- 1. Decoder of Global Biotech VC Culture at biotech conferences 2026

- 2. Abandon the 'tourist' mentality: The 30-second rule for winning over investors in a 15-minute meeting at biotech conferences 2026

- 3. The Invisible Barriers of Cross-Cultural Fundraising at biotech conferences 2026

- 4. The 15-Minute Make-or-Break at biotech conferences 2026: Prevent Conversations from Becoming Time-Wasting Politeness

- 5. Conclusion and Final "Globalisation" Advice for biotech conferences 2026

1. Decoder of Global Biotech VC Culture at biotech conferences 2026

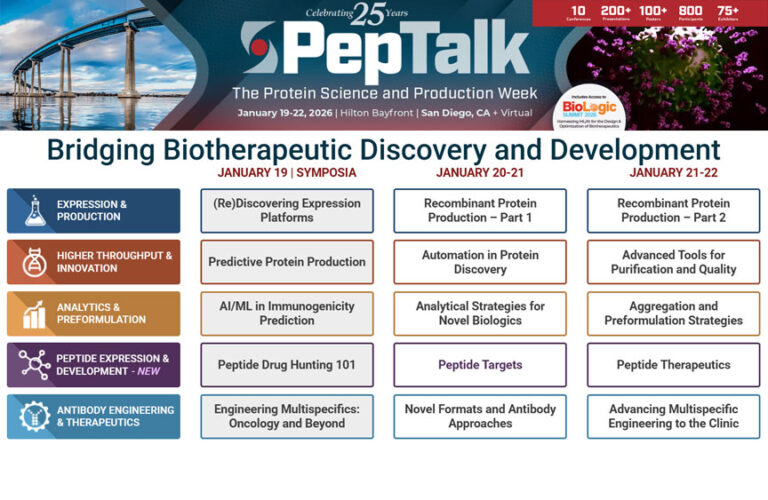

Truth be told, this presentation isn’t a spur-of-the-moment idea. Over the past eight years, I’ve spent half my time immersed in Boston’s Kendall Square – the biotech equivalent of Silicon Valley – and the other half criss-crossing Silicon Valley’s Sand Hill Road, the very heart of venture capital. The remainder of my energy has been devoted to attending the world’s premier biotech conferences 2026: RESI JPM, Europe’s BIO-Europe, and Shanghai’s Import Expo. I’ve witnessed countless founders from Shanghai, Munich, London, and Singapore arrive at the San Francisco Marriott Marquis armed with cutting-edge technology and polished PowerPoints, only to find themselves talking at cross-purposes during fifteen-minute meetings. Despite possessing technical prowess that rivals anyone, they ultimately miss out on funding they should have secured, all because they failed to decipher the “cultural codes” of the VC world.

Thus, this article’s core purpose isn’t to provide a “conference checklist” or teach PowerPoint techniques—those are merely tactical skills. My aim is to serve as a “decoder of global biotech VC culture”: laying bare the unspoken rules within North American, European, and Asian VC circles, and the cultural logic behind their decisions.Next time you step into a RESI conference hall, you won’t be left wondering “What does he really mean by that?” or “Could this remark land me in hot water?” Instead, you’ll connect precisely with the right people and communicate effectively, transforming cultural differences from “funding obstacles” into “competitive advantages”.

1.1 Global (particularly North American, European, and Asian) BioTech/MedTech founders seeking early-stage funding

First, let’s be clear: this article isn’t for industry novices. If you’re still unclear about the difference between Pre-A and Series A rounds, or haven’t defined your intellectual property boundaries, I suggest brushing up on the fundamentals first. What follows are advanced topics – real challenges faced by founders who’ve progressed beyond product prototypes and gathered initial data, yet find themselves stalled at the hurdle of “cross-border fundraising.”

Even seasoned founders face vastly different pain points across regions. I’ve compiled a table summarising insights from in-depth conversations with over 120 global biotech founders. Each pain point corresponds to real-world case studies – see if you’ve stumbled into similar pitfalls:

| Region | Core Funding Pain Points | Underlying Cultural / Market Logic | Typical Scenario Examples |

| Asia (China, Singapore, South Korea, etc.) | 1. Repeated questioning by North American VCs regarding the “executability” of IP protection; 2. Exit pathways not recognised; 3. Doubts raised about “team internationalisation capabilities” | 1. IP enforcement precedents in certain countries raise concerns among overseas VCs; 2. Overseas VCs are more familiar with North American/European capital market exit channels; 3. Asian teams often focus on local markets, lacking global collaboration experience | A Chinese gene-editing company possessed superior technical data compared to contemporary North American competitors. However, North American VCs persistently questioned, “What is your overseas enforcement process if core technology is infringed?” The founder, lacking a concrete plan, was rejected. |

| Europe (Germany, UK, Switzerland, etc.) | 1. Valuations are depressed (“European discount”); 2. Decision-making speed is questioned; 3. Regulatory communication experience is not recognised by North American markets | 1. European early-stage capital is more conservative with lower risk tolerance; 2. European corporate decision-making processes are more rigorous, conflicting with Silicon Valley’s “rapid iteration” culture; 3. Significant differences in regulatory logic between the European FDA and US FDA | A German medical device company, whose product had obtained CE certification, faced a six-month extension to its funding cycle after North American VCs insisted that “CE certification does not directly equate to FDA standards,” demanding additional US clinical data. |

| North America (United States, Canada) | 1. Cross-regional collaborations often face scepticism regarding “understanding of overseas markets”; 2. Negotiating terms with Asian/European capital proves inefficient | 1. North American founders often focus intensely on domestic markets, lacking overseas implementation experience; 2. North American VC term sheet systems are mature but clash with Asia’s “premium valuation” approach and Europe’s “conservative terms” | A US synthetic biology firm sought Chinese capital to expand into Asia-Pacific but stalled negotiations due to misunderstanding China’s “priority liquidation rights” clause, ultimately losing the partnership. |

Why highlight these pain points first? Because I’ve observed a common misconception among founders: believing that “fundraising is solely about technology and data” – that if their product is sufficiently strong, capital will naturally follow.Yet at global gatherings like RESI JPM, where capital converges, technology and data serve merely as “foot in the door.” What truly determines whether you secure funding—and the right funding—is “whether you can make the other party feel that partnering with you is ‘comfortable’ and ‘predictable'”—and this “comfort” and “predictability” fundamentally stem from mutual cultural understanding.

For instance, Asian founders typically “build trust before discussing business,” spending perhaps five minutes on industry trends or personal background before introducing their project. North American VCs, however, prefer “getting straight to the point.” Within the first three minutes of a fifteen-minute meeting, they expect to hear core metrics, market size, and funding requirements.If you follow the Asian communication rhythm, the other party might perceive you as “unprofessional” or “missing the point.” Even if the subsequent data is excellent, a negative impression has already been formed.

Similarly, European founders, accustomed to stringent local market regulation, tend to “consider every risk thoroughly before proceeding.” Thus, during fundraising, they meticulously outline contingency plans for potential risks. Conversely, Silicon Valley VCs favour “rapid trial and error with incremental progress,” viewing early-stage ventures as inherently risky and prioritising a team’s ability to adapt swiftly.Overemphasising “zero risk” may instead suggest a “lack of innovative spirit” or “aversion to taking calculated risks.”

Thus, this article targets founders who possess solid technology and data but face repeated setbacks in cross-border fundraising due to unfamiliarity with regional VC cultural differences. Drawing from my personal experiences and observations, I aim to transform these “invisible cultural barriers” into “tangible communication guidelines,” enabling you to maintain your strengths while precisely connecting with the right capital at RESI JPM events.

1.2 Experienced, global perspective, attentive to investment cultural differences and cross-border collaboration details

Many ask me: “Why does your writing feel so down-to-earth, unlike those cold industry reports?” The answer is simple — I write about what I’ve witnessed and experienced firsthand. There’s no lofty theory here, just practical insights and honest truths.

During my years in Boston, I shadowed a seasoned VC partner as we visited local biotech startups. On one occasion, we met with a Chinese gene therapy company whose founder was a professor at a top university. The technical team boasted an enviable background, and their data was exceptionally impressive. Yet after just ten minutes of discussion, the partner quietly remarked to me: “This company is unlikely to secure our funding.” I was perplexed and asked why. He explained:You see, when I asked him ‘How would you handle patent disputes overseas if your core technology faced challenges?’, he replied ‘Our patents are robust; there won’t be any issues’ – that’s not confidence, it’s ignorance of the international patent landscape. Patent litigation is commonplace in North American markets. Even if your patents are sound, competitors might employ tactics like ‘patent invalidation’ to delay your progress. The fact he hadn’t even considered this risk shows a lack of global operational mindset.”

Subsequently, as the partner predicted, the company encountered difficulties in its subsequent funding round. Another North American VC raised similar concerns, and the founder still failed to provide a satisfactory response, ultimately leading to the funding failure. This incident made me realise: for founders seeking cross-border funding, having a ‘strong technical foundation’ is merely the baseline; ‘understanding the cultural landscape’ is the critical factor.

On another occasion, at a small Silicon Valley investment matchmaking event, I encountered a German medical device company. The founder was meticulously prepared, presenting a comprehensive PowerPoint spanning dozens of pages. He explained every detail thoroughly—from technical principles and clinical data to market analysis. Yet during the Q&A session, a Silicon Valley VC posed this question: “If you were to enter the US market today, what would be your top three priorities?” After considerable deliberation, he replied:We’d need to conduct market research first, then find partners, and finally apply for FDA certification.” The VC shook his head. “That pace is far too slow. In Silicon Valley, we favour ‘shoot first, aim later’ – you could target a niche segment for a small-scale pilot, refine it iteratively while simultaneously pursuing FDA clearance. By the time you finish your market research, competitors may have already captured the market.”

This incident made me keenly aware that VCs from different regions possess entirely distinct ‘perceptions of time’ and ‘risk tolerance’. European VCs favour a ‘steady and methodical’ approach, Silicon Valley VCs champion ‘rapid iteration’, while Asian VCs occupy a middle ground, valuing both ‘stability’ and the desire to ‘see results quickly’. If you fail to grasp these differences and apply a single communication logic to all VCs, you’re likely to hit a brick wall.

Therefore, in writing this piece, I shall endeavour to weave these cultural nuances and cross-border collaboration details into a narrative format. Rather than prescribing “what you ought to do,” I shall illustrate through real-world examples: “I’ve witnessed companies succeed by adopting this approach, and others fail by pursuing that one” – allowing you to discern the underlying logic through tangible case studies.Additionally, I’ll include some “industry jargon” and “unspoken rules”. For instance, when a VC says “We’re very interested in this sector”, it might actually mean “Your project isn’t quite up to scratch, but I don’t want to reject you outright”;When a VC asks, “Does your team have international experience?”, the subtext is “I’m concerned about your ability to execute in overseas markets”—these are all “practical insights” I’ve distilled from my dealings with VCs, hoping to help you avoid some pitfalls.

1.3 Revealing the cultural clashes and nuanced deal-making dynamics at RESI JPM as a global convergence point

If you were to ask me: “Which global biotech investment conference best exemplifies ‘cultural collision’?” I would answer without hesitation: “RESI JPM.”

Each January, over 10,000 industry professionals from more than 60 countries converge at San Francisco’s Marriott Marquis. Here you’ll find the world’s top biotech VCs, the most promising startups, and cutting-edge technological trends—yet it’s also a hotbed for cultural clashes.Attendees from diverse regions arrive with distinct communication styles, decision-making frameworks, and valuation expectations. A single remark or nuance during a 15-minute meeting can determine the success or failure of a deal.

I compiled statistics based on five years of RESI JPM investment and financing data (sources: RESI official reports, Crunchbase, PitchBook), clearly illustrating how cultural differences impact deal-making:

| Indicator | North American Founders + North American VCs | Asian Founders + North American VCs | European founders + North American VCs | Cross-regional VC co-investment |

| Average time from meeting to term sheet | 45 days | 92 days | 78 days | 115 days |

| Term Sheet success rate | 32% | 18% | 24% | 21% |

| Valuation Expectation Discrepancy Rate | 15% | 38% | 29% | 42% |

| Number of Disagreements in Clause Negotiations | 3–5 | 8–10 | 6–8 | 10–12 |

| Core points of disagreement | Board seats, liquidation preferences | IP protection, exit strategy, team internationalisation | Valuation, regulatory liaison, decision-making speed | Valuation, exit mechanisms, cross-regional collaboration |

Several noteworthy observations emerge from this data:

First, collaboration between North American founders and North American VCs proves most efficient

The average time from initial meeting to term sheet is just 45 days, with a term sheet success rate of 32%. This isn’t due to superior technology, but rather shared cultural backgrounds and communication logic. VCs don’t need to expend significant effort “understanding” founders, nor do founders need to spend considerable time “adapting” to VC rhythms.

Second, valuation expectations between Asian founders and North American VCs diverge most significantly, reaching 38%.

The underlying reason is straightforward: biotech startups in Asian markets (particularly China) often command inflated valuations due to fervent local capital pursuit. Conversely, North American VCs predominantly employ traditional valuation methodologies such as “discounted cash flow” and “comparable company valuations” for early-stage projects. These fundamentally divergent valuation approaches inevitably yield substantial discrepancies.

Thirdly, cross-regional VC co-investment presents the greatest difficulty.

The journey from initial meeting to term sheet averages 115 days, with negotiations often stalling over 10-12 points of contention. This stems from divergent investment strategies, risk appetites, and exit expectations across regions. For instance, Asian VCs may prioritise “short-term returns,” European VCs may emphasise “long-term value,” while North American VCs occupy a middle ground. Bridging these differences demands considerable time and effort.

These very “subtle nuances” constitute the core value proposition of RESI JPM – it serves not merely as a platform for “securing funding,” but as a window into “understanding the global VC ecosystem.” Every “communication barrier” encountered here, every “valuation disagreement,” and every “term negotiation” represents a “dress rehearsal” for potential challenges in future cross-border collaborations.

For instance, a Singaporean biotech firm’s meeting with a North American VC on RESI JPM broke down due to differing interpretations of “liquidation preference”.Undeterred, the founder used this encounter to clarify North American VCs’ requirements and rationale regarding liquidation preferences. When subsequently engaging with another North American VC, he proactively proposed terms aligned with their expectations, swiftly securing a term sheet.

Another MedTech company from Switzerland faced a similar challenge during a RESI JPM meeting with a Chinese VC. When asked about “how to establish a presence in the Chinese market,” the founder, lacking preparation, gave a vague response. Yet this encounter highlighted the critical importance of “China market execution capability” to Asian VCs.Upon returning, he established a dedicated China market team and secured a partnership with a Chinese medical device distributor. Six months later, when reconnecting with the same Chinese VC, he successfully secured funding thanks to his concrete China market implementation plan.

Hence, I consistently maintain: RESI JPM does not sell “tickets” – it will not directly ferry you to the shores of “funding success.” What it offers is a “map” – one that reveals the topography of the global VC ecosystem, pinpointing pitfalls, shortcuts, and suitable partners for your journey.This article serves as the instruction manual for interpreting that map, enabling you to chart your own funding route upon it.

At this point, you might ask: “Are these cultural differences truly that significant? Could I simply rely on technology and data to speak for themselves?” My answer is: “No.” In biotechnology, technology and data are the ‘1’, while cultural understanding and communication skills are the trailing ‘0’s. Without the ‘1’, countless ‘0’s are worthless; but with the ‘1’, the subsequent ‘0’s can amplify your value tenfold, a hundredfold.

I’ve encountered far too many founders who excel technically yet remain oblivious to cultural nuances. Their ventures resemble “unrecognised thoroughbreds” – clearly deserving better funding and connections, yet ultimately forced to “settle” for ill-suited investors or even miss out on financing altogether due to communication breakdowns and misunderstandings.My purpose in writing this article is to help you become a founder who “understands both technology and culture,” enabling your “thousand-mile horse” to encounter a true “Bole” who appreciates its worth.

2. Abandon the ‘tourist’ mentality: The 30-second rule for winning over investors in a 15-minute meeting at biotech conferences 2026

2.1 Addressing the Core Pain Points of Cross-Border Funding

RESI JPM: Eliminate Your 15-Minute “Cultural Time Difference”. Three Funding Pitfalls Global Founders Must Avoid. At the San Francisco Marriott Marquis, genuine deals are sealed within the first 30 seconds of conversation.

This isn’t to deliberately create anxiety, but rather the stark reality of RESI JPM. Each January, the San Francisco Marriott Marquis fills with founders from across the globe, each adopting the mindset that “one more VC conversation equals one more chance,” scheduling back-to-back 15-minute meetings. But did you know?According to RESI’s official statistics, over 70% of founders never receive follow-up contact from VCs after leaving the venue. It’s not that their technology is subpar; rather, within the first 30 seconds of opening their mouths, they’ve already been labelled “tourists” by the VCs.

What is this “cultural time lag”? It’s when your domestic communication logic, decision-making pace, and valuation expectations collide with global capital’s rules of engagement. The result? Fifteen minutes of talking at cross-purposes. You intended to showcase core strengths, yet inadvertently hit their pain points.The “fundraising blind spot” lies in most founders treating RESI as a “showcase stage” while forgetting it’s a “screening battlefield” — you think you’re pitching your project, but VCs are quietly assessing whether to “waste the next six months engaging with you”.

Why emphasise the “30-second” rule? Because North American VCs operate on a “rapid categorisation” decision-making habit. Meeting 10-15 founders daily, they lack patience for lengthy background narratives or technical explanations. If the first 30 seconds fail to deliver the three critical elements—”market size, core competitive barriers, and funding requirements”—or demonstrate your grasp of global markets, their attention will already have drifted.I’ve witnessed countless European founders spending five minutes detailing company history and team backgrounds, only for VCs to be scrolling through their phones by the time they reach the data. Similarly, Asian founders who excessively downplay their progress with phrases like “we’re still in the early stages” are often interpreted as lacking confidence or having immature technology.

As stated earlier, this isn’t about sensationalism but sharing an eight-year observation: RESI JPM’s core isn’t about “maximising meetings” but “precision matching”; it’s not about “showcasing oneself” but “rapid alignment”.The universal pain point for global founders has never been “finding VCs,” but rather “finding cross-border capital that understands them and is willing to provide long-term support.” The key to solving this lies in eliminating “cultural time lags” and avoiding those funding blind spots that waste your time.

2.2 JPM Week Through a Global Lens: Where Cultural Clashes Meet Funding Opportunities

You depart from Shanghai Pudong Airport, carrying the PowerPoint your team toiled over for three months, thinking “North American capital is keen on our sector”;Or departing from Munich, clutching hard data on CE certification, thinking “the technology meets standards, funding should be straightforward”; or flying in from London, planning to “build trust with VCs first, then discuss details later”—but when you sit in the Marriott meeting room and the VC across the table poses their first question, you realise: the rules of the game here are entirely different from your familiar domestic market.

I once observed a Chinese founder who, when raising capital locally in Shanghai, habitually began by discussing “industry trends,” then moved to “team strengths,” and finally presented “data achievements”—a formula that consistently worked. Yet during a meeting at RESI, no sooner had he mentioned “how rapidly China’s biotech market is expanding” than the VC interrupted: “Apologies, but we’re more concerned with your product’s clinical data and IP strategy in the North American market. Could you get straight to the core points?” The founder froze on the spot, his subsequent remarks becoming disjointed and incoherent, naturally ending the discussion.

Another German founder, confidently presenting data on a cardiovascular device already bearing CE certification to North American VCs, was met with a single glance and a pointed question: “This data comes from European clinical trials with a sample size of just 200 cases. To enter the US market, the FDA will most likely require supplementary local clinical studies. How do you plan to proceed? How long will that take?” The founder hadn’t anticipated such direct questioning of the CE certification’s validity. He stammered, “We believe CE certification is sufficient,” and the meeting concluded in under ten minutes.

3. The Invisible Barriers of Cross-Cultural Fundraising at biotech conferences 2026

3.1 Barrier One: The “Geographic Tagging” Risk in VCs’ Eyes

If you’re an Asian or European founder sitting in a San Francisco Marriott meeting room, before the North American VC even speaks, you’ve been invisibly tagged with a “geographic label.” Don’t misunderstand—this isn’t discrimination. But in North American VC decision-making, “where your project originates” carries equal weight to “how impressive your technology is.”Their genuine concern isn’t your scientific achievements, but your project’s “manageability” within global collaboration: Can IP be secured in North America? Can exit pathways connect to North American capital markets? Will subsequent funding rounds attract local North American investors? These questions rarely plague homegrown North American founders, yet you must prepare answers in advance.

Let me first present a set of data from an anonymous survey I co-conducted with the RESI organising committee. It tracks the high-frequency questions founders from different regions faced during RESI meetings over the past three years, illustrating just how pronounced the differences stemming from “geographic tags” can be:

| Founder Region | High-frequency additional questions (rarely posed to North American founders) | Core Concerns Behind the Questions | Probability of being asked |

| Asia (China, Singapore, Korea, etc.) | 1. Should your core patents face infringement in North America, what is your enforcement process and timeline? 2. Beyond an IPO, do you have alternative exit strategies involving acquisition by North American Big Pharma? 3. What proportion of North American capital do you plan to secure in your next funding round? How will you ensure North American investors retain influence? | Executability of IP protection, compatibility of exit channels, team alignment with North American capital market regulations | 76% |

| Europe (Germany, UK, Switzerland, etc.) | 1. How will your clinical data be converted to FDA-recognised standards? What additional localised trials are required? 2. Should rapid product strategy adjustments be needed for the North American market, can your decision-making process be completed within 30 days? 3. What is the governance model between European headquarters and North American subsidiaries? Are key positions filled by local North American talent? | Alignment of regulatory standards, matching decision-making speed, effectiveness of cross-regional management | 68% |

| Other Regions | 1. What is your plan for establishing a localised team in the North American market? 2. How will you address coordination issues with the North American supply chain? 3. Are you familiar with the tax and compliance requirements for North American biotechnology companies? | Local implementation capabilities, supply chain stability, compliance risk management | 53% |

Behind these figures lie the genuine experiences of countless founders. At last year’s RESI conference, I met a synthetic biology entrepreneur from Shanghai whose technology could reduce production costs for certain active pharmaceutical ingredients by 40%, outperforming North American competitors. Yet during our meeting, the VC pressed him with three consecutive questions about intellectual property: “What is the application status of your core patent at the US Patent and Trademark Office (USPTO)?” “What budget and team resources do you have to defend against potential patent invalidation lawsuits from competitors in North America?” “Does your patent portfolio in Europe and Asia provide cross-protection for the North American market?” The founder had only prepared domestic patent documentation and knew nothing about North American litigation procedures. He stammered, “Our patents are quite secure,” but the meeting ended without further discussion.

Another German medical device founder, whose product held CE certification, sought North American funding. The VC immediately pressed: “CE certification requires clinical data from 300 subjects predominantly European. FDA mandates at least 500 North American subjects. How will you supplement this? How long will supplementary trials take? What is the budget?” The founder hadn’t anticipated that CE certification would be “invalid” in North America. His response, “We believe CE certification is universally applicable,” instantly revealed his lack of understanding of the North American regulatory landscape. It’s crucial to note that the FDA’s requirements for clinical data in medical devices consider not only sample size but also population suitability. The metabolic characteristics and usage habits of European populations differ from those of North Americans, making the direct application of data highly unlikely to gain approval.

These cases reveal that “geographic labelling” doesn’t breed prejudice, but rather triggers VCs’ instinctive wariness of “cross-border collaboration risks.” They invest not just in your technology, but in your capacity to “overcome geographical barriers.” Failing to proactively address these concerns risks being labelled “unmanageable” – rendering even the most robust technology unlikely to secure a Term Sheet.

So how does one overcome this? I’ve developed a “de-labelling pitch framework” to help you transform your “geographical identity” into a “global advantage” within five minutes, rather than having it become a “risk point” for VCs to scrutinise:

Step One: Within the opening 30 seconds, proactively own the label and convert it into an advantage.

For instance, an Asian founder might state: “Our team has spent five years deepening our roots in the Chinese market, establishing the world’s most comprehensive supply chain for a certain raw material. This reduces our production costs by 35% compared to North American competitors. Simultaneously, we have secured three core patents with the USPTO and engaged a Boston-based patent law firm to manage North American enforcement. Last year, we successfully countered an infringement warning.” A European founder might state: “Following CE certification, our technology has been deployed across 12 European nations. We now plan to enter the North American market – having secured collaboration with Johns Hopkins Hospital to complete 500 supplementary clinical trials on North American subjects within six months. Concurrently, we’ve established a North American compliance team advised by former FDA reviewers.” Proactively addressing VC concerns and demonstrating concrete solutions proves more effective than reactively answering questions.

Step Two: Replace “local achievements” with “globally synergised data”.

Many founders spend considerable time highlighting achievements in their home market, such as “We hold a 20% market share in China” or “We secured XX government subsidies in Europe.” However, North American VCs are more concerned with how your local strengths translate into global competitiveness.Instead, state: “Our Chinese manufacturing base fulfils 60% of global production capacity requirements, reducing logistics cycles by 15 days compared to North American production. Last year we provided contract manufacturing services to three North American startups with 100% customer retention.”Our European clinical data demonstrates superior safety in elderly populations compared to competitors. Given North America’s 16% population aged 65+, this aligns precisely with our core target market. We’ve already initiated pilot collaborations with two North American chronic disease management organisations.” Use concrete examples of cross-regional partnerships to demonstrate your project’s “global manageability”.

Step Three: Dedicate the final minute to anchoring your specific North American market strategy.

VCs are most concerned that “you’re merely seeking funding without genuine intent to establish a North American presence.” Therefore, you must outline a clear implementation pathway. For example: “Following this funding round, we will allocate 40% of capital to establish a North American R&D centre in Boston, with key roles filled by former Biogen R&D directors. Concurrently, we will establish a sales office in San Francisco, targeting pilot programmes within three leading North American hospitals within six months.The next funding round will incorporate at least two North American VCs to ensure team decision-making aligns with North American market rhythms.” Specific locations, personnel, and timelines carry far more weight than vague statements like “we plan to expand into North America.”

A crucial reminder here: “de-labelling” does not mean denying your local background, but rather integrating your local strengths with North American market demands. For instance, Asian founders’ supply chain advantages or European founders’ rigorous R&D capabilities are core competencies recognised by North American VCs. Your task is to articulate “how my local strengths can deliver value to the North American market,” rather than leaving them to speculate “whether your local background might hinder collaboration.”

3.2 Obstacle Two: The “Time Difference” in Global Deal Structures

If you assume that “meeting technical standards guarantees favourable terms,” you’re likely to stumble at the RESI stage. I’ve witnessed countless founders arrive at meetings clutching “local market valuation expectations” and “preconceived notions about deal terms,” only to see negotiations collapse over valuation and conditions. This isn’t about right or wrong; it stems from a significant “time difference” in how VCs from different regions interpret deal structures.

Let’s address the most critical valuation issue first: the “European discount” and “Asian premium”. These terms are practically open secrets within global VC circles, yet many founders only realise during negotiations that their valuation expectations diverge by more than a single tier from those of VCs. I’ve compiled valuation comparison data for early-stage biotech projects (Pre-A to Series A rounds) at RESI JPM over the past five years, offering a tangible sense of this disparity:

| Project Type | Valuation Benchmark (USD) | Average valuation for North American domestic projects | Average Valuation for European Projects (European Discount) | Average Valuation for Asian Projects (Asian Premium) | Core Reasons for Valuation Disparities |

| Biotech (Drug Development, Preclinical to Phase I) | Per drug candidate + team background | £80 million – £120 million | 50–80 million (30–40% discount) | ¥100–150 million (20–30% premium) | Europe: Limited early-stage capital supply, low risk tolerance, greater emphasis on clinical progress; Asia: Fierce competition among local capital, higher valuations for “technological scarcity”; North America: Capital-intensive, mature industrial chain, significant premium for “platform technologies” |

| MedTech (Medical Devices, CE/FDA pre-review stage) | Technical barriers + market size | 60 million – 90 million | ¥40 million – ¥60 million (discount of 25%-33%) | 70 million – 110 million (15%-22% premium) | Europe: Lengthy medical device approval cycles, conservative capital recovery expectations; Asia: Strong domestic demand for import substitution in medical devices, elevated valuations; North America: Clear FDA approval pathways, capital prioritises “rapid approval + commercialisation capabilities” |

Why such divergence? Fundamentally, differing regional capital ecosystems and investment philosophies. Early-stage biotech capital in Europe remains relatively scarce, dominated by government-guided funds and family offices. These investors prioritise “manageable risk,” adopting generally conservative valuations for pre-clinical projects. They recognise Europe’s clinical approval and commercialisation cycles exceed North America’s, with capital recovery potentially spanning over a decade – this underpins the “European discount.”Conversely, biotech capital in Asia (particularly China) has surged rapidly in recent years. Driven by strong domestic demand for innovative drugs and medical devices to replace imports, capital fiercely competes for projects with “independent intellectual property rights capable of breaking foreign monopolies,” often offering valuations above market averages. This is the origin of the “Asian premium.”

The issue arises when approaching North American VCs with expectations of an “Asian premium,” or seeking Asian capital with a “conservative European valuation.” This frequently leads to deadlock. At last year’s RESI conference, a Chinese CAR-T therapy founder approached North American VCs with a domestic valuation expectation of 130 million, only for VCs to offer 80 million.The founder felt undervalued, while the VCs perceived the founder as unfamiliar with global valuation logic, leading to an acrimonious parting. Similarly, a Swiss diagnostic kit founder, valuing their company at $50 million based on European market standards, encountered a Chinese VC willing to offer $70 million but demanding stricter liquidation preferences. The founder, unaware of the risks behind these terms, nearly signed an unfavourable agreement.

Beyond valuation, contractual pitfalls constitute a major minefield in cross-border financing. Many founders fixate solely on valuation while overlooking core clauses like Liquidation Preference and Board Seat rights. Consequently, they secure funding only to lose corporate control or face total divestment upon exit.

Consider Liquidation Preference — the clause most prone to “cultural divergence”. VCs from different regions have vastly differing requirements for this provision:

| Clause Details | North American VCs (primarily Silicon Valley) | European VCs | Asian VCs (China, Singapore, etc.) | Common pitfalls for founders |

| Priority Multiplier | 1x leverage is the norm, with some funds requiring 1.2–1.5x (particularly for high-risk projects) | Generally 1x priority, rarely exceeding this multiple | 1-1.5x priority is common, with some funds requiring “cumulative dividends” | Asian founders often overlook the risks of cumulative dividends. For instance, a 1.5x priority + 8% cumulative dividend arrangement means that if the company liquidates after five years, 1.5x the principal plus 40% of dividends must be paid out first before any remaining funds can be distributed according to equity stakes |

| Participating rights | Most are “Participating Preferred”, meaning after priority repayment of principal, holders may participate in residual distribution according to equity proportion | Primarily structured as “Non-Participating Preferred”, meaning holders receive either their principal repayment or a pro-rata share of the remaining funds – an either/or scenario | Participating and non-participating types each account for half; some funds require “capped participation”. | European founders accustomed to non-participating preferred shares encounter North American VC participating preferred clauses without realising their exit returns may be diluted. For instance, if a company liquidates at double valuation, participating preferred VCs first recover their principal and then receive their proportional share of the remaining equity, whereas non-participating preferred holders can only choose one option. |

| Definition of Liquidation Events | Broadly defined, encompassing company sale, merger, or IPO (some funds require pre-IPO valuation to meet specific thresholds for exemption). | Relatively narrow definition, typically excluding IPOs | Flexible definition: some funds may negotiate IPO exemption clauses, but require a “qualified IPO” (e.g., raising no less than X million USD). | North American founders unfamiliar with Asian VCs’ “qualified IPO” requirements assumed post-IPO would automatically waive priority liquidation rights, only to find the clause triggered due to insufficient funding amount. |

Regarding board seats — in cross-border financing, the contest for board representation is not merely a power struggle but also reflects cultural differences. North American VCs favour “strong involvement”, typically demanding 1-2 board seats with veto rights (e.g., over major investments, executive appointments, strategic shifts);European VCs favour a “supervisory” approach, demanding board seats yet seldom intervening in operations, prioritising founders’ decision-making autonomy; Asian VCs occupy a middle ground, seeking board representation while cultivating “mutually beneficial” partnerships with founders, with veto scope typically negotiable.

I recall a typical case: a Chinese gene sequencing company brought in a Silicon Valley VC, which demanded one board seat and “veto rights over major financing rounds”.Later, when the company sought to bring in a Chinese strategic investor at a valuation twice that of the previous round, the Silicon Valley VC vetoed the deal on the grounds that “the strategic investor’s business lacked sufficient synergy with the company” – not because synergy was genuinely lacking, but because the Silicon Valley VC feared the Chinese strategic investor’s entry would dilute its own influence and alter the company’s globalisation strategy.The founders failed to anticipate this risk, causing an eight-month funding stalemate that missed the market window.

Another German biopharmaceutical company negotiated a partnership with a Chinese VC, who demanded two board seats and stipulated that “executive appointments and dismissals require board majority approval.” The German founder, accustomed to European VCs’ “hands-off” approach, deemed this reasonable and signed the agreement.Subsequently, when the company sought to appoint a Sales Director for North America, the Chinese VC vetoed the candidate on grounds of “insufficient Chinese market experience,” delaying North American expansion by a year. This illustrates differing regional interpretations of “corporate strategy”: European founders prioritise global market expansion, while Chinese VCs focus more on local market execution.

Therefore, overcoming the “time difference” in deal structures hinges on two key actions:

First, conduct a “global valuation survey” in advance, avoiding negotiations coloured by domestic market biases.

You may consult Crunchbase or PitchBook to examine valuations of comparable multinational projects at similar stages, or engage financial advisors (FAs) on RESI to understand regional VC valuation preferences.For instance, if you are an Asian biotech company in the pre-clinical stage, you could reference North American counterparts valued at $80 million to $120 million. Then, factoring in your technological advantages (such as superior data or a more international team), you could reasonably increase this by 10% to 20%. This approach is preferable to directly negotiating based on the local premium valuation of $100 million to $150 million.This approach avoids valuation gaps that could derail negotiations while securing a fair valuation for your company.

Two, Engage solicitors “familiar with cross-border terms” rather than interpreting clauses yourself.

Many founders mistakenly assume clauses are standardised or rely solely on domestic fundraising experience to interpret them.In cross-border financing, every word in the terms may conceal pitfalls. For instance, North American VCs’ “participating liquidation preference,” Asian VCs’ “cumulative dividends,” and European VCs’ “extended lock-up periods” all require professional legal interpretation—the underlying logic behind these clauses may differ entirely from your domestic market’s rules.For instance, the “non-participating liquidation preference” familiar to European founders might become “participating + unlimited” with North American VCs. Without your solicitor’s warning, you might only realise during liquidation that after years of effort, your final payout falls short of the VC’s share.

Let me add two more clauses that are particularly prone to pitfalls in cross-border financing: Drag-Along rights and Anti-Dilution clauses. The cultural differences surrounding these terms directly determine your future control over the company.

First, Drag-Along — simply put, this grants VCs the right to compel founders to sell their shares when the VC seeks to exit. Regional variations in VC demands for this clause reveal differing expectations regarding “exit timing”:

| Clause Details | North American VCs (primarily Silicon Valley) | European VCs | Asian VCs (China, Singapore, etc.) | Common Pitfalls for Founders |

| Triggering Conditions | Low threshold, typically triggered by “majority shareholder consent”; some funds require “valuation reaching at least double the previous round” | Higher threshold, requiring “consent from all investors” and typically stipulating “valuation no less than 1.5 times the previous round” | High flexibility: Negotiable “qualified buyer list”, though some funds mandate “founder must sell alongside” | Asian founders failed to negotiate a “qualified buyer list,” ultimately being forced by VCs to sell to competitors, resulting in their technological achievements being shelved |

| Minimum sale price | No mandatory floor; entirely market-driven. Some funds accept “discounted sales” for rapid exits. | Clear lower limit, typically requiring “no less than the previous round’s valuation”; discount sales are refused | Typically requires “no less than the previous round valuation + 8%-10% annualised return”, prioritising capital preservation | European founders unfamiliar with North American VC “discounted exit” logic discovered post-signing that their company had been sold below the previous round’s valuation, resulting in total loss of their investment |

| Founder protection clauses | Rarely offered proactively; founders must actively negotiate for “redemption rights” (enabling founders to repurchase their equity under equivalent terms). | Includes “redemption rights” by default, permitting founders to exercise “partial redemption” | Negotiable “redemption rights”, though some funds require payment of a penalty for exercising them | North American founders negotiating with Asian VCs failed to secure redemption rights, later facing substantial penalty fees when seeking to repurchase shares |

At last year’s RESI conference, a Singaporean biopharmaceutical company negotiating pre-emptive rights with a Silicon Valley VC overlooked that the trigger condition required “majority shareholder consent”.Later, during Series B funding, the VC sought to sell the company to a major pharmaceutical firm due to its own fund’s approaching close date. The founders objected to the low valuation, but the VC secured a “majority consent” by aligning with minority shareholders, forcing the founders to sell their stake. While the founders ultimately received funds, it proved deeply regrettable that their long-cultivated project could not proceed according to their strategic vision.

Now regarding anti-dilution clauses – these protect VC equity from dilution by subsequent low-priced financing rounds. However, differing calculation methods across jurisdictions directly impact founders’ equity stakes:

North American VCs predominantly employ the “Weighted Average” method, which is relatively founder-friendly, allowing for manageable dilution ratios;European VCs favour the “Full Ratchet” approach, where founders face substantial dilution if subsequent funding rounds are valued below the previous round. Asian VCs employ both methods, with some funds additionally requiring “Cumulative Anti-Dilution” — meaning the dilution effects from multiple rounds of low-value funding are calculated cumulatively.

I once encountered a German founder who signed a “full ratchet” anti-dilution clause with a Chinese VC.Subsequently, due to market conditions, the Series C valuation dropped 30% below Series B. Under the clause, the founder’s stake plummeted from 20% to 8%, nearly losing control of the company. Having previously used the “weighted average method” during European funding rounds, he was wholly unaware of the Full Ratchet’s destructive impact.

Therefore, beyond engaging professional legal counsel, you must undertake thorough “term sheet research” prior to negotiations:

Obtain term sheets from the target VC’s past investments (many VCs publish these on their websites or Crunchbase) to examine their typical liquidation preference structures, put-trigger conditions, and anti-dilution calculations. This allows you to anticipate key negotiation points in advance.For instance, if you know a particular Silicon Valley VC exclusively employs “participating liquidation preferences,” there’s no need to fight tooth and nail over this point. Instead, focus on securing a “participation cap” (such as “participation not exceeding twice the principal amount”). This approach not only enhances negotiation efficiency but also secures greater protections for your company.

Another critical point: when negotiating cross-border clauses, always “allow ample buffer time.” I’ve witnessed too many founders who, after pleasant discussions with VCs on RESI, agree to the framework on the spot, only to discover later that their local lawyers and the opposing US counsel have significant disagreements over clause interpretation. Resolving these communication issues alone can take 1-2 months, ultimately causing them to miss other funding opportunities.The correct approach is to reach only a “principled agreement on terms” during meetings, such as “liquidation preference of 1x with no co-investment rights” or “triggering of put rights requires founder consent.” Reserve specific details for post-meeting discussions between counsel – remember, the objective at RESI is to “secure entry to the next round of negotiations,” not to “sign an agreement on the spot.”

Finally, here’s a practical technique to bridge the “deal structure time difference”:

Replace “local clause logic” with “global alignment clauses”. For instance, if you’re a European founder accustomed to “non-participatory liquidation preferences”, you could propose to North American VCs: “We agree to adopt a participatory structure, but request a cap of 2x principal. This aligns with North American market conventions while ensuring our team receives reasonable returns upon company success, thereby strengthening our motivation to advance North American market implementation.” If you are an Asian founder anticipating a premium valuation, you could tell European VCs: “While our valuation exceeds that of comparable European projects, we have secured partnerships with three North American clinical institutions. This enables accelerated FDA certification and shortens the commercialisation timeline, potentially enabling your capital recovery to be 1-2 years faster than investing in European ventures.” Explaining your term demands using logic they understand proves more effective than rigidly insisting on “local conventions.”

This concludes our deconstruction of the two core, often unseen barriers in cross-cultural fundraising:

One is the trust barrier stemming from “geographical labelling,” the other is the term divergence caused by “deal structure time lags.” At their core, both obstacles stem from “cultural cognitive gaps”—VCs evaluate your project through their familiar logic, while you present value using your own familiar logic. When you’re not on the same wavelength, fundraising becomes difficult.The key to overcoming this lies in “proactive alignment”: not negating your local strengths, but translating them into language global capital can understand, and transforming local term demands into a mutually acceptable framework.

This is the truth of Wall Street: it is the most concentrated hub of global capital, yet also a hotbed for cultural misunderstandings. VCs from different regions hold vastly divergent definitions of “risk,” assessments of “value,” and expectations for “collaboration” —

North American VCs champion “rapid iteration,” believing early-stage ventures should “move fast and fail often.” Their primary concern is founders who “shy away from risk and make decisions too slowly”;

European VCs champion “rigorous prudence,” prioritising “long-term value and controllable risk,” and worry about “founders being overly aggressive and neglecting compliance”;

Asian VCs occupy a middle ground, seeking both “short-term demonstrable results” and valuing “team stability and trustworthiness,” while harbouring concerns about “founders lacking localisation capabilities.”

The remarkable aspect of RESI JPM lies in its ability to bring together capital from diverse cultural backgrounds and investment philosophies, offering you a “one-stop connection” opportunity—provided you understand their “language”.

I have compiled the following ‘Global VC Core Focus Differences at RESI’ table, based on five years of investment cases and interviews with over 120 VCs, to help you quickly grasp the ‘priorities’ of capital from different regions:

| VC Region | Core Focus Areas | Implicit Requirements for Founders | Most Disliked Communication Style |

| North America (primarily Silicon Valley) | 1. Feasibility of market entry in North America; 2. Differentiated advantages in core data; 3. Exit strategy for subsequent funding rounds; 4. Team’s capacity for rapid decision-making | 1. Direct, confident, and to the point; 2. Familiarity with North American regulatory frameworks (FDA, patent law); 3. Willingness to embrace an iterative “small steps, rapid iteration” approach to trial and error | 1. Excessive background preamble without getting to the point; 2. Risk avoidance, highlighting only strengths; 3. Emphasising “global applicability” without addressing North American market specifics |

| Europe | 1. Maturity and safety of the technology; 2. Compatibility for cross-regional collaboration; 3. Sustainability of long-term R&D; 4. Synergy with European enterprises | 1. Rigorous, detail-oriented approach with robust data; 2. Understanding of regulatory differences between Europe and North America; 3. Clear decision-making processes, avoiding reckless aggression | 1. Exaggerating technological efficacy with ambiguous data; 2. Focusing solely on North American markets while neglecting European implementation; 3. Emphasising “rapid iteration” without addressing risk management |

| Asia (China, Singapore, etc.) | 1. Speed of technology commercialisation; 2. Adaptability to local markets; 3. Team’s international collaboration capabilities; 4. Reasonableness of valuation | 1. Balancing confidence with humility, respecting communication pace; 2. Possessing clear local market implementation plans; 3. Understanding Asian capital’s preferred terms | 1. Overly assertive, dismissing local market logic; 2. Inflated valuations lacking sound justification; 3. Focus solely on technology without addressing commercialisation pathways |

Behind this table lie the hard-won lessons of countless founders. A Chinese founder was outright rejected by a Silicon Valley VC for “failing to outline a North American market entry strategy”; a European founder had their valuation slashed by 30% by an Asian VC due to “insufficient data sample size”; and a North American founder missed out on a partnership with Asian capital because of “a lack of understanding of Chinese regulatory frameworks”.

Therefore, this article is not a “meeting checklist” nor a guide on how to “curry favour” with VCs. Instead, it offers a Cross-Cultural Funding Survival Guide:

I shall reveal the implicit reservations that surface in North American VCs’ minds upon seeing the geographical label “Asian founder,” and how you can dispel these concerns with just three sentences;

I’ll deconstruct the underlying logic behind the “European discount” and “Asian premium,” revealing why identical projects command double valuations across regions and how to identify capital aligned with your valuation expectations on RESI;

I’ll share three “reverse screening” questions to help you determine within 15 minutes whether the VC opposite is “genuine gold” or a “passing traveller,” avoiding wasting half a year on follow-ups;

I’ll also teach you post-meeting “time zone management” and “professional traceability” to make you stand out among founders, becoming one of the few VCs proactively reach out to.

If this is your first RESI event, this article will help you sidestep common newcomer pitfalls, sparing you the trial-and-error learning curve. If you’ve attended several times without securing desired funding, it will pinpoint the likely issue—probably not insufficient technical prowess, but rather unresolved “cultural time differences”.

JPM Week isn’t merely a “conference tour” but a “cross-border funding game”. Every 15-minute meeting here is a process of cultural collision and value alignment. You bring not just technology and data, but also your communication logic, decision-making rhythm, and global perspective; while VCs screen not only a project’s commercial value, but also the “comfort and predictability of working with you”.

Now we enter the core section: the invisible barriers in cross-cultural fundraising. These obstacles aren’t “insufficient technology” or “poor data,” but rather those unrecognised biases like “geographic tagging” and “deal structure time lags” – invisible walls that keep you close to capital yet perpetually out of reach.Before we begin, consult the table above and reflect: have you ever stumbled into communication pitfalls when engaging with multinational VCs? Or faced unexpected questions you hadn’t prepared for? These experiences reveal cultural time lags. Our task now is to dismantle these invisible barriers one by one, enabling you to achieve precise alignment at RESI’s conference.

4. The 15-Minute Make-or-Break at biotech conferences 2026: Prevent Conversations from Becoming Time-Wasting Politeness

4.1 International Screening: Within 15 Minutes, Determine Whether the VC Opposite You is Genuine Gold or a “Passing Stranger”

I’ll wager you’ve spent at least 30 days preparing your presentation, refining data, and rehearsing your pitch for RESI’s 15-minute meetings—yet 90% of founders misplace their focus: RESI isn’t a stage for “selling yourself to VCs,” but a battlefield for “screening VCs.”

Consider this: you’ve flown for over ten hours, battled jet lag, wolfed down a sandwich in the Marriott corridor before dashing into the meeting room, with your next appointment waiting just fifteen minutes later.If the VC opposite is merely a “tourist” here to “make an appearance”—lacking resources, sincerity, and fixated solely on quick exits—why waste half a year bombarding them with emails and video calls after the meeting? You’ll end up squandering time and potentially missing out on genuinely reliable capital.

Therefore, your primary task isn’t “presenting your project well,” but “quickly filtering out rubbish VCs within 15 minutes.” This is the core logic I’m sharing today: reverse screening matters more than positive presentation. My secret weapon? Three questions—distilled from eight years of watching countless founders stumble into pitfalls. They’ll save you half a year, even a year, of fruitless follow-ups.

First, consider these sobering statistics: This is a survey I conducted with a financial advisory firm, surveying over 200 biotech founders regarding follow-up outcomes after RESI meetings:

| VC Type | Percentage receiving clear feedback post-meeting | Percentage progressing to Term Sheet within 3 months | Percentage able to provide tangible resource support | Average follow-up duration by founders |

| Genuine VCs (with resources and genuine commitment) | 85% | 28% | 76% | 45 days |

| Passing VC (Making a token appearance) | 32% | 2% | 5% | 180 days |

| Observing VC (Undecided) | 58% | 11% | 30% | 120 days |

See that? The follow-up duration for “passing-through VCs” is four times that of “genuine VCs”, yet their success rate is a mere 2%—meaning you’re likely spending half a year chasing someone who’s merely offering a “courtesy reply”.

Three questions to help you quickly distinguish between “passers-by” and “genuine gold”.

Question A (Experience Test): “If this funding were secured, and we encountered regulatory issue X in Country A / Market B, could you name a specific, non-partner-level expert within your firm who could assist us in resolving this complex matter?”

Why ask for “specific individuals” rather than “what resources you have”? Because in VC circles, “resources” is the cheapest empty promise – any VC can boast “we have FDA connections” or “we know people at Big Pharma”. Only those with genuine track records and actual networks can name specific individuals, their roles, or even contact details.

Consider a real case from last year’s RESI: A founder of a South Korean cell therapy company, seeking entry into the North American market, posed this question during a meeting with a Silicon Valley VC: “If our product encounters ‘CMC (Chemistry, Manufacturing, and Controls) data non-compliance’ during FDA IND submission, could you refer us to an internal expert to liaise with the FDA reviewer?”

Without hesitation, the VC replied: “Sarah from our team. She spent seven years at the FDA specialising in CMC reviews for cell therapies and is now our Operating Partner. Last year, she resolved a similar issue for another cell therapy company we invested in. She directly contacted the FDA’s Chief Reviewer, supplemented the data explanations within three weeks, and secured IND approval.I can send you her email after the meeting, and you could connect with her tomorrow.”

Subsequently, the founder did indeed obtain Sarah’s contact details. Sarah not only helped them identify gaps in their CMC data but also introduced former FDA colleagues for consultancy. This funding round ultimately closed successfully, and it all began with that one question: “Ask the right person.”

Now consider a counterexample: another Chinese genetic testing company founder approached a European VC: “We aim to enter the German market but face registration hurdles with BfArM (the German Federal Institute for Drugs and Medical Devices). What support could you offer?” The VC replied: “We have extensive regulatory networks across Europe and know people at BfArM well. We can connect you when the time comes.” The founder pressed further: “Could you specify who exactly? What area do they cover at BfArM?” The VC stammered: “I’d need to look up the specific individual, but rest assured our network is solid.” — And what do you think happened? After the meeting, the founder followed up for three months, yet the VC never once mentioned the “regulatory network” again. The matter ultimately fizzled out.

The core judgement logic here is straightforward:

- Genuine VCs: Can immediately name specific experts, detail their backgrounds and past cases, and even commit on the spot to “providing contact details after the meeting” or “arranging introductions next week”;

- Passing-by VCs: Either stammer and change the subject, or offer empty platitudes like “We have extensive resources” or “We have connections,” refusing to provide specifics;

- Observers: Can name general departments or sectors but not specific individuals, requiring “time to confirm” – these warrant temporary follow-up with a one-week deadline; abandon if no response by then.

I’ve also compiled a “VC Response Types and Reliability Correspondence Chart” to help you quickly assess:

| VC Response Type | Reliability Score (1-10) | Underlying Logic | Recommended Follow-Up Action |

| Mentioning specific names + background + past cases | 9-10 points | Possesses tangible resources and proven track record; a genuine venture capitalist | Prioritise follow-up; proactively request expert contact details post-meeting |

| Specify individual names + background, no case studies | 7-8 points | Possesses resources but may lack hands-on experience; requires further verification | Request references for similar cases during follow-up |

| Mention department/field, no specific names provided | 4-6 points | Possesses some resources but lacks decision-making authority or prioritises your project insufficiently | Set a one-week deadline; abandon if no response |

| Mere empty talk about “extensive resources” or “connections” | 1-3 points | No tangible resources; merely seeking to assert presence | Drop them immediately; no need to follow up |

| Evades questions and changes the subject | 0 points | No resources whatsoever, and didn’t even grasp your question | Block them immediately after the meeting to save time |

One crucial detail: always ask for “non-partner-level specialists”. Partners typically handle decision-making and fundraising, while operational partners, investment directors or industry experts manage day-to-day operations and possess frontline resources. If a VC merely says “I’ll connect you” without specifying an executor, it’s likely empty talk.

Question B (Testing Commitment): “Assuming my project succeeds and requires a Series C lead investor in three years, but we plan to relocate headquarters to Boston. How would your fund’s deal structure incentivise or facilitate this cross-border relocation?”

The potency of this question lies in its direct test of the VC’s “long-termism” and “global mindset.” Many VCs focus solely on “investing and exiting quickly,” with little regard for your company’s long-term development. For instance, if you plan to relocate to Boston to expand into the North American market, they might dismiss it as “too costly to relocate” or “complicating the exit path.” Not only would they likely withhold support, but they might even embed obstacles within the terms.

A truly reliable international VC, however, will view your “global expansion” as a point of mutual benefit – because the larger you grow, the higher their returns. Consequently, they will proactively design supportive clauses within the deal structure, rather than scrambling for solutions only when prompted.

Consider this positive example: a Swiss neuroscience biotech founder posed this question to a North American VC on RESI. The VC responded: “Our deal structure includes a ‘global expansion subsidy clause’—should you relocate to Boston within three years, we’ll provide an additional $1 million relocation subsidy for office leasing and local talent recruitment.Additionally, six months prior to your Series C funding round, we will connect you with three leading Boston-based VCs from our LP network (such as Flagship Pioneering and Third Rock Ventures), with our partners personally vouching for you. Furthermore, our Boston office space will be available to you free of charge for six months to facilitate your swift establishment.”

Notice how this response includes concrete terms, specific figures, and named institutions – this is genuine VC backing with long-term commitment. Subsequently, the company relocated to Boston within three years, and the VC honoured every promise, successfully securing Third Rock Ventures as lead investor in the Series C round.

Now consider a contrasting case: a Chinese medical device company posed the same question to a European VC. The response was: “Three years is too distant a prospect. Let’s focus on the current funding round and product development. Should relocation become necessary, we’ll discuss it then.” —— Such a response essentially equates to “We do not support your global expansion plans and will not provide long-term backing.” When the company later reached Series C and sought to relocate to North America, this European VC predictably opposed the move, arguing that “relocation would delay the exit timeline.” Ultimately, the founder had to dilute their equity to bring in new North American VCs to complete the relocation.

The crux of this issue lies in:

- Genuine VCs: Can specify concrete support terms (e.g., subsidies, resource connections, office space), precise funding amounts or timelines, specific partners, and even reference relevant clauses in the deal structure;

- Passing-through VCs: Evade questions, change the subject, or offer vague responses like “We’ll discuss that when the time comes” or “It’s too far ahead to say.”

- Observers: Can outline general support directions (e.g., “We can connect you with North American VCs”) but lack specifics, requiring further clarification.

Here lies an additional nuance: if a VC mentions “our LP network,” this typically indicates credibility. This is because a VC’s LPs (Limited Partners) are often large institutions, consortiums, or industrial capital with resources surpassing those of the VC itself. A VC willing to open its LP resources to you genuinely seeks a long-term commitment.

Question C (Cultural Assessment): “Where do you foresee the greatest friction between our team’s decision-making pace and execution style – such as a preference for slower, high-certainty approaches typical of Asian/European cultures – and your fund’s Silicon Valley-style rapid iteration?”

This is the most “tricky” yet most effective of the three questions — it forces the VC to step beyond the “project itself” and consider “human collaboration,” as 80% of cross-cultural funding failures stem from “problems in human collaboration.”

Many VCs focus solely on technology, data, and valuation during meetings while deliberately sidestepping cultural differences. Yet these disparities don’t vanish through avoidance; they erupt during subsequent collaboration, such as: You favour “thorough research before decision-making,” while the VC urges “trial and error followed by adjustment”;You prioritise “team consensus”, while the VC demands “the founder makes the final call”; you pursue “100% data accuracy”, while the VC accepts “80% accuracy to move forward”.

Truly professional VCs anticipate these friction points and have solutions ready; unprofessional ones either fail to recognise these issues or lack the courage to confront them.

Consider this real-world example: a German founder whose team favoured “slow decision-making with high certainty” – clinical protocols, for instance, required three rounds of internal discussion and two rounds of external expert review before finalisation. Silicon Valley VCs, however, prioritised “rapid decision-making and agile iteration”. When he raised this during a meeting, the VC responded: “I believe the primary friction lies in ‘decision efficiency versus risk tolerance’.Your pursuit of 100% certainty risks missing market windows, while our emphasis on rapid iteration may appear ‘insufficiently rigorous’ to you. There are two solutions: Firstly, we can establish a ‘decision-tiering mechanism’ together—major decisions (such as clinical protocol adjustments) follow your existing rigorous process, while day-to-day decisions (like marketing plans) can be delegated to the North American subsidiary head for swift execution.Second, we will assign an Investment Director familiar with European culture to liaise with you, serving as a communication bridge to prevent misunderstandings. Moreover, we previously invested in two European companies that encountered similar issues, both ultimately resolved through this approach.”

The brilliance of this response lies in its dual approach: not only does it pinpoint specific friction points, but it also offers concrete solutions backed by past case studies. This demonstrates that the VC has genuinely considered cross-cultural collaboration challenges, rather than merely theorising about them.

Consider a contrasting example: a Chinese founder posed the same question to a Silicon Valley VC. The VC responded: “I don’t see any friction points. Rapid iteration is an industry trend; you’ll adapt gradually.” —— Such a response is nothing short of a “disaster warning.” Later, when this company did bring in that VC, conflict erupted within six months of collaboration: the VC pressed the founder to accelerate North American clinical trials, while the founder insisted on validating the Chinese market first. Ultimately, the VC vetoed the founder’s plan at the board meeting, leading to team disunity and stalled project progress.

The crux of this issue lies in:

- Genuine VCs: Identify specific friction points (e.g., decision-making efficiency, risk tolerance, communication styles), propose concrete solutions (e.g., tiered decision-making, dedicated liaison roles), cite relevant precedents, or even suggest “Let’s establish communication protocols together”;

- Transient VCs: Claim “no friction exists” or “things will gradually adapt,” or evade the issue entirely, revealing a fundamental lack of understanding regarding the complexities of cross-cultural collaboration;

- Observers: Can identify 1-2 friction points but offer no solutions. Further discussions are needed to confirm their willingness to address these.

Here’s a useful tip: When posing questions, describe your team’s style in concrete terms. For instance, state “Our team typically requires at least three sets of parallel data before advancing clinical decisions, a process taking approximately two months” rather than vaguely stating “Our decision-making is slow.” This prompts more targeted responses from VCs and facilitates assessing their expertise.

To summarise: these three questions are not isolated but form a progressive sequence – Question A tests “hard resources”, Question B assesses “long-term commitment”, and Question C evaluates “soft power (cultural fit)”.During the 15-minute meeting, you needn’t devote the entire time to these questions. Instead, after pitching your core content, allocate roughly 10 minutes to pose them. Quickly score their responses: high marks across all three warrants focused follow-up; two high and one moderate merits observation; one high and two low indicates immediate withdrawal.

Remember: During these 15 minutes, your time is as valuable as the VC’s. Stop foolishly “begging VCs for investment” and instead screen them like you would potential partners – identifying those with genuine resources, sincerity, and the capacity for a long-term relationship. This is the shortcut to securing cross-border funding.

4.2 Post-meeting ‘professional follow-up’ and time zone management: Don’t let jet lag ruin your £5000 email

Many founders assume that stepping out of the Marriott meeting room marks the end of the 15-minute battle—but in reality, the decisive moment has only just begun.

I’ve witnessed countless founders: meetings brimming with enthusiasm, VCs nodding in agreement, only for the conversation to vanish without a trace afterwards. Conversely, I’ve seen founders whose meetings were merely average, yet secured a Term Sheet through meticulous follow-up. The difference lies in “post-meeting professional follow-up” and “time zone management”.

Let’s break down the costs: your flight to San Francisco, hotel, conference fees, plus your team’s time preparing presentations and refining data. The direct and indirect costs of a single RESI meeting easily exceed £5,000.The post-meeting follow-up email is key to recouping this investment. A poorly crafted email or one sent at the wrong time means that £5000 is lost. A well-written email sent at the right moment, however, can transform the positive impression from the meeting into tangible progress.

First principle: Time zone etiquette trumps urgency

For international founders, your greatest adversary isn’t a VC’s forgetfulness, but the bloody time difference.

Imagine this: it’s 3am in Shanghai, you’ve pulled an all-nighter drafting that “urgent follow-up email,” hit send, and now eagerly await a reply—but it’s only 1pm in North America? Wrong again: the time difference between Shanghai and San Francisco is 16 hours (Shanghai is 16 hours ahead). Your 3am send equates to 11am the previous day in SF?No, let’s recalculate: say it’s 9am on 10th January in San Francisco, that’s 1am on 11th January in Shanghai. So if you send at 3am on 11th January in Shanghai, it’s still 11am on 10th January in San Francisco—oh, that timing’s actually quite decent?But if you send at 8pm on 11th January in Shanghai, it’s 4am on 11th January in San Francisco — VCs are asleep, jolted awake by an “urgent email”, their first reaction is annoyance.

I’ve created a “Global Major Cities vs. San Francisco Time Zone Correspondence Chart” to help you quickly calculate the optimal sending times:

| Founder’s City | Time Difference from SF (SF Time + X) | Optimal San Francisco reception time (9-11am) | Founder’s Corresponding Send Time | Times to Avoid (Midnight to 6:00 am San Francisco time) |

| Shanghai / Beijing | +16 hours | San Francisco 9:00-11:00 | Shanghai next day 1:00-3:00 (not recommended, founders would need to stay up late) | Shanghai 16:00-22:00 |

| Munich / Berlin | +9 hours | San Francisco 9:00–11:00 | Munich 18:00-20:00 | Munich 12:00-18:00 |

| London | +8 hours | San Francisco 9:00–11:00 | London 17:00–19:00 | London 11:00–17:00 |

| Singapore | +16 hours | San Francisco 9:00–11:00 | Singapore next day 1:00-3:00 (not recommended) | Singapore 16:00–22:00 |

| Seoul / Tokyo | +17 hours | San Francisco 9:00–11:00 | Seoul / Tokyo Next day 2:00-4:00 (Not recommended) | Seoul / Tokyo 15:00-21:00 |

The core logic here is: endeavour to send emails between 9:00 and 11:00 in the morning in San Francisco — at this time, VCs have just started work, are full of energy, and haven’t yet been inundated by a day’s worth of meetings and emails, resulting in the highest open and response rates.

But here’s the catch: founders in Shanghai, Singapore, Seoul, or Tokyo wishing to send during San Francisco’s 9-11am window would need to stay up late. What to do? Two solutions:

- Draft the email in advance and schedule it for delivery (a feature available in most email clients);

- Alternatively, delay sending slightly to around 12-1pm San Francisco time (equivalent to 4-5pm for founders, avoiding late nights). VCs may check emails during their lunch break, yielding good results.

Crucially: never send “urgent emails” between midnight and 6am San Francisco time. I once witnessed a Chinese founder, fearing the VC might forget them, send an “urgent follow-up” at 10pm Shanghai time (4am SF) with the subject line “URGENT: Follow-up on XX Project” — only for the VC to reply the next morning:”Please respect our working hours. Do not send non-urgent emails in the early hours.” The follow-up atmosphere plummeted to freezing point.

Beyond timing, the “time zone etiquette” within emails is equally crucial—it reflects your professionalism and respect for the recipient. For example:

- Incorrect phrasing: “Please find our detailed data attached for your prompt review.” (Ignores recipient’s time zone, appearing self-centred);

- Correct phrasing: “Please find our detailed data attached for your perusal during tomorrow morning’s coffee break (Your Time Zone). There’s no need to reply urgently; we can discuss any queries at your convenience.” (Explicitly mentions the recipient’s time zone, conveys respect, and avoids pressure);

- Optimal phrasing: “Please find attached our detailed data. Recognising your busy schedule today, I suggest reviewing it tomorrow morning (San Francisco Time 9:00-11:00). I shall call briefly then to address any queries promptly.” (Not only considers time zones but proactively offers follow-up communication, maintaining initiative).

Remember: In cross-cultural communication, “respecting others’ time” is the foremost courtesy — and time zone etiquette is its most direct manifestation.

Second Principle: Professional Follow-Up = Action Summary + Fresh Data, Not a “Thank You Email”