Trends in Innovative Drug Development and Collaboration Opportunities at Bio Convention 2025

Summit Overview: Chengdu as a Key Platform for Global Innovative Drug Development at Bio Convention 2025

The 10th Chengdu Innovative Drug Summit, a key segment of the Bio Convention 2025, will convene at the Longemont Hotel in Chengdu on September 25-26, 2025. This event stands as one of the largest and most influential platforms for new drug R&D and innovation exchange in Western China. This year’s summit is expected to attract over 5,000 pharmaceutical industry experts, entrepreneurs, investors, and policymakers from around the world to explore cutting-edge technologies, market trends, and collaboration opportunities in innovative drug R&D.

Summit Details

| Event | Details |

| Date | September 25-26, 2025 |

| Venue | China · Chengdu · Longemont Hotel |

| Scale | 5,000+ attendees (estimated) |

| Organizer | Chinese Pharmaceutical Association |

| Theme | Focusing on Global Trends in New Drug Innovation, Promoting Worldwide Collaboration |

| Concurrent Activities | Main Forum, Specialized Sub-Forums, Exhibitions, Business Matchmaking, etc. |

Current Status of Chengdu’s Biomedical Industry Development Discussed at Bio Convention 2025

Chengdu is accelerating its evolution along the Boston-Cambridge model, emerging as China’s premier “first-tier city” for innovative pharmaceuticals. By 2025, Chengdu will host over 3,000 biomedical enterprises, including nearly 400 large-scale companies, with an industry scale exceeding 200 billion yuan. In 2024, Chengdu accounted for 6 out of the 40 domestically developed Class 1 innovative drugs approved for market launch, ranking among the nation’s leaders. From 2016 to 2024, Chengdu secured approvals for 637 drug varieties, placing second among all Chinese cities.

Chengdu's innovative drug industry has developed distinctive strengths, achieving breakthroughs such as “world's first,” “best-in-class,” and “highest-value” in multiple fields:

- Significant achievements in global expansion:

- Over the past three years, Chengdu’s innovative drug license-out transactions totaled approximately $26 billion, accounting for about 30% of China’s total license-out value. The cumulative potential value of China’s XDC (X-Duty Coupling Drug) overseas licensing deals has exceeded RMB 350 billion, with nearly half originating from Chengdu.

- Sustained Enhancement of International Competitiveness:

- In the first half of 2025, Chengdu facilitated 98 innovative drug export deals, with transaction value rising to **$59.5505 billion** (Note: This represents a significant increase from the “$26 billion over the past three years” figure mentioned earlier. However, this article highlights major deals such as Kelun Botai ($9.3 billion) and Baili Tianheng ($8.4 billion), and other large-scale transactions concentrated in the first half of 2025, which is reasonable, demonstrating the robust growth of Chengdu-based pharmaceutical companies in the international market.

- Increasingly refined industrial ecosystem:

- Chengdu has formed a biomedical industry cluster centered around Chengdu Hi-Tech Zone, Tianfu International Bio-City, and Pengzhou Tianfu Traditional Chinese Medicine City, attracting a large number of innovative drug companies and R&D institutions.

Chengdu vs. Global Biopharmaceutical Innovation Hubs: Insights from Bio Convention 2025

Chengdu is actively positioning itself as China’s “Boston”. Compared to leading global biopharmaceutical innovation centers, it exhibits the following characteristics:

| Indicator | Chengdu | Boston | Singapore | London |

| Number of Enterprises | Over 3,000 biopharmaceutical enterprises | Over 1,000 pharmaceutical and biotech companies | Not disclosed | Over 2,700 life sciences companies |

| Industry Scale | Projected to exceed RMB 260 billion by 2025 | Not disclosed | The biomedical sciences industry accounts for 2.6% of GDP | Not disclosed |

| Venture Capital | Cumulative financing of RMB 121.714 billion from 2019 to 2023 | Ranked second in U.S. biotech venture capital investment, trailing only Silicon Valley | Not disclosed | $1.2 billion in venture capital funding in 2024 |

| Clinical Trials | Over 5,000 clinical trials are conducted annually | Not disclosed | Not disclosed | Not disclosed |

| Innovative Achievements | 6 out of 40 domestically developed Class 1 innovative drugs in 2024 originated from Chengdu | Not disclosed | Not disclosed | Not disclosed |

| Internationalization | Attracted 10 foreign Fortune Global 500 companies | 18 of the world’s top 20 pharmaceutical companies are located in the Boston-Cambridge area | Not disclosed | 19 of the world’s top 20 pharmaceutical companies |

From a global perspective, Boston, New York, and London ranked as the top three life sciences cities in 2024. Chengdu is accelerating its pursuit, already demonstrating competitiveness against world-class biopharmaceutical hubs across multiple metrics. Boston holds the overall top position, leveraging its 122 higher education institutions, early DNA research heritage, and dense academic-industrial clusters to lead in research innovation and talent ecosystems. This attracts global giants and yields a wealth of scientific output.

1. Global Trends and Frontier Areas in Innovative Drug Technologies (Featured at Bio Convention 2025)

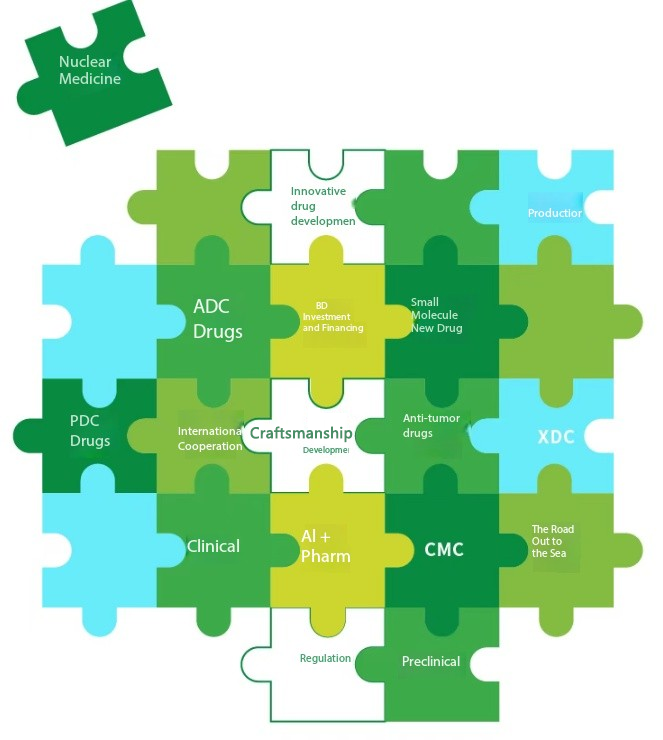

1.1 ADC Drugs: Target Expansion and Technological Innovation

1.1.1 Trend Toward Target Diversification

The ADC (Antibody-Drug Conjugate) field is undergoing a critical phase of target diversification. While traditional ADCs primarily focused on a limited number of targets such as HER2 and TROP2, ADCs presented at the 2025 AACR Annual Meeting now cover multiple novel antigens, including Core 2 O-glycan, uPAR, LRRC15, Ly6E, PTK7, and HER3. Among these, CDH17 emerged as the most prominent highlight. Its high-specificity expression in prevalent gastrointestinal cancers like gastric and colorectal cancers has attracted over 10 pharmaceutical companies—including East China Pharmaceutical, Veritas Therapeutics, SinoPharm, and Yilian Biotech—to develop programs targeting this molecule.

1.1.2 Multi-dimensional Technological Breakthroughs

Technological pathways for ADCs continue advancing, with multiple novel formats emerging as key research focuses for 2025:

- Dual-payload ADCs: Conjugating two payloads with identical or distinct mechanisms onto a single antibody enables multidimensional, synergistic tumor cell killing. Kanghong Pharmaceutical’s KH815 is the world’s first novel dual-payload ADC to enter clinical trials. Targeting TROP2, it conjugates a TOP1 inhibitor and an RNA polymerase II inhibitor, enabling simultaneous suppression of tumor cells at both the RNA and DNA levels.

- Bispecific Antibody ADCs:

- Over 25 pharmaceutical companies, including Innovent Biologics, Jinsai Pharmaceutical, Hengrui Medicine, and Ying’en Biotech, showcased their bispecific antibody ADC products at the 2025 AACR conference. Target combinations were diverse and rich, including popular pairs such as EGFR/cMET, EGFR/HER3, and PD-L1/Trop.

- Non-endocytic ADCs:

- Unlike traditional ADCs, which require tumor cell internalization to function, non-endocytic ADCs induce tumor killing without internalization. They evade ADC-related multidrug resistance mechanisms while minimizing off-target toxicity effectively.

- TCE-ADC:

- Vistabio’s LBL-058 is the world’s first TCE bispecific ADC targeting DLL3, built on a proprietary Linker-payload technology platform. It innovatively integrates a DLL3×CD3 bispecific antibody scaffold with a next-generation topoisomerase I inhibitor, achieving synergistic effects between T-cell killing and payload cytotoxic killing.

1.1.3 Clinical Progress and Market Outlook

- As of May 2025, China’s NMPA had cumulatively accepted over 250 ADC clinical trial applications and approved 12 ADC marketing applications. The global ADC market is projected to reach $20 billion by 2025, growing at a CAGR exceeding 30%.

- China’s ADC R&D advances rapidly, with Chinese ADC achievements accounting for nearly half of the presentations at the 2025 AACR Annual Meeting—a particularly impressive performance. Among these, ADC products from companies like Hengrui Medicine, BeiGene, and Innovent Biologics have entered late-stage clinical trials and are expected to gain market approval within the next 2-3 years.

- Chengdu’s Advantages in ADC:

- Chengdu-based companies excel in the ADC drug sector. Enterprises within the Tianfu Biomedical City Park account for 80% of the city’s total overseas licensing revenue for ADC drugs, establishing Chengdu as a key “bridgehead” for China’s innovative drugs going global.

1.2 Cell and Gene Therapy (CGT): Technological Breakthroughs and Industrial Acceleration

1.2.1 Market Size and Growth Forecast

- The cell and gene therapy (CGT) sector is experiencing rapid expansion. The global CGT market grew from $50.4 million in 2016 to $2.08 billion in 2020, and is projected to reach $30.54 billion by 2025—a compound annual growth rate (CAGR) of 71%. China’s CGT market, though emerging later, is growing more rapidly. It expanded from RMB 23.8 million in 2020 to an estimated RMB 17.885 billion by 2025, representing a staggering 276% CAGR. (Note: The discrepancy in China’s market data stems from “different data sources” (unattributed vs. China Investment Industry Research Institute), not an error; the global growth rate aligns with CGT’s “explosive growth” characteristic)

- According to the China Investment Industry Research Institute, China’s cell and gene therapy market is projected to reach RMB 18.631 billion by 2025, with a CAGR of 134.7% from 2023 to 2025, surpassing the global average. As of April 30, 2025, China had 25,965 enterprises engaged in cell and gene therapy-related activities, with 6,114 newly registered companies in 2024, demonstrating the industry’s vigorous development.

1.2.2 Technological Innovation and Breakthrough Directions

Technological innovation in the CGT field primarily focuses on the following areas:

- Industrialization of Universal Technologies: Traditional autologous CAR-T requires individual preparation for each patient, with production costs reaching millions of yuan. Universal technologies, however, modify healthy donor T cells through gene editing to enable “off-the-shelf” availability, potentially reducing costs by over 70%. Beiheng Biotech’s UCAR-T product achieves HLA-independent treatment for B-cell leukemia with response rates comparable to traditional CAR-T; Co-Gen Therapeutics employs CRISPR-Cas9 editing to knockout TCR and HLA-I genes, reducing graft-versus-host disease risks.

- Innovation in Vectors and Delivery Systems:

- Non-viral vectors have seen a significant increase in market share, rising from under 10% in 2019 to 25% currently. Lipid nanoparticles (LNPs) in gene editing therapies enhance off-liver tissue targeting through optimized lipid structures; electroporation-based delivery of CRISPR components achieves over 80% editing efficiency in in vivo gene therapy; Engineered exosome carriers leverage their natural delivery properties to load siRNA while reducing immunogenicity.

- Multi-target Synergy and Intelligent Design:

- Multi-target strategies for solid tumor treatment have become a key technical focus. BGI Biotech’s BRG01 injection for EBV-associated tumors employs a bispecific TCR targeting latent membrane protein, achieving a 64% objective response rate in nasopharyngeal carcinoma treatment. Additionally, breakthroughs continue in logic-gated CAR-T, CRISPR-Cas12a multiplex editing, and AI-driven antigen prediction technologies.

1.2.3 Clinical Applications and Commercialization Progress

- Multiple cell and gene therapy products have been launched globally, benefiting tens of thousands of patients worldwide. CAR-T products from companies like BMS and Gilead continue to scale up production. In China, Legend Biotech’s CAR-T therapy sales exceeded 900 million yuan in 2022, while gene therapies from companies like Nuvox Therapeutics, Longxin Biotech, and Tianze Yuntai demonstrate long-term therapeutic potential.

- In January 2025, the approval of Immatosec injection (for treating acute graft-versus-host disease) marked a breakthrough in the commercialization of stem cell therapies in China. Currently, CAR-T products from multiple domestic companies have entered Phase III clinical trials, with approval and market launch anticipated within the next 1-2 years. As the number of approved CGT products grows and R&D, production, and preparation technologies mature, the entire CGT market will rapidly gain momentum, inevitably driving vigorous development in supporting CXO services.

- Chengdu’s CGT Strategy:

- Chengdu Hi-Tech Zone is actively advancing its cell and gene therapy initiatives. On June 19, 2025, the zone announced the signing of three high-tech biomedical projects with significant strategic value for strengthening industrial chains. Among these is the SinoGenex High-End Cell Therapy Media Production Headquarters and R&D Base Project, which will provide crucial support for Chengdu’s CGT industry development.

1.3 Nucleic Acid Therapeutics: Delivery Technologies and Therapeutic Expansion

1.3.1 Technology Platforms and Delivery Systems

Nucleic acid therapeutics represent a novel class of drugs based on nucleic acid molecules (such as siRNA, mRNA, and antisense RNA), capable of directly modulating gene expression with high specificity and efficacy. The core challenge in this field lies in developing delivery systems. Current primary delivery technologies include:

- Lipid Nanoparticles (LNP):

- The most mature nucleic acid drug delivery technology has been successfully applied in mRNA vaccines. Optimizing lipid structures enhances targeting and reduces immunogenicity.

- Viral Vectors:

- Including adeno-associated virus (AAV) and lentivirus, which offer high transfection efficiency but face challenges with immunogenicity and production complexity.

- Polymeric nanoparticles:

- These encapsulate nucleic acid molecules within synthetic polymer materials, offering excellent biocompatibility and controlled release properties.

- Exosome-based carriers:

- These utilize naturally secreted cellular vesicles to deliver nucleic acids, exhibiting low immunogenicity and strong targeting capabilities.

1.3.2 Therapeutic Applications and Clinical Progress

The therapeutic applications of nucleic acid drugs continue to expand, currently focusing on the following areas:

- Vaccines:

- The successful application of mRNA vaccines during the COVID-19 pandemic demonstrated their immense potential. Multiple companies are now developing mRNA vaccines targeting influenza, HIV, tumors, and other diseases.

- Genetic Diseases:

- Correcting disease-causing genes via siRNA or gene editing technologies to treat hereditary disorders such as cystic fibrosis and sickle cell anemia.

- Cancer Therapy:

- Nucleic acid therapeutics can be used to express tumor antigens, suppress oncogenes, or enhance immune responses. Multiple products have entered clinical trial phases.

- Cardiovascular Diseases:

- siRNA can be employed to lower cholesterol levels or inhibit the expression of genes associated with atherosclerosis. For example, Alnylam’s Inclisiran has been approved for reducing LDL-C.

1.3.3 Market Outlook and Competitive Landscape

- The global nucleic acid therapeutics market is projected to grow from $5 billion in 2025 to $15 billion by 2030, with a compound annual growth rate exceeding 25%. Currently, companies like Moderna, BioNTech, and Alnylam lead the field, while domestic firms such as Aibio, SinoMicro, and RiboBio are rapidly catching up.

- Looking ahead, with continuous improvements in delivery technologies and expanding therapeutic applications, nucleic acid therapeutics are poised to emerge as a major drug category following monoclonal antibodies, offering novel treatment options for various diseases.

- Chengdu’s breakthrough in nucleic acid therapeutics: Wisgen Biotech’s independently developed WGc-043 injection is the world’s first EBV (human herpesvirus)-related tumor mRNA vaccine approved for dual clinical trials in both China and the United States, marking China’s leading position in this field.

1.4 Large and Small Molecule Drugs: Differentiated Innovation and Combination Therapies

1.4.1 Innovation Directions for Small Molecule Drugs

The small molecule drug sector is undergoing a shift from “me-too” to “me-better” and “first-in-class” approaches. Research presented at the 2025 AACR Annual Meeting focused on the following key directions:

- KRAS Inhibitors:

- KRAS gene mutations are common oncogenic drivers. While inhibitors targeting the KRAS G12C mutation, such as Sotorasib and Adagrasib, have gained approval, challenges persist regarding the emergence of resistance mechanisms and addressing other KRAS mutation subtypes. Multiple next-generation KRAS inhibitors were presented at the 2025 AACR meeting, including Zoldonrasib and VS-7375 targeting the G12D mutation, as well as the pan-KRAS inhibitor LY4066434.

- WRN Helicase Inhibitors:

- WRN helicase is critical for the survival of cancer cells with high microsatellite instability (MSI-H) or defective mismatch repair (dMMR), making it an important synthetic lethal target. Preclinical and clinical data for multiple WRN inhibitors were presented at the 2025 AACR Annual Meeting, including Roche’s RO7589831 and IDEAYA/GSK’s IDE275.

- Other Innovative Targets:

- Emerging targets such as PKMYT1 and KIF18A have also entered the clinical landscape, injecting new vitality into small-molecule targeted drug development.

1.4.2 Trends in Large Molecule Drugs

Large molecule drugs, particularly monoclonal antibodies and bispecific antibodies, remain a key focus in innovative drug development:

- Bispecific and Multispecific Antibodies:

- Bispecific antibodies bind two distinct targets simultaneously, delivering synergistic effects. Biosynovasys’ IBI3019 is a trispecific antibody targeting EGFR × CDH17 × CD16A, demonstrating potent efficacy and favorable safety in colorectal cancer models.

- Antibody-Fusion Proteins:

- Fusing antibodies with cytokines enhances immune activation. Innovent Biologics’ IBI3026 is a PD-1/IL-12 fusion protein designed to activate T/NK cells in the tumor microenvironment; PD1-IFNα fusion proteins induce PD1-dependent IFNα signaling, demonstrating superior preclinical efficacy.

- Cytokine Engineering:

- Enhancing targeting and therapeutic index by modifying cytokine structures. For example, fusing IL-2 with antibody fragments boosts its activity in the tumor microenvironment while reducing systemic toxicity.

1.4.3 Combination Therapy Strategies

Combination therapy has become a mainstream strategy in cancer treatment, particularly the combination of small-molecule drugs with large-molecule drugs:

- Chemotherapy + Immuno/Targeted Combination:

- In lung cancer, combination regimens now account for 65% of treatments. For instance, KRAS G12C inhibitors combined with anti-EGFR antibodies have demonstrated significantly improved efficacy in colorectal cancer treatment.

- ADC and Bispecific Antibody Combination:

- BioNTech’s BNT325/DB-1305 combined with BNT327 demonstrated safety and preliminary efficacy in Phase I/II clinical trials, with preclinical studies indicating superiority of the combination therapy.

- Multi-target Combined Inhibition:

- Simultaneously inhibiting multiple key pathways involved in tumorigenesis enhances therapeutic outcomes. For instance, PD-1 inhibitors combined with CTLA-4 inhibitors have demonstrated synergistic effects across various cancers.

1.4.4 Market Size and Competitive Landscape

- The global market for small and large molecule drugs is projected to reach $1.2 trillion by 2025, with small molecules accounting for approximately 55% and large molecules for about 45%. China’s small molecule drug market is expected to reach RMB 45 billion by 2025 and exceed RMB 60 billion by 2030 (CAGR 8.7%). Domestic companies like Hengrui Medicine and BeiGene have achieved import substitution through independent R&D, increasing their market share from 15% to 30%.

- Moving forward, small and large molecule drugs will continue to leverage their respective strengths while delivering enhanced therapeutic outcomes through combination therapies.

- Chengdu’s Achievements in Small and Large Molecule Drugs:

- Chengdu hosts innovative small molecule drug companies like MicroCore Bio and Chengdu Lead, alongside leading large molecule drug enterprises such as Canopy Biologics and Kelun BioPharma, forming a differentiated innovation landscape.

1.5 Peptide Drugs and GLP-1 Receptor Agonists: New Opportunities in Metabolic Diseases and Weight Loss Markets

1.5.1 Market Surge of GLP-1 Receptor Agonists

- GLP-1 (Glucagon-like Peptide-1) receptor agonists have emerged as one of the hottest drug categories in recent years, primarily used to treat type 2 diabetes and obesity. By 2025, the GLP-1 drug market is projected to reach $60 billion, with a compound annual growth rate exceeding 25%.

- In the weight loss sector, GLP-1 receptor agonists demonstrate immense potential. With the national emphasis on weight management, China’s overweight and obese population has reached 300 million. This phenomenon not only reflects heightened public health awareness but also signals a nearly trillion-dollar opportunity for the health industry. GLP-1 receptor agonists like semaglutide achieve significant weight loss by suppressing appetite and delaying gastric emptying, establishing themselves as dominant drugs in the weight management market.

1.5.2 Innovation Directions in Peptide Drugs

Innovation in the peptide drug field primarily focuses on the following directions:

- Multi-target agonists:

- To enhance efficacy and reduce side effects, researchers are developing peptides that simultaneously target multiple receptors. For example, Innovent Biologics’ independently developed and validated dual GCG/GLP-1 agonist Masdupt not only achieves substantial weight loss but also improves multiple health indicators including blood pressure, lipids, blood glucose, and uric acid, positioning it as a “metabolic regulator.” .

- Long-acting formulations:

- By modifying peptide structures or conjugating with macromolecular carriers, drug half-lives are extended to improve patient compliance. For instance, semaglutide boasts a half-life of up to 7 days, requiring only weekly injections.

- Oral formulations:

- Traditional peptide drugs are predominantly administered via injection. Developing oral formulations can significantly enhance patient compliance. Currently, multiple companies are developing oral GLP-1 receptor agonists, with potential market launch within the next few years.

1.5.3 Market Competition and Future Trends

- In the GLP-1 receptor agonist market, Novo Nordisk and Eli Lilly hold dominant positions, with their products semaglutide and tirzepatide demonstrating strong global market performance. Domestic companies such as Innovent Biologics, Hengrui Medicine, and East China Pharmaceutical are also actively positioning themselves, participating in market competition through a combination of independent R&D and generic innovation.

- Moving forward, GLP-1 receptor agonists will continue to expand in multiple directions: on one hand, indications will broaden from type 2 diabetes and obesity to additional areas such as non-alcoholic fatty liver disease and cardiovascular diseases; On the other hand, multi-target combination agonists will become a key R&D focus to enhance efficacy and reduce side effects. By 2030, China’s GLP-1 market is projected to exceed RMB 60 billion.

- Chengdu’s Positioning in the Peptide Drug Sector:

- Chengdu hosts multiple innovative enterprises in the peptide drug field, such as Chengdu Shengnuo Biotech, which are actively positioning themselves in hot sectors like GLP-1 receptor agonists.

2. Analysis of Global and Chinese Policy Environment (Interpreted at Bio Convention 2025)

2.1 Policy Support and Regulatory Reform of Innovative Drugs in China

2.1.1 R&D Support Policy

The Chinese government attaches great importance to the development of the biopharmaceutical industry and has introduced a series of policies to support innovative drug R&D:

- Incentives for R&D investment:

- “Chengdu Municipal Policies and Measures for Promoting the High-Quality Development of the Biomedical Industry” provides incentives of up to RMB 3 million, RMB 3 million, RMB 5 million, and RMB 7 million respectively according to 20% of the R&D investment of the corresponding stage for the completion of preclinical research, phase I clinical trials, phase II clinical trials and phase III clinical trials for the first category of innovative drugs. For two types of improved new drugs that have completed phase II and phase III clinical trials, the maximum reward of 2 million yuan and 3 million yuan will be given according to 10% of the R&D investment in the corresponding phase.

- Construction of industrial clusters:

- support the creation of national industrial innovation centers, technological innovation centers and manufacturing innovation centers in the field of biomedicine, encourage the construction of high-level medical platforms such as the National Medical Center, the National Clinical Medical Research Center, the National Regional Medical Center and the National Traditional Chinese Medicine Inheritance and Innovation Center, and support the acceleration of the construction of the Tianfu Jincheng Laboratory.

- Intellectual property protection:

- play the role of Chengdu Intellectual Property Protection Center as a platform for rapid patent pre-trial, and help biomedical enterprises to quickly obtain high-value patents. Give full play to the role of the Chengdu Sub-center of Overseas Intellectual Property Dispute Response Guidance to provide biomedical enterprises with assistance in defending their rights overseas.

2.1.2 Acceleration of Clinical Trials

To improve the quality and efficiency of clinical research, the Chinese government has introduced a series of reform measures:

- Mutual Recognition of Medical Ethics Review:

- Establishing the Chengdu Regional Medical Ethics Alliance, expanding the scope of mutual recognition of medical ethics review results, and simplifying the in-hospital ethics review process for projects reviewed by the Regional Medical Ethics Alliance at each medical institution.

- Clinical research support system:

- explore the establishment of preparatory clinical trial cohorts for cancer, cardiovascular, cerebrovascular, respiratory, and metabolic diseases, coordinate and promote the formation of a regional biospecimen bank alliance, and coordinate medical big data, experimental animals, and other research resources.

- Support for the development of GCP organizations:

- 500,000 yuan will be awarded to medical institutions that have first filed for the qualification of GCP organizations and have passed the inspection of the pharmacological supervision department, and have put them into operation. For qualified GCP organizations that undertake the research and development of new drugs and innovative medical devices and complete clinical trials, they will be rewarded according to 10% of the amount of the project, and the total amount of reward for each medical institution will not exceed RMB 2 million per year.

2.1.3 Accelerated Approval and Launch of Products

China’s drug regulators have adopted a series of measures to accelerate the approval of innovative drugs:

- Speed up review and approval:

- Seek support for national drug and device registration and review, and cooperate with provincial drug regulatory bureaus to implement pilot reforms to compress the time limit for reviewing and approving supplemental drug applications to 60 working days, and that for reviewing and approving drug clinical trial applications to 30 working days.

- Priority Review and Approval:

- Give priority review and approval treatment to products included in the national innovative medical device special approval or priority approval procedures.

- Breakthrough Therapeutic Drug Program:

- Innovative drugs that are included in the breakthrough therapeutic drug program and obtain a drug registration certificate for the first time will be awarded another 1 million yuan.

2.1.4 Reform of Medical Insurance and Payment

To improve the accessibility of innovative drugs, the Chinese government has actively promoted health insurance and payment reform:

- Dynamic adjustment of medical insurance:

- support innovative medicines and new medical technologies in the reform of the medical insurance payment method and the management of the medical insurance agreement, and improve the support measures, such as single-line payment, DRG exclusion mechanism, and special case single negotiation mechanism.

- Expansion of commercial health insurance:

- support the optimization of the coverage of universal commercial health insurance, establish a dynamic adjustment mechanism for the selection of special medicines for “Huirong Insurance”, and support the entry of eligible innovative medicines and appliances “as far as possible”.

- Payment Scenario Innovation:

- Accelerate the promotion of the application of the “three e-payments and two payments” scenario of medical insurance, promote the construction of the electronic prescription flow platform, and optimize the management of medical insurance designated retail pharmacies.

- Chengdu Policy Advantage:

- Chengdu City 2025 issued the “Chengdu Certain Policy Measures for Promoting the High-Quality Development of the Biomedical Industry” in February, which puts forward 25 policy measures in five aspects, including supporting R&D and innovation of medicines and devices, improving the quality and efficiency of clinical research, supporting the clinical application of products, supporting the development and growth of enterprises, and constructing a perfect industrial ecology, which provides strong policy support for the industry’s development.

2.2 International Regulatory Policies and Global Cooperation Trends

2.2.1 International Data Protection and Patent Policy

Intellectual property protection and data exclusivity policies for innovative drugs in major markets around the world are being continuously improved:

- China’s data protection regime:

- The Drug Data Protection Regulations (Draft) 2025 stipulate that for drugs that have been approved outside China but have not yet been marketed in China, the time difference between the date of acceptance of the NDA in China and the date of approval for the first marketing outside China will be deducted from the full data protection period for innovative and improved products, to encourage pharmaceutical companies to accelerate the product launches and market access of imported new drugs in China.

- U.S. and EU Policies:

- The U.S. and the EU provide longer data exclusivity and market exclusivity periods for innovative drugs, which provide good return expectations for innovative drug companies. The U.S. provides 5 years of data exclusivity and 3 years of market exclusivity for innovative drugs, and the EU provides 8 years of data exclusivity and 10 years of market exclusivity for innovative drugs.

2.2.2 Global regulatory harmonization and mutual recognition

International regulatory harmonization is being strengthened to facilitate the global development and launch of innovative medicines:

- Harmonization of international drug registrations:

- Guidelines developed by the International Conference on Harmonization of Pharmaceutical Registration (ICH) have been adopted by major regulatory agencies around the world, facilitating the harmonization of drug registration requirements.

- Mutual Recognition of Clinical Trial Data:

- More and more countries have begun to accept data from international multi-center clinical trials, reducing the need for repetitive trials and accelerating the global development of innovative drugs. China’s NMPA has begun to accept international multi-center clinical trial data that meets the requirements.

- Mutual Recognition of Inspections:

- The scope of mutual recognition of inspections between the US FDA, EU EMA, and other regulatory agencies is expanding, reducing the compliance burden on pharmaceutical companies. China’s NMPA is also actively promoting mutual recognition of inspections with international regulatory agencies.

2.2.3 Global Cooperation and Intellectual Property Protection

International cooperation and intellectual property protection have become the key to the global development of innovative drugs:

- International cooperation mode:

- The cooperation between multinational pharmaceutical companies and biotechnology companies has become increasingly close, and the cooperation mode includes various forms such as license agreement, co-development, and equity investment. For example, in April 2025, Boehringer Ingelheim and Cue Biopharma entered into a strategic partnership to develop and commercialize CUE-501, a B-cell clearance therapy for the treatment of autoimmune diseases, with an upfront payment of $12 million and research support funding for Cue Biopharma. Cue Biopharma has access to $12 million in upfront and research support funding.

- Intellectual Property Protection:

- As the globalization of innovative medicines accelerates, intellectual property protection is becoming increasingly important. In 2025, the Chinese government strengthened the protection of biopharmaceutical intellectual property rights and is playing the role of the Chengdu Sub-centre for Guidance on Responding to Overseas Intellectual Property Disputes in order to provide biopharmaceutical companies with assistance in defending their rights overseas.

- Global Accessibility of Medicines:

- While promoting the R&D of innovative medicines, global accessibility of medicines has also become a focus of attention. Governments and international organizations are exploring various ways to improve the accessibility of innovative drugs in developing countries. For example, through voluntary licensing, compulsory licensing, parallel importation, etc., the price of innovative drugs can be reduced to improve accessibility.

- Chengdu internationalization cooperation case:

- At the beginning of 2025, Canoa reached an exclusive licensing agreement with Timberlyne, a U.S. biopharmaceutical company, pushing the total amount of licensing deals for its global interest (except Greater China) in its anti-CD38 monoclonal antibody CM313 to $367 million, which has become Chengdu’s “first order to go overseas” in the New Year.

3. Market Opportunity Analysis: Key Therapeutic Areas and Regional Markets (Explored at Bio Convention 2025)

3.1 Oncology Treatment Market: Huge Demand and Unmet Treatment Needs

3.1.1 Market Size and Growth Forecasts

The global antitumor drug market shows rapid growth. The global antitumor drugs market is expected to reach $304.8 billion in 2025, growing at a CAGR of 15.2% from 2020 to 2025, and is further expected to grow at a CAGR of 9.6% to $482.5 billion by 2030. China’s antitumor drugs market size is expected to reach RMB 374.7 billion by 2025 and grow to RMB 609.4 billion by 2030.

The number of new cancer patients in China continues to grow and is expected to exceed 5 million cases by 2030, driving the precision medicine market to RMB45 billion (24% of the overall market). After structural optimization on the payment side, the priority of health insurance coverage has significantly accelerated in recent years to penetrate into the field of innovative drugs. In 2025, the health insurance coverage of targeted drugs is expected to increase to 85%, and the price of immune drugs will be reduced by 25%.

3.1.2 Therapeutic Field Segmentation and Hot Direction

The field of tumor treatment is experiencing a shift from traditional chemotherapy to precision treatment, and the main hot directions include:

- Targeted therapy:

- China’s targeted drug market will reach RMB45 billion in 2025 and exceed RMB60 billion in 2030 (CAGR 8.7%). Local enterprises such as Hengrui Medicine and Baizi Shenzhou have realized import substitution through independent research and development, and their market share has risen from 15% to 30%. Hot directions include TGF-β inhibitors (gastric cancer) and HER2 dual antibodies (breast cancer).

- Immunotherapy:

- PD-1 inhibitors have an effective rate of over 60% in lung cancer, and the market size in China will increase from RMB 36 billion to RMB 118 billion (2025-2030). Merck Sharp & Dohme Keytruda and Roche Tecentriq dominate the high-end market, but Hengrui and Xindanwei’s PD-1 inhibitors seize the market share through price advantage.

- Cell and gene therapy:

- The global CAR-T market is expected to reach $4.5 billion in 2030, and the layout of local Chinese companies is accelerating. Emerging technologies, such as lysosomal virus and double antibiotic, have become investment hotspots.

- Combination therapy:

- chemotherapy + immunotherapy/targeting combination has become mainstream, with 65% of the combined regimen in lung cancer. For example, the KRAS G12C inhibitor combined with the anti-EGFR antibody has shown significant efficacy improvement in colorectal cancer treatment.

3.1.3 Unmet Therapeutic Needs and Opportunities for Innovation

Despite significant progress in the field of oncology, there is still a large unmet therapeutic need:

- Solid tumor treatment:

- Currently, cell therapies such as CAR-T have achieved significant efficacy in hematological tumors, but still face challenges in the treatment of solid tumors, such as inhibition of the tumor microenvironment, target heterogeneity, and other issues. For example, BAY 3713372, a PRMT5 inhibitor developed by Bayer in collaboration with Puho Pharma, is brain permeable and can target CNS metastases and primary brain tumors, which is expected to provide a new therapeutic option for patients with MTAP-deficient brain metastases.

- Resistance problem:

- With the widespread use of targeted therapies and immunotherapies, drug resistance has become an important challenge. For example, the emergence of drug-resistant mutations in EGFR-TKI limits its long-term efficacy. The development of a new generation of targeted drugs and combination therapies to overcome drug resistance is an important direction of innovation.

- Treatment of brain metastases:

- Brain metastases have limited treatment options and a poor prognosis. The development of drugs that can penetrate the blood-brain barrier and new therapeutic approaches are important directions for innovation.

- Therapeutic accessibility:

- Despite the continuous expansion of China’s health insurance coverage, there is still room to improve the accessibility of innovative drugs, especially in primary care and rural areas. Improving the accessibility and affordability of innovative drugs is an important direction for the future.

- Chengdu’s advantages in tumor therapy:

- Chengdu has several innovative companies in the field of tumor therapy, such as Canoa, ColumboTech, Hengrui Medicine, etc., which have achieved remarkable results in the fields of ADC drugs, double antibiotics, cell therapy, and so on.

3.2 Autoimmune and Inflammatory Disease Market: Growth Potential and Innovation Direction

3.2.1 Market Size and Disease Burden

Autoimmune & Inflammatory Diseases are a common group of diseases that severely affect the quality of life, including rheumatoid arthritis, psoriasis, inflammatory bowel disease, and others. The global autoimmune and inflammatory disease drugs market is expected to reach USD 450 billion by 2025, growing at a CAGR of approximately 8%.

The incidence of autoimmune diseases in China is on the rise, especially against the backdrop of accelerating urbanization and changing lifestyles. Currently, there are more than 50 million patients with autoimmune diseases in China, but the diagnosis and treatment rates are still low, with huge market potential.

3.2.2 Therapeutic Areas and Innovative Drugs

Innovations in the treatment of autoimmune and inflammatory diseases mainly focus on the following directions:

- Targeted biologics:

- Targeted biologics, represented by TNF-α inhibitors, IL-6 inhibitors, IL-17 inhibitors, etc., have become the mainstream choice for autoimmune disease treatment. These drugs are characterized by good efficacy and few side effects, but their high price limits their wide application.

- Exploration of novel targets:

- With the deeper understanding of the pathogenesis of autoimmune diseases, new therapeutic targets are emerging. For example, CUE-501, developed by Boehringer Ingelheim in collaboration with Cue Biopharma, is a uniquely advantageous B-cell clearance therapy for the treatment of autoimmune diseases. It selectively bridges viral-specific memory-killing T-cells by combining with B-cell-specific membrane proteins, enabling them to selectively clear B-cells and inhibit autoimmune and inflammatory processes.

- Oral small molecule drugs:

- In order to improve patient compliance, oral small-molecule drugs have become a hot spot for research and development. For example, JAK inhibitors, BTK inhibitors, and other oral small-molecule drugs have shown good efficacy in many autoimmune diseases.

- Cell therapy:

- The application of cell therapy, such as CAR-T, in autoimmune diseases is also being explored, and preliminary studies indicate that it may have potential value in refractory autoimmune diseases.

3.2.3 Market opportunities and development trends

Key opportunities in the autoimmune and inflammatory disease therapeutics market include:

- Unmet need for treatment:

- There is still a large number of patients with autoimmune diseases who are not effectively treated, particularly in primary care and rural areas. Improving diagnosis and treatment rates will unlock huge market potential.

- Biosimilar opportunities:

- With the expiration of patents for originator biologics, biosimilars will provide more choices for the market and improve drug accessibility, as well as bring price competition. For example, with the expiration of patents for drugs such as Thiomersal, the launch of biosimilars will significantly reduce treatment costs.

- Combination therapy strategy:

- The combined application of multiple therapies will become an important strategy to improve efficacy. For example, the combination of targeted biologics and small molecule drugs, and the combination of biologics with different targets.

- Personalized treatment:

- With the development of precision medicine, personalized treatment based on biomarkers will become a future trend to improve the precision and effectiveness of treatment.

- Chengdu’s layout in the autoimmune field:

- Chengdu has innovative enterprises in the autoimmune field, such as Canoa and Cinda Bio, and has actively invested in the fields of antibody drugs, double antibiotics and cell therapy.

3.3 Rare disease treatment market: high value and policy support

3.3.1 Market size and patient demand

The global rare disease treatment market is expected to reach US$250 billion by 2025, with a compound annual growth rate of about 10%. China has more than 20 million patients with rare diseases, but the diagnosis and treatment rates are extremely low, so the market has huge potential.

Due to the low incidence of rare diseases and the dispersion of patients, there have long been problems such as the difficulty of drug research and development and low accessibility. However, in recent years, with policy support and increased market attention, the field of rare disease treatment has ushered in new development opportunities.

3.3.2 Therapeutic Technology and Innovative Drugs

Innovations in the field of rare disease treatment mainly focus on the following directions:

- Gene therapy:

- Gene therapy offers potential cures for many monogenic hereditary rare diseases. For example, the use of CRISPR gene editing technology in rare diseases such as sickle cell anemia and Duchenne muscular dystrophy has shown encouraging preliminary results.

- Enzyme Replacement Therapy:

- Enzyme replacement therapy is an effective treatment for many rare metabolic diseases. For example, aglycone α for Pompe disease and imiglucerase for Gosheimer’s disease have shown promising results in clinical applications.

- Small-molecule targeted drugs:

- Small-molecule targeted drugs that target specific gene mutations or signaling pathways also play an important role in the treatment of rare diseases. For example, CFTR modulators targeting cystic fibrosis have shown promising results in clinical applications.

- Orphan antibodies:

- Monoclonal antibodies against antigens associated with rare diseases are also a hot topic of research and development. These antibodies usually have high specificity and affinity and can precisely target disease-related molecules.

3.3.3 Policy Support and Market Opportunities

Major opportunities in the rare disease treatment market include:

- Policy support:

- The Chinese government attaches great importance to the prevention and treatment of rare diseases, and has introduced a series of policy measures in recent years, including the inclusion of 27 rare disease drugs into the national health insurance catalog, the release of the First Batch of Rare Disease Catalog, and the establishment of the Rare Disease Diagnostic and Treatment Collaboration Network, which provides a favorable policy environment for the rare disease treatment market.

- Market exclusivity period:

- Governments usually provide a longer market exclusivity period for rare disease drugs to encourage companies to invest in research and development. For example, the U.S. offers 7 years of market exclusivity for rare disease drugs, and the EU offers 10 years.

- High pricing strategy:

- Due to the high R&D costs and small number of patients for rare disease drugs, companies usually adopt a high pricing strategy to ensure a return on investment. This strategy has been widely accepted in developed markets, but still faces challenges in developing countries such as China.

- Patient organization partnerships:

- Establishing good partnerships with patient organizations not only helps with drug R&D and clinical trials, but also with market education and drug promotion.

- Chengdu’s breakthrough in the field of rare diseases:

- ZS112 injection of ZhishenweiXin is the world’s first gene therapy drug for myasthenia gravis, which fills the international gap in this field.

3.4 Regional Market Analysis: Unique Strengths and Challenges of the Chinese Market

3.4.1 Scale and Growth of China’s Innovative Drug Market

China has become the second-largest pharmaceutical market in the world, and the innovative drug market has shown rapid growth. In 2025, the size of China’s innovative drug market is expected to reach 200 billion yuan, with a compound annual growth rate of more than 20%. Driven by policy support, capital investment, and return of talents, China’s innovative drug R&D has transformed from “running after” to “running alongside” and “leading”.

As the most important biopharmaceutical industry base in western China, Chengdu’s innovative drug market is also showing a booming trend. Currently, Chengdu has more than 3,000 biopharmaceutical enterprises, of which nearly 400 are above scale, with an industrial scale exceeding RMB 200 billion. Chengdu Hi-tech Zone, Tianfu International Bio-city, and Pengzhou Tianfu Traditional Chinese Medicine City have become the core areas of industry agglomeration.

3.4.2 Unique Advantages of the Chinese Market

The unique advantages of China’s innovative drug market are mainly reflected in the following aspects:

- Policy support:

- The Chinese government attaches great importance to the development of the biopharmaceutical industry and has issued a series of policies and measures to support the R&D and industrialization of innovative drugs.2025 In February, Chengdu City issued the “Chengdu Municipal Policies and Measures to Promote the High-Quality Development of the Biopharmaceutical Industry”, which puts forward 25 policies and measures to provide support for the R&D and innovation of medicines and devices, improve the quality and efficiency of clinical research, support the clinical application of products, support the development and growth of enterprises, and build a perfect industrial ecology. It puts forward 25 policies and measures in five aspects, providing strong policy support for the development of the industry.

- Market scale:

- With a population of 1.4 billion and a wide spectrum of diseases, China provides a huge market space for innovative drugs. Especially in the fields of tumors, autoimmune and metabolic diseases, there is a huge unmet medical demand.

- R&D Cost Advantage:

- Compared with developed countries, China has obvious advantages in R&D personnel cost and clinical trial cost, which helps reduce the R&D cost of innovative drugs. For example, the cost of clinical trials in China is usually 30%-50% lower than that in the US.

- Talent advantage:

- In recent years, a large number of overseas students and Chinese scientists have returned to China to start their own businesses or joined domestic enterprises, bringing advanced technology and international vision to China’s R&D of innovative drugs. For example, Chengdu has several universities and research institutes, such as Sichuan University and the University of Electronic Science and Technology, as well as a number of national research platforms, providing strong intellectual support for innovative drug R&D.

3.4.3 Challenges facing the Chinese market

Despite the rapid development of China’s innovative drug market, it still faces the following challenges:

- Insufficient innovation ability:

- Compared with developed countries, the originality of China’s innovative drug R&D is still insufficient, with most innovative drugs belonging to the “me-too” or “me-better” category, and fewer truly “first-in-class” drugs.

- Quality of clinical trials:

- Despite the rapid growth in the number of clinical trials in China, there is still room for improvement in terms of trial design, data quality, and international recognition.

- Pressure on health insurance payment:

- With the increase in the number and price of innovative drugs, the pressure on health insurance payment is gradually increasing, which may affect the market access and availability of innovative drugs.

- Intellectual property protection:

- Although the Chinese government continues to strengthen the protection of intellectual property rights, there are still some problems in the actual implementation, which affects the motivation of innovative drug companies.

3.4.4 Chengdu’s Positioning and Advantages in the Innovative Drug Industry

As the core city of the biomedical industry in western China, Chengdu has an important position in the innovative drug industry:

- Advantages of an industrial cluster:

- Chengdu has formed a biopharmaceutical industry cluster centered on Chengdu High-Tech Zone, Tianfu International Bio-City, and Pengzhou Tianfu Chinese Medicine City, gathering a large number of innovative drug enterprises and R&D institutions. According to the “2024 China Biopharmaceutical Industrial Park Competitiveness Evaluation and Analysis Report” released by China Biotechnology Development Center, the comprehensive competitiveness of Chengdu Hi-tech Zone is second only to Zhongguancun and Suzhou Industrial Park, which is steadily ranked as the “first echelon” in China.

- Abundant R&D resources:

- Chengdu has a number of universities and research institutes, such as Sichuan University and the University of Electronic Science and Technology, as well as a number of national research platforms, which provide strong intellectual support for innovative drug research and development. For example, the West China Hospital of Sichuan University conducts more than 5,000 clinical trials annually, providing biopharmaceutical companies with full-chain support from R&D to industrialization.

- Strong policy support:

- Chengdu has introduced a series of policies and measures to support the development of the biopharmaceutical industry, including financial support for R&D of innovative drugs, support for clinical trials, and support for the listing of innovative drugs. For example, for Class 1 innovative drugs, if preclinical research, Phase I clinical trial, Phase II clinical trial, and Phase III clinical trial are completed, a maximum of 3 million yuan, 3 million yuan, 5 million yuan, and 7 million yuan will be rewarded according to 20% of the R&D investment in the corresponding phase.

- Abundant Talent Resources:

- Chengdu has abundant scientific research and industrial talents, especially in the fields of biopharmaceuticals, medicinal chemistry, pharmacology, and other areas with strong talent reserves. For example, Chengdu has more than 100 national-level talent teams, 10 listed and approved enterprises, cooperation with 20 of the world’s top 500 multinational pharmaceutical companies, and 50 well-known investment institutions have jointly set up biopharmaceutical special industry funds.

- Chengdu Industrial Cluster Effect:

- Chengdu has built an advantageous track and characteristic track in the field of I.V. infusion, blood products, antibody drugs, nuclear medicine, vaccines, traditional Chinese medicine, high-end medical devices, etc.; it has cultivated 4 of the top 100 enterprises in China’s pharmaceutical industry, and the number of listed enterprises (21 enterprises) ranks the first in Central and Western China, and has settled in 10 of the world’s top 500 enterprises outside of China.

4. Cooperation Models and Strategic Choices: Paths for International Enterprises to Participate in the Chinese Market (Shared at Bio Convention 2025)

4.1 International Cooperation Case Study: Successful Models and Lessons Learned

4.1.1 Technology Licensing and Cooperative Development Mode

Technology licensing and co-development a common modes of cooperation between international pharmaceutical companies and Chinese enterprises. The following are a few typical cases:

- Boehringer Ingelheim and Cue Biopharma:

- In April 2025, Boehringer Ingelheim and Cue Biopharma announced a strategic collaboration and signed a licensing agreement to develop and commercialize Cue Biopharma’s investigational molecule CUE-501, a B-cell clearance therapy for autoimmune diseases. B-cell clearance therapy for the treatment of autoimmune diseases. Under the terms of the agreement, Cue Biopharma is entitled to a $12 million upfront payment and research support funding, and is also eligible to receive milestone payments totaling approximately $345 million corresponding to the achievement of the research, development, and commercialization phases, as well as royalties based on net sales.

- Bayer and Puho Pharma Collaboration:

- In March 2025, Bayer and Suzhou Puho Pharma Science & Technology Co., Ltd. announced a global licensing agreement for the development of oral small molecule PRMT5 inhibitors for selective targeting of MTAP-deficient tumors. Under the agreement, Bayer has been granted an exclusive worldwide license to develop, manufacture, and commercialize MTA synergistic PRMT5 inhibitors. A Phase I clinical trial of BAY 3713372 has been initiated, and the first patient has been enrolled.

- Syngene and NextCure Collaboration:

- In June 2025, Syngene, an innovative antitumor drug company of Syngene Pharmaceuticals, entered into a strategic collaboration with NextCure, a U.S.-based clinical-stage biopharmaceutical company, to co-develop SIM0505, a novel antibody-drug-conjugate (ADC) novel drug targeting the CDH6 target, for the treatment of solid tumors. Under the agreement, NextCure will acquire global rights to SIM0505, except for the Greater China region, which will be retained by CCTF. During the potential development phase of the collaboration, Syngenta will receive up to US$745 million in related payments, including a down payment, development and sales milestone payments, and tiered royalties based on net sales of the product outside of Greater China.

4.1.2 Equity Investment and M&A Model

Equity investment and mergers and acquisitions are important means for international pharmaceutical companies to rapidly enter the Chinese market or strengthen their existing layout:

- Strategic investment:

- International drug companies establish partnerships with Chinese innovative drug companies through equity investment, such as Roche’s investment in Keystone Pharmaceuticals and AstraZeneca’s investment in Hutchison Whampoa Pharmaceuticals. This model can help international drug companies access cutting-edge technologies and R&D pipelines in the Chinese market, while providing Chinese companies with capital and international resource support.

- M&A Integration:

- International drug companies rapidly acquire technology, products, and markets through mergers and acquisitions of Chinese innovative drug companies or R&D teams. For example, Takeda Pharmaceuticals acquired Shanghai 3D Biotechnology Co., Ltd, a local Chinese pharmaceutical company, to strengthen its layout in the field of oncology.

- Joint ventures:

- International drug companies set up joint ventures with Chinese companies to jointly develop and commercialize innovative drugs. For example, AbbVie has set up a joint venture with Baizi Shenzhou to co-develop and commercialize Baizi Shenzhou’s BTK inhibitor zebrutinib in several Asian markets.

4.1.3 Joint R&D and Clinical Trial Collaboration

Joint R&D and clinical trial cooperation is an important form of cooperation between international pharmaceutical companies and Chinese companies:

- International multi-center clinical trials:

- International drug companies include China in their global multi-center clinical trials to accelerate the registration and marketing of innovative drugs in China. For example, multinational drug companies such as Pfizer and Roche have conducted a number of international multi-center clinical trials in China, which not only accelerated the process of product launch in China but also provided Chinese patients with the opportunity to use innovative drugs earlier.

- Joint laboratories:

- International drug companies have established joint laboratories with Chinese research institutions or enterprises to jointly carry out cutting-edge technology research and drug development. For example, Novartis has established a joint laboratory with the Shanghai Institute of Pharmaceutical Sciences of the Chinese Academy of Sciences (SIPAS) to research therapeutic targets and drug development for neurodegenerative diseases.

- CRO cooperation:

- International drug companies cooperate with Chinese CRO companies to take advantage of China’s cost advantages and expertise in clinical trials and drug development. For example, Chinese CRO companies such as WuXi AppTec and Kanglong Huacheng have become important partners of international drug companies.

4.1.4 Commercialization, Cooperation, and Market Access

Commercialization, cooperation, and market access are key to the success of international pharmaceutical companies in the Chinese market:

- Distribution cooperation:

- International drug companies cooperate with Chinese pharmaceutical distribution companies to utilize the latter’s distribution network and market coverage capabilities to increase the market penetration of their products. For example, many multinationals have established strategic partnerships with large Chinese pharmaceutical distribution companies such as Sinopharm, Shanghai Pharmaceuticals, and China Resources Pharmaceuticals.

- Market education and academic promotion:

- International pharmaceutical companies cooperate with Chinese medical associations, societies, hospitals, etc., to carry out academic exchanges and market education activities to improve doctors’ and patients’ knowledge and acceptance of innovative drugs. For example, multinational drug companies organize academic conferences and conduct clinical studies to improve doctors’ awareness and use of innovative drugs.

- Health insurance access strategy:

- International pharmaceutical companies actively participate in China’s health insurance negotiations to strive for the inclusion of innovative drugs in the national health insurance catalog, so as to increase the accessibility and market share of their products. For example, in the adjustment of the national health insurance catalog in 2024, a number of innovative drugs, including PD-1 inhibitors and CAR-T cell therapies, have entered the catalog through negotiation and price reduction.

- Chengdu cooperation case:

- Chengdu Pioneer has established cooperation with multinational pharmaceutical companies such as Pfizer, Merck Sharp & Dohme, Johnson & Johnson, etc., and utilizes its DNA-encoded compound library technology platform to provide new drug R&D services for its partners.

4.2 Strategic Options for International Enterprises to Participate in the Chinese Market

4.2.1 Direct entry and localization strategy

For international pharmaceutical companies wishing to enter the Chinese market directly, the following strategies can be considered:

- Establishment of local R&D centers:

- Establish R&D centers in China to take advantage of China’s R&D talents and cost advantages to carry out innovative drug R&D. For example, multinational drug companies such as Pfizer, Roche and Novartis have already established R&D centers in China. Chengdu is an ideal location to establish an R&D center as it has a rich pool of research and industrial talents, especially in the fields of biopharmaceuticals, medicinal chemistry and pharmacology.

- Localized production:

- Establishing production bases in China to localize product production reduces costs and improves market responsiveness. For example, AstraZeneca has established a global supply base in Wuxi to produce a wide range of innovative drugs. Chengdu, with its comprehensive industrial support and policy backing, is an ideal choice for setting up a manufacturing base.

- Local team building:

- Set up localized management, R&D, and sales teams to improve their understanding of and ability to adapt to the Chinese market. For example, multinational pharmaceutical companies can recruit Chinese scientists and managers with international backgrounds to help them better integrate into the Chinese market.

- Government Relationship Management:

- Actively communicate with Chinese government departments to understand policy dynamics, participate in policy formulation, and seek policy support. For example, multinational pharmaceutical companies can join Chinese pharmaceutical industry associations and participate in the discussion and formulation of industry policies.

4.2.2 Cooperative Development and Authorization Mode

For international pharmaceutical companies wishing to enter the Chinese market through cooperation, the following strategies can be considered:

- Technology licensing:

- Licensing its own technology or products to Chinese enterprises to obtain licensing fees and sales shares. For example, Cue Biopharma licensed its research molecule CUE-501 to Boehringer Ingelheim for development and commercialization. Chengdu is home to a number of innovative drug companies, such as Canoa and ColomboTech, making it an ideal partner for technology licensing.

- Co-development:

- Co-developing innovative drugs with Chinese companies, sharing R&D costs and results. For example, Hutchison Pharmaceuticals and AstraZeneca are collaborating to develop the MET inhibitor vorlatinib. Chengdu is home to a number of research institutions and innovative companies, such as Sichuan University and Chengdu Pilot, making it an ideal partner for co-development.

- Product introduction:

- Innovative drugs developed by Chinese companies are introduced to the international market for mutual benefit. For example, Baizi Shenzhou licensed its BTK inhibitor Zebutinib to AbbVie, Cinda Biotech licensed its PD-1 inhibitor Sindilizumab to Roche, and Skyland Bio licensed its CD47 antibody to AbbVie. Chengdu enterprises have strong R&D strength in the fields of ADC drugs and nucleic acid drugs, making them ideal partners for product introduction.

- R&D Outsourcing:

- Outsourcing part of the R&D work to Chinese CROs to take advantage of China’s cost advantage and expertise in clinical trials and drug development. For example, Chinese CROs such as WuXi AppTec and Kanglong Huacheng have become important partners of international pharmaceutical companies. Chengdu has a number of CRO companies, such as Chengdu Pilot and Huaxi Haiqi, which are ideal for R&D outsourcing.

4.2.3 Investment and M&A Strategy

For international pharmaceutical companies wishing to enter the Chinese market through capital operation, the following strategies can be considered:

- Venture capital:

- Invest in Chinese innovative drug companies through venture capital to obtain equity returns and technology access. For example, Sequoia China, Qiming Venture Capital and other venture capital organizations have invested in a number of Chinese innovative drug companies in the biomedical field. Chengdu, which has several innovative drug companies, such as Konoia and ColumboTech, is an ideal target for venture capital investment.

- Strategic investment:

- Establishing in-depth partnerships with Chinese innovative drug companies by way of strategic investment to gain access to technology, products and markets. Examples include Roche’s investment in Keystone Pharmaceuticals and AstraZeneca’s investment in Hutchison Whampoa Pharma. Chengdu has a number of innovative drug companies, such as Microchip Bio and Chengdu Pioneer, which are ideal targets for strategic investments.

- M&A Integration:

- Rapid access to technology, products and markets through mergers and acquisitions of Chinese innovative drug companies or R&D teams. For example, Takeda Pharmaceuticals acquired Shanghai 3D Biotech Co. Chengdu, which has several innovative drug companies, such as Hengrui Pharma Chengdu R&D Center and Conoya, is an ideal target for M&A integration.

- Joint Ventures:

- Joint ventures with Chinese companies to jointly develop and commercialize innovative drugs. For example, AbbVie established a joint venture with Baizi Shenzhou to co-develop and commercialize Zebutinib in the Asian market. Chengdu has a number of innovative drug companies, such as Clariant Pharmaceuticals and Yuandong Bio, making it an ideal partner for setting up joint ventures.

4.2.4 Regional Market Selection and Layout

The regional layout of international pharmaceutical companies in the Chinese market should consider the following factors:

- Industrial clusters:

- Priority should be given to layout in biopharmaceutical industry cluster areas, such as Beijing, Shanghai, Guangzhou, Shenzhen, Chengdu, Suzhou and other cities, which have perfect industrial ecology and policy support. Chengdu has formed a biopharmaceutical industry cluster centered on Chengdu Hi-Tech Zone, Tianfu International Bio-City and Pengzhou Tianfu Traditional Chinese Medicine City, which is an ideal choice for layout.

- R&D resources:

- Choose areas with abundant R&D resources, such as Zhongguancun in Beijing, Zhangjiang in Shanghai, BioBay in Suzhou, and Tianfu International BioCity in Chengdu, which have a large number of research institutions, universities and innovative enterprises. Chengdu has a number of universities and research institutes, such as Sichuan University and University of Electronic Science and Technology, as well as a number of national research platforms, which provide strong intellectual support for innovative drug development.

- Clinical trial resources:

- Choose areas with abundant clinical trial resources, such as Beijing, Shanghai, Guangzhou, Chengdu and other cities, which have a large number of tertiary hospitals and clinical trial organizations. Chengdu has top medical institutions such as West China Hospital of Sichuan University and Sichuan Provincial People’s Hospital, which conducts more than 5,000 clinical trials annually, providing biopharmaceutical companies with full chain support from R&D to industrialization.

- Policy environment:

- Pay attention to the biomedical industry policies of each region, and choose the region with strong policy support and favorable business environment. Chengdu has introduced a series of policies and measures to support the development of the biopharmaceutical industry, including financial support for R&D of innovative drugs, support for clinical trials, and support for the listing of innovative drugs, etc. It is a region with a superior policy environment.

- Chengdu Location Advantage:

- The scale of biopharmaceutical industry in Chengdu Hi-Tech Zone has maintained 20% growth for many years in a row, with more than 100 national-level talent teams, a total of 10 listed and passed enterprises, cooperation with 20 of the world’s top 500 multinational pharmaceutical companies, and a total of 50 renowned investment institutions have jointly set up a biopharmaceutical special industry fund.

4.3 Chinese Enterprises’ “Going Overseas” Strategy and International Cooperation

4.3.1 Current Situation and Trend of Chinese Innovative Drugs Going Overseas

Chinese innovative drugs “going overseas” has become an important trend in the development of the industry.2024 Chinese pharmaceutical companies have made remarkable achievements in overseas licensing deals, with the number of deals exceeding 90 and the total amount exceeding USD 50 billion. According to the tracking data of Founder Securities, in the first half of 2024 alone, the first payment for foreign authorization of innovative drugs has exceeded US$2.5 billion, and the total transaction amount is close to US$50 billion, which is the same as the annual performance in 2023.

In the first half of 2025, the number of Chinese innovative drug overseas deals reached 98, with the value of the deals rising to US$59,550.5 million, demonstrating the strong growth of Chinese drug companies in the international market. This trend coincides with a report by investment bank Stifel, which states that large pharma companies brought in 31% of their innovative R&D pipeline assets from China in 2024.

4.3.2 Collaboration Patterns between Chinese Companies and International Drug Companies

There are several major models of cooperation between Chinese innovative drug companies and international drug companies:

- License-out model:

- Chinese drug companies license the rights to develop and commercialize their self-developed innovative drugs in specific regions to international drug companies for down payment, milestone payment and sales share. For example, Baizi Shenzhou licensed its BTK inhibitor Zebutinib to AbbVie, Cinda Biotech licensed its PD-1 inhibitor Sindilizumab to Roche, and Skyland Bio licensed its CD47 antibody to AbbVie.

- Co-development:

- Chinese drug companies co-develop innovative drugs with international drug companies, sharing R&D costs and results. For example, Hutchison Pharmaceuticals and AstraZeneca collaborated to develop the MET inhibitor vorlatinib.

- M&A Integration:

- Chinese pharmaceutical companies acquire international pharmaceutical companies or R&D teams to gain access to technology, markets and channels. For example, Fosun Pharma acquired Indian pharmaceutical company Gland Pharma to expand its global market layout.

- Equity investment:

- Chinese pharmaceutical companies establish partnerships with international pharmaceutical companies through equity investment. For example, WuXi PharmaTech’s strategic investment in Germany’s Bayer.

4.3.3 Internationalization Strategies and Cases of Chengdu Enterprises

The internationalization pace of Chengdu biopharmaceutical enterprises is also accelerating:

- Technology licensing:

- Chengdu enterprises cooperate with international pharmaceutical companies through technology licensing. For example, Chengdu Pilot Drug Development Co., Ltd. has established cooperative relationships with a number of international pharmaceutical companies, utilizing its DNA-encoded compound library technology platform to provide new drug R&D services for its partners.

- Joint R&D:

- Chengdu enterprises carry out joint R&D with international pharmaceutical companies. For example, Chengdu Pioneer has established cooperative relationships with multinational pharmaceutical companies such as Pfizer, Merck Sharp & Dohme, and Johnson & Johnson to jointly develop innovative drugs.

- International Multi-Center Clinical Trials:

- Chengdu companies actively conduct international multi-center clinical trials to accelerate the global development and launch of innovative drugs. For example, Chengdu Kanghong Pharmaceutical’s Compexip Ophthalmic Injection has conducted international multi-center clinical trials in the U.S., laying the foundation for its global launch.

- Overseas Market Expansion:

- Chengdu companies are actively expanding into overseas markets to improve the international competitiveness of their products. For example, the products of Chengdu Dior Group and Chengdu Huashen Group have been registered and listed in many countries and regions.

4.3.4 Challenges and Countermeasures for China’s Innovative Drugs Going Overseas

Although China’s innovative drugs “going overseas” have made remarkable achievements, they still face the following challenges:

- Clinical data recognition:

- The recognition of Chinese clinical trial data in the international market still needs to be improved. Countermeasures include conducting international multi-center clinical trials, following international standards and norms, and strengthening communication with international regulatory agencies.

- Intellectual property protection:

- China’s innovative drugs face challenges in protecting intellectual property rights in overseas markets. Countermeasures include strengthening the layout of intellectual property rights, actively responding to overseas intellectual property disputes, and seeking support from the government and industry organizations.

- Commercialization ability:

- Compared with international drug companies, Chinese drug companies are still deficient in global commercialization ability. Countermeasures include cooperating with international drug companies, introducing internationalized commercial talents, and establishing their own overseas commercial teams.

- Cultural differences:

- Cultural differences in different countries and regions may affect the market acceptance of innovative drugs. Countermeasures include in-depth understanding of the culture and market environment of the target market, formulating targeted marketing strategies, and strengthening communication with local partners.

- Cases of Chengdu Enterprises Going Overseas:

- In 2024, the total amount of ADC drug cooperation deal between CorenBotics and Merck Sharp & Dohme was as high as USD 9.3 billion, which set the highest record of China’s innovative drug authorization to the outside world. In December 2023, Bailitianheng entered into a global strategic cooperation with Bristol-Myers Squibb (BMS) and pushed the total amount of authorization deal of its pioneering EGFR×HER3 dual-antibody ADC drug, BL-B01D1 to USD 8.4 billion, of which the down payment was as high as USD 8.4 billion. The total authorization deal of BL-B01D1, its first EGFR×HER3 dual-antibody ADC drug, amounted to US$8.4 billion, of which the down payment was as high as US$800 million, which was the highest record for a single transaction of Chinese innovative drugs going overseas at that time.

5. Strategic Recommendations and Action Plan: Seizing the Opportunities of Chengdu Summit (Aligned with Bio Convention 2025 Goals)

5.1 Summit Participation Strategy: Maximize Exposure and Cooperation Opportunities

5.1.1 Value and Positioning of the Summit

The 10th Chengdu New Drug Innovators Summit is one of the largest and most influential new drug R&D and innovation exchange platforms in western China. The summit will gather more than 5,000 pharmaceutical industry experts, entrepreneurs, investors and policy makers from all over the world, providing an excellent opportunity for international exhibitors to showcase their products, expand their network and seek cooperation.

The summit is organized by the Pharmaceutical Society of China, with high authority and professionalism. The conference will set up the main forum and several professional sub-forums, inviting well-known academicians, experts, scholars and business executives at home and abroad to deliver speeches and share the latest research results and industry dynamics. Exhibitions, business negotiations, investment docking and other activities will also be held during the summit, providing participants with an all-round communication and cooperation platform.

5.1.2 Participation Target Setting

International exhibitors should set clear objectives for participation in the Chengdu Summit, including:

- Brand exposure:

- Increase the visibility and recognition of your company and products in the Chinese market. Increase brand exposure through the summit display area, speaking opportunities, and sponsorship activities.

- Technology Showcase: