIII. Conclusion: Seizing the Historic Opportunity of Industry Reinvention – Synergizing Global Pharma & Biotech Summit 2025 and BIO International Convention 2025 Date Location

Summit Summary and Core Value Reaffirmation

Global Pharma and Biotech Summit 2025 is not only an industry conference, but also a platform to witness and participate in the historic transformation of the pharmaceutical and biotechnology industry. Under the theme of “Embracing an industry reset”, the Summit brings together top decision makers, innovation pioneers and thought leaders from around the world to discuss how to achieve sustainable development against the backdrop of technological disruption, regulatory change and market reshaping.

From the AI-driven drug discovery revolution, which is expected to drive 30% of new drug discoveries by 2025 , to the explosive growth of the obesity treatment market, which is expected to grow from $19.6 billion to $104.9 billion, and the mainstreaming of precision medicine, which is expected to reach a market size of $220.68 billion, the trends collectively paint a picture of the industry that is full of opportunities and challenges.

Suggestions for Action and Future Prospects: From Summit Value to Long-Term Industry Paths

I. Phased Action Guide: Practical Solutions to Maximize the Value of the Summit

Based on the feedback from the exhibitors of the 2024 Summit (89% of the exhibitors who realized their intention to cooperate with each other followed the logic of “accurate preparation – efficient participation – closed-loop follow-up”), and in combination with the special features of the 2025 Summit, the following phased action suggestions are formulated:

(I) 30 days before the conference: Anchor the target accurately and make full “orientation preparation”.

- Demand dismantling and target locking

- Clarify core demands: prioritize demands according to “technology cooperation/market expansion/investment layout”, e.g. “seek technical cooperation on AI clinical trial optimization”, “expand the European fertilizer industry”, “expand the European fertilizer industry”, “expand the European fertilizer industry”, “expand the European fertilizer industry”, “expand the European fertilizer industry”, and so on. For example, “seeking AI clinical trial optimization technology cooperation” should prioritize Isomorphic Labs, Medidata, etc., while “expanding the European obesity treatment market” should focus on Novo Nordisk and Eli Lilly Europe;

- Research on the dynamics of target enterprises: through the “Database of Participating Enterprises” on the official website of the summit (including enterprises’ latest product pipelines and cooperation needs), organize the “cooperation points of convergence” of 3-5 core target enterprises (e.g. a Biotech’s AI target discovery technology can complement the R&D shortcomings of pharmaceutical enterprises), and then organize the “cooperation points of convergence” of 3-5 core target enterprises. (e.g. the AI target discovery technology of a biotech can supplement the R&D shortcomings of a pharmaceutical company), and form a 1-page “docking list”;

- Preparation of customized materials: Adjust the focus of PPT for core target enterprises (e.g. highlighting “production capacity demand and quality standard” when docking CDMO enterprises, and “R&D pain points and data support capability” when docking AI companies), and attach 1-2 cases of similar cooperation (e.g. “R&D pain points and data support capability”). Attach 1-2 similar cooperation cases (e.g., “shorten clinical trial cycle by 40% with an AI company”).

- Early activation of summit resources